FB: Meta needs to prove itself, now a show-me story

Meta($Meta Platforms, Inc.(FB)$), the parent company of Facebook and Instagram has come under tremendous pressure recently after missing earnings estimates last quarter and delivering guidance which disappointed investors. Its share price has slid over 50% over the past couple of months as investors raise concerns over the growth and longevity of its business. In this article, I discuss the risks and opportunities of investing in Meta and how Meta could be valued based on these factors.

Why did Meta's shares drop 50%?

Following its disappointing FY22 earnings and forward guidance, Meta's company shares slid as investors reassess the future profitability of its business. In its CFO Outlook during its latest quarterly report, Meta expects first-quarter 2022 total revenue to be between $27-29 billion, which represents 3-11% year-on-year growth due to headwinds to both impression and price growth. It also said that it is facing increased competition for people's time and a shift of engagement towards Reels which monetizes at a lower rate than Feed and Stories. Additionally, it cited that pricing growth will be negatively affected by Apple's iOS changes and cyclical weakness impacting advertiser budgets created by cost inflation and supply chain disruptions.

Meta is also aggressively investing in the Metaverse through its subsidiary, Reality Labs, which creates augmented and virtual reality-related consumer hardware, software and content. As it is still in the early stage of growth, Reality Labs's operating losses continued to widen from $6 billion to $10 billion in 2021. With no clear indication on whether Reality Labs will become profitable, it is extremely difficult to value and is purely speculative at this point. Therefore, my analysis will focus on Meta's Core business, its Family of Apps segment which includes Facebook, Instagram, Messenger, WhatsApp and other services.

