$MAPLETREE INDUSTRIAL TRUST(ME8U.SI)$

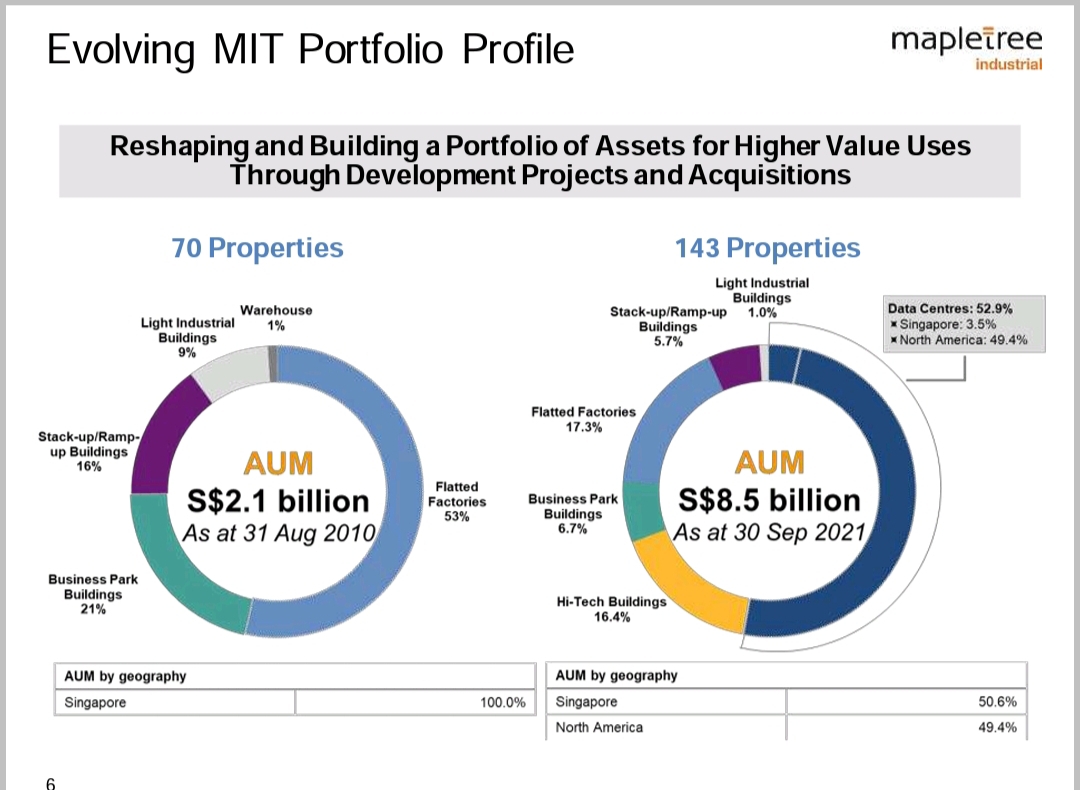

Another Reit sharing, this time, Mapletree Industrial Trust. This is an SGX-listed REIT that owns a portfolio of 141 industrial and data centre properties located in Singapore and North America.

