Intel’s latest earnings report and outlook spooked investors, with the stock extending losses on Friday.

On Friday, Intel stock $Intel(INTC)$ sank 11% to $49.60, erasing its year-to-date gains. The stock also declined in extended trading Thursday evening, immediately after the earnings report. Shares of its rival $AMD(AMD)$ edged up 0.5% to $119.98, while the S&P 500 index was flat.

A short look of AMD

Advanced Micro Devices ($AMD(AMD)$ ) had a great five-year run – from about $2 in early 2016 to over $100 in the last few months. A rather spectacular 50x run. Along the way, many analysts have doubted the company and called an end to AMD's stock run; and there is still a cottage industry of analysts who continue to call an end to AMD’s ascent. For long-term investors, none of the doubting analysts’ prognostications matters as long as the company continues to out-execute its peers. As such, investors should not mind much about catching dips in the stock but focus on the long-term prospects of the company.

Why AMD Stock Is Rising After Intel’s Disappointing Quarter?

According to Piper Sandler analyst Harsh Kumar, it is said that Intel pointed to weakness in the low-end of the PC market whereas the high-end PC market fared better. Chips for high-end PCs are an area of strength for AMD. He thinks that’s good news for AMD, which reports quarterly results on Tuesday.

Besides, Apple’s M1 Max processor may create new opportunities for AMD.

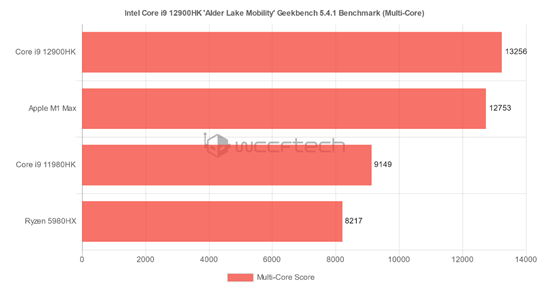

Apple$Apple(AAPL)$ has unveiled a new 14-inch MacBook Pro on October 22nd, which is with a new processor that outscores intel’s i9-11980h. Apple may be about to revolutionize the laptop market.

We won’t discuss the processors detailly. Above all, the lesson we can learn from Apple's M1max is that there is not much need to upgrade today's laptops. For Intel and AMD, they could use the same solution to improve performance and reduce power consumption.

And especially for AMD, this has been done for consoles for a long time, though AMD doesn't have a unified cache architecture right now, it's a piece of cake for AMD.

So if AMD wants to do it, in the next generation, it can do this like Apple.

“When we downgraded the stock to Underperform in April, our thesis was that what appeared certain was the need to spend aggressively over the nextseveral years, and that Intel would bleed share to AMD while they did so.” Raymond James analyst Chris Caso said.

So, with AMD’s quarterly financial report will issue this Tuesday,

Do you think its stock will go up or down?

In the next five years, do you prefer Intel or AMD?

精彩评论