Industry Analysis and Porter's Five Forces

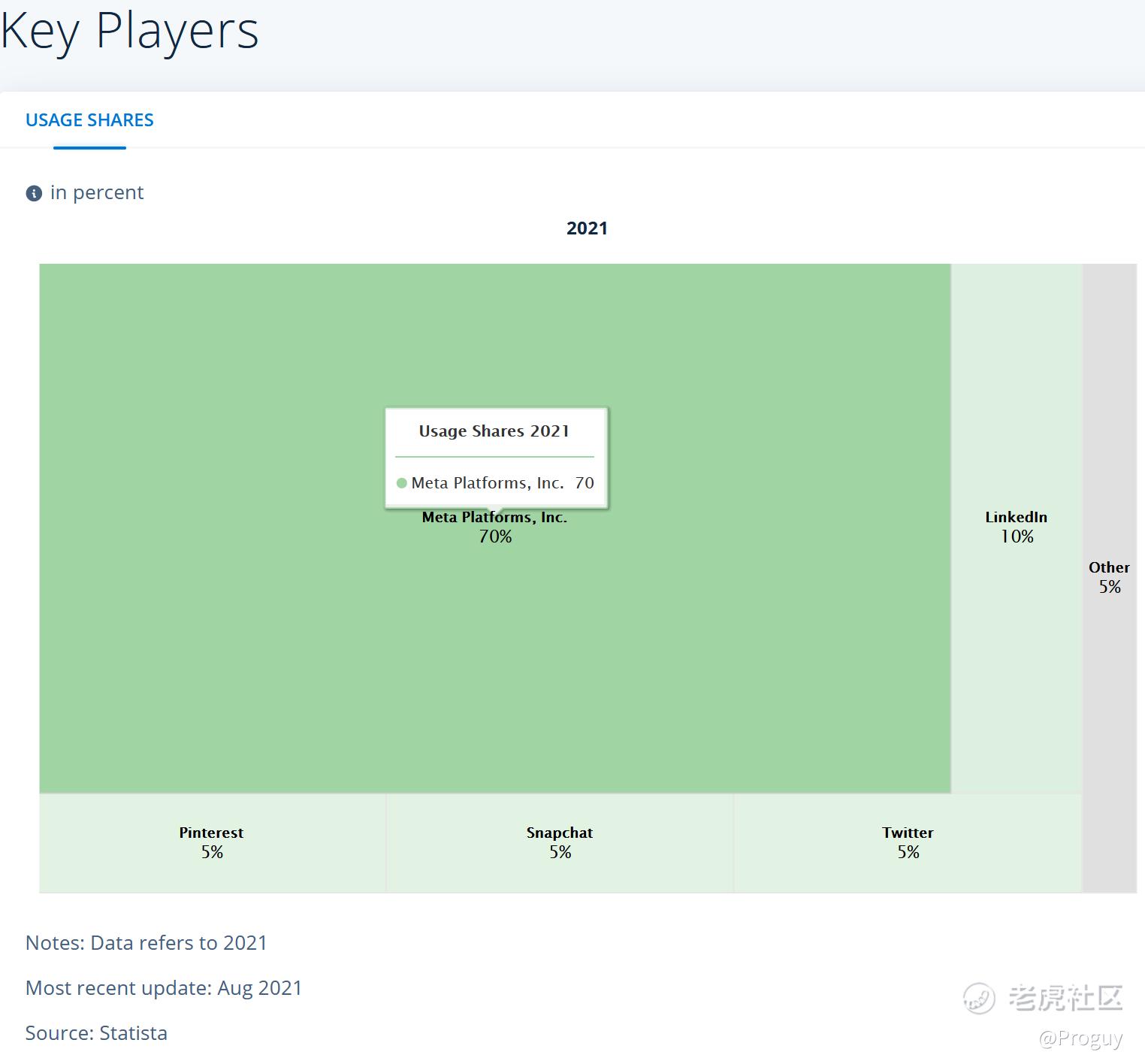

Meta operates in the digital advertising industry which has grown into one of the most important forms of advertising due to rising internet penetration rates and the popularity of social media sites such as Facebook and Instagram. Social media advertising spending worldwide which includes both desktop and mobile devices is expected to reach US $63 million in 2022 and is expected to grow at a CAGR of 8.80% to US$88.3 million in 2024. Meta currently has a 70% market share in terms of social media usage and its main rivals are Pinterest, Snapchat, Microsoft (LinkedIn) and TikTok with 5-10% market share each.

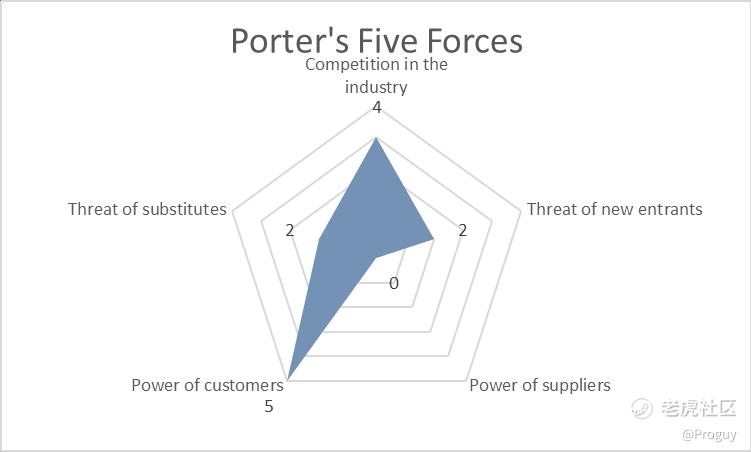

According to Porter's Five Forces analysis, the power of customers and competition in the industry have the greatest impacts on Meta's business. Meta's customers include both users who spend time browsing through social media as well as businesses who pay to feature their ads on Meta's platform. As views and impressions drive advertising demand, the more time that users spend on Meta's platforms, the more advertising budget businesses would be willing to spend to advertise on Facebook or Instagram. While Meta remains the largest social media platform in terms of its number of users, its competitors are quickly catching up to them. TikTok has gained huge popularity among a younger demographic of internet users and could pose a threat to Meta should they continue on their current trajectory. Likewise, Pinterest and Snapchat have also been growing their MAUs nicely over the past year by targeting younger audiences. Should Meta fail to follow suit, it could risk losing its audiences to competitors which does not bode well for its business. The threat of new entrants and substitutes are unlikely at this point in time as social media has almost become an irrevocable part of our everyday lives and has become an essential platform for us to communicate with our friends and communities.