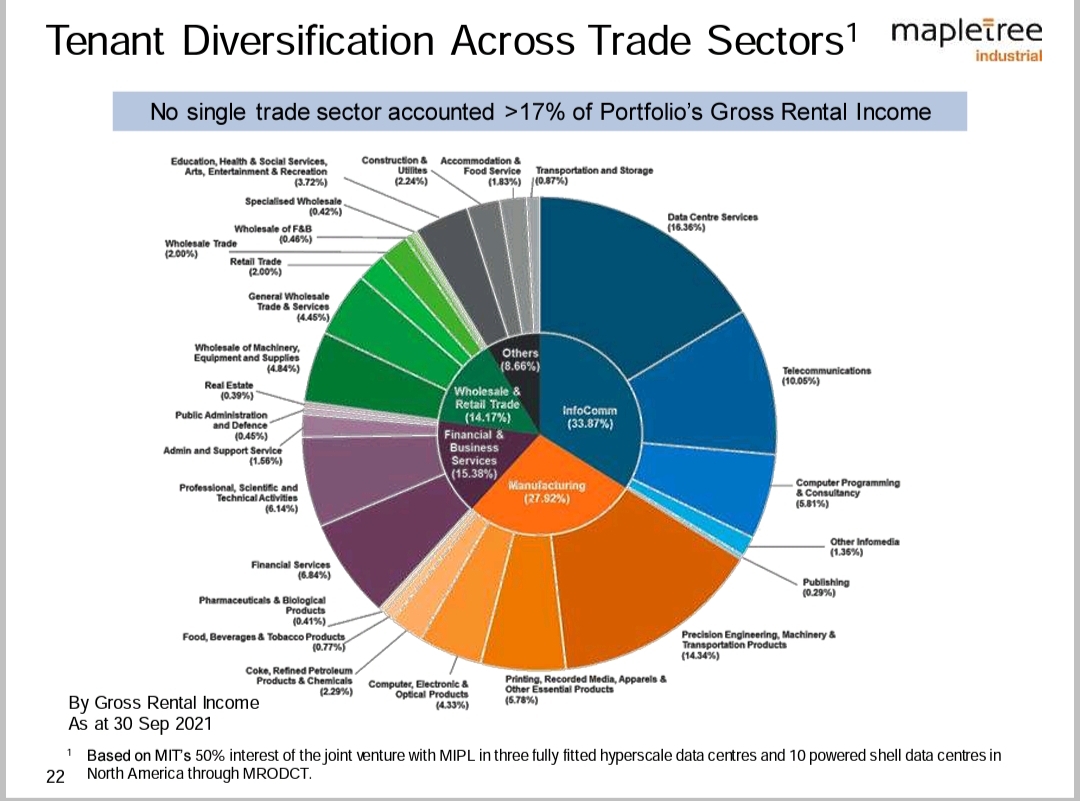

Its main investment strategy is to create a diversified portfolio of income producing real estate used primarily for industrial purposes in Singapore and income producing real estate used primarily as data centres worldwide beyond Singapore, as well as real estate-related assets.

