- In 2022Q4, the company reported roughly flat growth for 361º corebrand, while 361º Kid retail sales increased by a low single digit yoy.

- It is understood the retail sales performance has started recoveringsince Dec2022. During the New Year’s holiday, offline retail sales rose 15% yoy.

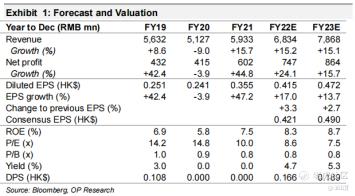

- Maintain BUY and tune up TP to HK$4.70, which represents 10.0x PER for FY23E.

Resilience against headwinds.We are impressed by the roughly flat growth for the retail sale of 361º core brand when most retailers suffered from the recentpandemic outbreak. This was better than that of domestic sportswear peers like Anta brand and Xtep Core brand, both of which reported high-single-digit yoydecline in 2022Q4. 361 Degrees mitigates some of the weak offline sales with its fast-growing e-commerce business. In 2022Q4, the company reported a 25% yoyincrease in retail sales of 361 e-commerce products. During the Double 11 shopping festival, it reported a 40% yoy increase in retail sales of e-commerce products.

The worst has likely passed.We understand the company’s retail sales have started recovering since Dec 2022, after China removed most of its COVID-19 restrictions. During the New Year’s holiday, offline retail sales rose 15% yoy, of which 361ºcore brand/ 361ºKid grew by 11%/25% respectively. The sales growth momentum is expected to resume in 1H22. We slightly lower our net profitforecast by 1.1% to RMB747mn for FY22E, while we keep the profit forecast(RMB864mn) for FY23E to reflect the relatively mild impact of the pandemic outbreak.

Maintain BUY and slightly tune up TP to HK$4.70.The new TP represents 10.0x of FY23E PER. This is equivalent to 60% discount to its domestic peers. As the pandemic fades, we expect 361 Degrees to maintain 15%+ yoy sales growth in FY23E. The fast-growing kidswear business, the upgrade of the product mix driven by the growing recognition of its professional running shoes and basketball shoes, and the growing brand value are the long-term growth drivers for 361 Degrees.

Risks: (1) Brand damage and/or deterioration in the market position

精彩评论