Risks

- Threat from competitors such as TikTok

- Cyclical weakness in FY23, compounded by Russia's censorship of Facebook

- Spending on the Metaverse which may not come to fruition

Previously, I have mentioned how Meta is no longer a dominant force in the social media industry as its competitors have found a new way to attract a younger demographic of audiences. This presents a headwind to Meta's business and revenue growth as advertisers could shift their budgets towards other competitors and was a key observation highlighted during Meta's CFO outlook last quarter. Meta is finding ways to compete in this area through its new feature, Reels. However, this new feature monetizes at a lower rate than Feed and Stories, presenting a challenge for management to increase its CPM. Meta has experienced similar competition in the past when Snapchat introduced Snapchat Stories and has responded swiftly by introducing its own Instagram Stories which have helped to attract and retain audiences.

In Meta's CFO outlook, it was also noted that the current macroeconomic backdrop is not favorable for social media advertising spending as advertisers face rising cost inflation and supply chain disruptions. This has been exacerbated by Russia's invasion of Ukraine which has not only further disrupted supply chains but also resulted in Meta's being blocked in Russia as part of state censorship. It is estimated that Meta would lose $2 billion in revenue directly from this move. With no clear resolution to the conflict and uncertainty on Russia's access to social media in the future, it could take Meta a while to recover from this setback and result in sustained losses to its revenue.

In response to these challenges, Facebook has aggressively branded itself as Meta, projecting a brand image of a future leader in the Metaverse. Its subsidiary Reality Labs is the main driver of its push to the Metaverse and focuses on developing new technologies in fields such as VR and AR. While this may be seen as a bold move by the company to act as a first-mover in the Metaverse space, there is no guarantee that this move will pay off as the Metaverse remains highly speculative and can be quickly disrupted by technological and regulatory change. As Meta is pushing for its own iteration of the Metaverse, other players are also pushing for their own ideal version of the omniverse built on the principles of decentralization and transparency. This phenomenon, known as Web 3.0 has gained widespread popularity among internet users due to its power to protect customers from the profits of Big Tech companies such as Meta. We have already seen how Apple's iOS privacy changes negatively affect Meta's revenue growth and further decentralization of information would only result in a decline in future profits. Therefore, while the Metaverse itself presents an opportunity for Meta, it could also disrupt its entire business model and render it obsolete just like many tech companies during the dot com bubble.

