$Walt Disney(DIS)$An entertainment icon that is widely known across the world. Here is the break down of $DIS, otherwise known as The Walt Disney Company.

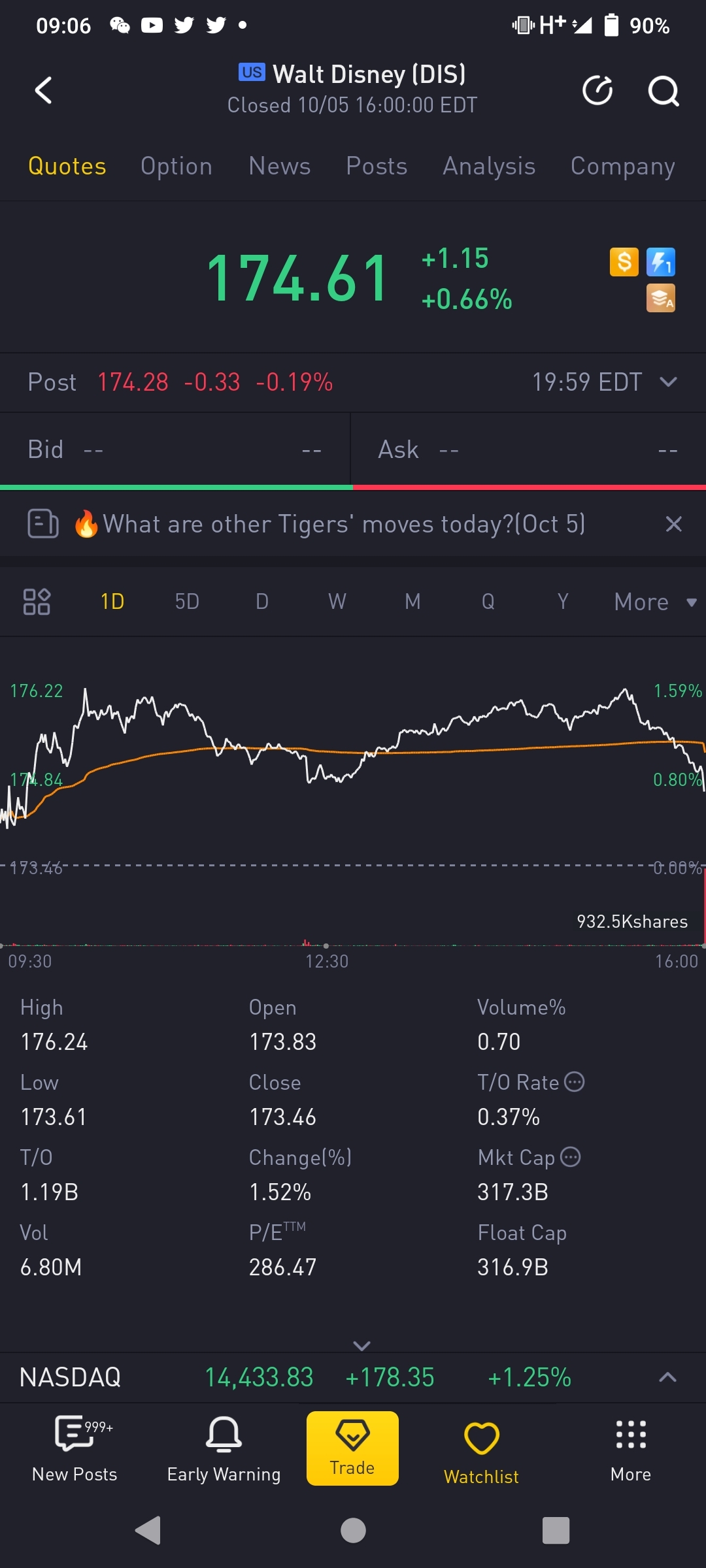

Current Price: $174.61

52/Wk High: $203.02

52/Wk Low: $117.23

Market Cap: $317.1 Billion

3 Month Performance: 0.34%

Read below for the break down!

The Walt Disney Company ( $DIS ) is one of the most well-known global entertainment companies in the world, boasting a significant business network that spans media networks, amusement parks, studio entertainment, travel, direct-to-consumer content, and more.

Breaking down Disney segment by segment the company operates within four operating segments; Media Networks, Parks, Experiences and Products, Direct-to-Consumer & International, and Disney Studios.

Sifting through stock price representation by segment, according to TREFIS (@trefis) Media Networks represents 35.2% of Disney’s current stock price.

Furthermore, Direct-to-Consumer & International represents 30%, Parks, Experiences and Products 22.6%, and Disney Studios 12.2%. Finally, net debt represents 9.8%.

Exploring Disney, the company operates under an umbrella of brands including Disneyland Resort, Walt Disney World, Disney Cruise Line, Disney+, ESPN+, Hulu, Disney Music Group, Marvel Studios, 20th Century Studios, Pixar, ABC Entertainment, FX, and many more entertainment brands.

Disney is led by Chief Executive Officer Bob Chapek, who took over for business icon Robert Iger in February of 2020. Prior to taking leadership, Chapek served as Disney’s Chairman of Parks, Experiences, and Products since 2018.

Furthermore, management consists of leaders who have worked within the Disney network for years, while others boast prior experience from the likes of ABC, ESPN, Warner Bros, BHP, and more.

In recent news, Disney stock was sent tumbling shortly after CEO Bod Chapek implied that streaming growth slowed throughout the most recent quarter.

Chapek noted at a Goldman Sachs summit that investors should expect subscriber count to increase by “low single digit millions”, disappointing investors who were expecting significant Disney+ growth.

