This is part 5 of Demystifying Options... If you are not familiar with options, I would suggest reading my first 4 posts:

Demystifying Options Part 1 - Introduction to options

Demystifying Options Part 2 - Selling Put options

Demystifying Options Part 3 - Buying Put options

Demystifying Options Part 4 - Selling Call options

A short recap on the types of options available...

There are 2 types of options - Put option and Call option. You can buy and sell both of them.

This post will be discussing about BUYING call options.

When you BUY an option, you have to pay premium to the seller of the option. Buying CALL options gives you the right to buy shares. You have the right to buy, but you do not have to buy if you do not want to.

In its most basic form, buying a CALL option locks in the price of the share you want to purchase at your desired value. If the price of the share rises quickly, you can exercise the option to buy the shares at the previously agreed price.

One example will be Elon Musk exercising the options that allows him to purchase Tesla shares at $6.24 per share. This is likely a call option issued by the Tesla as renumeration for being the CEO, so regardless of the current market price, he will only pay $6.24 to buy 1 Tesla share. However, these are special cases, typically reserved for employees or company stakeholders who have the privilege to get such deals.

For normal traders, buying CALL options are used as part of a strategy to amplify their gains when the stock prices rise.

The ONE RULE to take note of when buying call option is that you must be prepared to lose the entire premium you pay. That is also the maximum amount of money you will lose.

Let's use Tesla as an example company for all descriptions below.

Let's say you believe the share price will rise higher than $1500 in 6 months time. You have 2 choices.

Choice 1: You can buy the share now at $1100 and hold it. If you buy 100 shares, you will have to pay $110,000 upfront to get the shares.

Choice 2: You can buy a call option with a strike price of $1500 that have an expiry date longer than 6 months (see Q&A below for explanation). For this case, you only need to pay the premium of the option which is typically a fraction of the total cost of the shares. If the share price rises to beyond $1500, you can sell your option and take profit of the gain in the premium OR you can let the BUY CALL option get exercised and get the shares at a discounted price to sell it later to profit from the difference between strike price and market price.

Lets go through the process of buying call option:

