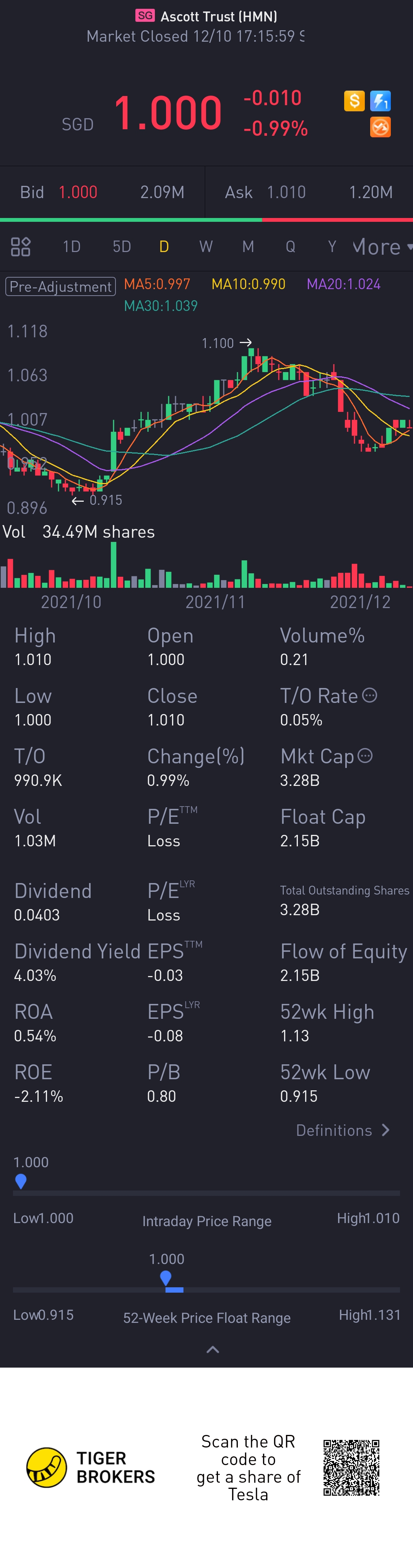

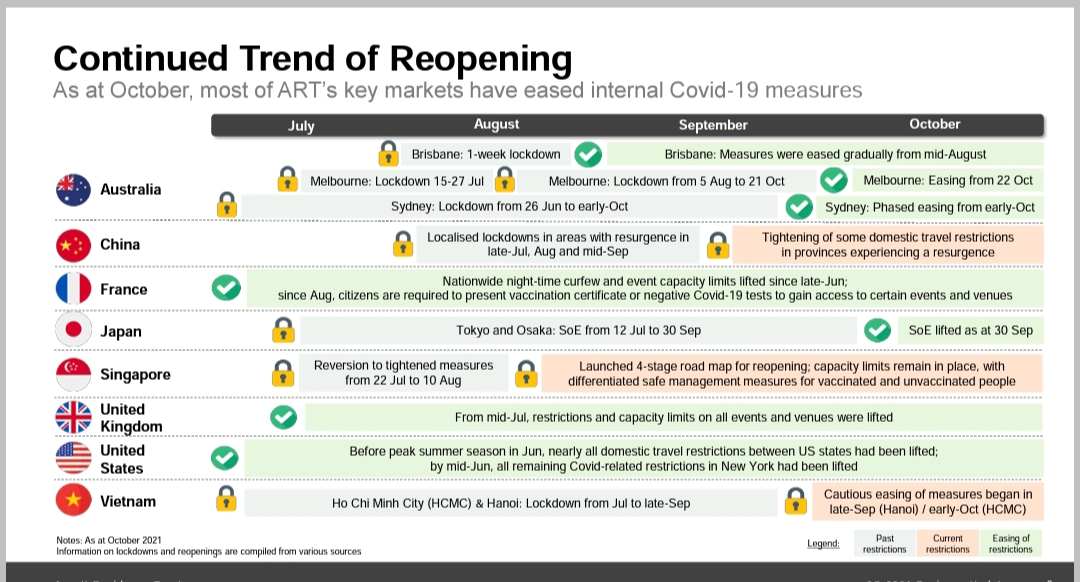

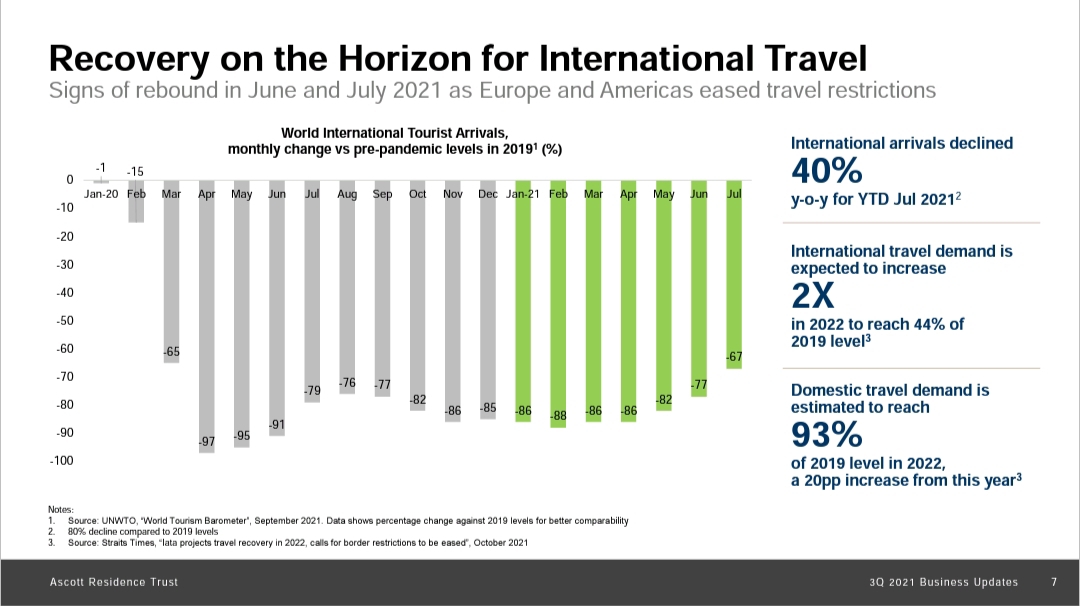

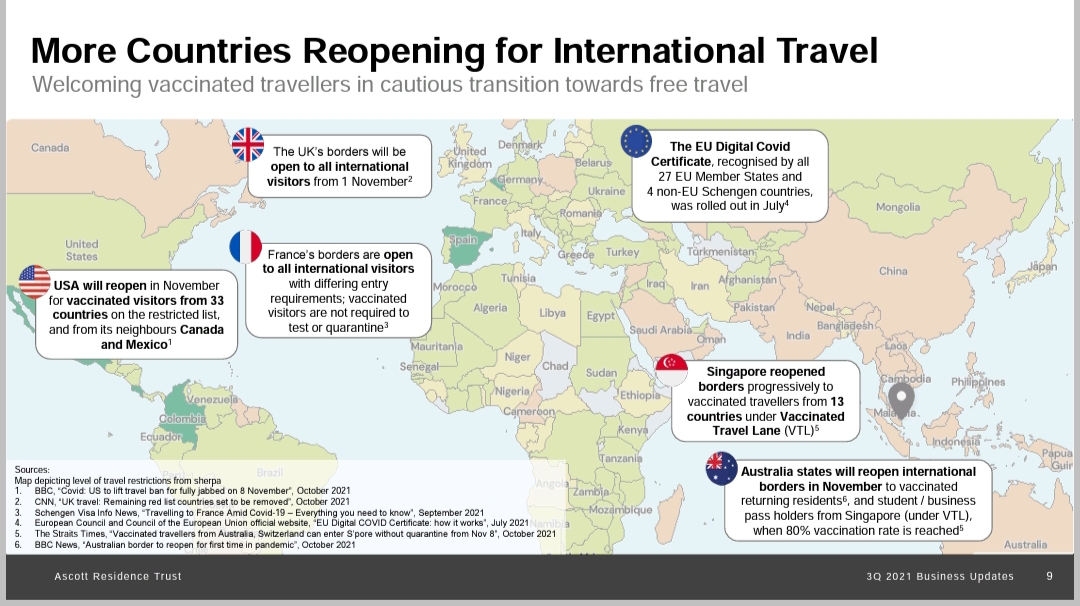

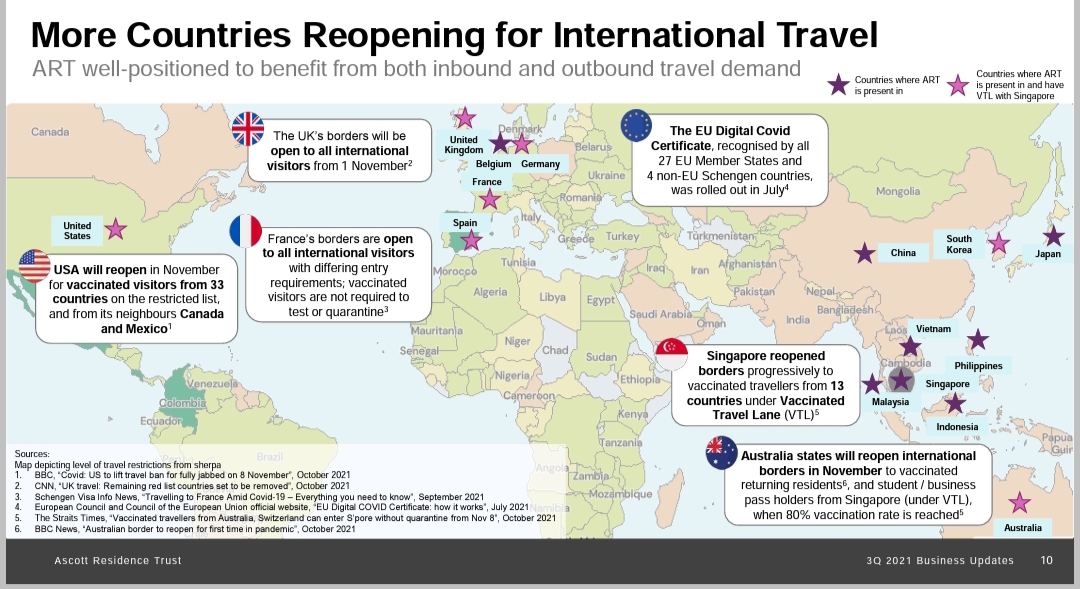

