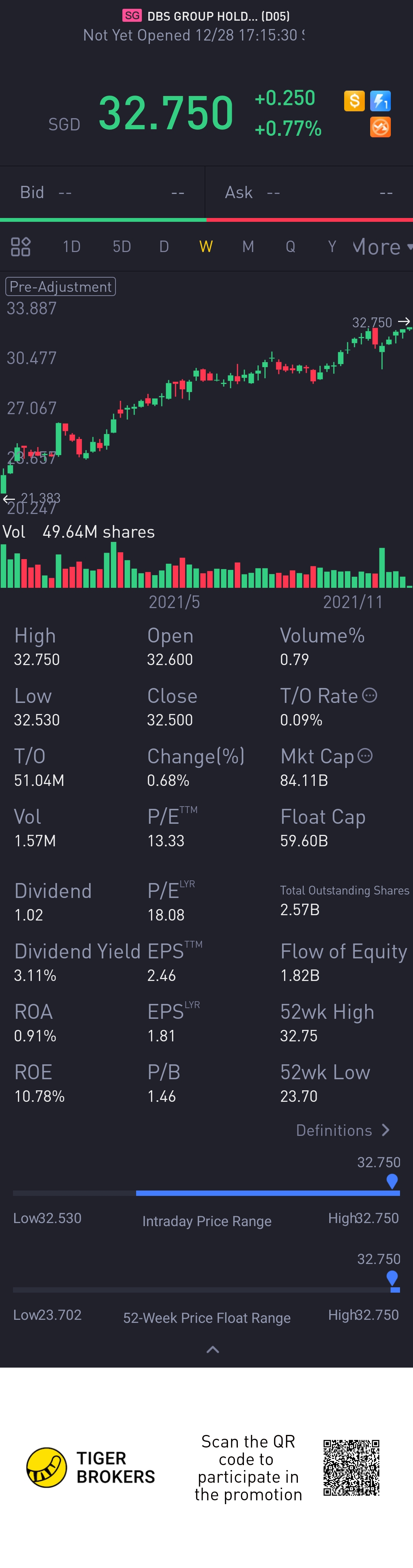

$DBS GROUP HOLDINGS LTD(D05.SI)$

DBS share price continue to test and reach new heights in 2021. Even as ww approach the end of the year, the steam is not lost. The momentum is still great. The engine is still running hot. No doubt this is one of the star performer in Singapore market and also in the region.

DBS Group reported a 31% year-on-year increase in net profit to S$1.7 billion for third-quarter 2021, beating Refinitiv analysts’ average estimates of S$1.57 billion.

Price to earning ratio is highest among the 3 banks here. But personally I can see why its trading with premium.

Trading sentiment among analysts remained mostly positive on DBS Group as of late October, with 14 ‘buy’ calls, seven ‘hold’, and no ‘sell’ recommendations. Their target prices averaged S$33.55.

So based on this target price, there are not much upside.

Yes, with the digital bank coming on board, it may give some pressure to the traditional banks. But can see that the leadership team of DBS continue to innovate and look for opportunity to add value for investors. Going into Crypto, to me its a breakthrough. It almost like many years back, the government decided to build Casino in Singapore. Many disagreement, but the risk were mitigated and looking back now, its certainly the Right thing to do.

Personally, i am confidence with the Global and Singapore economy. And Banks typically do well. With Singapore continue to open up border, with the economy expect to growth, and more important, with vaccination rate above 90%, Omicron being not so fatal. I am bullish in general stock market especially banking@Tiger Stars@小虎活动

精彩评论