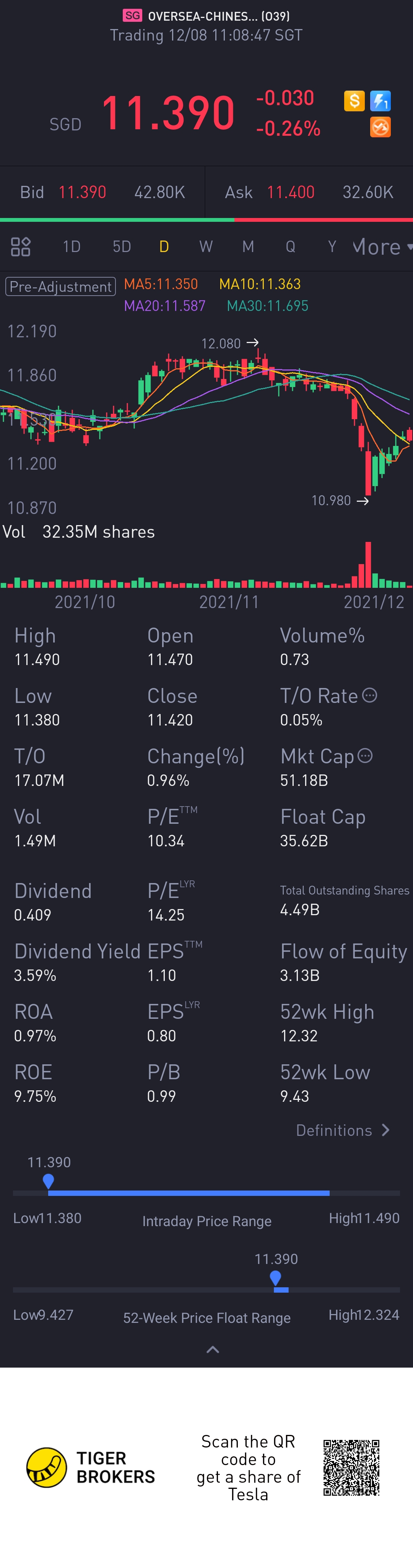

$OVERSEA-CHINESE BANKING CORP(O39.SI)$

Singapore market is stable and to many investors, its boring. There is lack of growth and lack of exciting startup and technology firm listing here. That why new SPAC listing rule was define to encourage new listing in Singapore.

To me, I agree that the Singapore market is lacking growth and not exciting. But it provide stable and good dividend if you pick the right choice. As I start to prepare to build a stable income stream through dividend for my retirement, my obvious choice are Singapore market, Reits and Bank stock. I know I will not get the kind of growth like US tech stock. But I can sleep peacefully at night without having to worry about big volatility of the market. It really depend on your investment objective and horizon. If you are young, longer runway, you can take higher risk. For me, at my current stage, I am do not want to risk or push back my retirement. 3-5years horizon is not long for investment.

Let take a look at a Bank counter in Singapore today.