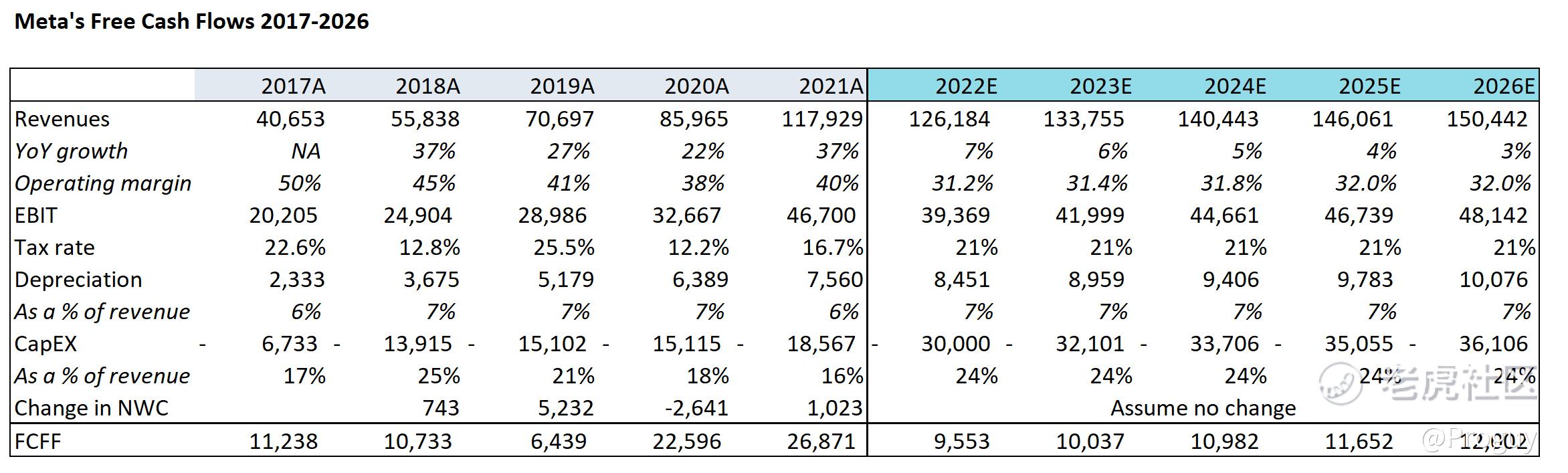

Predicting future cash flows

In my forecasts for Meta, I assumed revenue would grow 7% this year which is in the middle of the forecast range given by management (3-11% annual growth). EBIT was calculated using an operating margin of around 32% which is based on analysts' forecasts for the company. Depreciation is projected to be 7% of revenue based on a historical average and Capex is projected to increase to 24% of revenue as spending on the Metaverse increases. As NWC showed no historical pattern, it was assumed to remain constant.

