$恒生指数(HSI)$ Hang Seng spot index is not looking great today, having fallen from a day peak of 26,400 to a day low of 26,040 and is currently around 26,150, being down almost 1%. Shenzhen index is not looking great either, and is down around 0.7% at 14,693, which is just within points of 14,700. Shanghai index is almost flat at 3517.

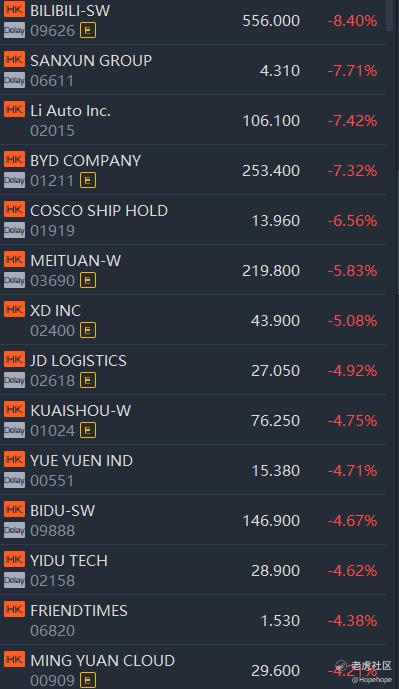

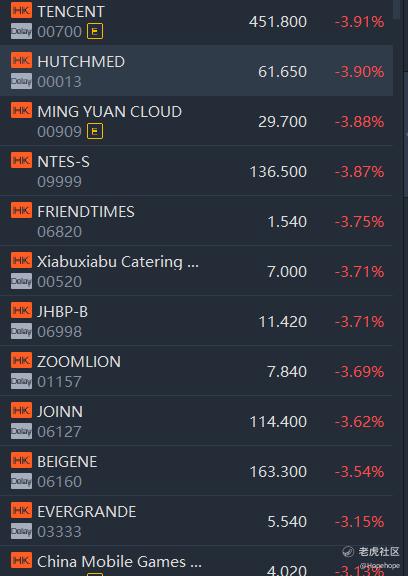

Near term wise, Chinese markets are really not looking great. Market participants in particular the institutional funds are worrying about the implementation and/or introduction of new regulations. Just over last weekend, there was comment made by state media on gaming companies confusing gamers with wrong history due to the use of historical figures in China history. This news impact on game streaming companies is definitely not negligible since $哔哩哔哩-SW(09626)$ hong kong shares, $腾讯控股(00700)$ Tencent, $网易(NTES)$ share price suffer again today. HSI Tech is down 2.7% at 6400 now...

Should I rush into Chinese tech stocks? No not at this stage since there is a possibility of another leg down. $小米集团-W(01810)$ Xiaomi being into physical business in addition to its tech background, has made it relatively resilient. However, short term price movement wise, it may not be able to withstand the barrage of negative news should the negative market sentiment spread. Nevertheless, I will continue to hold my position in Xiaomi.

Readers should know that I have no intention to own any Alibaba shares at this stage. Even if it did go down to around 160 USD.

Douyu's financial results will be released today... Lets see if it will shed light into how Huya may perform as I have the view that Huya will have a much better financial results than that of Douyu. Readers should nevertheless know that the poor price performance of Bilibili and Kuaishou Tech may still affect price sentiment of Huya with or without good financial results.

As always, I do not think now is a good time to take big positions in Chinese tech stocks. If I want, I will nimble and add on small positions to my existing positions slowly. As for Haidilao, I do not think the price structure looks great and there may be a significant downleg. I have not studied the fundamentals of the business though and interested readers should study its business and funamentals before taking any positions be it long or short positions.

As always, this should not be construed as any investment or trading advice.

精彩评论