Throughout the conference, Chapek also noted that subscriber growth quarter-to-quarter would not be steady, and the summer reopening created a difficult growth situation.

Sifting through Disney’s streaming power, the company maintains multiple streaming outlets including Disney+, Hulu, and ESPN+, of which ended the third quarter with a combined 173.7 million subscribers.

Furthermore, according to eMarketer and the Morning Consul and Adweek, 33% of US households use or have a subscription to Disney+, while 31% use or have a subscription to Hulu as of May 2021.

Digging into the numbers, Disney beat third-quarter 2021 expectations with an EPS of $0.80, better than the analyst’s EPS consensus estimate of $0.55. On a year-over-year basis, EPS improved by 900%.

On the revenue front, Disney delivered $17.022 billion in Q3 revenue, representing a 45% improvement over the Q3 2020 total revenue level of $11.779 billion.

Breaking down revenues, the Disney Media and Entertainment Distribution segment delivered $12.681 billion in revenue, while the Disney Parks, Experiences and Products segment delivered $4.341 billion in revenue. On a year-over-year basis, the segments improved by 18% and roughly 400%.

Shifting into income, Disney delivered a Q3 net income from continuing operations of $923 million, representing a sizable improvement over the Q3 2020 level of $-4.718 billion. Segment operating income totaled $2.382 billion in Q3, higher than the $1.099 billion in 2020.

Rounding out income, company-wide net income totaled $1.123 billion in Q3, representing a sizable increase over the same time 2020 Q3 net income of $-4.512 billion.

Breaking down segment operating income, the Disney Media and Entertainment Distribution segment delivered $2.026 billion in operating income, representing a 32% decline on a year-over-year basis.

Rounding out segment operating income, the Disney Parks, Experiences and Products segment delivered $356 million in operating income, representing a significant improvement over the Q3 2020 level of $-1.878 billion.

Exploring the Disney Media and Entertainment Distribution segment, below is a revenue breakdown with YoY growth metrics.

Linear Networks:

$6.956 Billion, Up 16%

Direct-To-Consumer:

$4.256 Billion, Up 57%

Content Sales/Licensing and Other:

$1.681 Billion, Down 23%

Furthermore, below is an operating income break down for the segment with YoY growth metrics.

Linear Networks:

$2.187 Billion, Down 33%

Direct-To-Consumer:

$-293 Million, Up 53%

Content Sales/Licensing and Other:

$132 Million, Down 58%

Rotating into the Disney Parks, Experiences, and Products segment below is a revenue break down with YoY growth metrics.

Parks & Experiences:

Domestic:

$2.656 Billion, Up +100%

International:

$526 Million Up +100%

Consumer Products:

$1.159 Billion, Up 57%

Furthermore, below is an operating income break down for the segment with YoY growth metrics.

Parks & Experiences:

Domestic:

$2 Million

International:

$-210 Million, Up 52%

Consumer Products:

$564 Million, Up +100%

Rotating out of segment metrics, company-wide cash flows experienced declines. Disney reported $2.934 billion in cash provided by operations in Q3, representing a $3.015 billion decline year-over-year.

Lastly, Free Cash Flow (FCF) totaled $466 million in Q3, representing a $2.190 billion decline in free cash flow on a year-over-year basis.

To conclude the quarter, Disney reported 116 million Disney+ subscribers, 14.9 million EPSN+ subscribers, and 42.8 million Hulu subscribers, representing 200%, 75%, and 21% growth year-over-year respectively.

Finally, Disney reported average monthly revenue metrics per user of which is listed below by service with YoY growth metrics.

Disney+:

$4.16/subscriber, Down 10%

ESPN+:

$4.47/subscriber, Up 7%

Hulu:

SVOD Only:

$13.15/subscriber, Up 15%

Live TV + SVOD:

$84.09/subscriber, Up 23%

Shifting into the balance sheet the numbers are solid.

Total Debt: $55.838 Billion

Total Liabilities: $115.480 Billion

Total Assets: 202.221 Billion

Cash & Short Term Inv: $16.070 Billion

On a valuation basis, Disney does trade at a premium.

Price to Earnings: 284.31x

Forward Price to Earnings: 24.86x

Price to Sales: 5.10x

Price to Book: 3.74x

Price to Free Cash Flow: 231.37x

Price to Earnings Growth: 5.59x

Management has been effective but could improve in the years to come.

Return on Equity: 1.34%

Return on Assets: 0.81%

Return on Invested Capital: 1.02%

Given the numbers the analysts are bullish with a mean price target of $217.26/share, representing a 24.49% upside.

The high price target is $263.00/share, representing a 50.70% gain, while the low price target is $185.00/share, representing a 6.01% upside.

The big money is quite involved with 63.76% of Disney being owned by institutions. Top holders include The Vanguard Group, BlackRock Institutional Trust, and State Street Global Advisors.

On a technical basis, Disney has been stagnant. According to the six-month charts, the MACD is moving with minimal downside momentum within a tight range around -0.0867.

The six-month charts are also indicating an RSI of 42.34 and CCI of -103.19, both of which are on the low end. Also, note that a major volume node has been building within the range of roughly $170 to $190.

Exploring investor sentiment the bears believe strong streaming competition and a still spreading COVID-19 virus are reasons to expect future downside.

Meanwhile, the bulls believe Disney's power streaming trio, reopening parks, and decelerating COVID-19 spread are reasons to be positive on the name.

In short, The Walt Disney Company ( $DIS ) is an entertainment icon that is not going anywhere, boasting a growing streaming segment, recovering in-person entertainment segment, reliable management team, solid balance sheet, and loyal customer base.

精彩评论