各位好! 如果你有某种内容想要我写,可以留下留言。多谢支持!😃

Any other ways to passively invest besides putting my money into Singlife?

This is the second learning lesson in which I will be sharing my thoughts and please bear in mind this is not financial advice. This is a series of articles where I will focus on topics of what others have done previously and to find possible ways to improve on their positions.

If you have not read the first learning lesson, read it here. 😀 Portfolio Rebalancing (Learning Lesson #1)

Disclaimer: All information stated below are only for illustration purposes. It’s not a call to buy or sell any financial products. Please perform your own due diligence before investing as always.

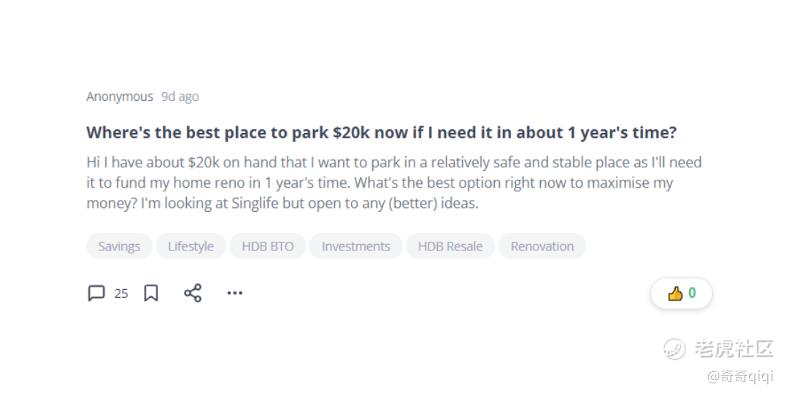

Here, I will share the first real-life example of the following issue that this person is facing.

Background Analysis

- From this case, there is about 20K SGD on hand in cash that is available now to invest into anything.

- Risk-averse and prefer to put into somewhere relatively safe and stable

- Money will be required for home renovation

- Time duration to invest is about 1 year.

- Besides Singlife, any other ways to invest?

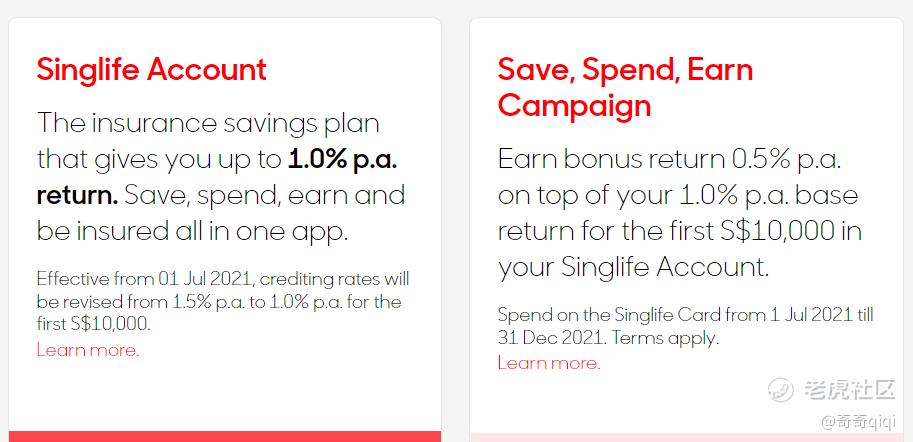

First and foremost if you are using Singlife and treating this as a form of investment, I think you are wasting your time. Singlife has been reducing its interest rate returns for the past year. Now it’s at 1.0% p.a. return and I expect them to drop this figure closer towards 0% return in the future.

I will like to reiterate and emphasize that Singlife is not a pure investment product for goodness sake. It’s a hybrid insurance cum ‘investment’ product that tries to promote to you a low-hanging carrot of the brilliant benefits of buying insurance and savings at the same time without having you put in time and effort to study about investments. Obviously, it’s their Marketing department marketing strategy to get more people on board to sign up and be a member of this platform.

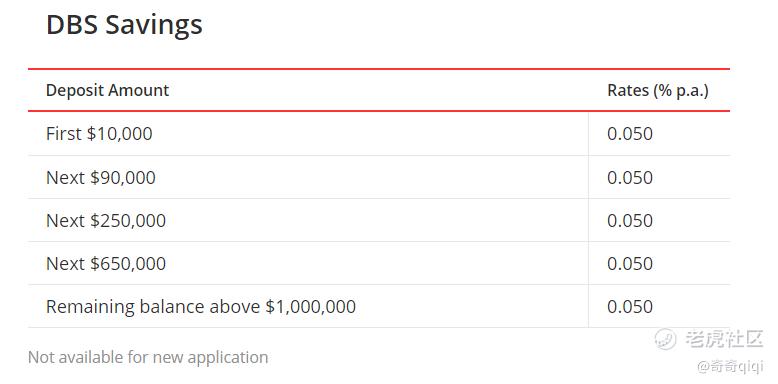

We cannot always use the bank’s saving account interest rates as a form of yardstick and be the benchmark of what might be a better alternative investment return.

Banks are giving us a ridiculous savings interest of 0.05% p.a. Just look at the table below. Even by depositing 650K into the savings account, they will not even reward you with a higher interest rate and you still get to enjoy only 0.05% p.a. regardless of how much you plan to put in.

