Successful investing is simple but not easy. Nonetheless, there is a “winning strategy” which simple arithmetic suggests and history confirms; to own shares of as many publicly held businesses at a low cost. By doing so, you are essentially able to capture almost the entire return that these businesses generate in the form of dividends and earnings growth.

That said, from a retail investor standpoint, we have limited capital outlay to purchase a universe of stocks which leads us to the question of how we can adopt the aforementioned “winning strategy''? The answer lies in Unit Trust.

Recognising the fact that Unit Trust comes with somewhat expensive management fees, we argue that the benefits that Unit Trust can bring about to your investing journey justifies the management fees charged.

Diversification & Portfolio Stability

In our previous article Understanding Unit Trust, we mentioned that Unit Trust amasses money from a pool of investors to purchase stocks, bonds and other securities. Therefore, when you purchase a Unit Trust, you are immediately diversified into a variety of investments within its portfolio.

Given that the value of an investment may not rise or fall in tandem, having a broad base diversification limits the downside risk of an investor since the underperformance of a certain company would be balanced out by the returns from other companies in the portfolio.

High Liquidity

Liquidity is yet another important factor when it comes to investing. Take for example the stock market. When a particular stock has low liquidity, it is difficult for investors to enter or sell their position. When investing in a Unit Trust, investors can be sure that they can enter or exit their investment on any business day as fundhouses are obligated to repurchase the units during redemption.

Simple & Convenient

Compared to other investment vehicles, investing in a Unit Trust is much simpler. The fund’s track record, historical returns, investment holdings and investment objective are clearly stated in its fact sheet. Such convenience allows you to make your decision according to your investment needs and preferences relatively effortlessly.

Furthermore, your transaction of a Unit Trust is based on the Net Asset Value (“NAV”) at the end of the day, eliminating intra-day fluctuations and the need to constantly check on prices.

Expert Management

Unit Trust managers deploy an active investing strategy which focuses on which securities to buy and sell at any given time based on factors such as earnings growth of a company or perhaps the prevailing macroenvironment. This allows investors to enjoy additional alpha created by the fund manager which at times could outperform a market index.

To put things into perspective, let’s take a look at the $Fidelity Global Demographics A-ACC-SGD (SGD/USD hedged)(LU1791710582)$ Fidelity Global Demographics fund which aims to achieve long-term capital growth from a portfolio primarily invested in equity securities of companies throughout the world that are able to benefit from megatrends like Ageing Population, Rise of the middle class and population growth.

1 in 6 people will be aged 65+ by 2050. We are in a period of unparalleled ageing.

By 2030, global middle-class consumption could be $29 trillion more than in 2015.

By 2050, global water demand is projected to increase by 55% and food production needs would rise by 70%, with the population growth projections we are witnessing today.