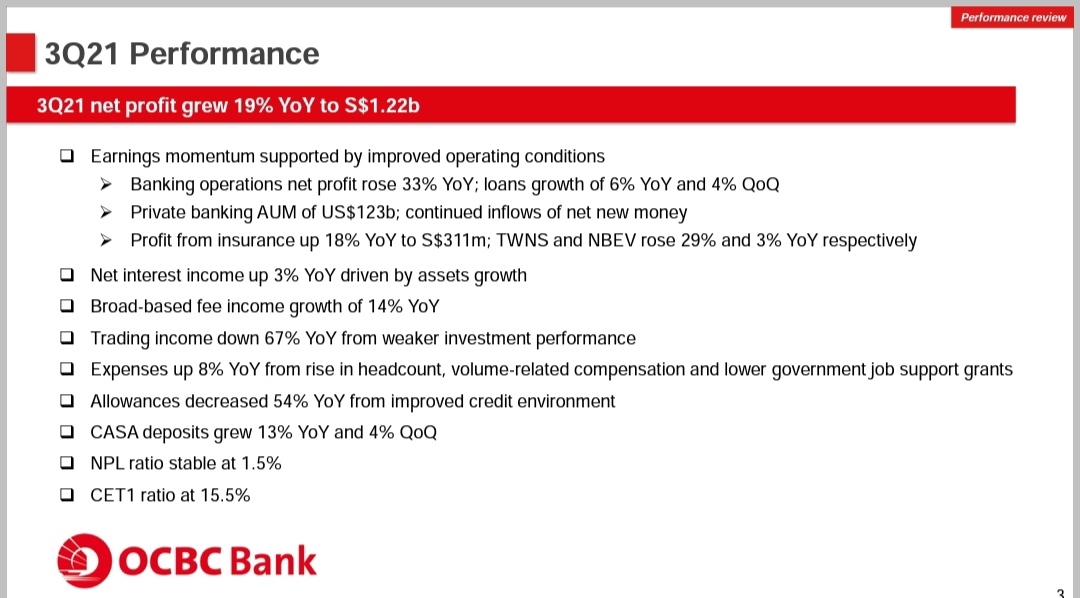

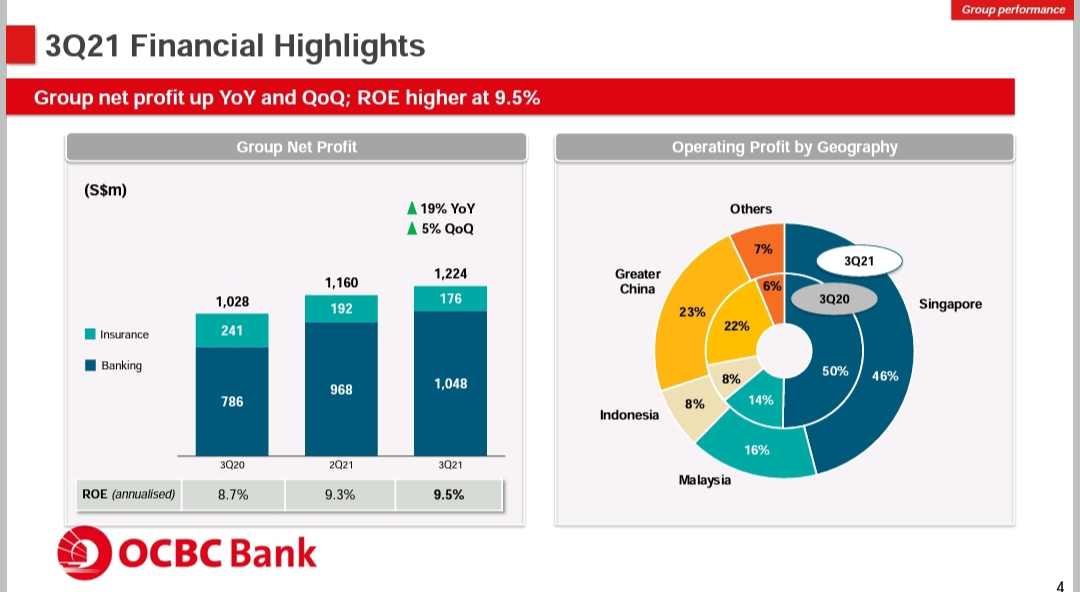

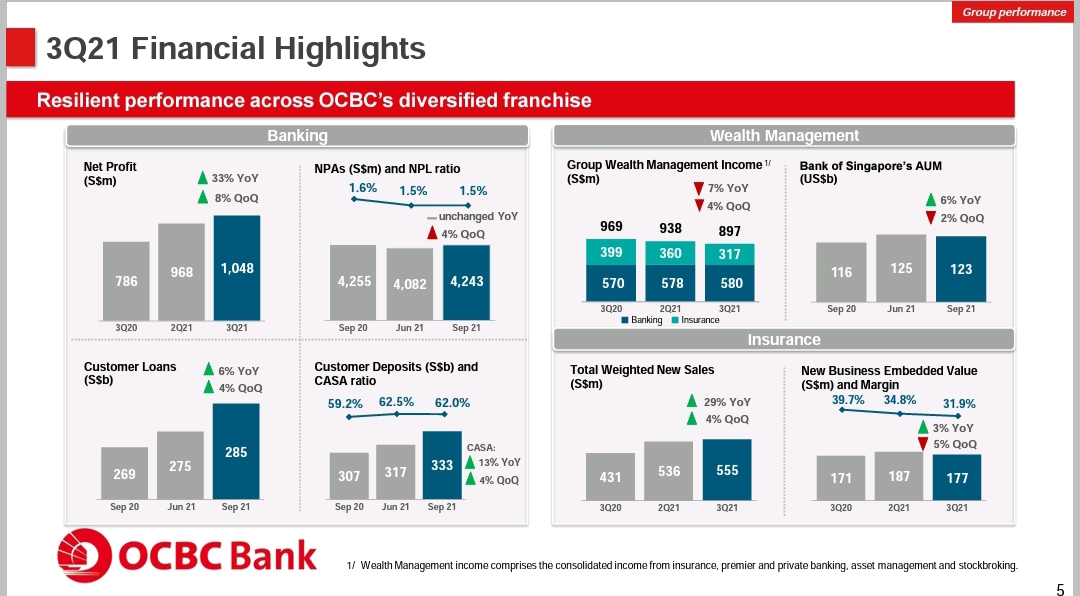

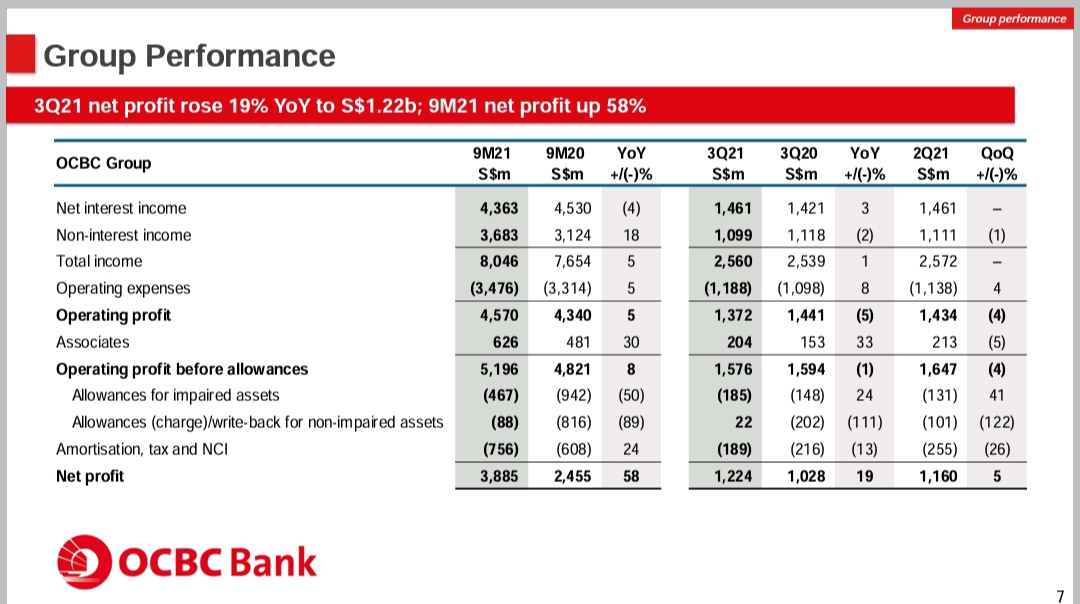

OCBC is the smallest of the 3 Bank. Also lowest in term of PE ratio. So is it worthwhile to add to portfolio with recent pullback?

On the dividend record,

OCBC past dividend yield ranges from 3.3% to 4.8%, with an average of 3.9%. Not bad at all for retirement portfolio.

OCBC PE ratio was between 9.7x and 11.8x, translating to an average ratio of 10.9x. Lowest of the 3 Banks. DBS and UOB is in range of 13.5x.

OCBC past PB ratio fluctuats from 0.8x to 1.3x, giving an average of 1.1x

With OCBC’s share price of around S$11.45 now, the latest valuations is as follows,

OCBC estimate dividend yield 4.7%

OCBC PE ratio: 10.6x

OCBC PB ratio: 1.0x

OCBC declared a 2021 interim dividend of S$0.25 per share, up from S$0.159 per share declared a year ago.

Assuming OCBC pays a final dividend of S$0.28 per share for the 2021 fourth-quarter (similar to the final dividend in 2019’s fourth quarter), OCBC’s dividend yield comes up to 4.7%.

Personally if this yield is sustainable, I am more than happy to invest through SRS fund or even CPF funds.

精彩评论