Singapore Telecommunications (Singtel) shares are on the uptrend in the last one month, and about 8.2% on a year-to-date basis. Not bad for a stock that is labelled as boring.

Taking references from analysysts, out of 19 of them, 17 recently recommended ‘buy’ on Singtel shares, two suggested ‘hold’, and none gave ‘sell’ calls, Bloomberg data showed.

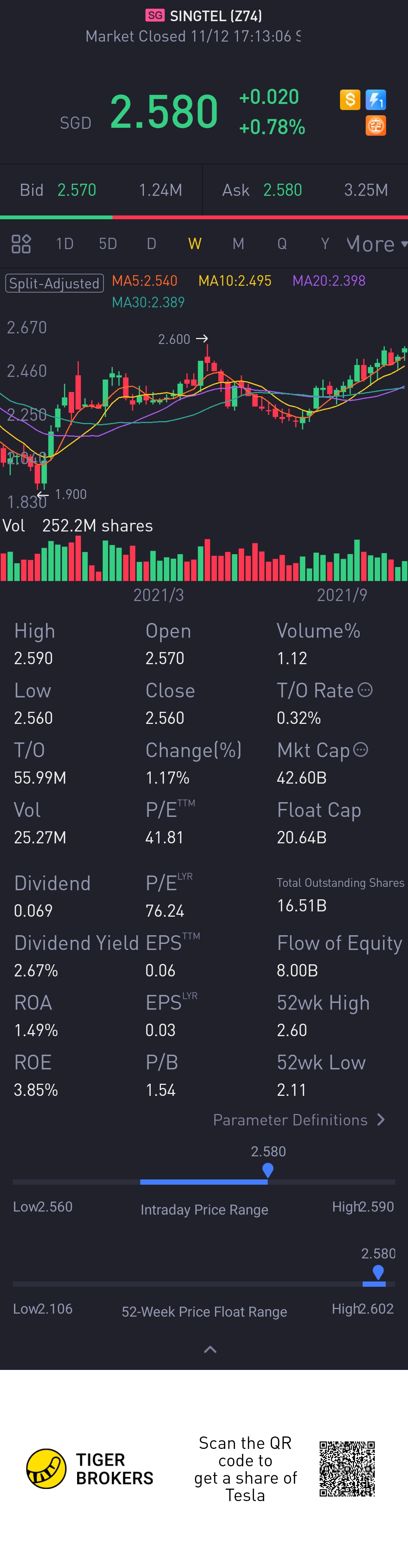

Their average target price was S$2.97,meaning there is a potential upside of 18.8% based on the stock’s latest price of around S$2.55.

It was also highlighted that digital banking may be a value creator for Singtel in the long run, even though it may not be highly profitable in the first five years. But its not something that we will see the result in short term.

Singtel’s Australia tower asset monetisation plans was also deem as a good move.

Believe many of us are probably vested in Singtel with shome free shares in CPF. So just sharing here. Certainly not a stock that most of us will track or even in out watchlist. But perhaps this time is different. At this price, with some new plan, i am wondering if it can possibly return to the days of $3.5 with consistent good dividend. Then it will be a good choice as part of retirement fund![[龇牙]](https://c1.itigergrowtha.com/community/assets/media/emoji_014_ciya.6e6d1a10.png)

![[龇牙]](https://c1.itigergrowtha.com/community/assets/media/emoji_014_ciya.6e6d1a10.png) @Tiger Stars

@Tiger Stars

精彩评论