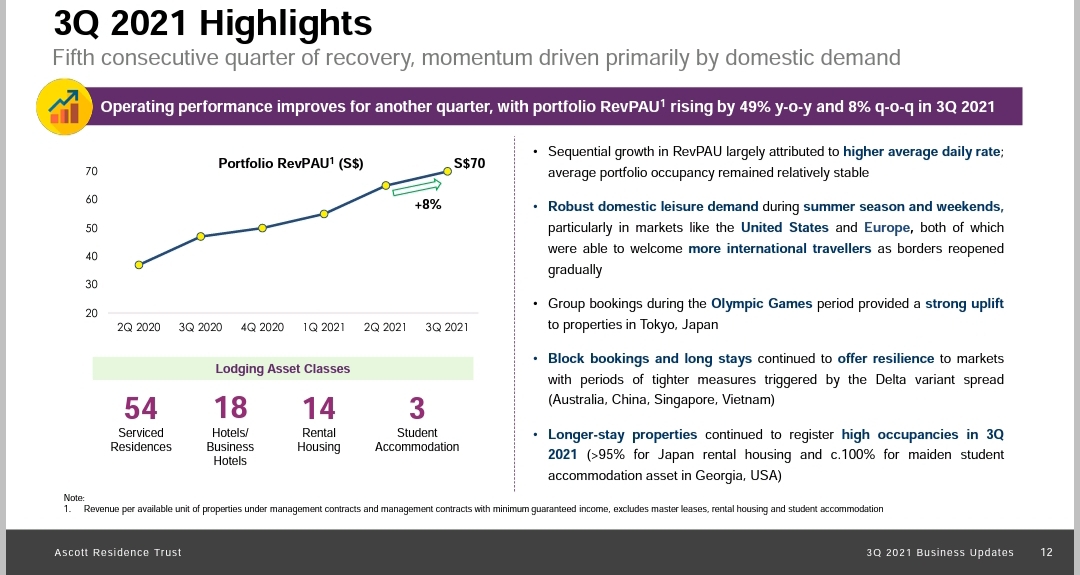

Sharing another Reit in listed in Singapore. Previous sharing are all about Industrial, Commerical, Logistic and DataCentre Reits. First time I am touching on Hospitality Reit which is one of the most badly hit sector during the pandemic. In fact, we have not recover. But with many countries opening border, is this the right time to take position and hold for recovery.

