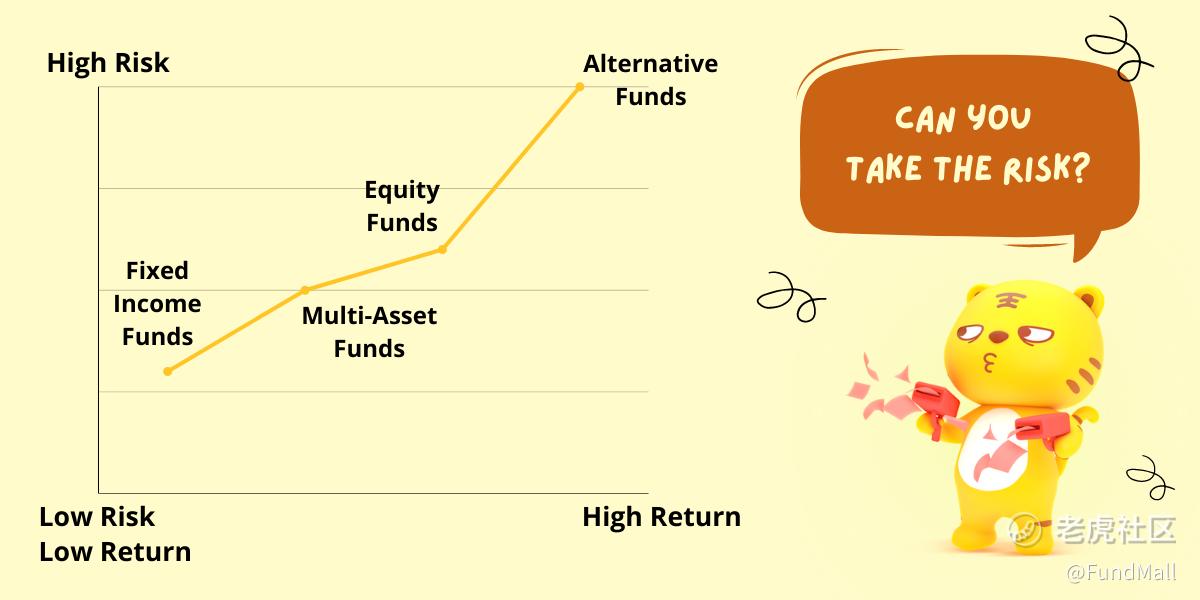

Previously, we provided our readers with a brief introduction to Unit Trust. In today’s piece, we go a step deeper and take a look at the different types of Unit Trust an investor can add to their portfolio.

Equity funds

An equity fund is a fund that invests primarily in stocks. The objective of an equity fund is generally to seek long-term capital appreciation. These type of funds may focus on certain sectors of the market or may have a specific investment style, such as investing in value or growth stock.

Fixed Income Funds

A fixed income fund is a fund that invests primarily in bonds or other debt securities. Fixed income funds generally pay a return on a fixed schedule, though the amount of the payment can vary. Investors may consider this type of fund for their potential for income generation and capital preservation.

Multi-Asset Fund

There’s more to diversification than just combining bonds and stocks. A multi-asset fund offers exposure to a broad number of asset classes, often offering a level of diversification typically associated with institutional investing. Multi-asset funds may invest in a number of traditional equity and fixed income strategies, index-tracking funds, financial derivatives as well as alternative investments. This diversity allows portfolio managers to potentially balance risk with reward and deliver steady, long-term returns for investors, particularly in volatile markets.

Alternative Fund

Alternative funds invest in a variety of strategies and asset classes, and look to provide risk and return profiles that have lower correlation to traditional asset classes such as equities, fixed income and cash. Alternative funds have since become an increasingly option for investors who seek to reduce volatility and improve their portfolio returns.

Any investment comes with risks

Before including any of the above mentioned fund types into your portfolio, it is important to understand the risk that comes with it and ask yourself if it suits your risk tolerance.

Typically, the risk of a fund can be accessed using “Beta”. A Beta of a fund measures market or systemic risk which in other words tells us how sensitive to changes it is. To find out how sensitive or volatile a fund is, we often compare the Beta of a fund to the market Beta which is always assumed to be 1.

To put things into perspective, let’s take an example of a fund which has a Beta of 0.8. What this means is that in the event the market goes up by 1%, the fund would increase by 0.8% and vice versa.

What is the risk for the different types of funds?

Equity funds: Generally, an equity fund has significantly higher risk compared to that of a fixed income fund as it is designed to generate higher returns by adopting specific investment methodologies (Sector, Country, Regional, Country and Global). Investors with a risk appetite of 7 on a scale of 1-10 can consider adding equity funds into their portfolios.

Fixed income funds: Depending on the categories of bond classes that the bond fund invests into, a fixed income fund usually has a risk rating between 2-5. For example, if a fund invests mostly into government debt of developed nations, the risk rating would be on the lower side of the scale since credit risk is low. However, a bond fund which invests in high yields from emerging markets will come with a higher risk rating due to the greater chance of default. Overall, we think yield seekers could consider both low and high risk fixed income funds to benefit from higher yields yet balance out the risk they take.

Multi-asset funds: Multi-asset funds fall under the category balanced funds. Balanced funds have a risk rating between 4-6, depending on the regions the fund invests in as well as the asset allocation of the fund. For example, if the multi-asset fund allocates a greater amount of its assets to equities, the risk rating will be 6. In our view, investors seeking both yields and capital gains from equities but is rather risk averse can consider a multi-asset fund.

Alternative funds: Alternative funds usually comes with higher risk since they are often not correlated to conventional markets and yet have the potential to generate high returns. As such, they have fall between the 7-10 range on the risk scale, just like an equity fund. A common type of alternative investment is real estate and commodities. Nonetheless, investors can consider holding a small amount of alternative funds as it is a suitable tool for portfolio diversification and can be an effective hedge against inflation.

精彩评论