Valuation

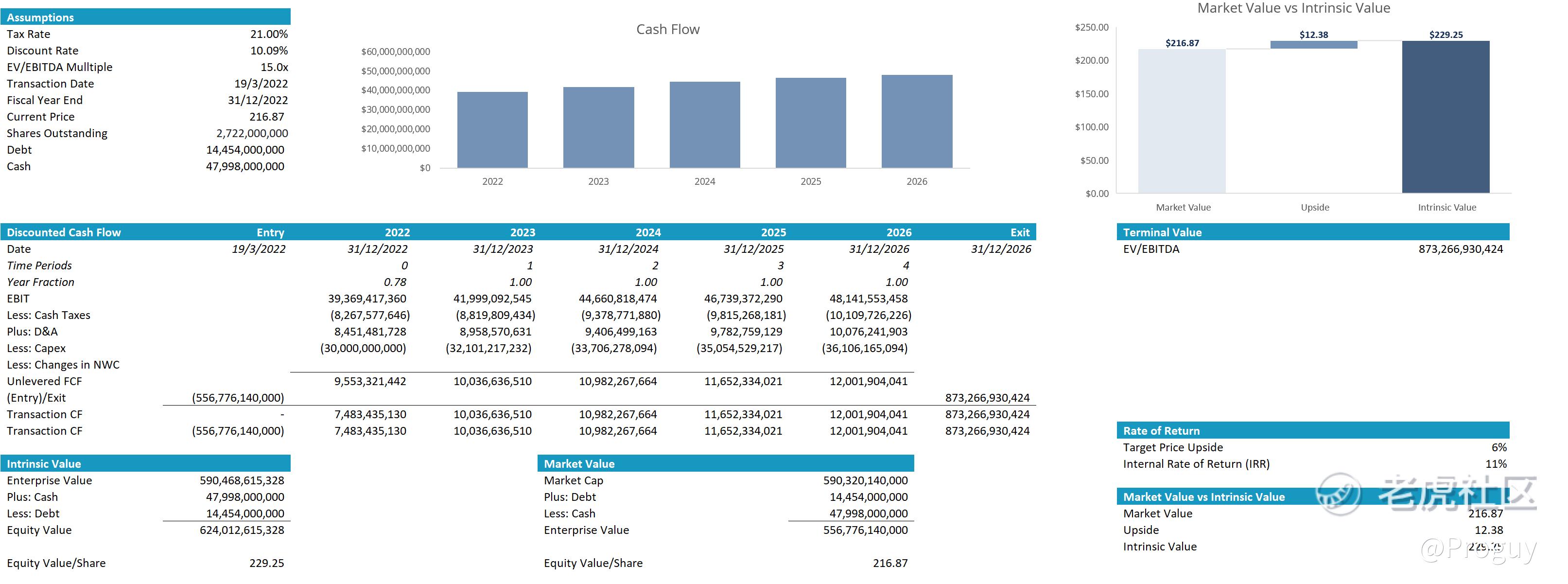

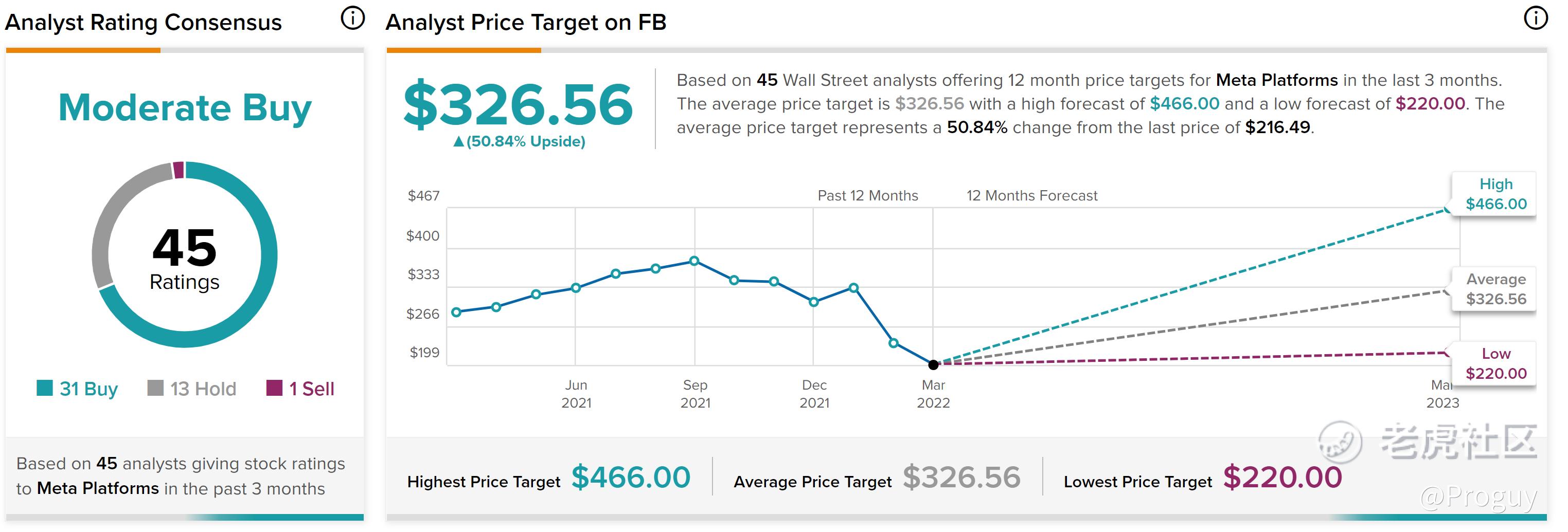

The discount rate was calculated using a WACC of 10.08%, with the cost of equity derived from the CAPM equation and an after-tax cost of debt to be zero percent. Using my Free Cash Flow projections from 2022-206, I used a 5-year DCF model to calculate the intrinsic value of Meta's shares today. Terminal value was calculated using an EV/EBITDA multiple of 15x which was adjusted downwards from its mean (19x) due to risks in the Metaverse which I highlighted earlier on. The intrinsic value of Meta's shares was found to be $230 or 6% higher than what it is currently trading at $207. In comparison, analysts on TipRanks have an average price target of $326 on Meta with 31 buy, 13 hold and 1 sell ratings

Conclusion

I see increasing risks in Meta's business due to increased competition from rivals, cyclical weakness and the rise of the Metaverse (or whatever you wish to call it). This is on top of the regulatory scrutiny Meta currently faces over concerns over privacy issues. I fear that the amount of pressure and competition Meta is facing may cause it to lose sight of its business and negatively affect operating performance. The company seems to already have set its sights on expanding into the Metaverse, investing heavily in the future. While this may prove to be a bold move in hindsight, there is fierce competition in the space and Meta has to rely on operational excellence in order to execute this move into the Metaverse. Considering the risks and opportunities of the business, I would assign a Hold rating on Meta's shares with a price target of $230 and a 6% upside.

Disclaimer: This article is for educational/informational purposes and does not constitute investment advice. Perform your own due diligence and seek financial counsel before making any investment decisions.

精彩评论