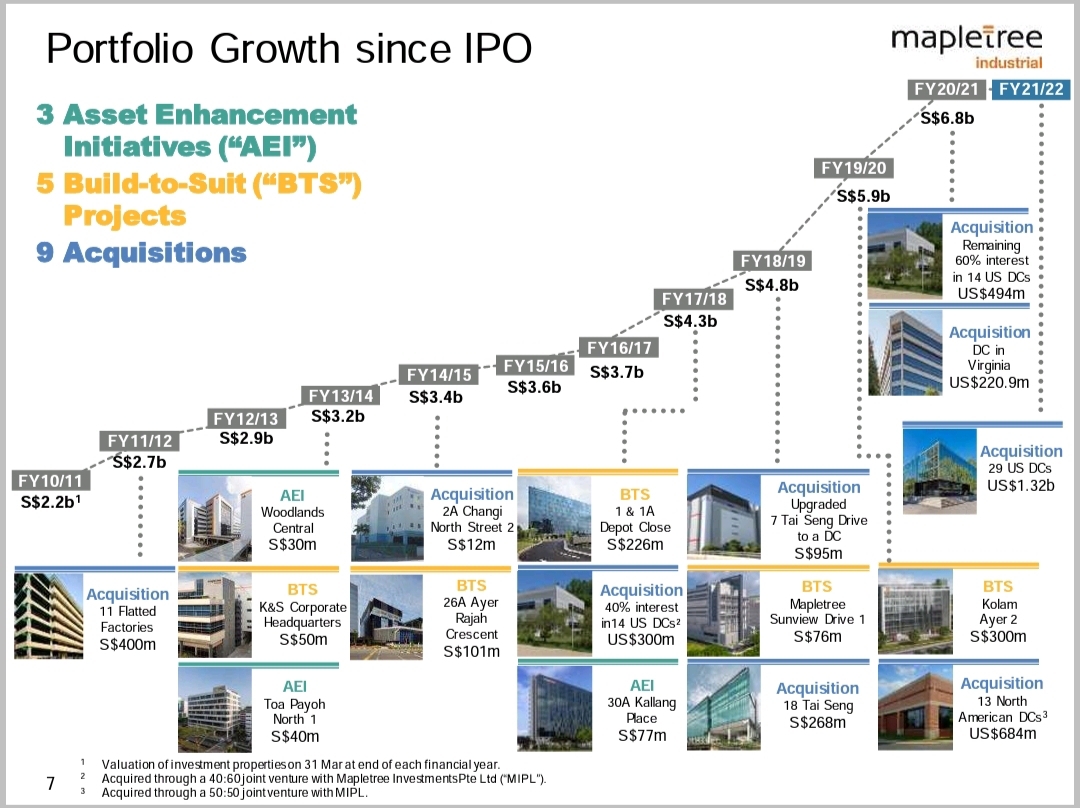

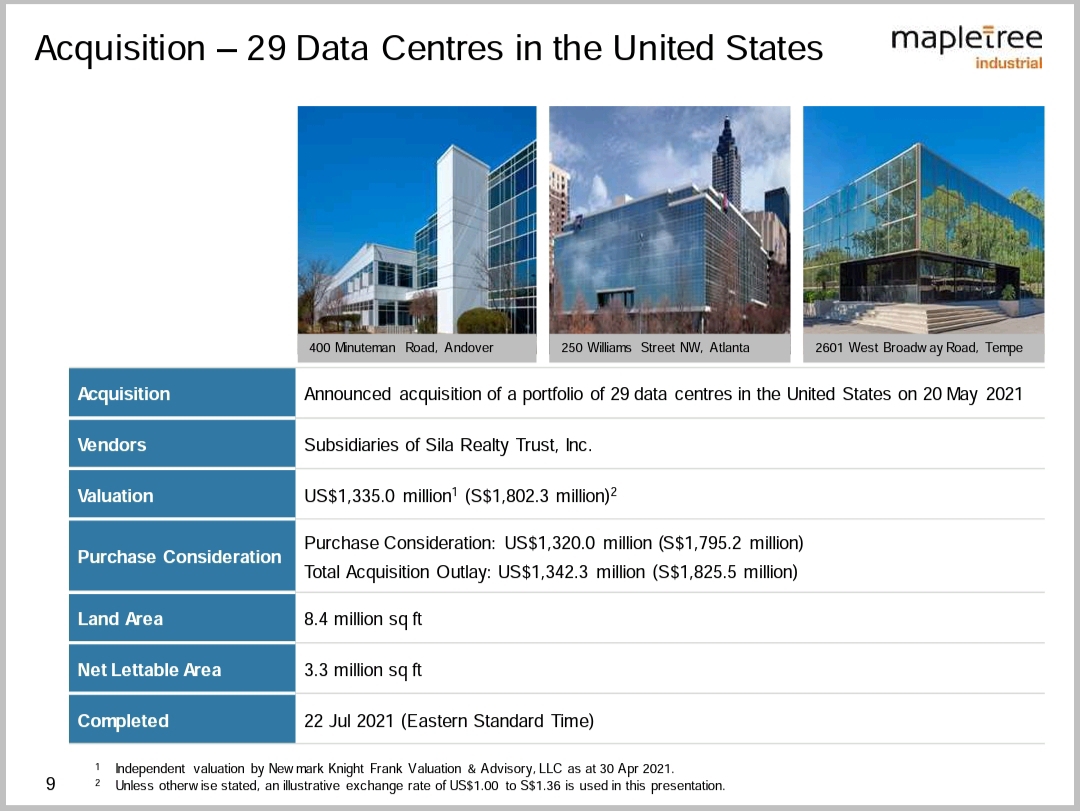

Asof 30 September 2021, the total assets under management was S$8.5 billion, which comprised 86 properties in Singapore and 57 properties in North America. The portfolio includes Data Centres, Hi-Tech Buildings, Business Park Buildings, Flatted Factories, Stack-up/Ramp-up Buildings and Light Industrial Buildings.

COVID-19 caused huge impact to many Singapore REITs, especially the hospitality, malls and offices. But industrial REITs and Data Centre were spared the worst and, in fact, perform better during the pandemic.

The recent result reported in Sept 2021, saw gross revenue increased 10.2% year-on-year to S$447.2M from S$405.9M. Net property income increased 10.4% year-on-year to S$351M, from S$318.1M. The growth was due to the consolidation of revenue from the 14 data centres in the U.S.

