The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). This is also known as the "Fear Index" in relationship to S&P 500. Thus, $Cboe Volatility Index(VIX)$usually move in opposite direction against theS&P500 index $S&P 500(.SPX)$.

When there is more fear (VIX) ie up trend, the S&P500 would usually move down trend and vice versa.

There are typically 2 price actions involving VIX:

1. VIX Spike - this is characterised by a suddent move up and pull back quickly. This usually imply short term panic. For some traders, this can be interpreted as a buying signal as this is usually shorter term (few days).

2. VIX Swell - this is a slow but gradual move up while market rallies. However, VIX and S&P500 moving together in the same direction is a warning which implies potential correction coming (usually in weeks). But it is possible that this can be triggered suddenly by a sudden "black swan" event.

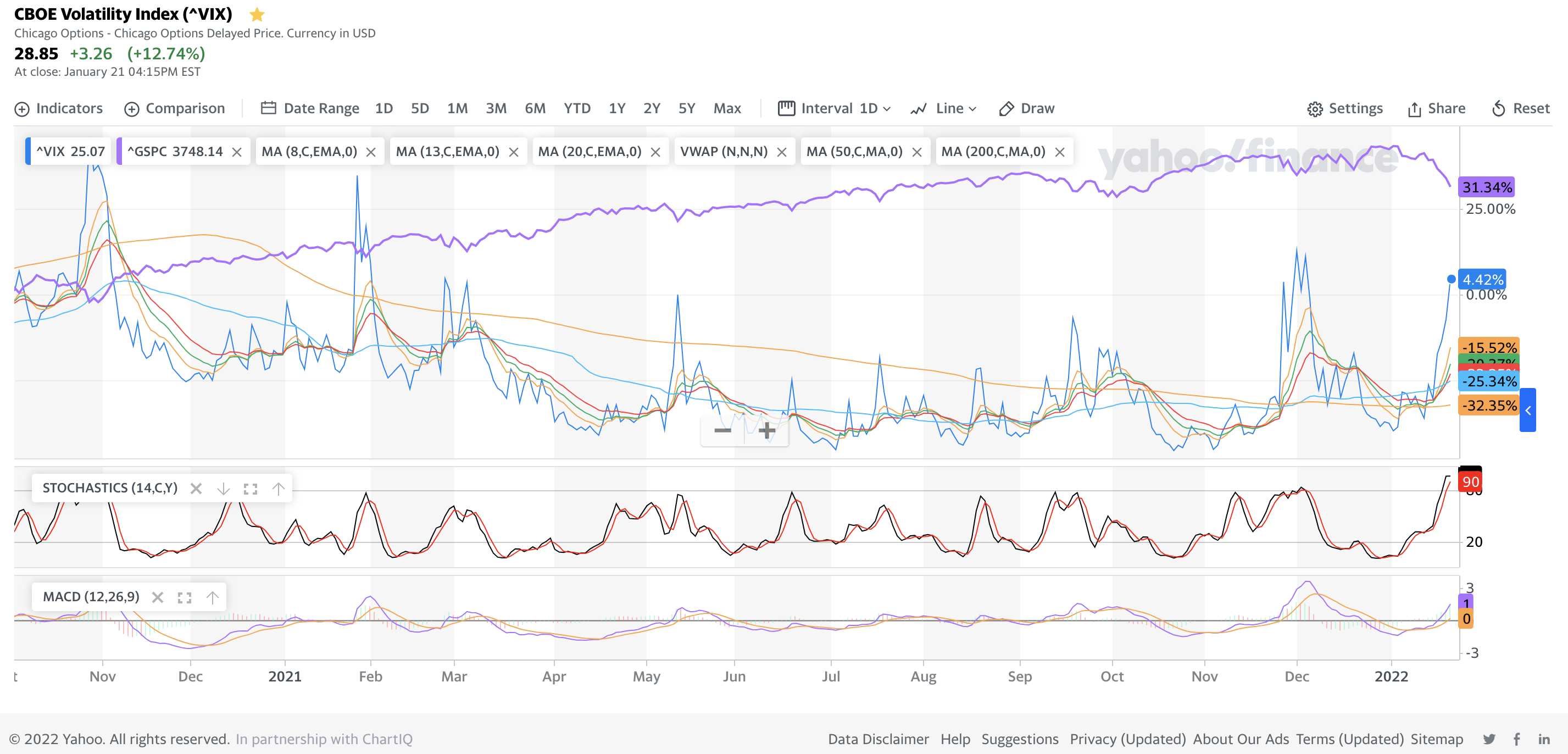

For VIX, it moved from 17 to 29 within a week, a sign of market showing volaility and "fear". VIX above 30 implies higher volatility and value under 20 is usuallyaccepted as "stable". The below is VIX chart - showing clear market dips when VIX surges.

From the chart above (1 Day), we noticed that S&P 500 index (seen in the purple line) does drop whenever there was a surge in the VIX. However, since Oct 2021, to early Jan 2022, we can see both are trending upwards despite the volatility. This is divergence that implies warning. Thus, it is not surprising that Friday's market dipped into red in record decline of recent pandemic time.

Investors should avoid the temptation to buy the dips in expensive high-growth stocks because “once the fever breaks, it lasts a long time,” according to Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management as per reported by Bloomberg on 23 Jan 2022.

Strategy

Personally, we should consider defensive stocks like utilities or supermarkets like $Costco(COST)$, $Wal-Mart(WMT)$. However, we should try to buy these at"fair price" so that we can stand more to gain. High growth stocks which promise future profits will be the ones who will continue to suffer as market rotates to value assets. Remember, not buying is also a good strategy especially when the market await the coming Fed meeting during this coming week - where we can expect more clarity on the coming interest rates increase.

精彩评论