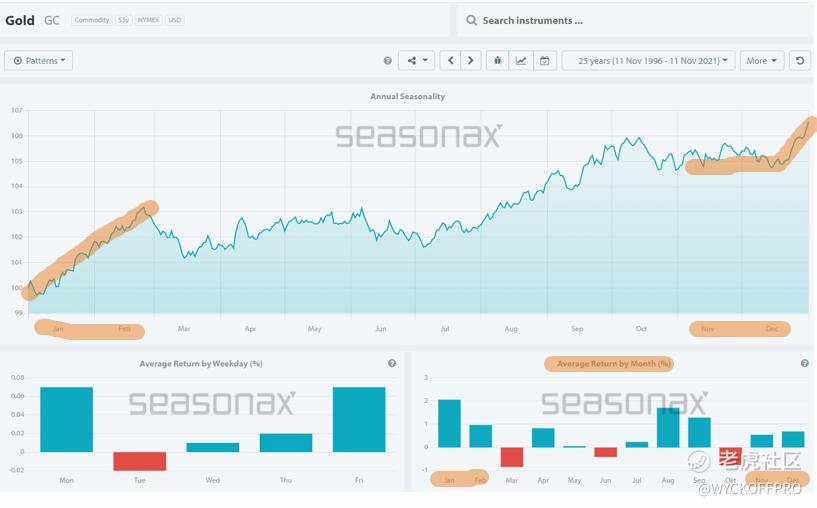

Take a look at the annual seasonality chart of $黄金主连 2112(GCmain)$ for the past 25 years below.

Generally, Gold forms a bottom in November and starts to rally up in December all the way till February. Since this is an annual seasonality chart, it does not mean every year Gold will behave as per the chart above. Rather, it means that Gold tends to perform in this seasonal pattern based on averaging the data for the past 25 years.

Next, let’s visualizethe current context of Gold together with the performance of the identified bullish season (from Nov-Feb) in the monthly chart below:

Since Gold hit the peak at 1923 in 2011, it had a sharp selloff to 1100 and consolidated between 1050–1400 for 6 years (2013–2019). After that, Gold broke out from the accumulation range with a sign of strength rally and hit all time high closed to 2100 followed by a backup action to 1700.

This multi-years formation looks like a cup and handle and we can further divide into 3 trading ranges (boxed up in blue) and two trends (boxed up in pink). Obviously, from 2011 till now (2021) Gold is not in a clear trend.

Within these 10 years, I have highlighted the season from Nov-Feb (in orange) with the findings below:

- In the first range (distribution structure), the performance during the season is flat to negative.

- In the selloff (trend) and start of the second range, the performance is positive.

- In the second range, the performance is positive 6/6.

- During the uptrend, the performance is positive 2/2.

- In the last range, the performance is negative 1/1 while the current season is still unfolding.

Based on the above, the bullish season from Nov-Feb has worked very well in the past 10 years, especially when Gold is mainly in a sideway range and not trending. The only flat to negative performance is right after a buying climax and within the distribution range.

Is the current range a distribution or re-accumulation?

Let’s focus on the price action and volume as shown in the weekly chart below.

After a buying climax formed in Aug 2020, Gold had a pullback in a down-sloping range. Supply has been decreasing (as reflected in the volume) from left to right, which is a sign of accumulation.

Last week, Gold just broke out from the downtrend line and the resistance at 1825 with increasing demand. In terms of Wyckoff phase analysis, this could be phase C pending a sign of strength rally as a confirmation, which could take Gold to the immediate resistance at 1960 or even all time before another reaction sets in.

Gold Price Targets based on Point & Figure Chart

The immediate target for the potential sign of strength rally is 2050. Should this target hit, subsequent price targets are 3075, 4125 and even 5175 with aggressive counts based on causes from the multi-years accumulation built (based on Wyckoff’s law: Causes vs Effects).

Ways to Get Exposure in the Potential Bull Run in Gold

The easiest way is to buy the Gold ETF $SPDR黄金ETF(GLD)$ or Gold Miners ETF $黄金矿业ETF(Market Vectors)(GDX)$ . If you would like to beat the performance of the ETF, feel free to explore the Gold miner stocks such as NEM, AG, GOLD, AEM, etc…

From now (Nov) till Feb is the most bullish season for Gold. You might want to start forming your trading strategy to suit your risk profile and personality such as passive swing trading to buy and hold for 3 months, find the low risk entry to ride multiple swings, day trade by leaning of the daily bias, investing or position trading with anticipation of the high price targets. As long as you are comfortable with the risk involved, you are good to go.

Safe trading. If you are day trading the US futures or swing trading for Malaysia and US stocks, do check out my YouTube Channel: Ming Jong Tey for additional videos and resources. @Tiger Stars $小鹏汽车(XPEV)$ $阿里巴巴(BABA)$ $苹果(AAPL)$

Further Reading

Trade The Pullback Without Catching a Falling Knife Even If You Are A Beginner

3 Signs That the Stock Market could be Topping Out

The Most Important Trading and Investing Rule You Need to Know

精彩评论

gold is always good to have.