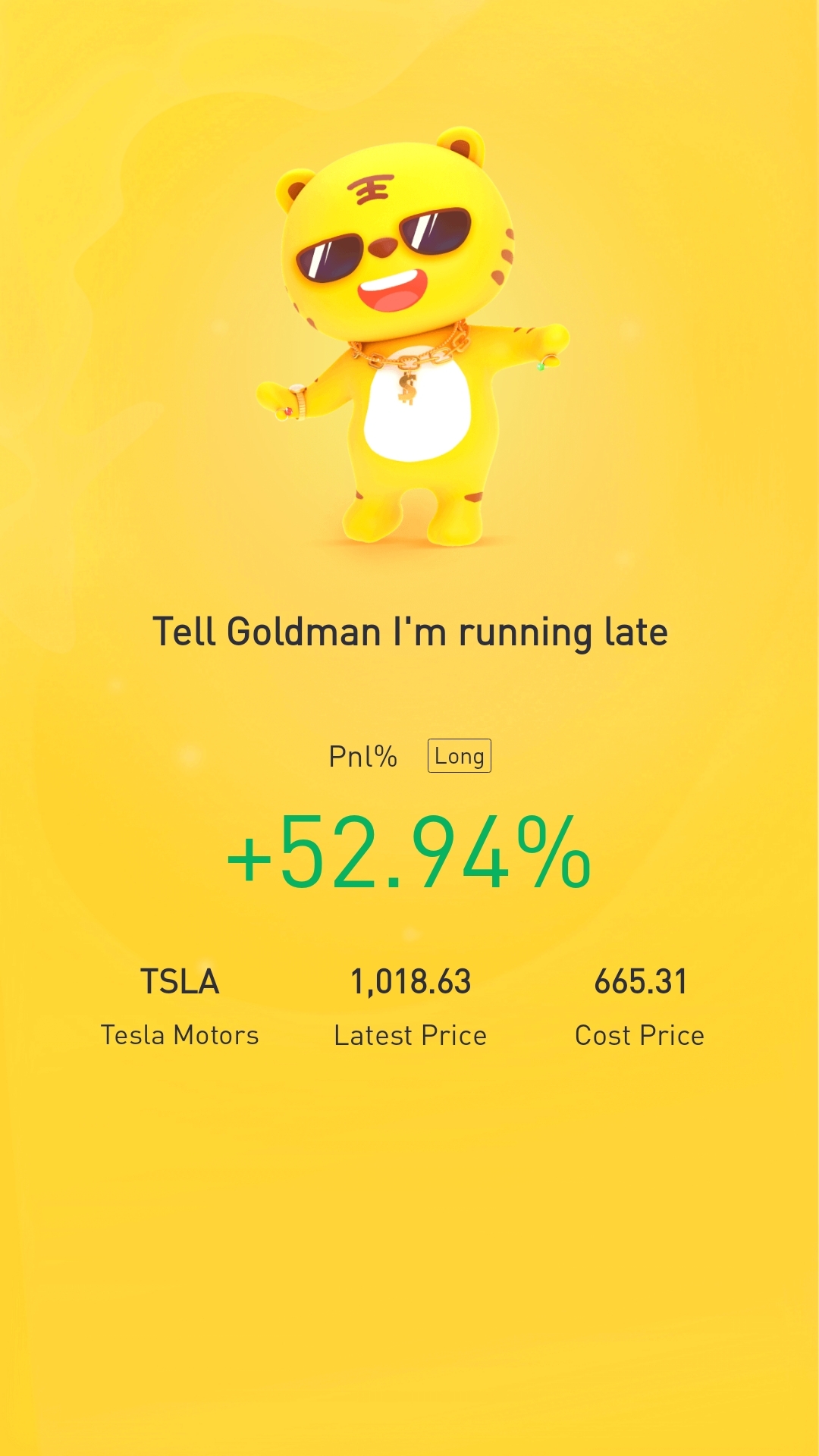

$Tesla Motors(TSLA)$Selling puts: A strategy to earn money while having a lower risk.

• Selling (also called writing) a put option allows an investor to potentially own the underlying security at a future date and at a much more favorable price.

•Selling puts generates immediate portfolio income to the seller; puts keep the premium if the sold put is not exercised by the counterparty and it expires out-of-the-money.

