Singapore O&G Ltd got my attention because it had no volume yesterday morning trading hours except my placed order filed.

So, I looked deeper for this company.

Established in 2011, Singapore O&G Ltd. (SOG) is a leading healthcare service provider dedicated towards delivering premier medical services to women’s and children’s health and wellness at affordable prices.

This stock P/E was 12.15 and dividend yield was 7.12%, these numbers were top in the health care industry.

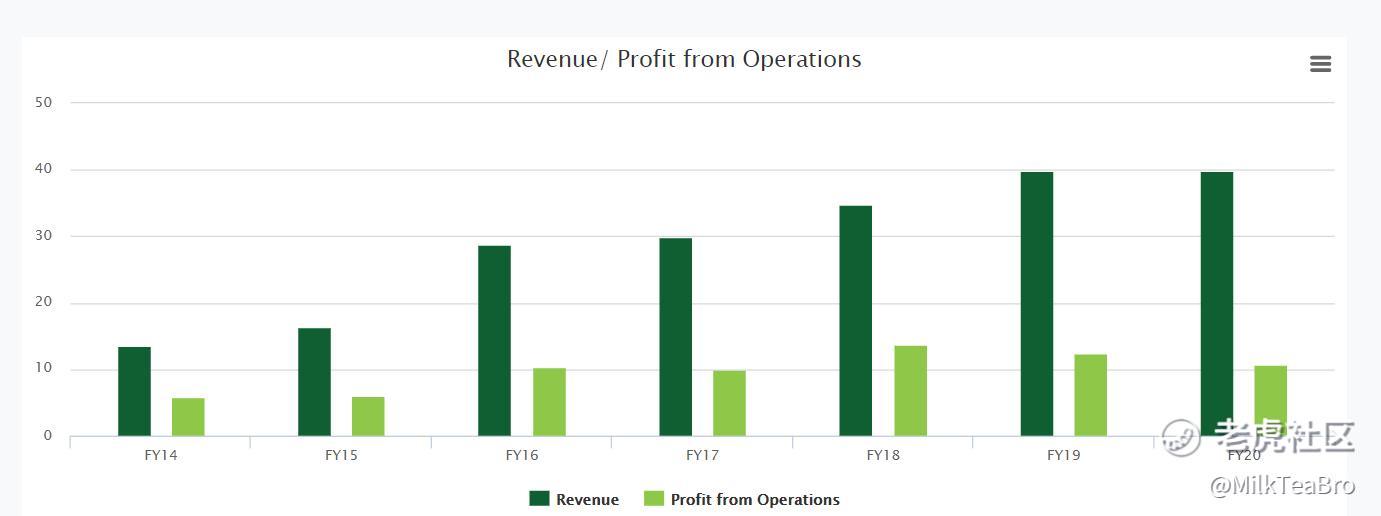

The company operation revenue was stable.

Net profit was stable expect last year loss 1.1 million.

I continued to look for reason for 2019 loss in the 2019 annual report. ‘an impairment of goodwill of S$11.9 million due to the declining earnings of the Dermatology segment which impacted the recoverable amount of this cash-generating unit, the Group posted a net loss after income tax of S$1.1 million for FY 2019’

So, the year 2019 loss was one time action and not cash related, goodwill reduces for Dermatology Segment. If put back 11.9 million to the account, year 2019 profit was totally normal.

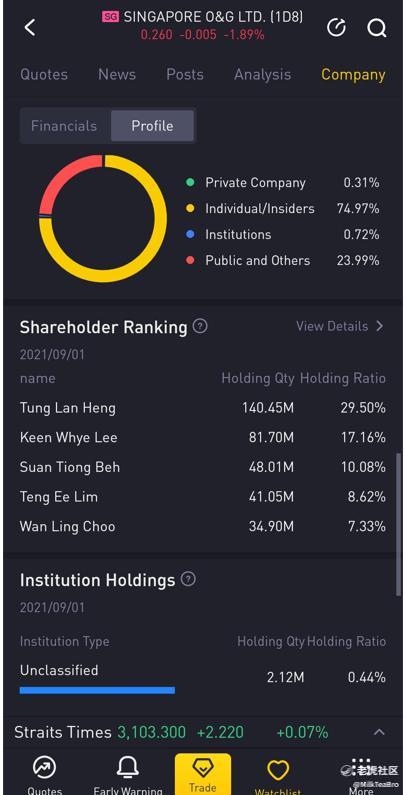

Let’s look at interesting part, top holder of Singapore O&G updated on 01/09/2021.

Five people hold more than 70% shares. And all these five people are doctor who work in Singapore O&G.

Tung Lan Heng, Doctor, Executive Director;

Kee Whye Lee, Doctor, Executive Director;

Suan Tiong Beh, Doctor, Executive Chairman;

Teng Ee Lim, Doctor;

Wan Ling Choo, Doctor.

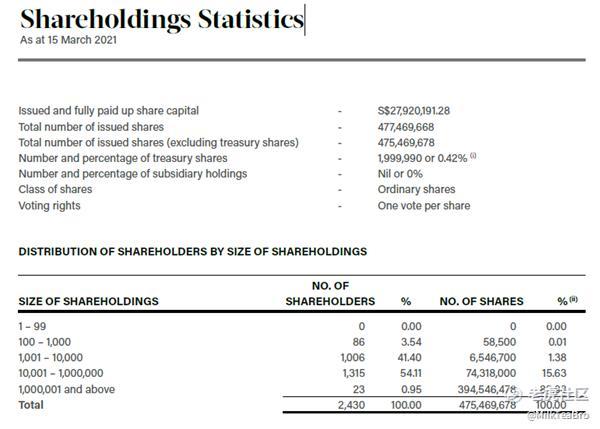

Shareholdings Statistics in 2020 annual report.

Total 2430 share holder only, it was funny. My company employee number is more than it.

Doctors were highly respected in Singapore. I believed these five Doctors, the owner of Singapore O&G, would not manipulate stocks.

In another side, liquidity of stock was very low, very little share holders and very litter shares in the public, the big institution investor can’t buy it.

My wife gave second childbirth in Singapore University Hospital. But all my company colleague’s family choose private hospital to give birth except me. Singaporeans are rich. My wife visited women private clinic one time because government hospital appointment would be 2-3 Month later, we can’t wait for it. In my personal experience and opinion, Singapore O&G revenue will maintain steady.

The company doesn’t have dividend policy. However, the Company has declared and paid dividends each year since IPO. For FY 2020, 1.70 Singapore cents per share, represented 85.2% of the Group’s net profit after tax for the year.

Health care industry, Leading in Women and Children clinic, good dividend, and P/E value, but very low stock liquidity, how will stock price go?

精彩评论