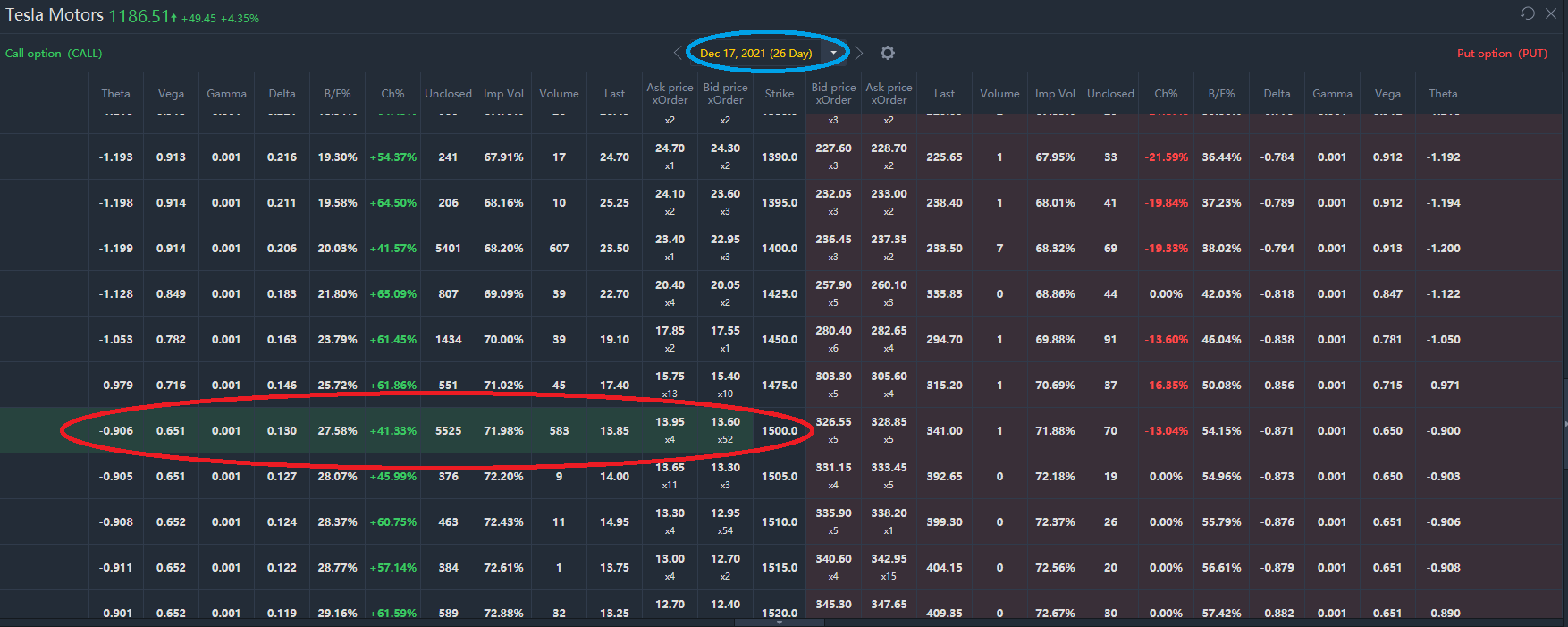

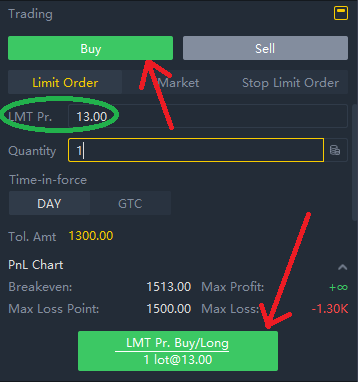

Step 1: Select an expiry date from the list (circled in blue), the strike price you decide (circled in red), and enter the premium you want to collect (circled in green). This premium is for 1 share. The total premium will be multiplied by 100. Remember that you are BUYING CALL option, so click on BUY shown with the red arrow.

Step 2: The next screen is the confirmation screen of your buy call option. You can expand the order detail to see how much the commission and fees and the total premium you must pay. Note that the amount you pay will be the total amount PLUS the commission and fees.

Step 3: If a seller decides that the premium you want to pay is acceptable for the duration of the contract, he/she will take your premium and the contract becomes valid. Note that the premium is paid immediately, and not at the expiry of the contract.

Step 4: If you do not intend to buy the shares, you would want to close out your position when the profit you want to make is achieved.

Step 5: On the day of expiry at market closing (if you leave it to expiry), 2 things can happen.

1) If the share price on the day of expiry at market closing is the same or below the strike price, the contract expires worthless. This means that you have "lost" the entire premium that you paid.

2) If the share price on the day of expiry at market close is the above the strike price, the contract gets exercised. Tiger will buy 100 shares of Tesla at the option strike price. Even if the share price is above the strike price, you will still be paying the strike price because you paid for the right to buy at strike price as per the option contract. If you do not have money for 100 shares of Tesla and you have not exceeded your margin, Tiger will borrow you money to obtain the 100 shares of Tesla. This is ok as you can sell the shares on the market at market price and profit from the difference between the market price and strike price.

Q: Why select an expiry date longer than 6 months?

A: You typically want to give more time for the company to increase its share price. The longer you give, the higher the chance of the company share price will increase to beyond the strike price for you to profit. However, the further the option is to its expiry date, the more premium you need to pay, therefore, the sweet spot is typically about 6 months to 1 year. However, this varies for different company, so you will need to do some research to figure out the sweet spot.

Q: How would buying call options amplify your gain?

A: Assuming you buy 100 shares of Tesla at $1100 per share. The share price increases to $1500 per share in 1 month. You sell it and take profit of $400 per share. The percentage gained is ((1500-1100)/1100)*100% = 36.4%. This is not bad.

Now, using options, assuming the premium for a CALL option at strike price of $1500 is 90 dollar per share. If the share price rises up to $1500 per share, the premium at strike price of $1500 will be about $160 dollars per share. Note that you are trading options now, so you will pay $90 dollars to BUY CALL and if the share price rises, you will close your BUY CALL position at $160 dollars. The percentage gained is ((160-90)/90)*100% = 77.8%. Note the huge difference in the gain.

The premium of each option is calculated using complex mathematical functions beyond the scope of this post. We can simplify the equation to this: Option Premium = intrinsic value + extrinsic value.

Intrinsic value exist if the option is ITM (See Demystifying Options part 3 for explanation of ITM, ATM, and OTM). The intrinsic value will be (market price - strike price). e.g if the strike price is $100 and market price is $120, intrinsic value will be ($120 - $100 = $20). If it is ATM or OTM, intrinsic value is 0.

Extrinsic value depends on the time value and how close the strike price of the option is to the market price. To explain in simple terms for time value, it means that the further the option is to its expiry date, the higher the extrinsic value. The extrinsic value will also be much higher if the option strike price is close to the market price or ATM as compared to if the option strike price is very far from the market price.

Note: Closing an option contract is DIFFERENT from exercising an option contract. To close a contract is to do the reverse action. In this post, we are talking about BUYING CALL option, so to close a BUY CALL, we will SELL CALL. On the tiger app, you can right click on the option position and select "Close" to make your life less complicated.

In Demystifying Options part 6, I will explain which are the important parameters to pay attention to when buying and selling PUT and CALL options...

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

精彩评论