$Tesla Motors(TSLA)$had a great Q4/2021 and here are some of the key highlights from their earnings:

With 2021 deliveries up by 87%, Tesla achieved the highest quarterly operating margin - a testament that EV can be more profitable than ICE vehicles. If there is only one metric that we look into for any business, it have to be free cash flow (FCF). For us to appreciate the magnitude of growth, I have thus chosen to focus on the YoY comparisons.

Some of the following are extracted from their earnings report:

Cash

Operating cash flow less capex (free cash flow) of $2.8B in Q4

In total, $1.5B increase in our cash and cash equivalents in Q4 to $17.6B

Profitability

$2.6B GAAP operating income; 14.7% operating margin in Q4

$2.3B GAAP net income; $2.9B non-GAAP net income (ex-SBC) in Q4

30.6% GAAP Automotive gross margin (29.2% ex-credits) in Q4

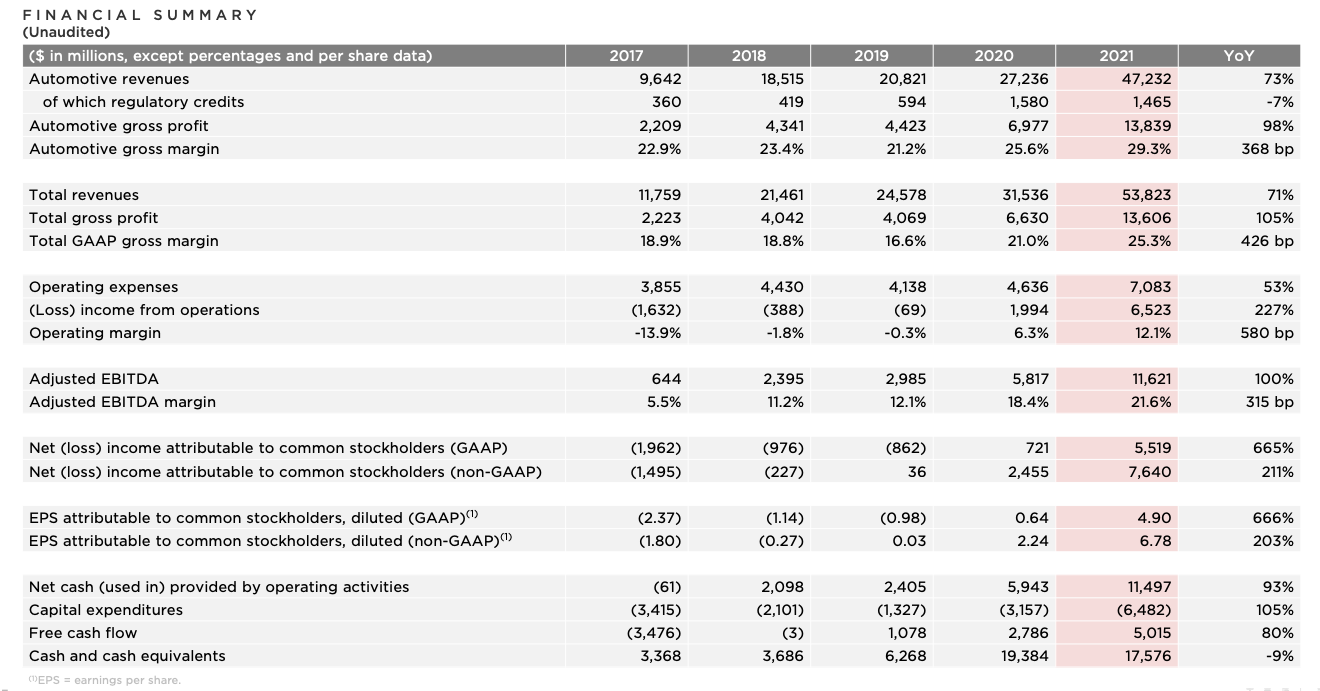

Apart from an outstanding quarter, I have chosen to show the unaudited annual financial summary. This revealed the achievement by the company in revenue generation, costs management that led to good profitability. The automotive gross margin has been increasing annually and doubling the operating margin as compared to 2020. Thus, EPS for the year has grown from $2.24 (2020) to $6.78 (2021) - an outstanding 203% increase.

More than all these, Tesla has maintained strong cash (and cash equivalent) but more importantly, saw an 80% growth in their Free Cash Flow (FCF) from $2.786B (2020) to $5.015B (2021). This was accomplished despite investing $6.482B (in 2021) into capital expenditures (into expansion and building of new Gigafactories, not forgetting the expansion too in Fremont). We can only expect the production to increase and that Tesla will continue to lead in both sales and deliveries.

What contributed to the profitability are the following:

Per vehicle costs reduction, growth in vehicle deliveries and better profits from leasing and other services. The additional costs were causd by the $340M payrolltax on CEO award option exercise for 2012, inrease costs in raw materials, commodities, logistics and also increased warranty, recall costs for vehicles. Few of the current projects, including large castings, structural battery pack, 4680 cells and many others, should help to minimize their product cost in the coming months.

