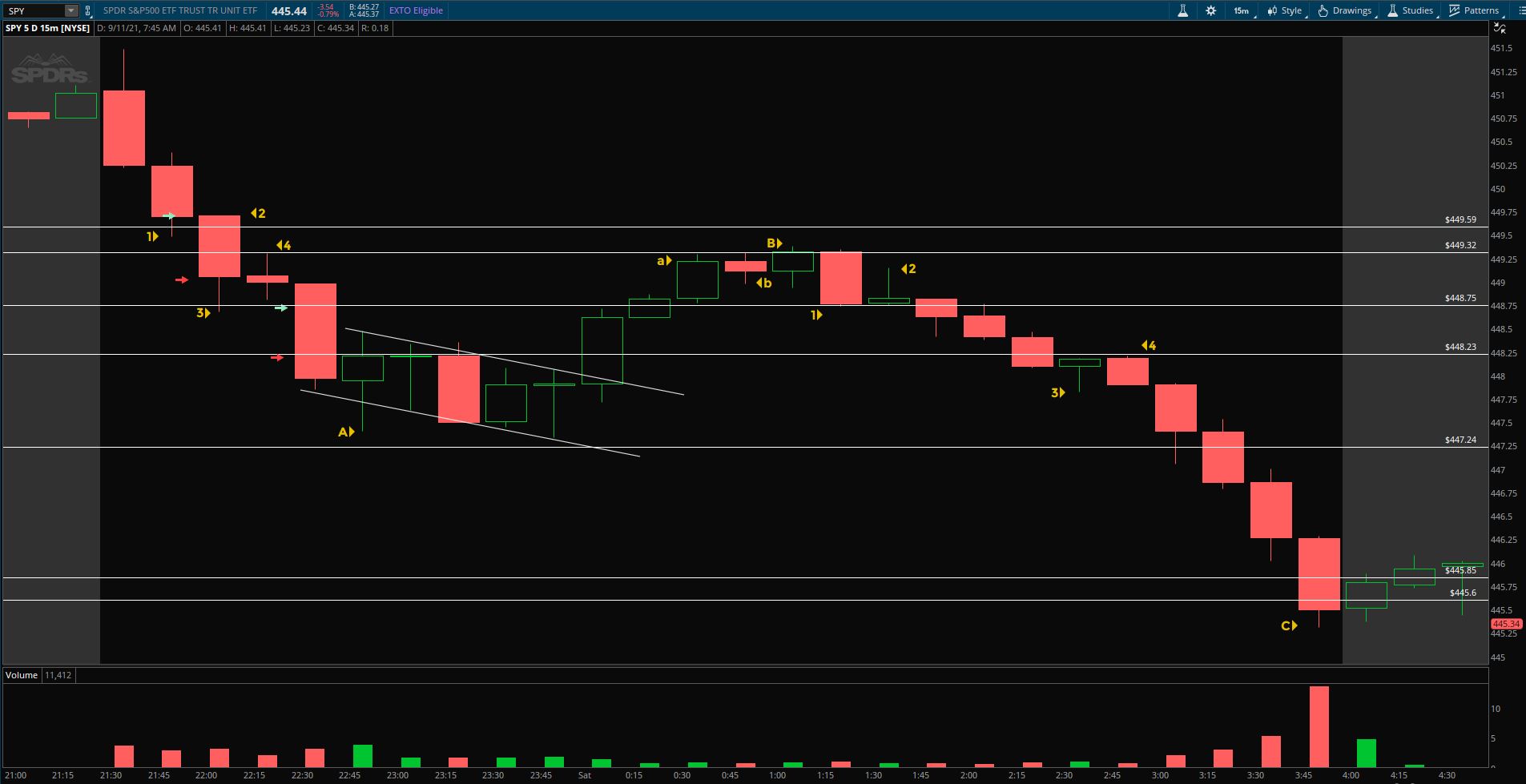

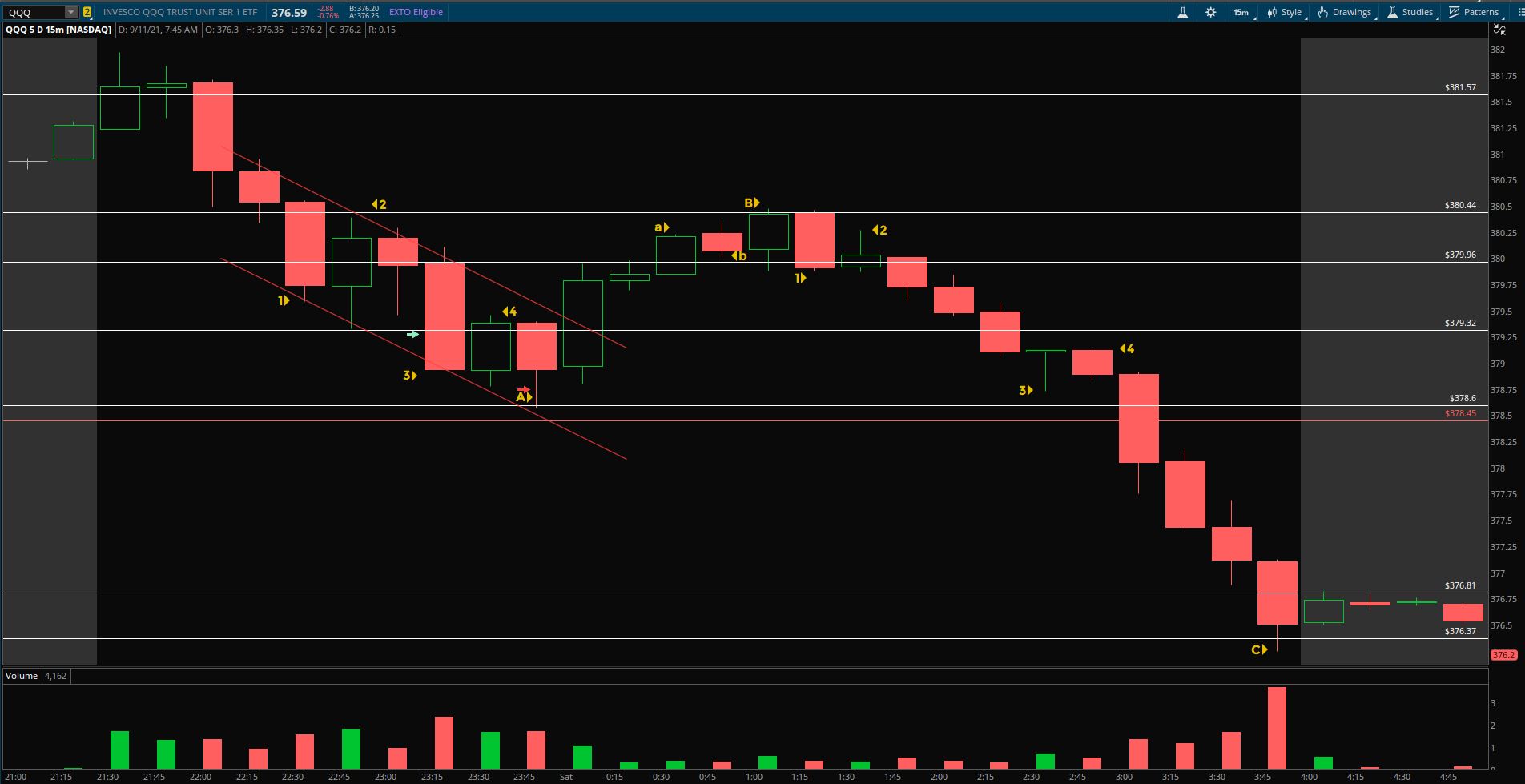

Nice textbook downwards impulse waves on the 2 big indexes intraday.![[眼眼]](https://c1.itigergrowtha.com/community/assets/media/emoji-069-looking.e352b1f4.png) Hope those who recognised this managed to get in some good trades riding the market down.

