Market momentum has slowed down significantly in contrast to the high flying 1H21. Since then, investors are struggling with investing in the prevailing macroenvironment. Today, we will break down the market situations and help investors select potential winners heading into 2022.

Equity Market Recap

In the first half of the year, market sentiments was largely positive due to the expectation that a post-pandemic global reopening is near. However, with the resurgence of the delta variant in the second half, optimism has wavered.

Supply shortages have also sent prices of raw materials, in particular energy related cost to record highs, threatening a looming inflationary pressure which is considered detrimental to the price of long duration assets, more specifically growth equities.

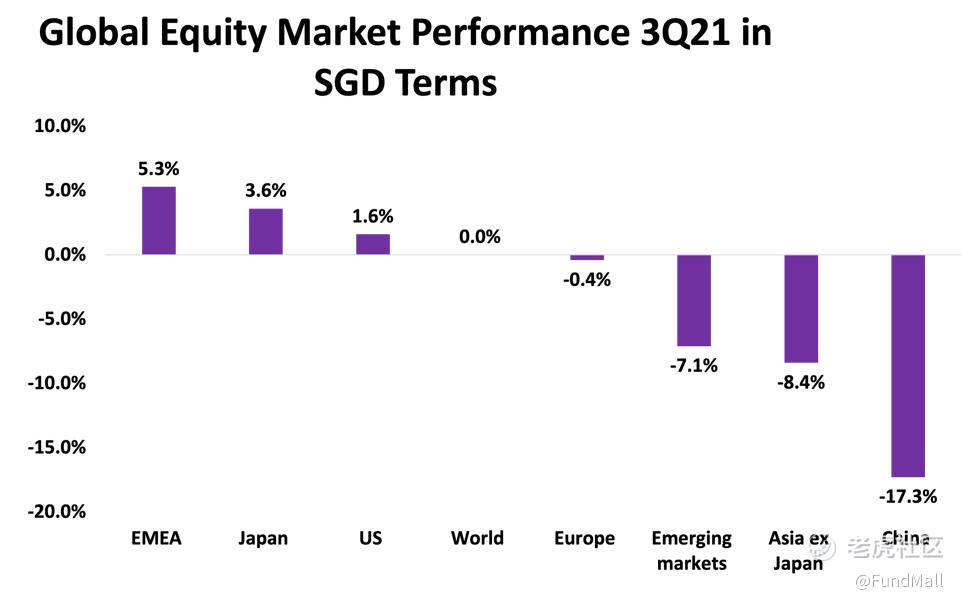

Nonetheless, developed markets (DMs) still deliver gains of 1.6% (SGD Terms) in 3Q21 in the face of rising inflation and weakening economic growth momentum.

Similarly, investors of Europe equities are also wary of inflationary pressures - Annual inflation in the Eurozone surged to 3.4% in September, up from 3.0% the month prior.

Additionally, political risk in Europe is something at the top of Mr. Market’s mind too. Given the upcoming election for two of Europe’s largest economies (Germany and France), uncertainty stemming from the political front raises worries about European equities going ahead.

Looking at emerging markets (EMs), particularly Asian countries, equities underperformed, led by a sell-off in China. Two major headwinds continue to plague Asian equities; (1) continued regulatory crackdowns in China and (2) worries about the overall credit health of the Real Estate sector.

