These are some highlights from $Tesla Motors(TSLA)$ Q3 2021 earnings report:

<PLUS> are positive developments

<WATCH> are potential areas of concerns

Notable highlights:

- Operating margin 14.6% despite the Average Selling Price (ASP) of vehicles drop by 6% YoY in Q3 on top of record vehicle production and deliveries. This is due to vehicle volume increase and costs reduction.

- Challenges that affected the margin: semi conductor shortages, congestion at ports and rolling blackouts - thus, the factories could not operate at “full capacity”

- <PLUS> FSD City Streets rolled out in Q3 - this is based on the safety score of the drivers (good). Tesla’s Autopilot is 8x better than the US average for millions of miles between collision.

- Operating margin grew from 9.2% in Q3/2020 to 14.6% in Q3/2021 and the EPS (GAAP) increased from $0.27 in Q3/2020 to $1.44 in Q3/2021

- <PLUS> repayment of $1.5B for net debt and finance lease > debt reduction

- Vehicle production and deliveries are growing

- <WATCH> Solar deployed (MW) dipped to 83 comapred to 85 in Q2/2021 but still up from 58 in Q3/2020

- Storage deployed (MWh) improved to 1295 compared to 759 in Q3/2020

- Vehicle deliveries improved 73% YoY and the supercharger stations/connectors increased by 49% & 51% respectively.

- (TTM) Market Share of Tesla is about 1 to 2% for US/Canada, EU & China

- 4680 batteries are undergoing testing

- Updated vehicle Software/APP in Q3/2021

- New MegaPack factory - capacity from 3GWh to 40GWh > more production can be expected.

- <PLUS> Tesla service and insurance - Telematics insurance > accurate assessment of drivers > matched with correct insurance and also Tesla proactively communicate what driving adjustments to be made to reduce collision

- <PLUS> Target to increase vehicle deliveries by 50% annually.

- <PLUS> GigaFactory Berlin and Texas expect to start production by end of 2021 and to ramp up production over 2022. CyberTruck is expected to be built in Texas.

- <WATCH> item that kept losing money since Q3/2020 is "Services and other"

- <PLUS> Net income per share of common stock (Basic) has improved from $0.32 (Q3/2020) to $1.62 (Q3/2021) - this is over 5x improvement

- Personally, I will prefer for Current assets (especially cash and liquid assets) can be more than current liability but there is sufficient liquidity for the operations.

- Free Cash Flow stands at $16.694B at the end of Q3/2021 remains strong and adequate.

Other notes (yahoo finance):

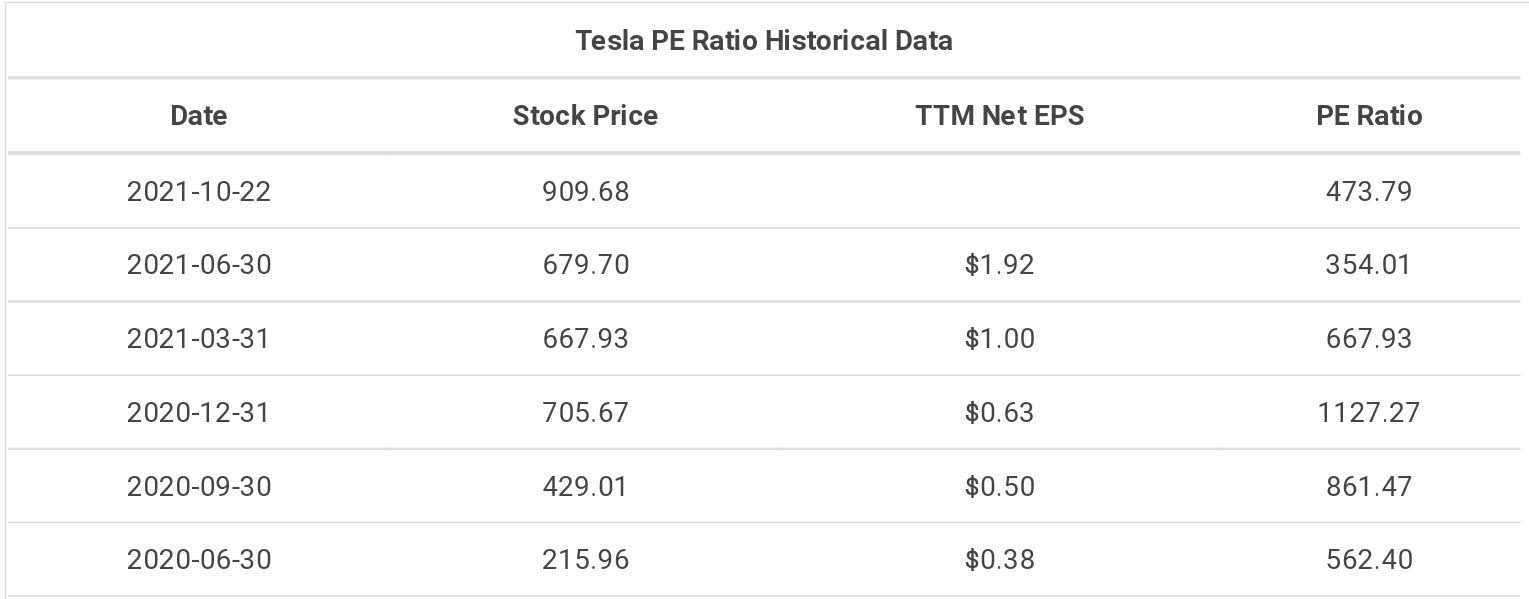

Diluted EPS (TTM) has grown to 3.07 from 1.92 (TTM ending in June 2021) and P/E ratio has dropped from 354.01 (30Jun21) to 296.22 (22Oct201). This means that the earnings is faster than the price increase.

The above is an example of I would go over the earnings report. however, it is important for us to see the trend of the company by quarters and also by years to see a longer time frame development of the company. Let us do our diligence before we invest.

精彩评论