$UNITED OVERSEAS BANK LIMITED(U11.SI)$ UOB share price has been holding up rather well lately in spite of Omicron. According to our local financial analysts, UOB is a BUY!

CGS-CIMB at 30.30 ADD, DBS Research at 29.20 BUY, Maybank Kim Eng at 31.150 BUY, OCBC Investment 29.00 BUY and Phillips Securities 29.00 Accumulate.

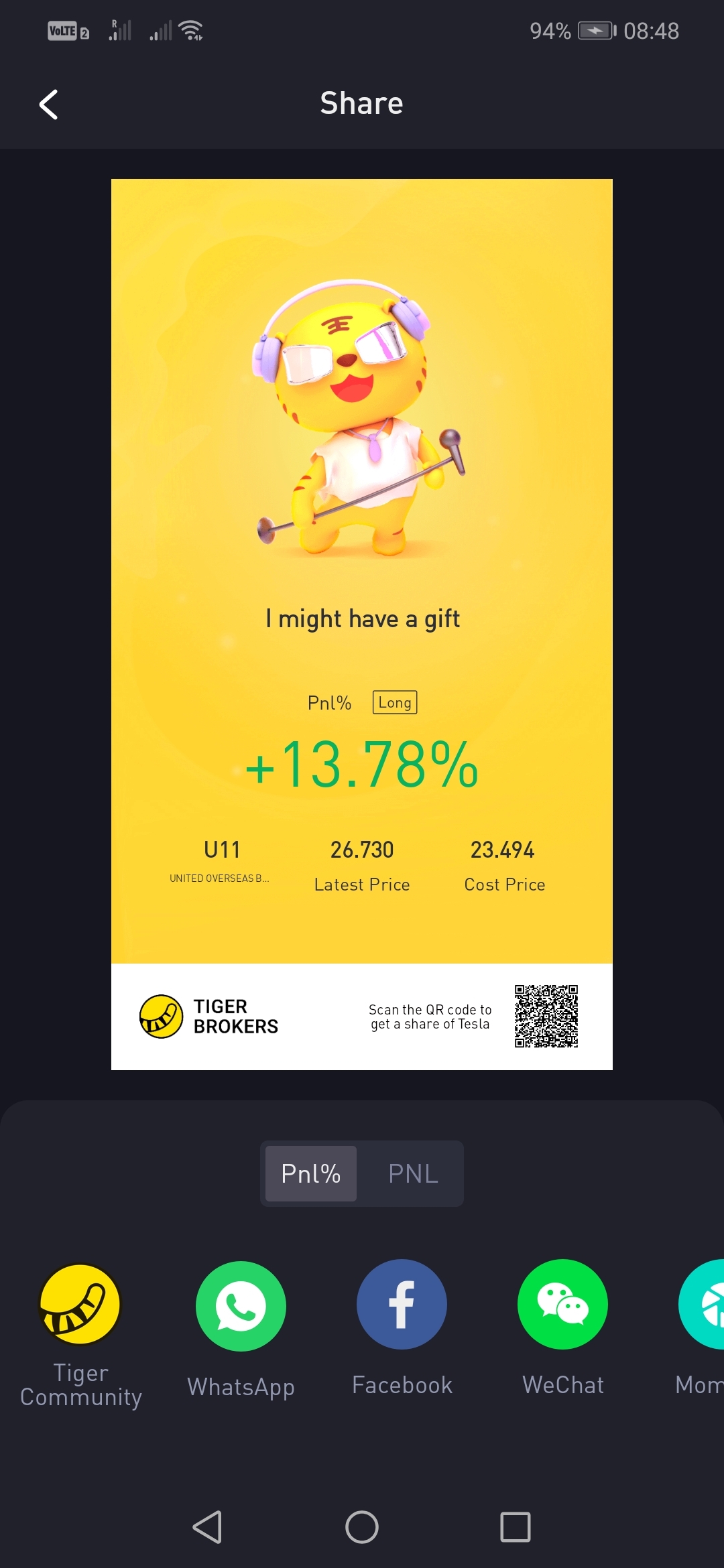

UOB closed yesterday (27 December 2021) at SGD26.73.

UOB is the 3rd largest bank in Singapore. According to the latest 3Q21 results, its Net Profit increases 4% quarter on quarter to SGD105 billion, despite slower economic recovery in South East Asia. This was achieved by healthy loan growth and sustained fee income as well as lower credit allowance.

UOB Balance Sheet stayed robust with ample liquidity and strong Common Equity Tier 1 ratio at 13.5%.

UOB was named the World's Best Bank for Small and Medium Enterprises by Euro money and Global Finance.

The impending interest rate hike in 2022 will turbo charge UOB share price too.

UOB also pays steady half yearly dividends. The last dividend paid was 0.60 cents and it is projected the next dividend payout will be the same, bringing a total dividend of SGD1. 20 per share.

In view of the above, I am bullish on UOB as it is very solid Singapore bank, with excellent management, wide moat and great cash reserves.

Go Long Go Strong Go UOB! That's my maxim.

@小虎活动 - SG stocks

精彩评论