Source: Bloomberg

Fixed-income Market Recap

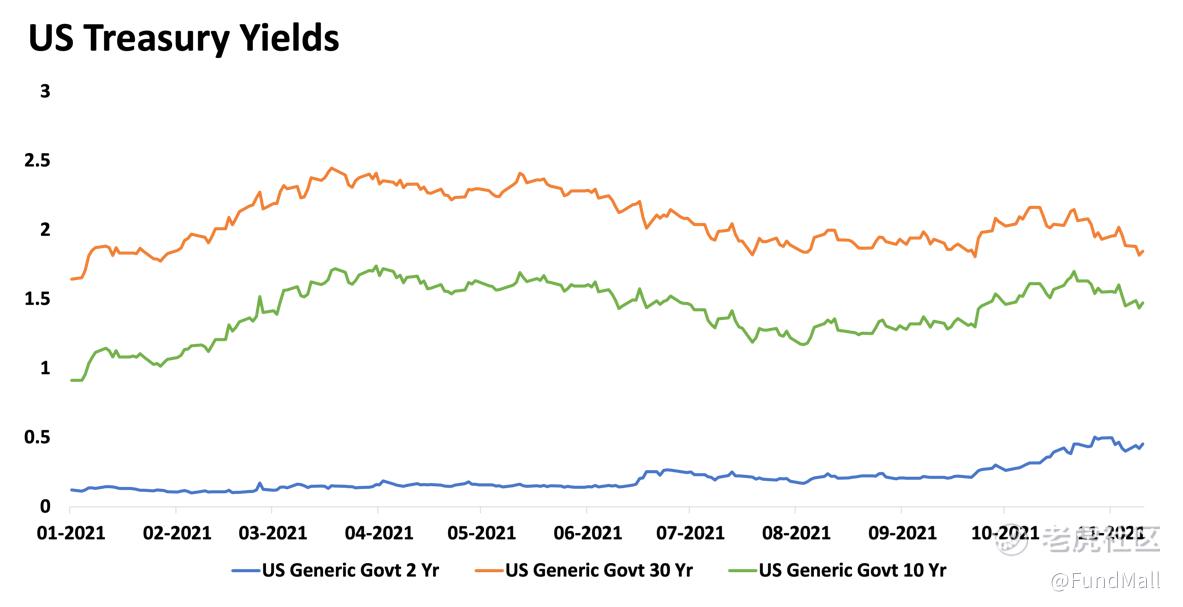

In 3Q21, Treasury yields traded range bound in July and August but shot up rapidly in September as supply chain disruptions spurred inflationary pressures. So how did fixed-income markets perform in 3Q?

Source: Bloomberg

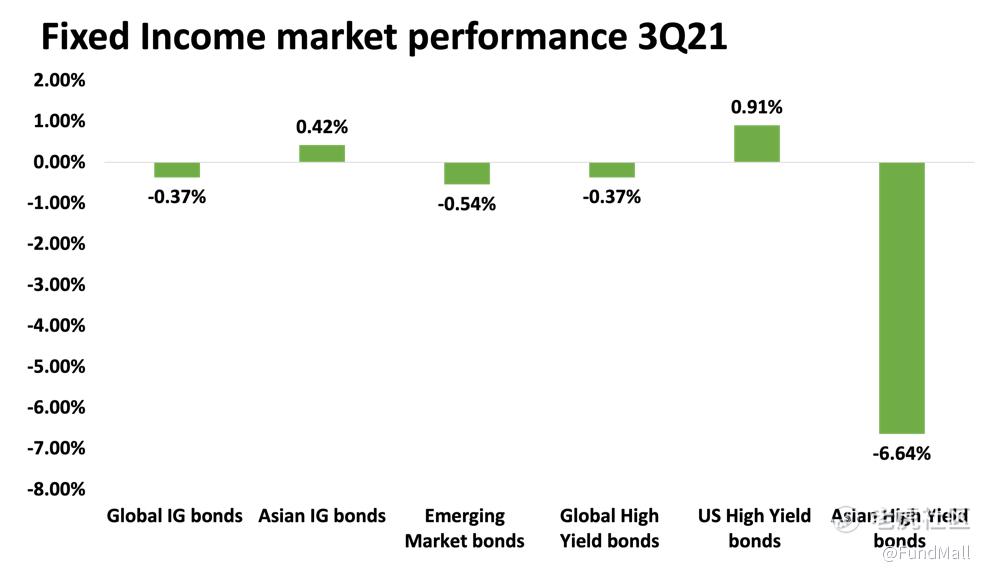

Broadly, global bond prices have fallen in 3Q21 as investors begin to re-evaluate the narrative of ‘transitory inflation’ painted by the US Federal Reserves (“Feds”). That said, US High Yield (USHY) bonds and Asian investment grade bonds, registered relatively good returns for investors. Asian High Yield (“AHY”) bonds on the flip side disappointed as default risks mounted and market sentiment soured for the prospect of Chinese property sector’s ability to repay their debt.

Source: Bloomberg

Equity funds to consider

As we round the bend into 2022, we hold true to the belief that the macro backdrop remains sanguine as economies continue to recover from the Covid-19 carnage. Growth still has potential to run in our view, as global activities have yet to reach pre-pandemic levels.

