各位好,如果你有某种内容想要我写,可以留下留言。

如果你学到新知识或思维有所改变,可以给我点赞,好评或在你的朋友圈分享给其他人阅读这篇文章。多谢支持!

How to compare and remove weaker performing investment assets from your portfolio. I will usually see people online posting questions on forums asking things like

- Should I stop my ETF now and just focus on individual stock picking?

- Should I continue with bonds?

- Should I do growth over dividend stocks vice versa?

The thing is you need to have a common unit of measurement (UOM) across your different investment assets. Each investment assets eg. bonds, stocks, Robos, fixed deposits etc will give you returns in different formats. You need to find a way to group them, quantify such that you are able to do an apple to apple comparison across them.

From here, you will know which are the weaker performing assets and you decide if you want to keep them longer or cut and exit swiftly. This is the same for better performing assets if you want to add more into your current positions.

For those that have made their first move into investing, congrats!😌 Good to let your money work for you while you sleep. For those that have not started, it’s never too late. With the recent market correction for both the stock and crypto markets, There are so many opportunities and methods to go in and invest for the long term and for your future in a safe and systematic manner.

For this topic, I will be going into the technical aspect of portfolio evaluation using daily return of investment (ROI). This is how I do it on my own portfolio, not sure if anyone else uses this, as well as I have not read anyone talking about this online.

As summed up in the thumbnail above, to do an evaluation of your portfolio, to me, there are 3 big categories that everyone has to go through.

Number #1

How much time are you going to set aside for your investments?

If you are someone that hates looking at numbers or prioritise focusing on your full-time career, then having a financial advisor or Robo-advisor, etc., to help grow your money will be ideal vice versa. Do note that when someone else assists to manage your portfolio, you will tend to incur some form of management/intermediary fee etc., and it will lower your ROI compared to someone who ‘Do-it-yourself’ and manages everything on their own.

Number #2

How much risk are you willing to take?

Are you a risk-taker or risk-averse in your approach? And how long is your investment horizon? If you cannot stomach price volatility and prefer to have some form of stability in your assets, stuffs like Bonds, Fixed Deposits, FSP from the banks will seem ideal to you.But with that being said, their ROI returns are definitely lower compared to higher risk approaches such as stock picking, options, cryptocurrency, etc., due to the constant fluctuation and uncertainty in demand and supply of these kinds of asset classes.

Investment horizon is extremely important as well.Are you someone investing in the short or long term? Usually, short-term investors enter and exit the market too swiftly and the likelihood of trading speculative products which tend to change in prices more frequently in the short term than higher quality products which might not be beneficial to their investments e.g. <6 months.

Number #3

Systematic approach to perform an ROI comparison

How to have a standard method to do an ROI comparison across your different investments to know which you should continue to keep and which are those that you should let go for the greater good of higher ROI investment opportunities.

This is my own method that I created. I don’t think anyone else has mentioned it before online. You decide if you want to use this for yourself.

The list of examples that I share here will not be exhaustive. You will have to understand the methodology that I am going to share and apply it to your own investment to evaluate.

Dividend Stock — Example 1

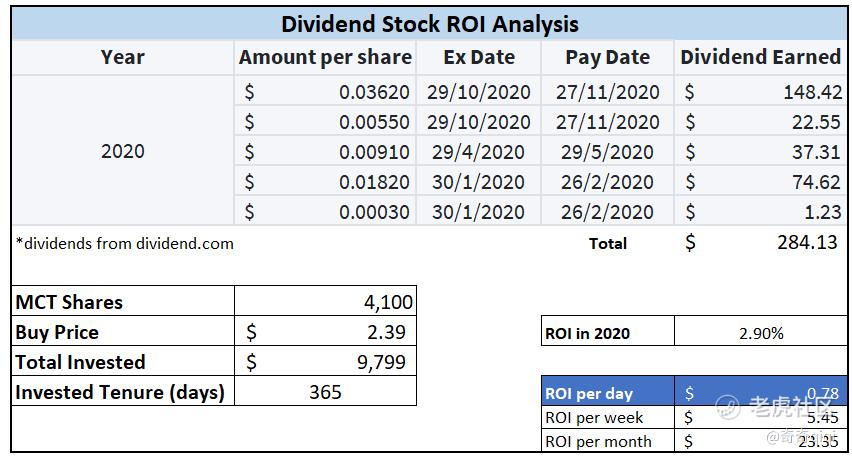

- I invested 10k SGD into Mapletree Commercial Trust (MCT) $丰树商业信托(N2IU.SI)$ on 3rd Jan 2020 @ 2.39 SGD per share.

- 10k SGD can buy approximately 41 lots (41,000) of MCT shares.