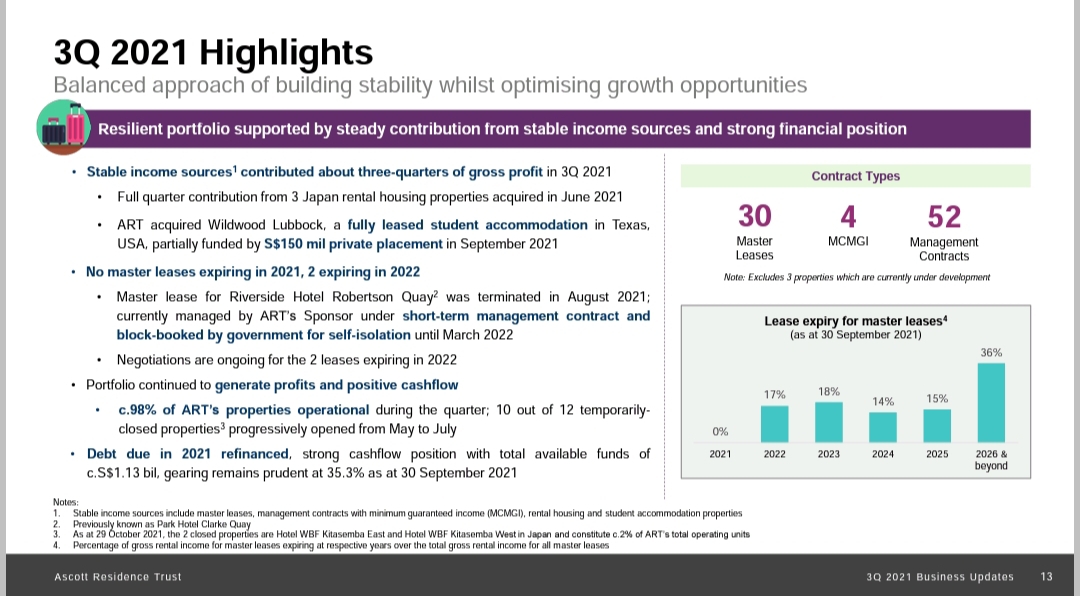

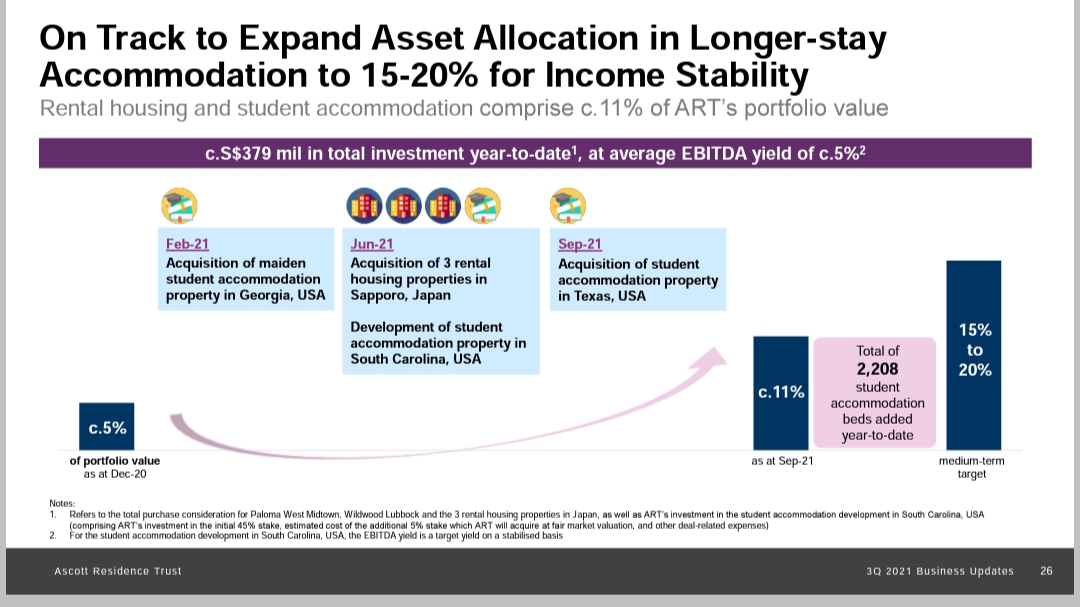

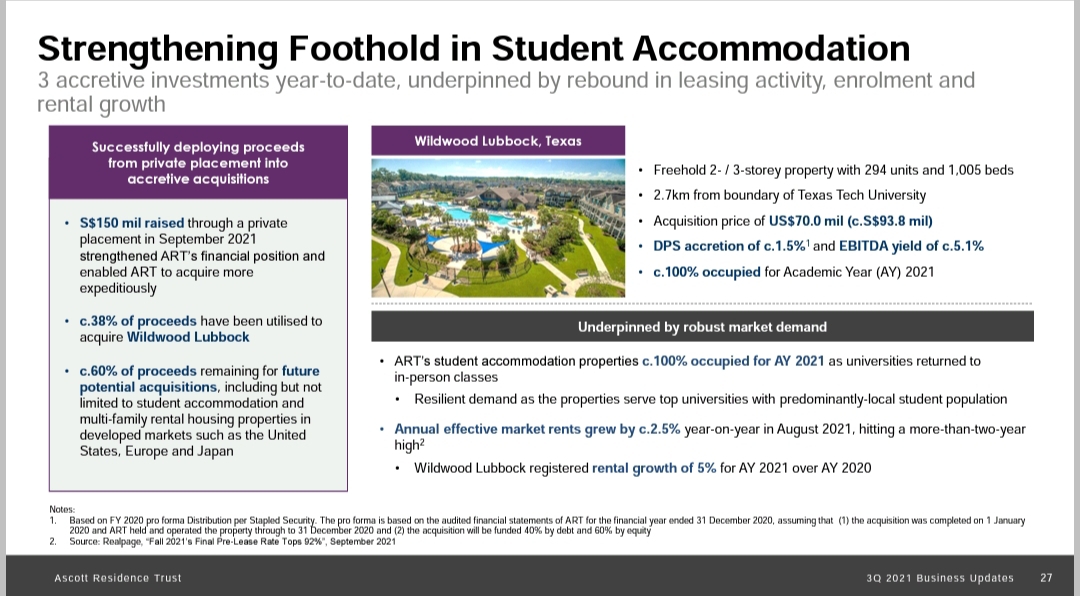

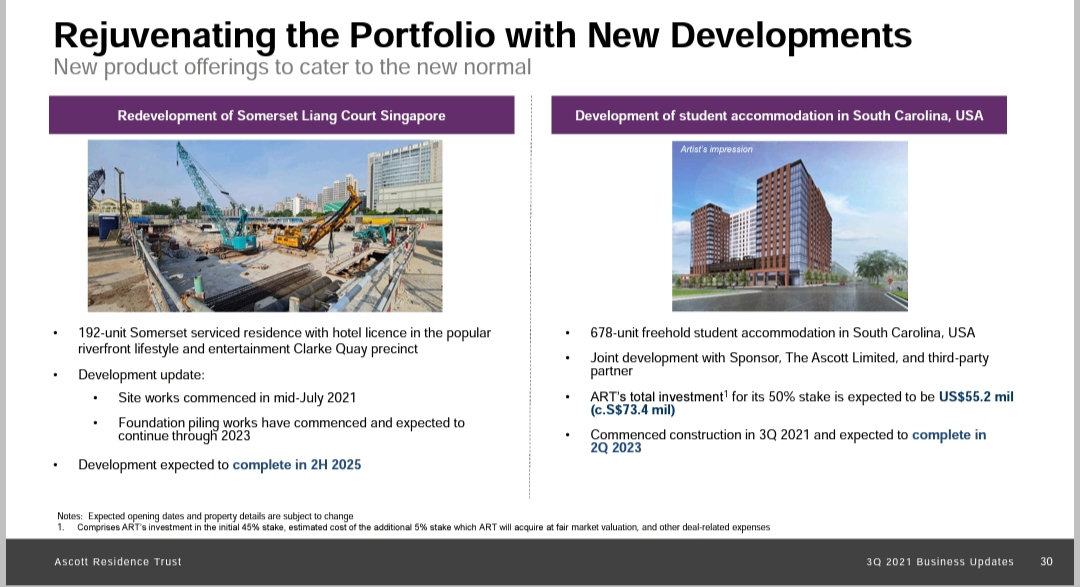

Ascott Residence Trust is the largest hospitality trust in Asia Pacific with an asset value of close to S$7.3 billion. Having listed on the Singapore Exchange Securities Trading Limited since March 2006, its mai objective