That said, most global equity markets with the exception of Asia, China and Latin America are trading at stretched valuations. Hence, for value-oriented investors, a proposition to extend their exposure into these expensive equities may not sound appealing.

We suggest such investors to look into China A shares market since global markets are susceptible to corrections in the near term. To put things into perspective, China has suffered a beating of 31% from peak to trough. Nevertheless, we still see some positives investing into the China onshore market.

First of all, we understand that investors are concerned over the recent slew of regulatory crackdown news. Yet, we argue that this is perhaps the major tailwind for an investment into China’s onshore market.

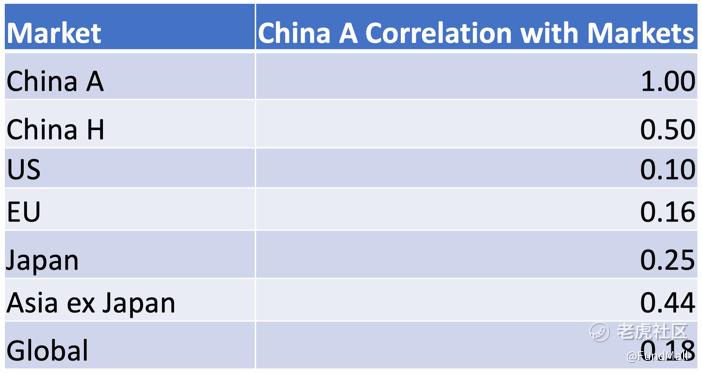

Amid the reforms, companies listed on the A shares market are poised to benefit. Secondly, China is the 2nd largest economy in the world, making it too big to ignore. Hence, China A shares is the easiest way to gain exposure to the burgeoning economy. Finally, China A shares have low correlation to global equity markets, making it a portfolio diversifier.

Source: Bloomberg

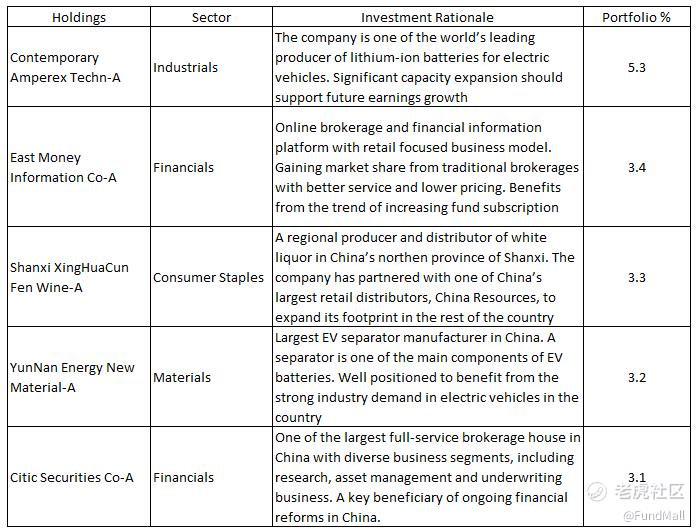

To add China into your investment portfolio, we recommend the $Allianz China A Shares AT Acc USD(LU1997245177.USD)$ which is managed by Anthony Wong and Kevin You who have a combined experience of 33 years. The fund adopts a bottom-up, fundamental and active investment strategy. Some of the themes that the team sees potential for a sustained growth in the years ahead are; 1) self-sufficiency, 2) industrial upgrade, 3) healthcare/biotech, 4) renewable energy and 5) domestic consumption.

Source: Allianz China A Shares AT ACC USD Factsheet

For more aggressive investors, we suggest looking to the tech sector despite lofty valuations. Mainly, the two concerns that has led to the recent weakness in Big Tech names are 1)Speculations of a early rate hike is a huge headwind to growth stocks 2) Efforts to regulate Big Tech remains at the top of mind of investors.

Nonetheless, when we look at things rationally, 3Q21 earnings results suggest that Big Tech can sustain much of its pandemic boost. In addition, difficulties from supply chain bottlenecks will eventually eased as inventory picks up over time. Lastly, we believe that secular growth trends remain intact on a longer term horizon.

Longer term outlook investors who like to accumulate some tech exposure, we recommend the $FTIF - Franklin Technology A (acc) SGD-H1(LU1803068979)$. It offers a growth-oriented and diversified approach to investing in the tech sector with names like Microsoft Corp, Amazon.com, Apple Inc, to name a few, as the top holdings. Some of the growth themes the fund invests in are i) E-Commerce, ii)Internet of Things and iii) Cloud computing.

