Much was anticipated in the opening week of the New Year as Mr Market rotated out of most growth tech stocks, especially those with lofty valuations and switched in on companies which might benefit from the rising interest rate environment (i.e banks, oil).

I took an opportunity to take a short position on Netflix last week which I have been quite bearish on since it announced the Q3 earnings a few months ago which I wrote here.

Here are a few of the reasons why I am expecting Netflix to underperform in the next upcoming months:

1.) Lofty Valuation Is Vulnerable In Current Inflationary Environment

Whichever we want to look at it, Netflix’s valuation is not cheap by any standard metrics for valuing a company.

It’s more traditional valuation metrics such as the Price to Sales at 8x, and Price to Earnings at ~50x can only be justified if the company is still growing rapidly. However, as we will see later, growth will start to come down significantly which means that the current valuation will be too lofty for such a company with $240b market cap.

It’s Price to Cash Flow is no better either and as you will see later, it is struggling in the aspect of Free Cash Flow as well.

In an inflationary environment where interest rate is rising, the risk free rate also increases as you can now earn interest in a risk free tools better than before. This puts pressure on assets and companies who might not be able to pass on the inflationary costs to its customers thus creating an increase in the risk free premium demand. In fact, Netflix has reduced its subscription prices in recent times in places like South America and India in order to maintain their subscription rate.