^Provided by Fidelity International

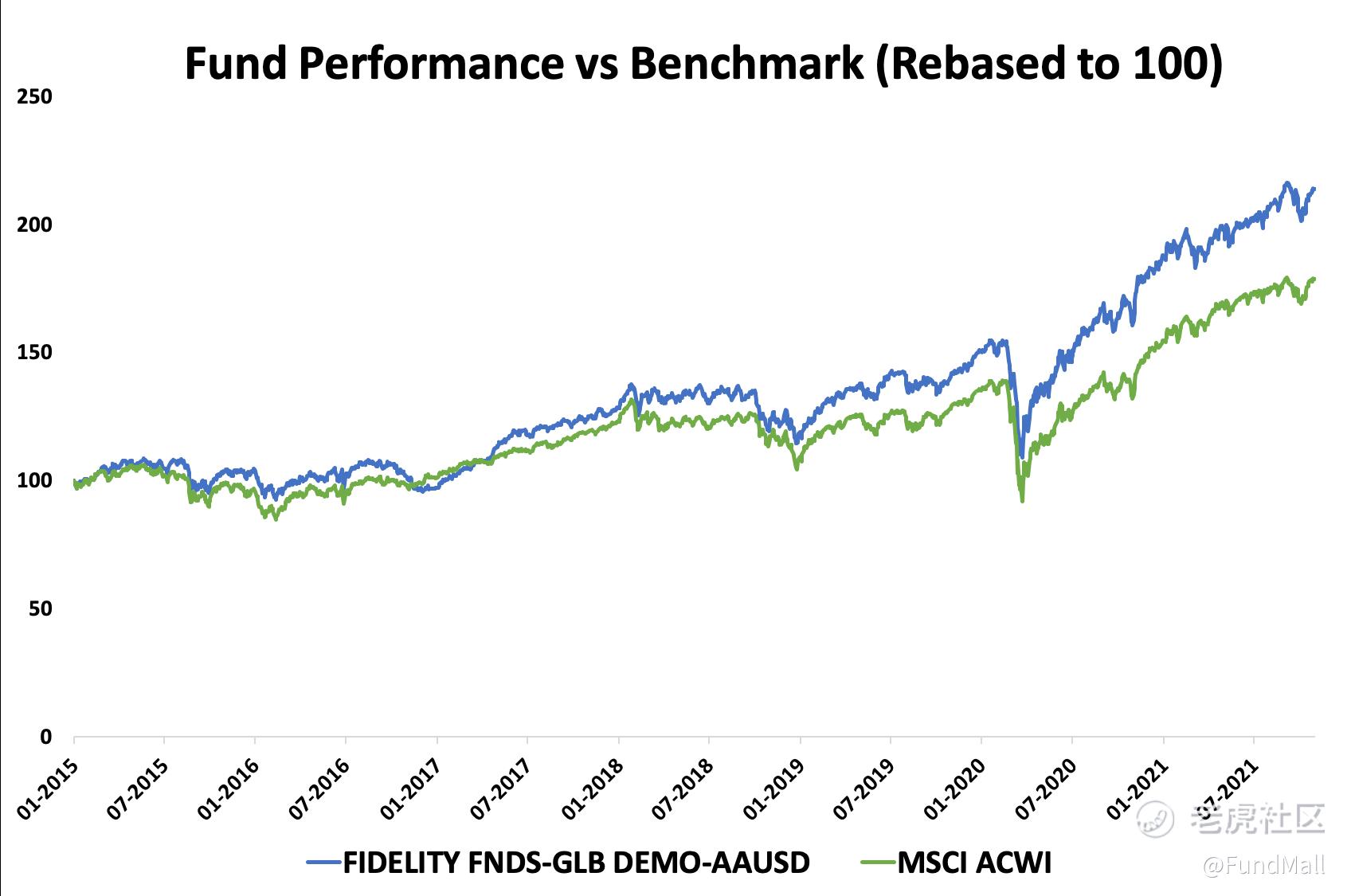

On a year-to-date basis, the fund has outperformed its benchmark (MSCI ACWI Index) by a huge margin.

Chart 1: Strong performance historically and on a year-to-date basis, data are obtained and compiled from bloomberg

Such strong returns generated amid an ongoing pandemic in our view, is attributed to the fund manager’s decision to allocate most of its assets to sectors like information technology, health care, consumer discretionary and financials which are the winners in the prevailing market.

For investors who seeks diversify and would like exposure to structural demographic growth themes, the Fidelity Global Demographics fund is a good pick to add into your portfolio.

Flexibility to invest in smaller amounts

Unit Trust investing is an affordable way to start your investing journey due to its low minimum investment amount of $1000. However, in a scenario whereby you are a fresh graduate making a salary of $4000/month, an investment amount of $1000 could be quite a hefty amount to fork out.

Here at Tiger Brokers, we offer a minimum investment of $100 for Unit Trust. Nevertheless, investors could also opt to embark on a Dollar Cost Averaging (DCA) strategy commonly known as Regular Savings Plan (RSP). RSP is a subscription plan to help market participants invest $100 every month automatically with no additional platform fees involved.

Start your Unit Trust investing journey with Tiger Brokers, head over to Fund Mall to have a look at the variety of Unit Trust we provide on our platform. 0% Sales Charge, 0% Platform Fee.

精彩评论