Elon Musk says he’s using a Twitter poll to determine the future of 10% of his Tesla shares

KEY POINTS

-Elon Musk on Saturday asked his 62.5 million Twitter followers to determine the future of a chunk of his Tesla holdings.

-Twitter polls are informal, however, and Musk previously said he was likely to sell “a huge block” of his options in the fourth quarter.

Elon Musk on Saturday asked his 62.5 million Twitter followers to determine the future of a chunk of his Tesla holdings.

Twitter polls are informal, however, and Musk previously said he was likely to sell “a huge block” of his options in the fourth quarter.

At an appearance at the Code Conference in September, Musk said when his stock options expire at Tesla, his marginal tax rate will be over 50% and that he was already planning to sell soon.

“I have a bunch of options that are expiring early next year, so ... a huge block of options will sell in Q4 — because I have to or they’ll expire,” Musk said at the conference.

Other current and former Tesla board members, including Robyn Denholm, Kimbal Musk, Ira Ehrenpreis and Antonio Gracias have also sold hundreds of millions of dollars worth of their Tesla shares since Oct. 28, as the company’s stock rallied.

Shares climbed after a record third quarter for Tesla, and an announcement from rental car company Hertz that it was ordering 100,000 Tesla vehicles for its fleet. Musk waited for a week after Hertz made its announcement to clarify that Tesla had not signed a contract with the rental car company yet. Before he made that statement, he taunted investors who were short shares of Tesla on Twitter, writing: “Tesla Hertz shorts.”

Since the Hertz announcement, Tesla shares have risen by around 34% and so has Elon Musk’s net worth.

According to InsiderScore Director of Research Ben Silverman, Tesla had just over 1 billion shares outstanding as of late October. If Musk exercised his options today, the number of shares outstanding would increase by just over 2%, InsiderScore calculated. Silverman predicts the effect on shareholders will be minimum, partly because the sales won’t be a surprise.

“Musk will likely continue to be vocal about what he’s doing — exercising the options because they’re close to expiration, selling stock because of the enormous tax bill and because of the liquidity of Tesla shares,” he said.

Suggesting that he was actually responding to criticism that he’s avoided paying his fair share of taxes, rather than simply managing his options holdings, the Tesla CEO asked users on Saturday to decide whether or not he should hold or sell 10% of his stock.

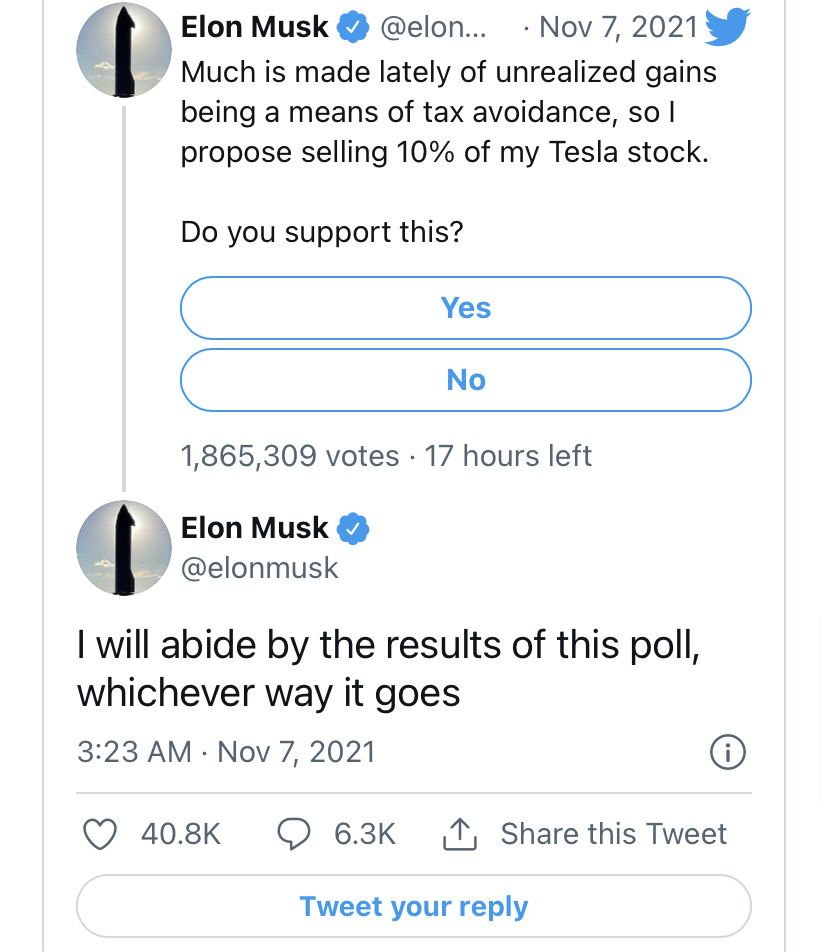

“Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock. Do you support this?” he said. Musk added a poll function, so users could vote “Yes” or “No.”

“I will abide by the results of this poll, whichever way it goes,” Musk, one of the world’s richest people, added. It wasn’t immediately clear what that proposed sale would amount to. As of last December, Musk owned about 22.4% of the company’s shares outstanding.

Billionaires can benefit from tax-avoidance strategies not offered to people whose earnings come from conventional wage income. Extreme wealth is often largely based on the rising value of stock and real estate that is not considered taxable unless those assets are sold.

Earlier this summer, ProPublica, an investigative news site, reported on Musk’s tax bill as part of a massive analysis of billionaires’ finances. The outlet found that Musk’s income tax bill amounted to zero in 2018. Musk later shot back, saying the reporting was “tricky” and “misleading.” He added the number was so low because he does not draw a salary, so his cash compensation is close to zero.

“Note, I do not take a cash salary or bonus from anywhere. I only have stock, thus the only way for me to pay taxes personally is to sell stock,” he said on Saturday.

Of his considerable holdings, Musk has options for 22,862,050 shares at $6.24 due to expire on Aug. 13, 2022. These options were awarded to him in 2012.

精彩评论