•An investor who sells put options in securities that they want to own anyway will increase their chances of being profitable.

•Note that the writer of a put option will lose money on the trade if the price of the underlying drops prior to expiration and if the option finished in-the-money.

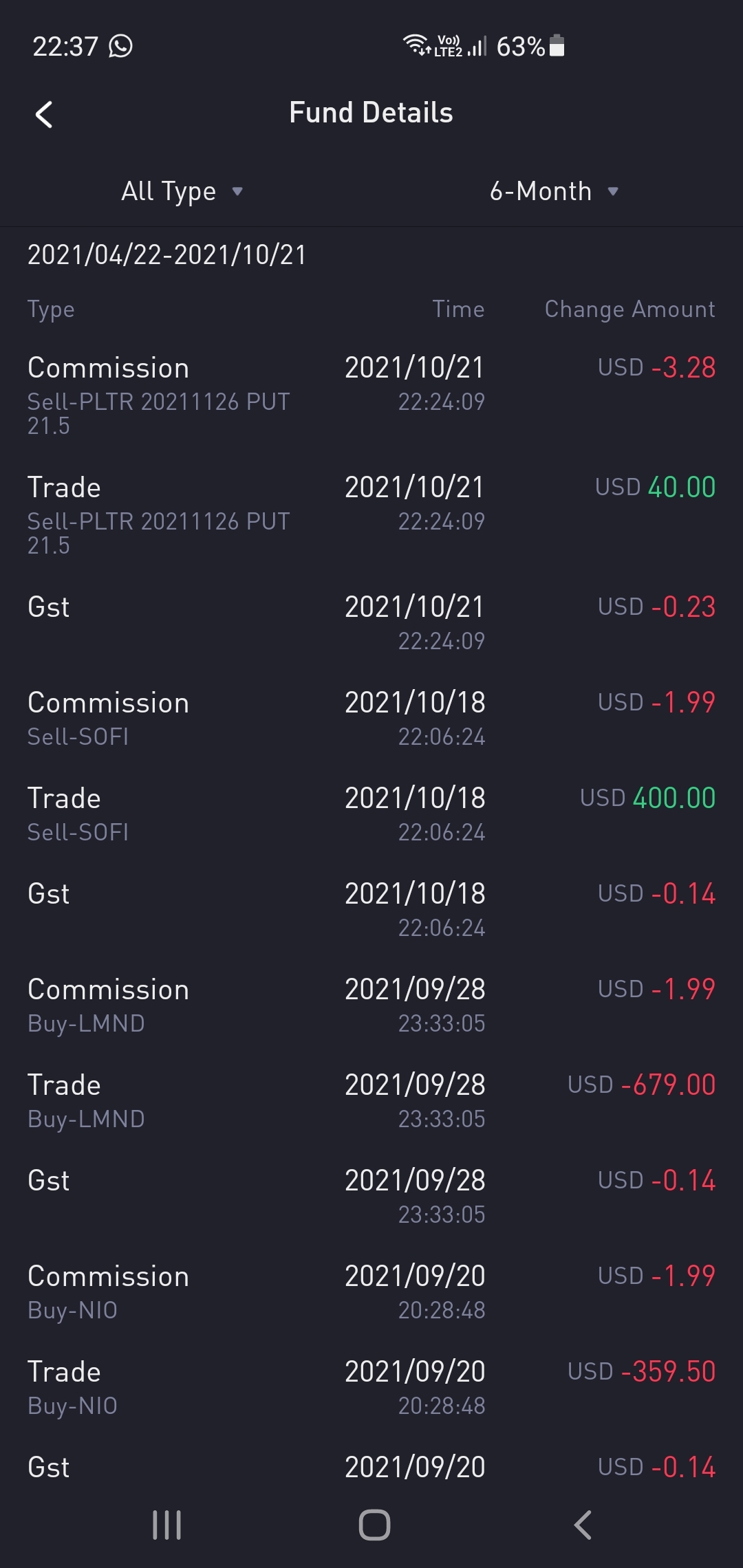

So if you want the stock in your portfolio anyways, why not get it at a discount and if the price doesn't reach your strike price, you still get to walk away with the premiums. Below I have an example which I took the premium for PLTR when I sold a put contract.

精彩评论