Flatted Factories remained the largest segment contributor, accounting for about 31% and 30% of gross revenue and NPI respectively.

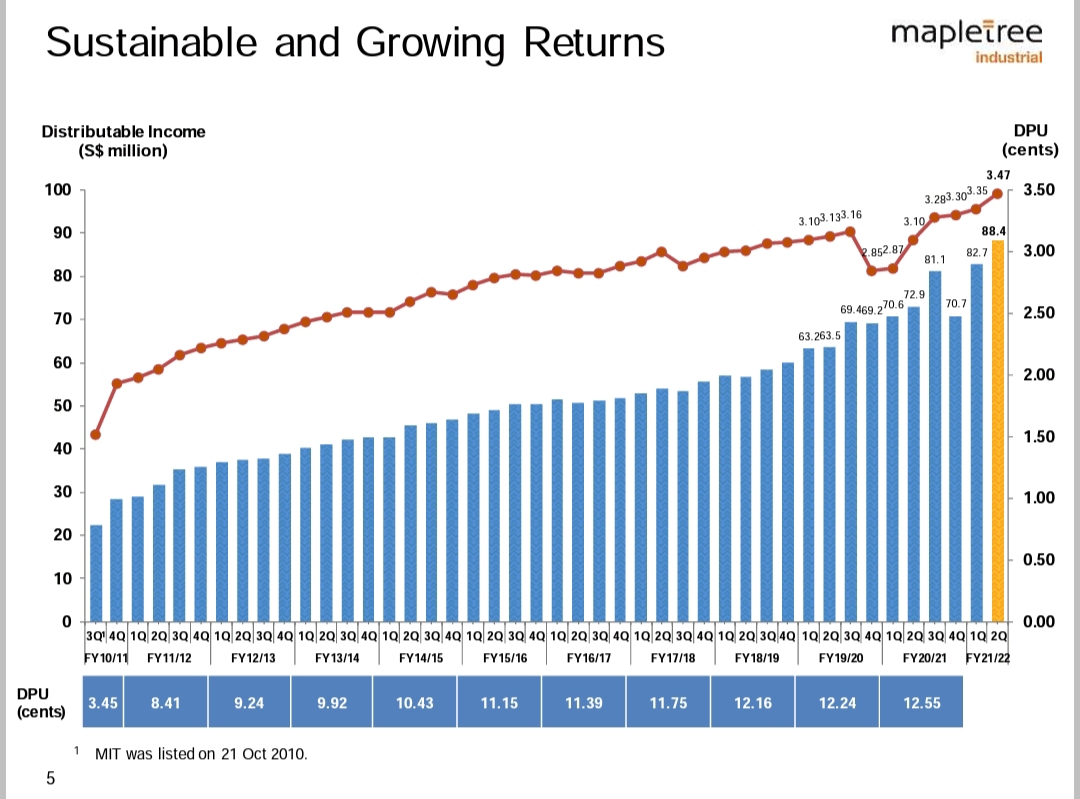

Distributable income of S$295.3M was an increase of 11.3%. This was attributed mainly due to higher NPI and cash distributions declared by joint ventures.

DPU did not grow proportionately with distributable income due to the enlargement of MIT’s unit base through a private placement of S$410.0 million which was used to fund the acquisition of the remaining 60% interest in the 14 data centres in the U.S.

The Fourth Industrial Revolution will drive technologies like the IOT, cloud computing, and AI to the fore and data centres demand will continue to grow exponentially. North American data centres are primarily lease on a triple net basis and have a long weighted average lease expiry of 6.2 years, adding more resilience to its portfolio.

Besides North America, the Reits also continue to lookout for investment opportunities in established data centre markets in Europe and Asia Pacific.

It has delivered consistent growth in revenue and distributable income over the last five years. Its focus on expanding its portfolio towards the data center looks a great strategy to move forward and in line with the economy demograhic.

As a fan of Reits investing, at current price of $2.71 (Nov 25th), the yield is closed to 5%. Its beginning to look very attractive. I am currently not vested in this Reits yet, except through the Syfe Reits portfolio. I will be considering about vesting into this. Could be via SRS fund which I will be topping up for tax relief.@Tiger Stars[微笑] [微笑]

精彩评论