That said, we would like to remind investors that near term corrections are bound to happen with an investment into the technology sector. Hence, we reiterate that having extra liquidity is important in times like that . Alternatively, investors can consider a regular savings plan (RSP), commonly known as the dollar cost averaging strategy.

Fixed-income funds to consider

With inflation fears and energy crisis still at the crux of the topic in the investment world, we think that this serves a timely reminder to investors who are holding long duration bond funds to reduce their exposure.

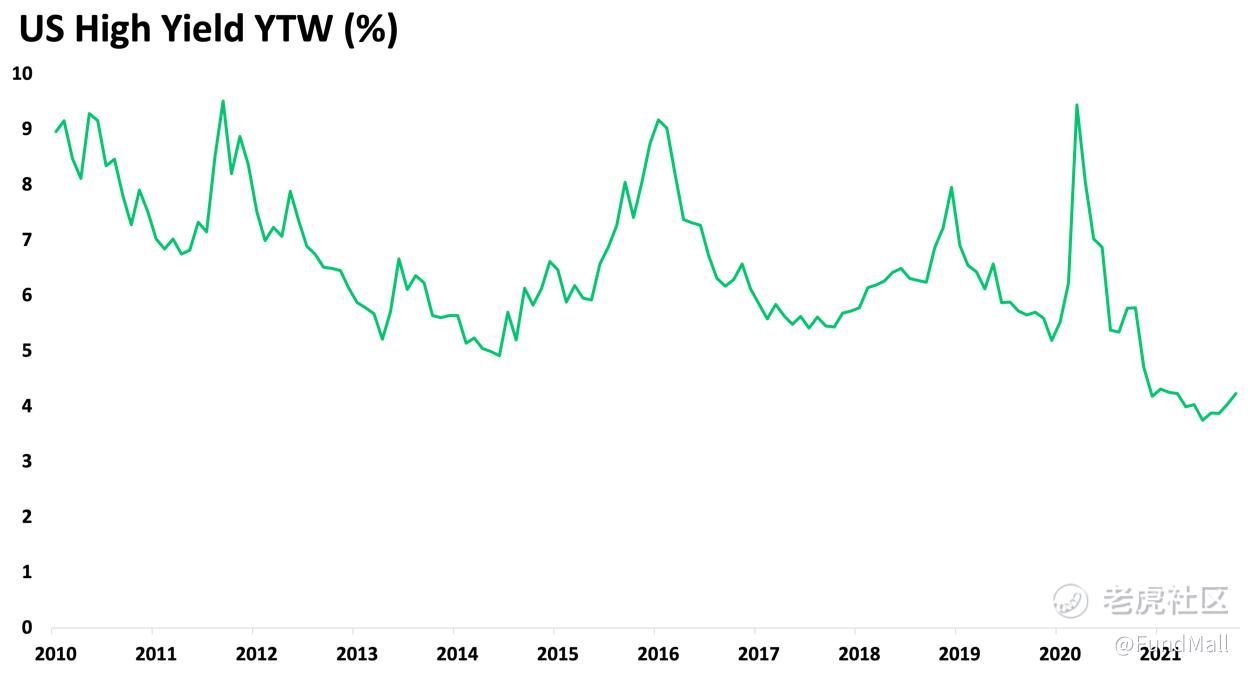

Recognising the fact that USHY has done well in 2H21, we do not recommend yield seekers to invest in this fixed-income segment because yields are at all-time lows which translates to limited price upside.

