I like to sell out on SE, as a small investor I use to trade one unit of short put every time and over the last few month had been trading when SE price drop, of course, win and lose. Overall winning rate is ard 70%. I would say SE is my most favourite counter so far.

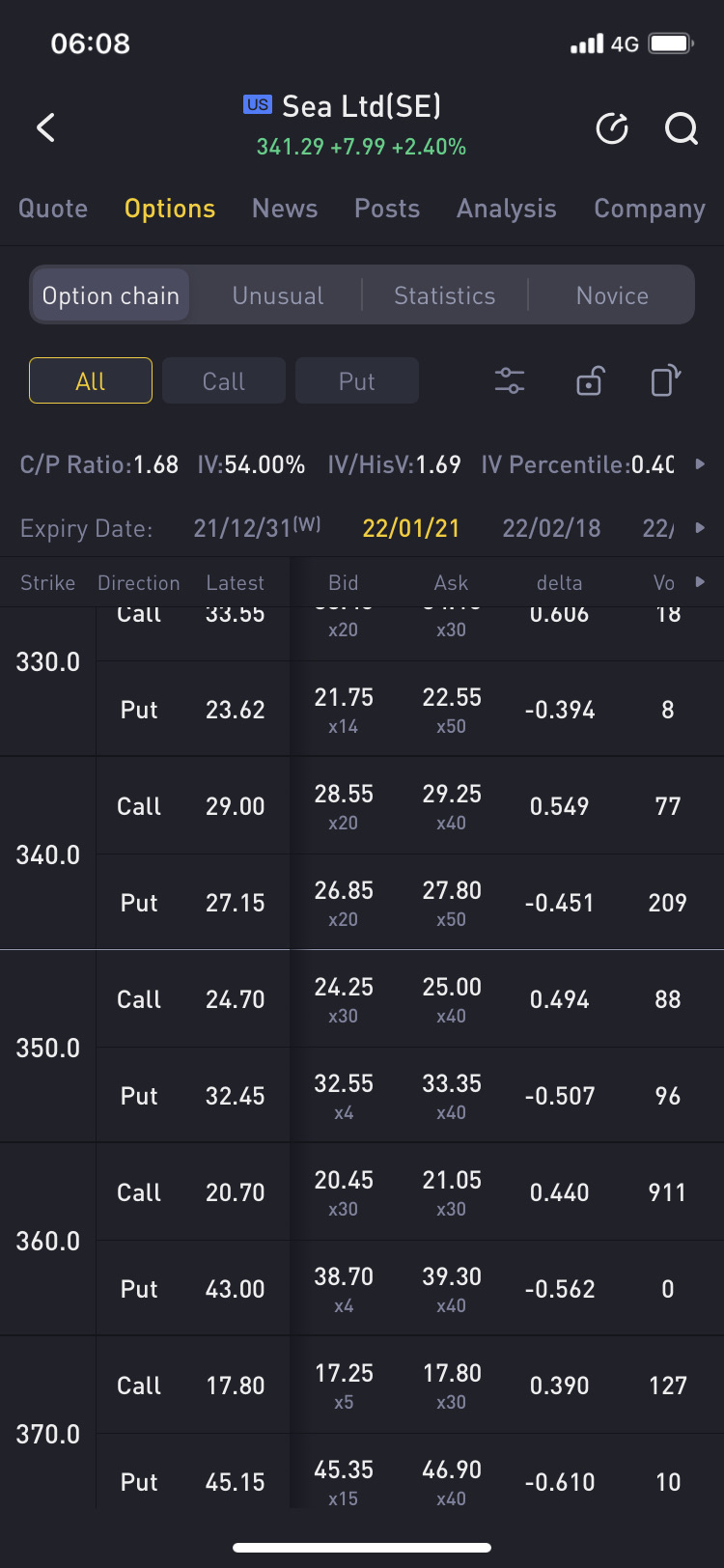

I used to trade with expiry ard 2months withstrike price very close to current price. I.e stock price is 340 and I sell at ard 340. And psychologically thinking the safe line is 340 and below. Of course the lower strike price the lowest risk, since I am selling Put. But of course the premium would be lower if I sell at lower strike price, low risk low return.

Today I have a diff thoughts, why sell at strike price near current price? Why not sell putat HIGHER price?

Taking 370 as an example, put option expiring on 2022 jan gv a premium of 46.90 with delta 61%. Breakeven is ard 379-46.9=323

Strike price 340 gv premium of 27.80 with delta 45%. BE point 340-27.8=312

See the diff? break even is only 10dollar diff but premium is almost 20. Higher risk with higher return.

And what does it mean to me? If I decide to sell PUT on SE. That mean I expect it price to goes up. And I normally close deal when I get ard 60-70% profit. I.e buy back the PUT to close this option.

Strike price of 340 and 370 gv premium of 27.8 and 46.9. With BE point of only 10dollar diff and assume I close deal when I get 50%profit. Then 27.8/2=13.9, 46.9/2=23.44. I will get an extra profit of usd1000! Emm.. sound great. [Miser]

Worst scenario? At 370, I keep the whole premium usd4690 buy SE at 370 bearing in mind my BE is 323. Wait for the next rebound.

But actually I seldom acquire stock, I roll theput again ..

This is meant to be my internal note for what I feel. Might be wrong, pls invest with care.

精彩评论