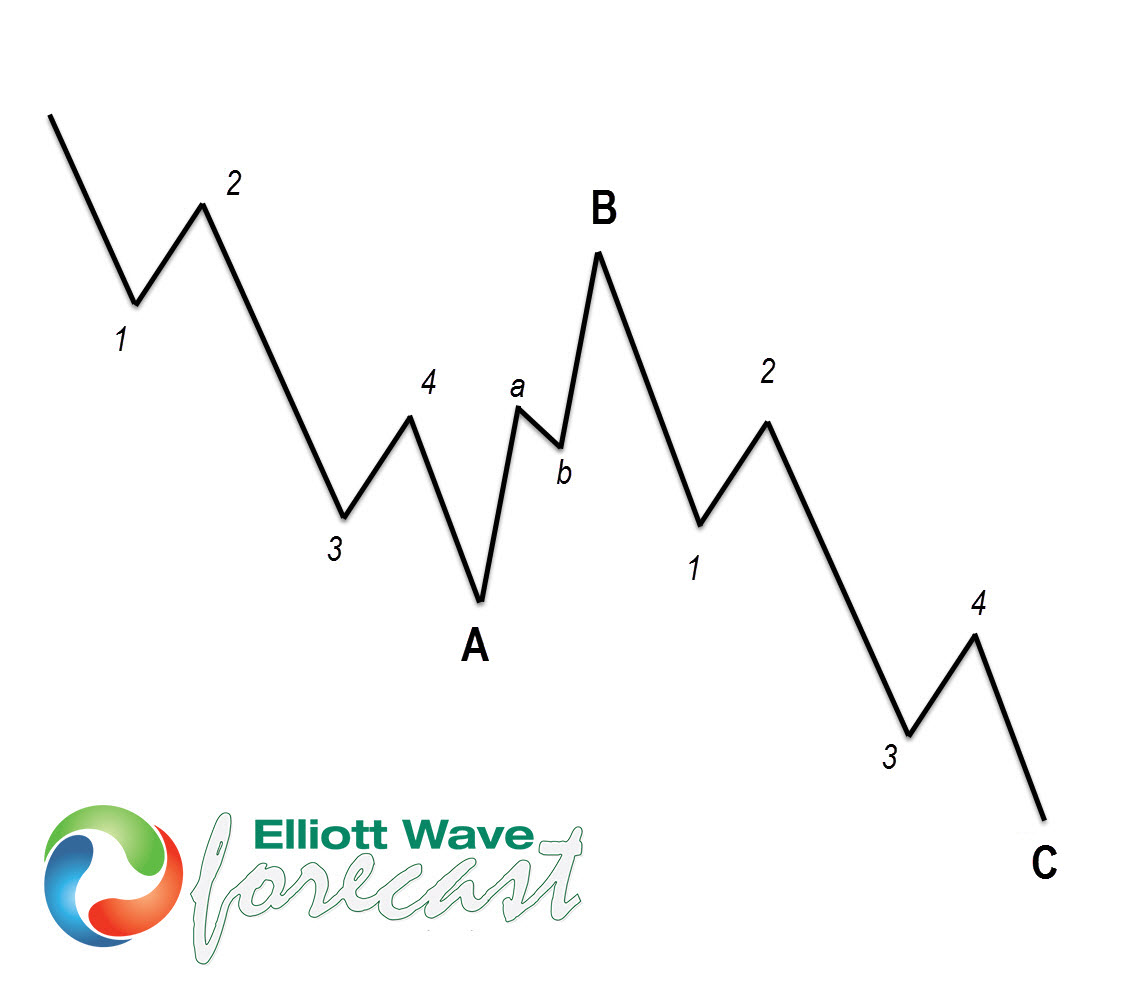

Hope those who recognised this managed to get in some good trades riding the market down.![[胜利]](https://c1.itigergrowtha.com/community/assets/media/emoji-060-victory.9884dde5.png) For those who don't know what are impulse waves, here's an example:

For those who don't know what are impulse waves, here's an example: ![[你懂的]](https://c1.itigergrowtha.com/community/assets/media/emoji_030_nidongde.7d229aff.png)

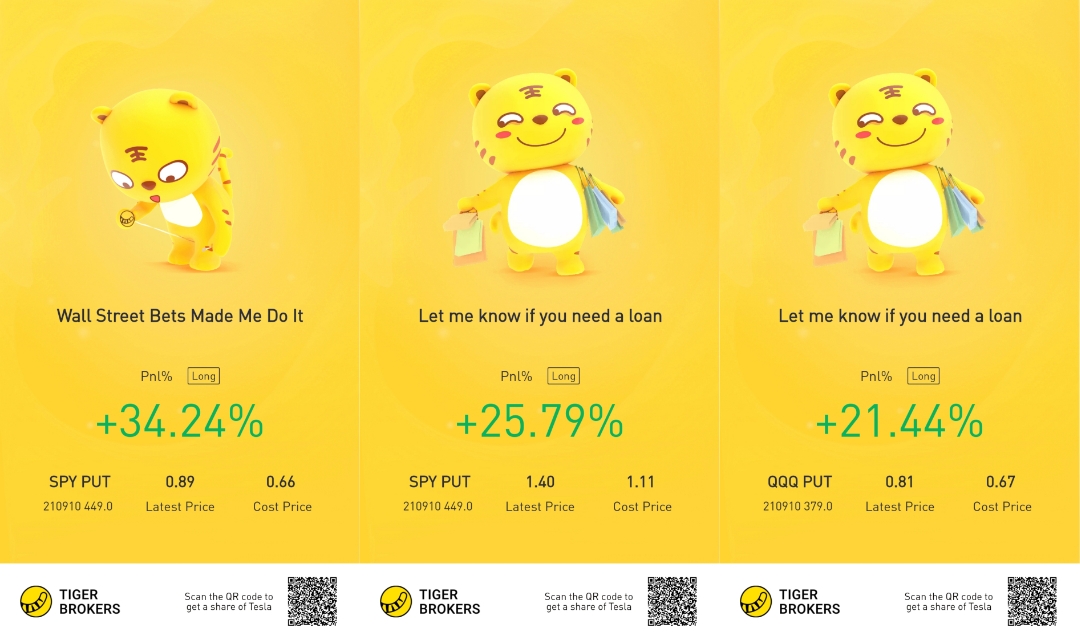

I got in 4 trades intraday. First 2 trades were riding the $S&P500 ETF(SPY)$impulse waves down.![[财迷]](https://c1.itigergrowtha.com/community/assets/media/emoji_003_caimi.53908f82.png) First trade sold at 0.91, 30%+ in 6 minutes. Second trade sold at 1.40, 20%+ in 1 minute. The third trade I tried to buy calls for$NASDAQ-100 Index ETF(QQQ)$at support level in hope for a bounce. As soon as I realised that it is forming impulse waves too, I immediately cut my calls for -10% and switch to puts. Rode the fifth wave down for a little gain. Sold at 0.85, 25%+ in 25 minutes.

First trade sold at 0.91, 30%+ in 6 minutes. Second trade sold at 1.40, 20%+ in 1 minute. The third trade I tried to buy calls for$NASDAQ-100 Index ETF(QQQ)$at support level in hope for a bounce. As soon as I realised that it is forming impulse waves too, I immediately cut my calls for -10% and switch to puts. Rode the fifth wave down for a little gain. Sold at 0.85, 25%+ in 25 minutes.![[可爱]](https://c1.itigergrowtha.com/community/assets/media/emoji_021_keai.977d71ae.png)

- Conclusion

Looking back at the day, if I held these puts, they would all be multi-baggers with the 2 indexes plummeting at the last hour.![[惊讶]](https://c1.itigergrowtha.com/community/assets/media/emoji_015_jingya.47626a91.png) Even though I recognised the impulse waves and could have held on, I also understand that sometimes the market doesn't give us what we want and it is always better to secure profits for me.