Source: Bloomberg

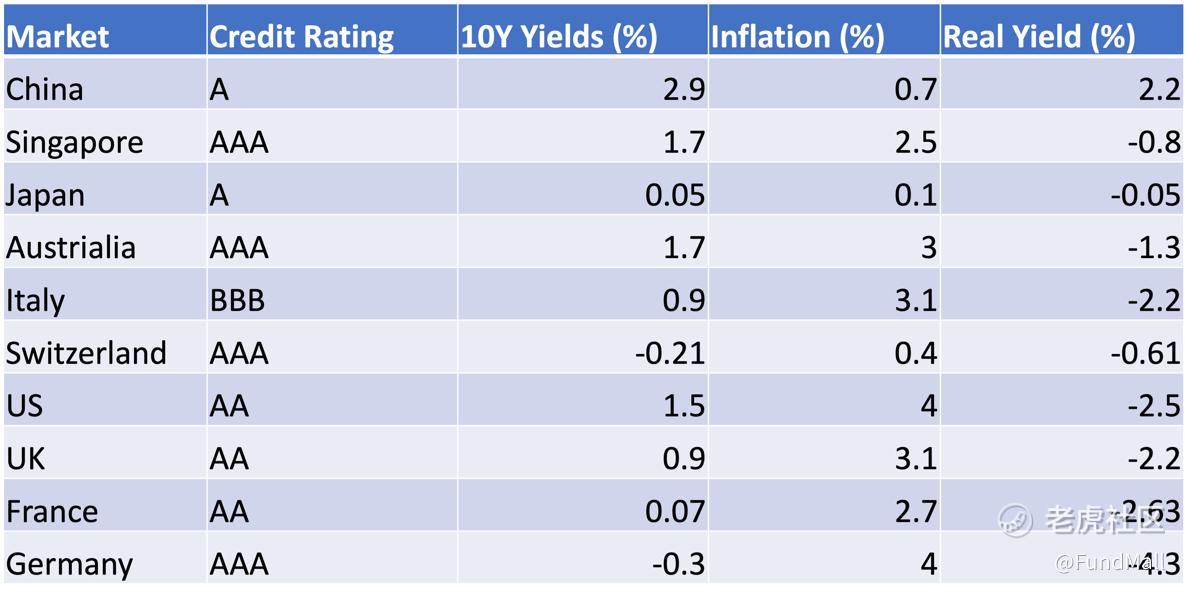

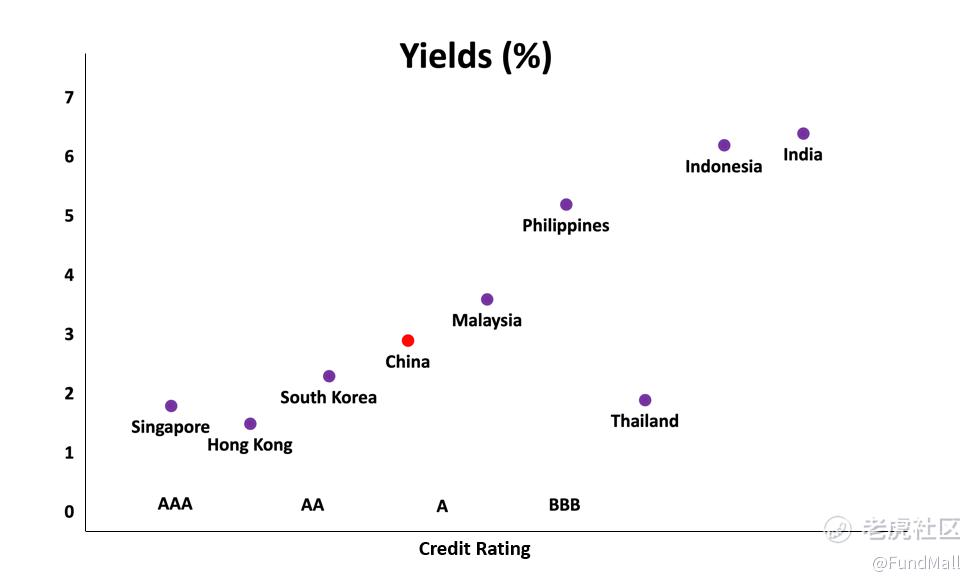

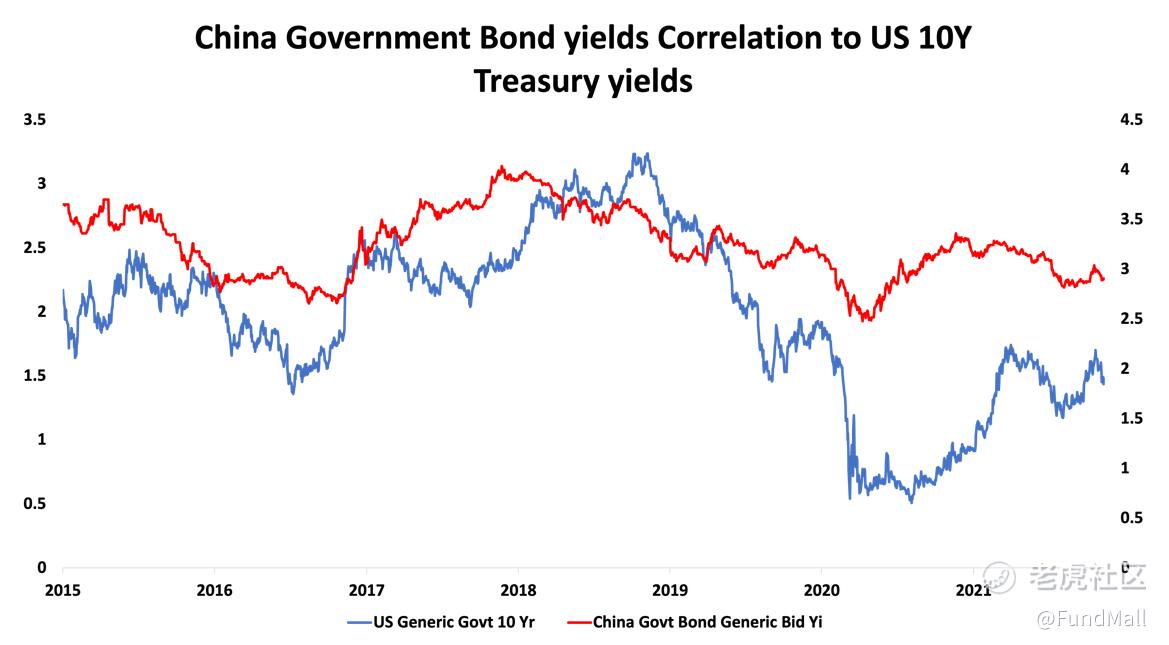

However, there is an alternative should you seek stable income. In our opinion, China Government Bonds (“CGB”) are a good choice for risk averse investors because of i) its ability to provide higher real yields at lower risk, ii) low correlation to other fixed income market and iii) a growing structural demand.

Firstly, CGB provides higher real yields as compared to other bond categories and classes of similar tenure despite the extra yield pick-up over US 10Y Treasury narrowing down from 230bps to 150bps. Secondly, Chinese RMB bonds have low correlation to other key asset classes which make them a good diversification option to your portfolio. Lastly, the inclusion of CGB into major fixed income indices will mean having greater foreign inflows. As such, investors can expect higher demand and price appreciation from the Chinese bond markets over the longer term.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

To gain exposure to the ever-growing Chinese bond market, yield hunters can consider the $Fidelity China RMB Bond A-ACC-USD(LU0740036214.USD)$. The fund adopts an interesting strategy where it aims to capture returns on both the onshore and offshore market. It is able to do so as the fund typically invests its assets in investment-grade RMB denominated bonds, money market securities, with the flexibility to capitalise on cross-market opportunities in the offshore market while maintaining full RMB exposure.