2.) Cashflow Struggles

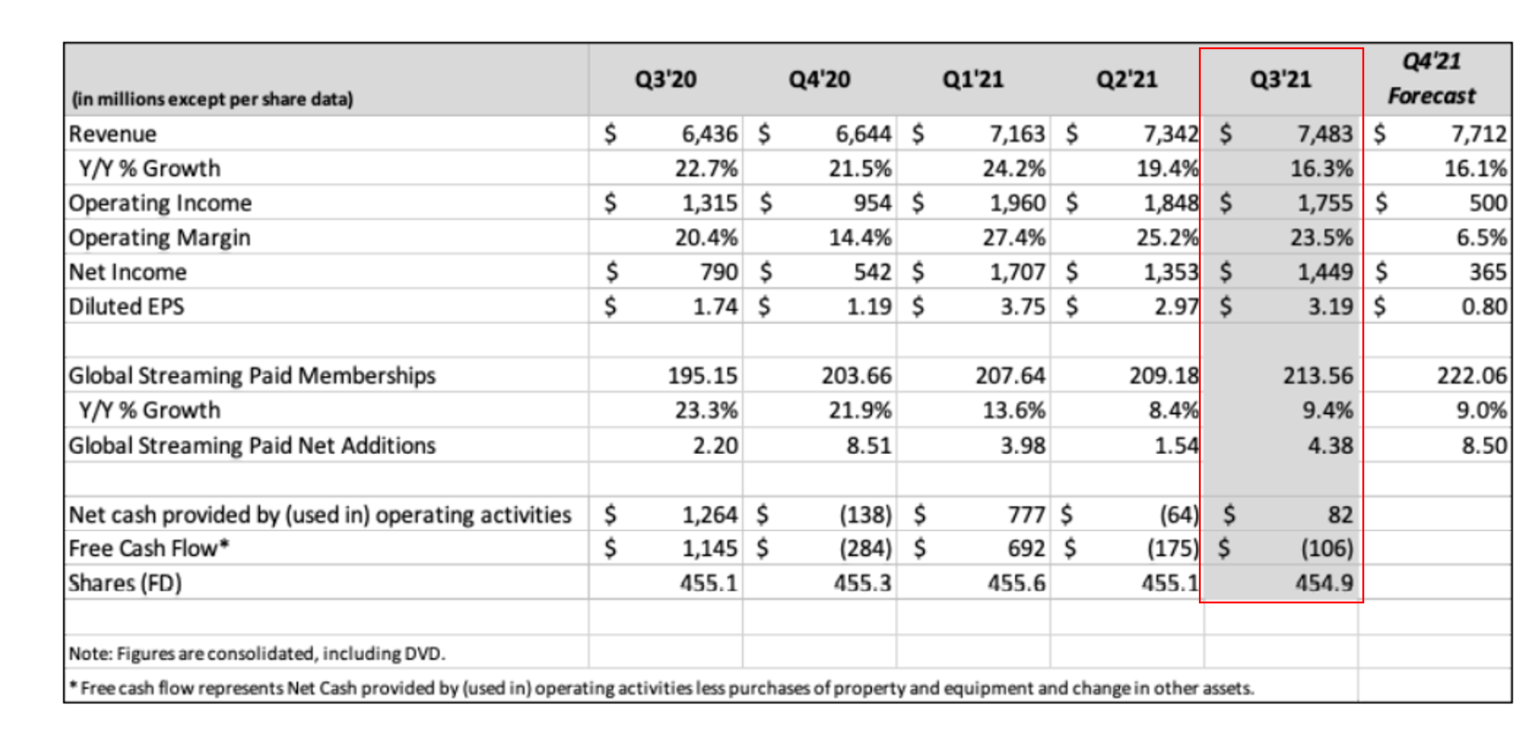

Netflix’s goal is to generate about $1b in free cash flow annually as it recently announced that it does not need to access the capital market but from the past few quarters, we can see that much of those were very lumpy in nature.

The company has about $15b in debt and has repurchased just a very small tiny fraction of their outstanding shares, indicating that much of those cashflow they are generating are still required to be used on working their topline growth further through creating new contents, new games, etc.

Disney for instance, has committed to spending about $33b on its content production for next year, which will give the rest of its competitors a good run for their money.

3.) Paid Net Additions Are Slowing Down

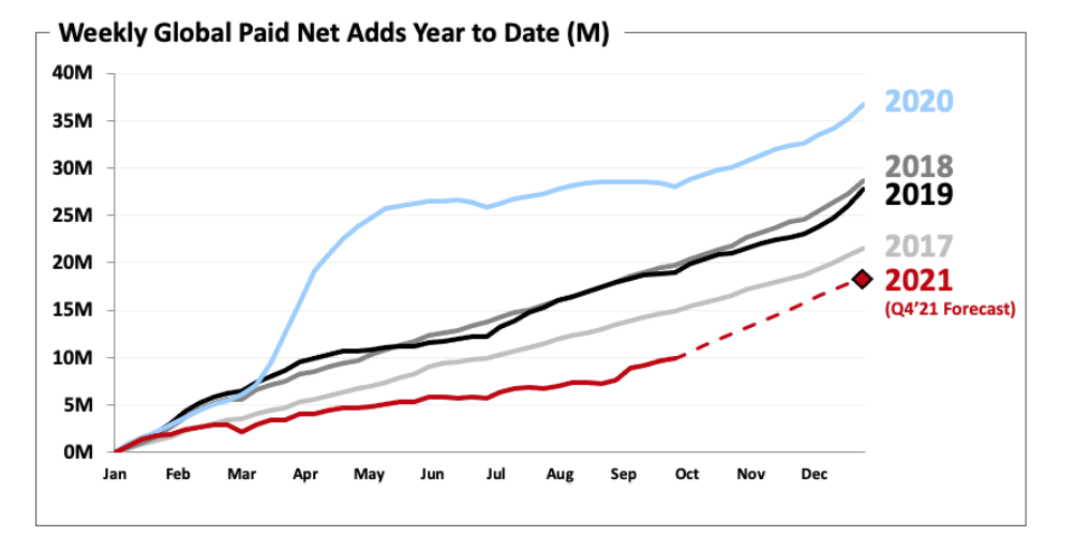

Paid Net Additions’ growth have slowed down the most in 5 years given a strong blockbuster performance especially during the pandemic season so the company is forecasting 2021 to come in slower.

The company has added just 1.54m and 4.38m subscribers respectively in the last two quarters but expecting 8.50m additions in the last quarters which traditionally has been their strongest performance. Anything that came in less than 8.50m and a weaker outlook ahead will see a quick re-rating on the company.

4.) Chart Broke Critical Support

In the past week, both Nasdaq and Netflix have failed to close above their critical support and is likely to continue heading down towards their next immediate support which is at $513.

This will be the next immediate support before its earnings for Q4 which is due on 21st January 2022. The upcoming outlook ahead will also be critical as we will pan to see what the management will do in order to curb the slowing growth.

Mid-term target will be at EMA200 weekly at $428.

On longer term target, I have placed a target price of $300 which will put the company at Price to Current Sales of about 5x, and a company which is still growing but only very decently in growth volume.

精彩评论