Now comparing Singlife with the bank’s savings account, getting a 1% p.a. return seems to be a good deal. But I beg to differ on this notion. Because there is something called inflation my friend. I covered this topic before. If you have not read it yet, click here to read it. How Can You Invest To Hedge Against Inflation?

Taking reference from the MAS (Singapore’s Central Bank) in August 2021, the MAS Core Inflation rose to 1.1% on a year-on-year basis. 😕

It’s +1.1% inflation!!!!!

Putting your money into a 1.0% p.a. Singlife product is going to reduce your purchasing power by -0.1% on a year-to-year basis. Please think twice if you want to put your eggs into Singlife.

For me, any interest rate returns of less than 3.0% p.a, I will just ignore and don’t care about it. The returns are just too little.

Going back to the case

Background Analysis:

- From this case, there is about 20K SGD on hand in cash that is available now to invest into anything.

- Risk-averse and prefer to put into somewhere relatively safe and stable

- Money will be required for home renovation

- Time duration to invest is about 1 year.

- Besides Singlife, any other ways to invest?

20K SGD is a sum big enough to invest into something and get a good return of investment after 1 year.

I will skip Fixed Deposits, 1 year T-bills or bonds, savings account, cash management accounts, etc.

Moving Forward

Robo-Advisors

In a hypothetical situation, I will take the 20K and invest in either Stashaway or Syfe Robo Advisors. To me, this is quite clear as I have used both products before and their returns are good enough to achieve this objective in 1 year’s time.

Both Stashaway and Syfe are licensed and regulated by the MAS in Singapore as stated on their websites. This fulfils the relatively and somewhere safe and stable risk levels that the author is looking for.

You can check their websites to find out more.

There are many different plans on both platforms, choose one which suits your risk level and comfort level. Please take note, choose and focus on 1 plan only as concentration is the key to building wealth and 1 year is not a very long time to play with 2 plans.

For me, I know how both works so I will be very aggressive and choose the Stashaway 36% highest risk level plan or Syfe Equity 100 plan.

Split 1 year into 12 equal months. Dollar-cost average a fixed amount monthly till expiry in 1 year time. With 20k, each month I will DCA 1666 SGD into the plan and wait for it to grow. Possible to reach greater than 7% return per annum after factoring in the platform’s monthly management fees of xxx amount. How cool is that! 😎

For me personally, I did it for about 1 year and got back a 10% return for doing nothing every month other than to deposit money and just click into the dashboard to see my money grow while I sleep and do other things in life.

One strong reason for choosing Robo-Advisors is the unit of measurement (UOM) is in SGD which is just investing using fiat dollars. It provides convenience as I do not need to change to USD or a Crypto stable coin to invest.

Stocks

For people who are comfortable with traditional investment methods like purchasing stocks, this is an option as well. To be on the safe side, if you don't have the time to research about a particular company then buy ETFs and forget about individual stock picking. There might be not enough time for certain individual stocks to appreciate their prices within 1 year so be careful.

There are ETFs out there for every market, industry, etc depending on what you are looking for. There is the S&P500 $标普500ETF(SPY)$ for the US market, Hang Seng Index $恒生指数(HSI)$ for the Hong Kong market or you are looking for a niche ETF such as ARKK $ARK Innovation ETF(ARKK)$

No matter what you choose in the end, always do your own due diligence and not copy other people. To further reduce your order risk, purchase using DCA instead of all in at once unless you are very sure that it is the market bottom which no one can predict.

Cryptocurrency

For the more adventurous people, 1 year is also sufficient to invest in Cryptocurrency. But the obvious downside is you first have to convert your fiat money (SGD) into a stable coin (eg. USDC) then you decide what you want to do with those coins. After 1 year, you have to then convert back your crypto coins into fiat money (SGD) and use this sum to pay for the house renovations.

Of course, this brings with you a higher risk and more time is required to do your own research to find out how to maximise your returns using Cryptocurrency.

Please avoid using Liquidity Mining (LM) as 1 year is a short period of time and you will be subjected to the ‘Impermanent Loss’ as the time horizon to invest is very short.

Can focus on doing staking for coins that are able to stake. Those that cannot stake eg. BTC or LTC, you can deposit your coins into a lending platform and they will just reward you with interest rates according to the proportion that you deposit with them. There are a few platforms such as Celsius Network etc.

For stable coins: eg. USDC your returns will be solely based on the platform’s interest rates. This one you can straightaway convert your fiat money into the stable coin of your choice in lump sum as stable coins prices are fixed at around 1 USD.

For non-stable coins: eg. BTC/ETH etc your returns will be based on the platform’s interest rates as well as the price appreciation of the Cryptocurrency itself. For this, remember to dollar cost average in and out to average down on your purchase price. Never ever one lump sum buy into a particular price as that will increase your overall risk and you will take a slightly longer time to break even if the overall Crypto market is experiencing a bear market or at the accumulation stage.

There is no right or wrong way to invest. It really depends on how comfortable and knowledgeable the person is and he/she will take the necessary actions that work best for them.

Originally published at https://medium.com/the-investors-handbook/where-to-park-20k-if-i-need-that-in-1-years-time-learning-lesson-2-411e6b2b946a?sk=589ffbea699915f02c757d7f2598ee7e

精彩评论