By investing in the fund, investors will gain exposure to China’s fixed income space via three different markets, namely, i) the onshore CNY market, ii) offshore CNH market and iii) offshore USD market. These markets have their differing characteristic which allows the fund manager to construct a portfolio with suitable risk-return characteristic.

For more aggressive investors, we think that Asian High Yield (“AHY”) is perhaps a segment you can look at due to its i) cheap valuations, ii) better yields and iii)short duration.

The fund we recommend investors consider adding into their portfolio should AHY appeal to their risk appetite is the $Eastspring Investments - Asian High Yield Bond AS SGD-H(LU2324821094)$, which invests in a diversified portfolio consisting primarily of high yield fixed income / debt securities issued by Asian entities or their subsidiaries.

At this point in time, the fund holds an overweight on China (50.6%) and has a heavy allocation towards the Home Construction sector. While we note that the overweight in China high yield real estate sector was the main culprit of its underperformance, we argue that it is well positioned for a recovery play when credit concerns start to wane. As such, investors who decide to hold this fund should have a longer-term in mind.

Disclaimer: Tiger Brokers do not take into account the financial situation, time horizon, existing portfolio and risk profile of an individual investor. It is the investor's responsibility to decide if these funds are suitable for him or her. If in doubt, please seek the advice of professional advisers.

精彩评论

哈哈

买元宇宙的基金