Even though I recognised the impulse waves and could have held on, I also understand that sometimes the market doesn't give us what we want and it is always better to secure profits for me.![[摊手]](https://c1.itigergrowtha.com/community/assets/media/emoji-062-spreadhands.021a2a0a.png)

Once there was a guy who told me what I earned each trade is too little. Sometimes I also ask myself why not just go all in on my trades since I have a pretty decent winrate. Here are my thoughts. ![[思考]](https://c1.itigergrowtha.com/community/assets/media/emoji-061-thinking.eba47008.png)

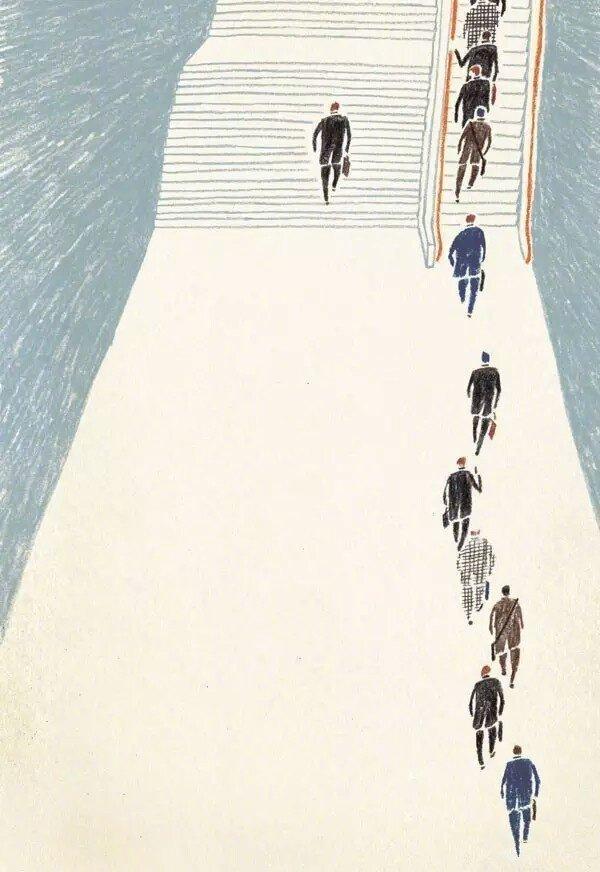

Some people like to use the escalator, while I always take the stairs. Taking the difficult path will provide growing experience and sense of satisfaction knowing I refused to settle for any easy path like everyone else. When you choose the easy path, for example, gamble for a one-time strike big chance, like $AMC Entertainment(AMC)$, the reward is less satisfying and you will crave for more, which may leads you to be trapped in endless greed. On the other end, you take the slow path and you need to put in more hardwork to learn and grow in order to reach your destination.You will become more knowledgeable, emotionally stronger, appreciate the reward more and be satisfied with where you are. In the end, the journey matters more than the destination. If you are trapped in endless greed, you may never truly be happy. If you reached your goals with satisfaction, you may not be the most successful or richest, but you may feel truly happy with what you have achieved. I just want to be happy.![[微笑]](https://c1.itigergrowtha.com/community/assets/media/emoji_001_weixiao.5a33f007.png)

Disclaimer: Weekly option contracts are super risky and I do not advocate it. The trades mentioned are for my own future reference and not investment advice. If you choose to follow the trades, do note that this is a trade recap and I am no longer holding on to the positions mentioned above. Prioritise your own risk management, expel emotions & focus on your trading plan.![[暗中观察]](https://c1.itigergrowtha.com/community/assets/media/emoji-055-observed.6e7a9a0f.png)

精彩评论

Traders with different personalities trading in diffrent ways. I find this article relatable and a humour to read :)