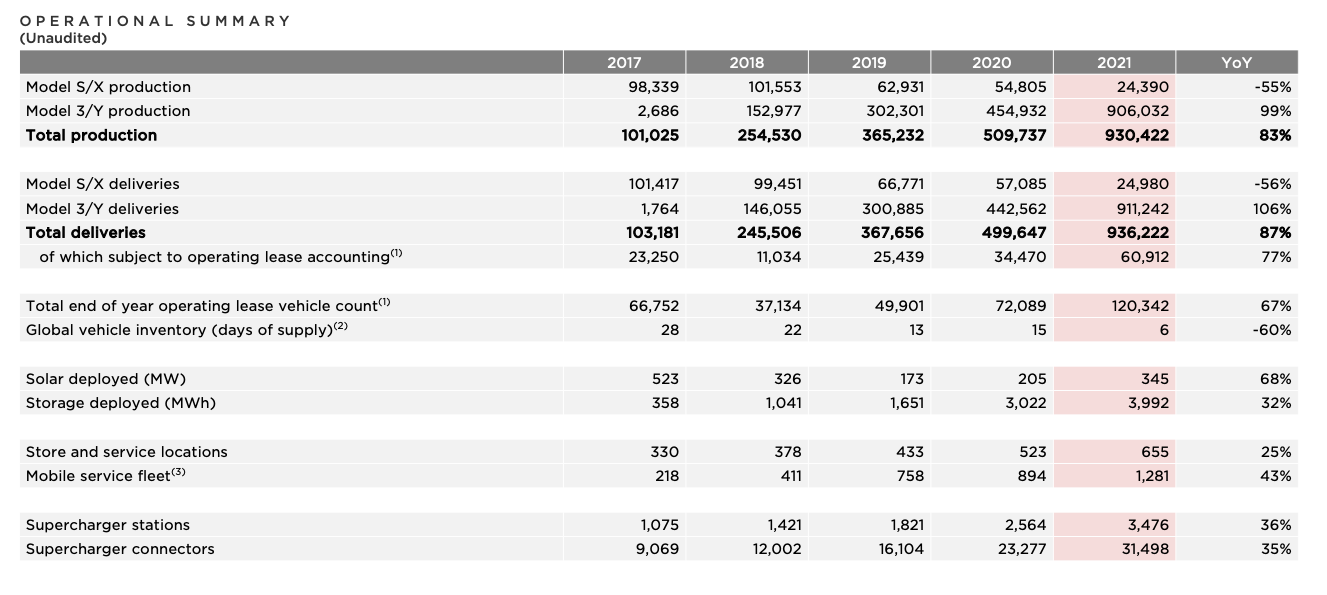

From the annual operational summary, Tesla has ramped up their production capacity by 83% and deliveries by 87%. We can also see 67% increase in the totalend of year operating lease vehicle count. The global vehicle inventory has dropped 60% to 6 days of supply. This implies the demand for Tesla vehicles is much stronger than the supply.

The only concern is that the growth of the supercharger stations of 36% is much lesser than the growth of the vehicle deliveries. This can help to steer the increase of take up of EV with a strong charging infrastructure. Of course, there are home owners who have installed home charging too. So, hopefully, this will notturn out to be a bottleneck.

Tesla Energy solutions

Energy Storage

Energy storage deployments increased by 32% YoY in 2021, mainly driven by strong Megapack deployments. As demand remains substantially above capacity, growth has been limited by supply.

Solar Retrofit and Solar Roof

Solar deployments were 345 MW in 2021, increasing by 68% YoY, with cash/loan purchases accounting for nearly all solar deployments. This came from a tripling of the solar roof deployment in 2021.

What is most interesting are not the outstanding financial figures but rather the roadmap that Elon Musk has painted.

1. The most important product for Tesla is Optimus humanoid which can be bigger than the auto division, even bigger than the robotaxi

2. $25,000 car - not working on this as they have enough on their plate.

3. FSD offers much more upside coming to software margin and Elon mentioned that it should be ready in 2022. When car is autonomous? the costs of transport drops 4 - 5x and FSD should be ready by 2022 with its safety significantly better than when driven by humans.

4. 4680 cells > Austin is building Model Y with 4680 cells

5. New Gigafactory > announce new location(s) by end of 2022

Other notable developments:

Insurance offered in 5 states and could offer up to 80% Tesla customers by 2022 and after that will focus to Europe.

Cybertruck - key is its affordability. Goal is 250k per year production.

Interestingly, Tesla stock fell by 11.55% on 27 Jan 2022 (one day after the earnings announcement).

Recommendations

the fundamentals of Tesla remains strong and great growth is expected in 2022 with the new GigaFactories (Berlin & Texas) coming online. I will provide my thoughts on why Tesla stock price fell in a separate post.

精彩评论