- 41 lots x 100 shares per lot x 2.39 SGD per share = total 9,799 SGD spent

- What was the ROI for the year 2020 for MCT stock?

Looking at the analysis that I have done, if 10K was spent on dividend stocks e.g., in this case using MCT, the dividend returns in dollar value on 31st Dec would be just 284.13 SGD with a simple interest of 2.90% dividend yield.

Putting in so much money and the return was just 284.13 SGD. My method of evaluation on whether this is good or bad is based on the ROI per day metric as shown in blue colour.

284.13 SGD return in 1 year (2020) as an assumption. Per day will be 284.13 SGD divided by 365 days = 0.78 SGD.

Meaning, if I proceed to do this investment, every day, my return is only 0.78 SGD if I collect dividends for the entire year in 2020.

Not to forget your 10K sum is tied up into this stock for the entire year and unable to take out for any other purpose. Dividends were only paid out on 5 occasions in the year 2020, mainly twice in Jan, once in April, and twice again in Dec.This meant that for the other 360 days (365–5 days of dividends), your investment was just idling and not doing anything!!! 😖

Can you see where I am coming from? You put your money into an investment that pays you dividends for only 5 times in a year, and the other days, it’s just sitting there doing nothing for you. 😟 This kind of investing to me is just meant for the rich, which puts in like 20k SGD and above then it’s a worth-well investment.

The reason I don’t care about the 2.90% is that it’s just a percentage, a number. It does not tell us the full picture of how well your investment is doing in totality, e.g., 2.90% of 1million sgd is a very good return, but 2.90% of 1000 sgd is a very poor return. Can you see why this value is not useful for your portfolio evaluation? 😀

I prefer to use Daily ROI as a comparison instead. Is 0.78 SGD a big or small amount? This has to be compared with other investments in order to know whether it’s high or low for your risk appetite. Daily ROI is useful, right? Let me show you how I compare, and you will be amazed. 😃

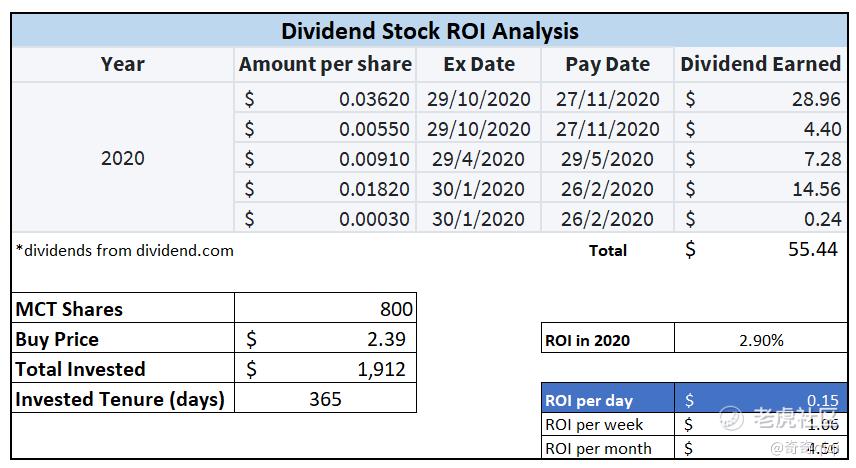

Before I move on, I want to reiterate from a previous article that I wrote on Dividend stock investment method is not good for those who are planning to to invest very little money. eg. < 3k into a dividend stock. Let me show you why. Why You Should Avoid Portfolio Diversification At All Cost (Beginners Beware)

Now assuming I only have 2k SGD to invest in MCT stock and I buy 8 lots of shares. From the analysis, you will at most receive 55.44 SGD of dividends for the whole year and 0.15 SGD ROI per day!!! 😦

55 SGD is like enough to pay for 1 haidilao 海底捞 hotpot meal only. The return is just too low. If you want to continue to invest in MCT, the higher the amount invested in this will be better compared to a lower amount invested. Suggest putting this amount into another investment vehicle to yield higher returns.

It may not have to be dividend stocks. I am just using dividend stocks as an example to illustrate as it is easily to explain the earnings concept to you. In reality, you can also use this daily ROI on ETFs such as the S&P500 $标普500ETF(SPY)$ or even on growth stocks such as Apple $苹果(AAPL)$

Crypto Interest Rate — Example 2

- Now, I show you another example to let you understand the concept of Daily ROI better.

