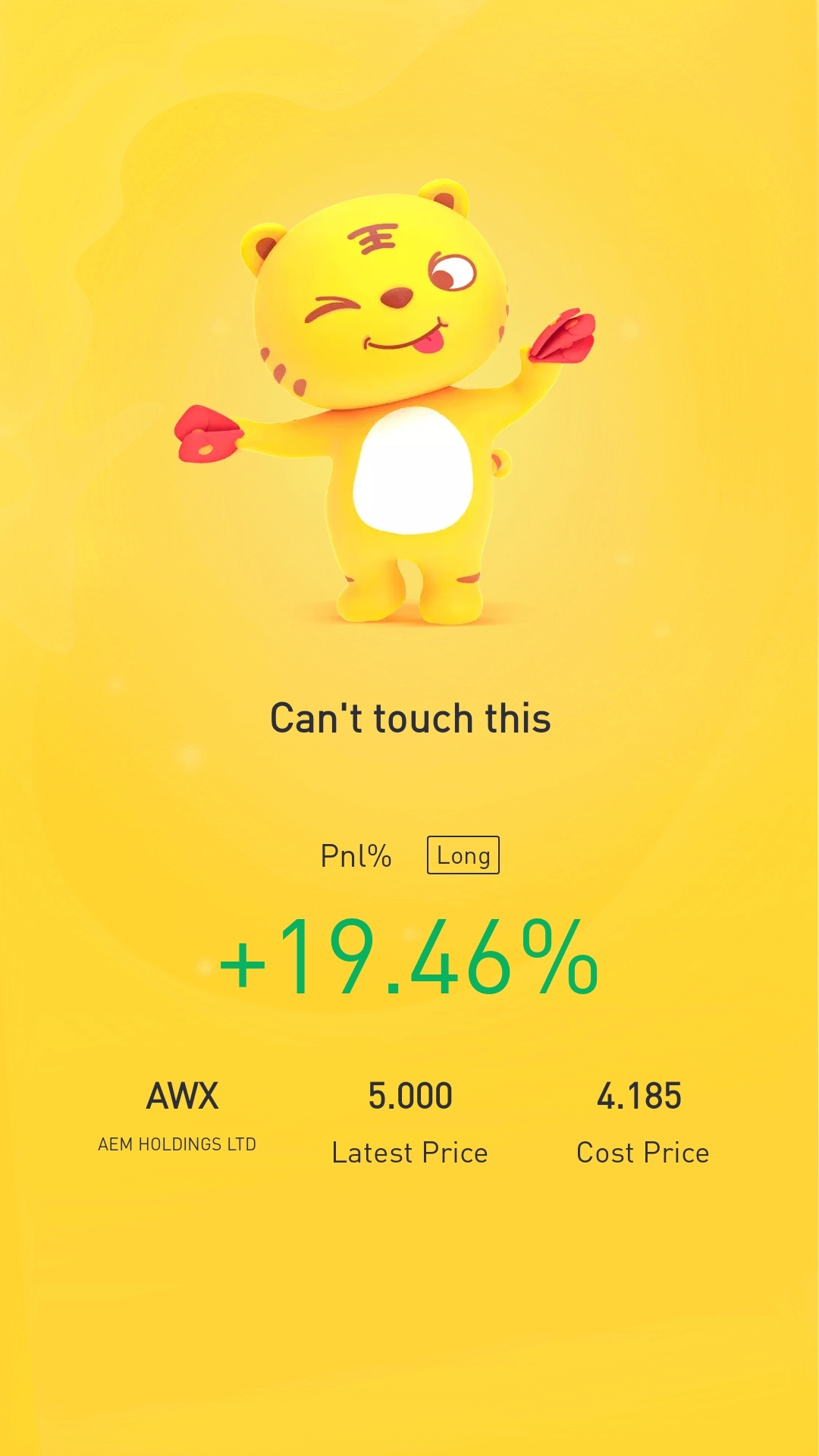

$AEM HOLDINGS LTD(AWX.SI)$ The Come-Back Kid! From 52 week low of SGD 3.23 to Last Closing Price of SGD5. 00! Just simply amazing. Luckily I believe in AEM and did not sell.

AEM's mission is to provide the most comprehensive semiconductor and electronics test solutions based on best in class technologies, processes and customer support.

It was founded in 2000 and has a market capitalisation of SGD1. 55 Billion. It has grown from a Centurion Club with market capitalisation below 1 Billion to the Billion Dollar Club!

In the latest earnings report, AEM recorded revenue of SGD146.2 million in 3QFY2021 ended 30 September, up 9.7% year on year from SGD112 million in 2QFY2021, on the back of volume ramp for next generation handlers.

AEM has raised FY2021 revenue guidance to between SGD525 million and SGD550 million.

Profit Before Tax grew 7% year on year to SGD27. 8 million in 3Q2021. Net Profit for the quarter was SGD23. 3 million up 4.3% year on year.

Free cash flow increased from SGD134. 8 million as at 31 December 2020 to SGD204. 1 million

Total assets increases by 90.9% to SGD640.5 million over the same period.

Best of all, AEM pays dividends half yearly. Current dividend yield 1.32%

AEM is optimistic about its prospects as semiconductor test content grows and aims to increase its market share globally.

As a long term investor, it pays not to panic sell when AEM's share price dropped. Instead I believe that$AEM HOLDINGS LTD(AWX.SI)$ has solid fundamentals in a growing demand for semiconductors worldwide. I am so happy that I did as the price has now jumped so quickly! The next target price is now SGD5. 84. Go AEM! Go Strong, Go Long! That's my maxim.

@小虎活动 - Earnings Season

精彩评论