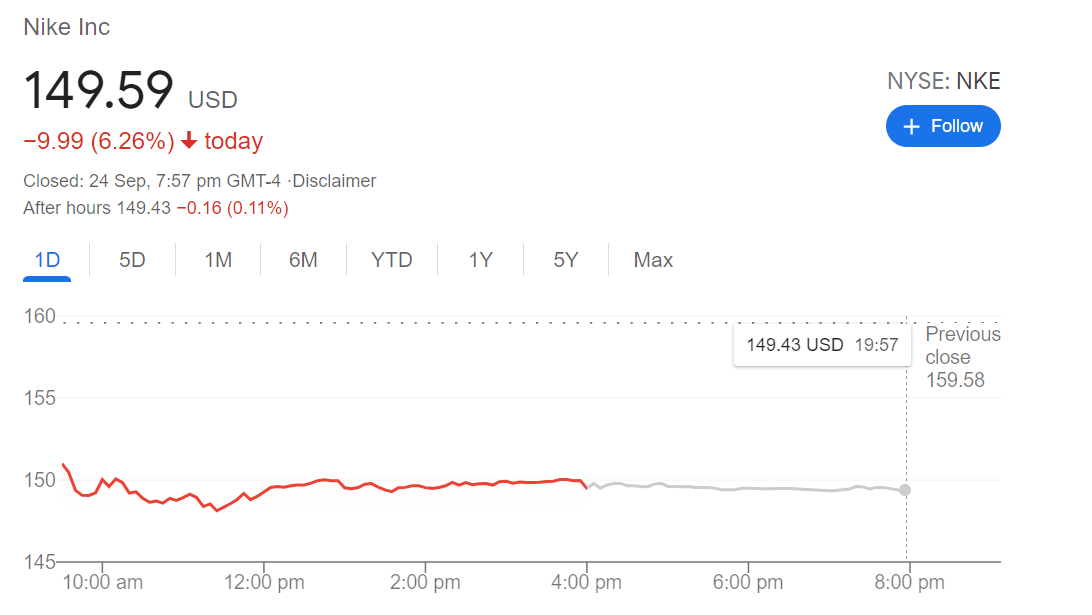

Shares of Nike Inc. $Nike(NKE)$dropped by more than 6% last Friday after the company announced earnings for the first quarter of fiscal 2022 that disappointed investors.

The company cited supply chain disruptions which include temporary forced closures of its manufacturing facilities in Vietnam and Indonesia – both countries that are still facing battle of the Covid-19 pandemic.

First quarter earning is not all bad and gloom.

The company reported sales of $12.2 billion and an underlying EPS of $1.16, which is just under the market estimates of between $12.4 billion and $12.6 billion.

The company managed it’s profit margin better in the first quarter due to less incentives given to customers due to higher than expected demand in the marketplace which led to a higher EPS but warned the increasing supply chain disruptions might hurt their margins going forward.

The ongoing disruptions with the manufacturing facilities in Vietnam and Indonesia are also likely to reduce productions over the next few months which likely leads to a lower sales.

The company also guided for next quarter (Q2) to be flat and revised down the overall fiscal year 2022 revenue to be on mid-single digit growth (down from the previous low double-digit) due to inventory and supply chain disruptions.

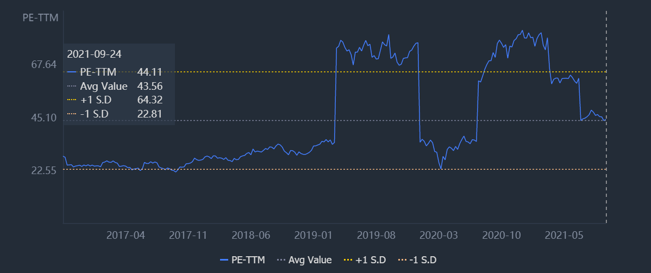

The company is currently trading at a market cap of $236 billion and a price to earnings valuation of around 44x, not exactly cheap if you compare them across the last 5 years period.

From a technical chart perspective, Nike had a gap up when it announced and guided for higher growth in the last Q4’21 earnings.

This gap is now likely to be filled in with sentiments muted for the rest of the year since the company has guided for a much slower growth for the rest of the fiscal year.

For investors who are looking out on this, you may want to watch out the $139 gap level to be filled in in due time.

If you want to be further conservative, you can use the options to look at the $126 strike when the share price has hit the $139 mark. That would be a good level where investors can start going long again, and paid to wait to be patient.

精彩评论