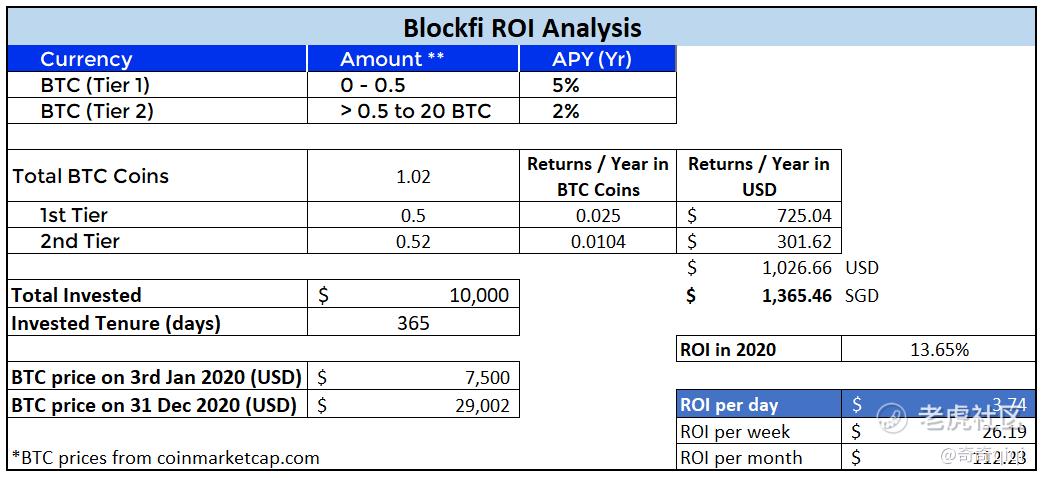

- The same 10K SGD I instead invest into buying 10K SGD worth of Bitcoin (BTC), will my return in interest rates be higher or lower than MCT stocks? (exclude capital gain/appreciation in BTC price).

- 10K SGD invested into buying BTC on the 3rd Jan 2020 @ 7,344.88 USD per BTC.

- 10K SGD /1.33 = approximate 7518.80 USD conversion.

- 7518.80 USD can buy approximately 1.02 value of BTC coins.

- What was the ROI for the year 2020 for BTC? (exclude BTC’s price appreciation).

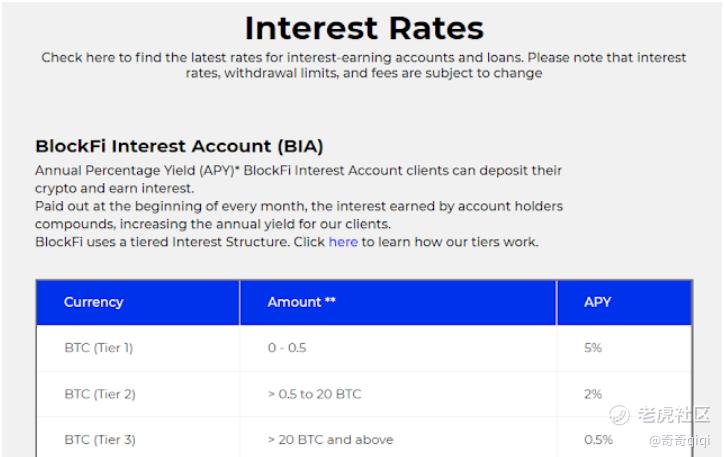

To earn more on my BTC, I transferred and stored my BTC inside Blockfi’s centralized finance (CeFi) platform to earn a daily interest rate which will then be compounded monthly.

Blockfi Interest Rates:

With a 1.02 value of BTC, the first 0.5 BTC will be under tier one, getting 5% APY in BTC coins as rewards, while the remaining 0.52 BTC will be under tier two getting 2% APY in BTC coins as rewards.

Refer to my analysis for the interest returns of BTC on Blockfi platform after one year.

If 10K was spent on buying BTC coins, the interest returns in dollar value on 31st Dec would be 1,365.46 SGD with an ROI of 13.65% using the BTC price on 31st Dec @ 29,002 USD per BTC.

Daily ROI will be 3.74 SGD (1365 / 365 days), as shown in blue colour.

MCT’s Daily ROI per day was 0.15 SGD, and BTC’s Daily ROI per day was 3.74 SGD. From here, it’s clear and obvious which is the one that will give you a higher yield in a year. Each day theoretically, you are receiving about 3.59 SGD (x24 times) more in returns (3.74–0.15) if you chose to invest using BTC.

This is not a financial advice to invest in BTC. Please do your due diligence as always before placing any orders.

Hope that this will assist you to provide you with another perspective in evaluating your own investment products. 😃

Originally published at https://medium.com/the-capital/using-daily-roi-to-evaluate-your-investment-portfolio-b348e3f67455?sk=97584223e800f17171eafecd5959d9b7

精彩评论