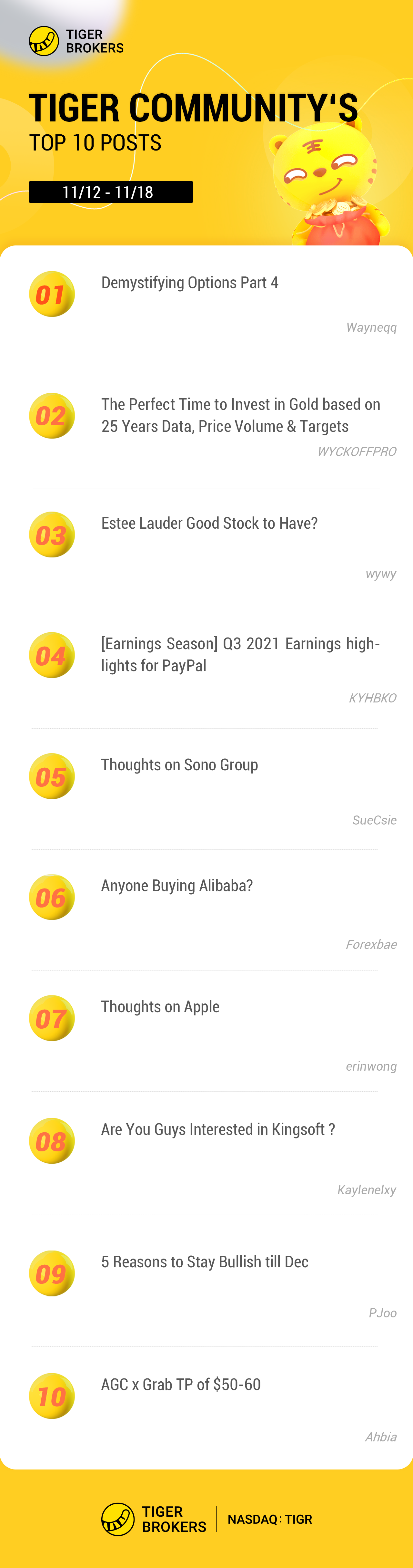

Welcome to our column: Posts of the Week! 🚀🚀🚀🚀🚀🚀🚀🚀

A tip:

We have extended the list with 10 posts and if tigers want their posts to be chosen, you can @Tiger Stars in the article or the comment to earn more exposure because we will evaluate those posts that @Tiger Stars with priority.

A quick wrap-up of this week

For this week,

1. @Wayneqq @WYCKOFFPRO @wywy @KYHBKO have mentioned @Tiger Stars in their articles and all their informative posts have been successfully selected! congratulations!! We welcome and encourage more tigers to @ us!!

2. Congrats to Tigers @SueCsie @erinwong @PJoo @Ahbia ! Their posts are the first time selected in the "🏆 Posts of the Week". Thanks for sharing your insights on stocks and markets with us.

3. Another highlight is Demystifying Options Part, written by @Wayneqq. He clearly explains how Option works, selling put options and buying put options. If you are interested in options, read it!

Market trends and industry news:

1. The Perfect Time to Invest in Gold based on 25 Years Data, Price Volume & Targets

Tiger: @WYCKOFFPRO

Last week, Gold just broke out from the downtrend line and the resistance at 1825 with increasing demand. In terms of Wyckoff phase analysis, this could be phase C pending a sign of strength rally as a confirmation, which could take Gold to the immediate resistance at 1960 or even all time before another reaction sets in.

2. 5 reasons to stay bullish till Dec

Tiger: @PJoo

4. Fund managers are loaded with cash. This is last last minute Christmas shopping. Some FOMO will kick in to buy and hold stocks.

5. Its has always been the time of the year, that market goes up. Supported by recent boost on higher profits guidance and the birth of MAMAA. Well, when the probability is higher to go up. It will happen.

Tigerpedia:

3. Demystifying Options Part 4

Tiger: @Wayneqq

There is 1 IMPORTANT rule when SELLING CALL Options. Violating this rule means you have a very high chance of losing money.

Rule: You have at least 100 shares of the company to sell should the option be exercised. Each option contract is 100 shares, so the more option contracts you sell, the more shares you need to hold. If you do not have the shares and the share price goes up, you will be forced to buy the shares at market price and fulfil your sell call obligation at a loss.

Stock opportunities:

4. Estee Lauder good stock to have?

Tiger: @wywy

So decided to do more read up on EL, started buying through DCA. And for the rest of the year, the trend just continue to headup.

Lately, it releases Q1 FY22 result. And I can say it had a very strong start. Everyone was thinking, with the work from home norm and mask wearing, for sure, result will not be too positive. But instead, EL rebound from COVID-19 with sales up double digits organically in all regions and up 18% for the group.

5. [Earnings Season] Q3 2021 Earnings highlights for PayPal

Tiger: @KYHBKO

From the 1D chart above, PayPal’s decline of stock price from a recent high of $310 should bottom up soon based on the MACD chart below. It would be prudent for us to to take BUY positions after MACD has bottomed up (with the 2 lines have crossed). This should take few days. After doing our own due diligence, we can consider adding new positions for this attractive company.

Tiger: @SueCsie

Most recently, as of January 1, 2021, European Union, or EU, regulations now impose their most stringent ever CO2 emission limits on all new passenger cars registered in the EU. These are the additional competitive advantage to Sono because of the affordability and solar technology.

Tiger: @Forexbae

Price is at the ichimoku and stochastics trendline support. On top of that, it's on a graphical horizontal support where the 50% Fibonacci retracement is. Seems like a strong support zone and I'm hoping price bounces off 156.4 to 165.1 where the horizontal swing high resistance and 38.2%Fibonacci retracement is. I'll have my stop loss at the 61.8% Fibonacci retracement at the last support level at 151.2. In case I'm wrong, I'll be able to get out of the trade fast! If this set up is right though, it's a 1:2.3 risk to reward.

Tiger: @erinwong

Does this mean Aapl will go back up to retest 155 straight and break new high? Maybe. But I feel it may go sideways for abit or even pullback a little due to OpEx this week to eat up time decay and to let options expire worthless.

9. Are You Guys Interested in Kingsoft ?

Tiger: @Kaylenelxy

I see that is it currently abiding to the descending trendline, signifying a bearish momentum. We can expect price to drop from the pivot level in line with 50% Fibonacci retracement towards take profit level in line with 78.6% Fibonacci projection and 61.8% Fibonacci retracement. My bearish bias is further supported by the RSI indicator where it is abiding to the descending trendline resistance.[Onlooker]

Tiger: @Ahbia

With a valuation of 40b and largest SPAC deal, u dont want to miss this and not be part of the history.Dash IPO was ard $100, less than a year on, it shoots up to $200.Shorties are hoping that it will be similar SPAC deal that fail big time. But fundamentally, they are not aware of how big Grab is in the whole of South East Asia(not only SG).

How can I get selected?

1、Write in-depth posts as many as you can, sharing insights on stocks and markets with others.

2. The posts should be ORIGINAL.

3. Posts with more than 500 characters are to be given priority.

4. Posts with any content that undermine the community experience will NOT be selected, like misinformation, rumors, Insults, harassment, threats, derogatory languages, etc.

NOTES:

1. Tiger coins will be sent within 5 working days after the results are announced.

2. This column will be upgraded in the future with more rewards.

精彩评论