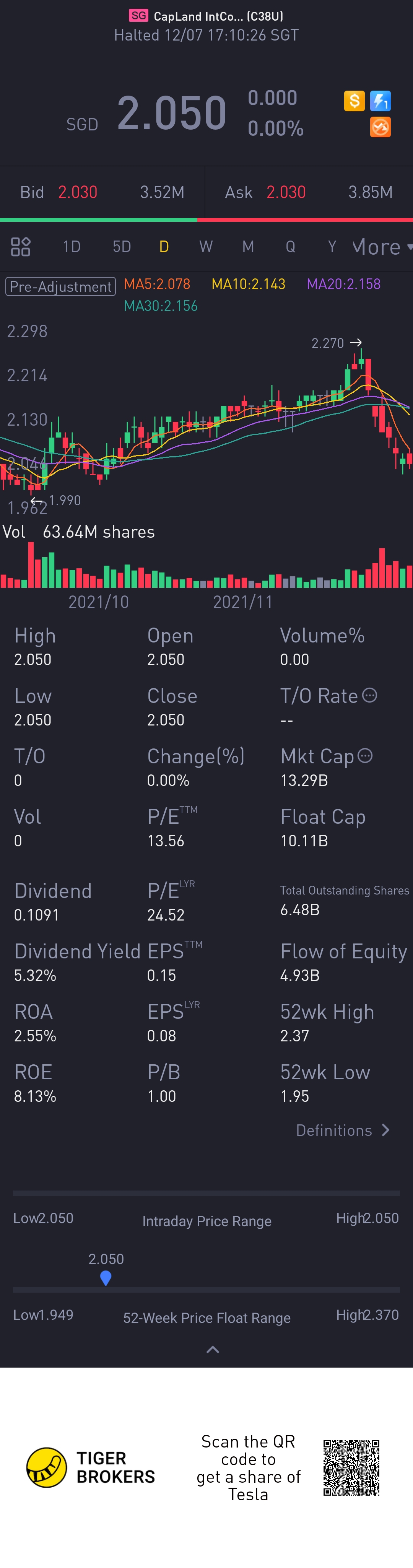

As a Reits investor, I am also vested in CapitaLand Integrated Commercial Trust. Looking at the portfolio, personally I prefer Fraser as the mall are in the heartland servicing the community. Whereas CICT is less pandemic resilience as it rely on visitors as well as non essential businesses. But having said that, we are turing around the corner. It may still take a while to recover fully. So should we invest now with better price?

Some background on this Reit.

CapitaLand Integrated Commercial Trust is one of the biggest real estate investment trusts in the Asia Pacific region and the largest REIT in Singapore by market capitalisation and total portfolio property value.

It was formed after the successful merger between CapitaLand Commercial Trust (CCT) and CapitaLand Mall Trust (CMT).

CICT’s portfolio comprises of 24 properties in the retail, office, and integrated developments space.

Singapore accounts for 96% of its portfolio property value, with the remaining 4% in Germany

Over in Germany, CICT owns two properties — Gallileo and Main Airport Center — that are located in Frankfurt’s city centre and its airport office district, respectively.

By asset type, CICT’s office properties took up the bulk of the 2021 first-half net property income at 31.1%, while retail contributed to 40.0%, and integrated developments were at 28.9%.

In terms of contribution by properties, Raffles City Singapore was the largest contributor at 14.8%, followed by Plaza Singapura and The Atrium@Orchard (9.7%), and Asia Square Tower 2 (8.3%).

CICT had a gearing ratio of around 40%.

This is well within the previous regulatory limit of 45% and the revised ratio of 50%.

I prefer to perform DCA on Reit fund now instead of buying into CICT for now@小虎活动@Tiger Stars

精彩评论