is to invest primarily in income-producing real estate and real estate-related assets which are used or predominantly used as serviced residences, rental housing properties, student accommodation and other hospitality assets in any country in the world.

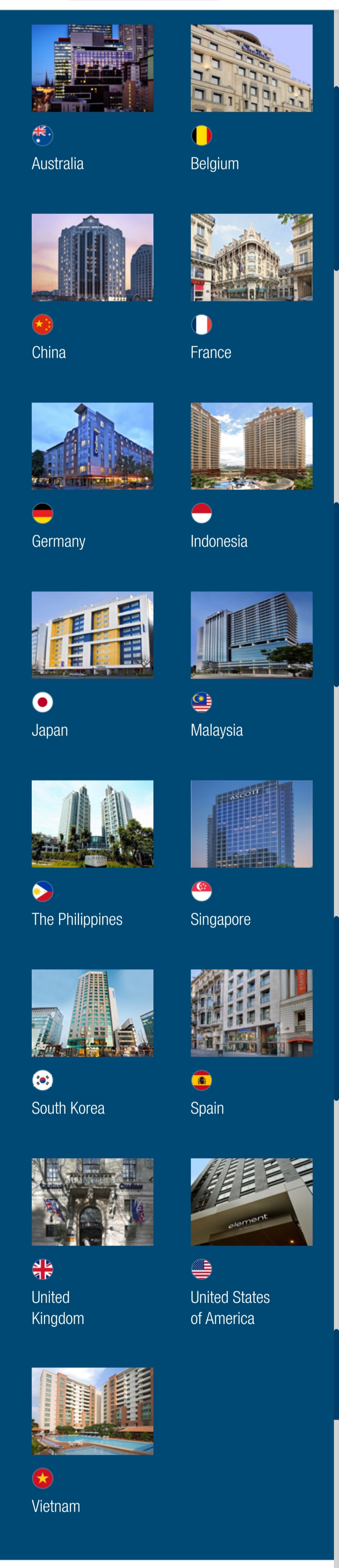

It has a international portfolio comprises 89 properties with about 17,000 units in 39 cities across 15 countries in Asia Pacific, Europe and the United States of America as of September 2021.

The properties are mostly operated under the Ascott The Residence, Somerset, Quest and Citadines brands. They are mainly located in key gateway cities such as Barcelona, Berlin, Brussels, Hanoi, Ho Chi Minh City, Jakarta, Kuala Lumpur, London, Manila, Melbourne, Munich, New York, Paris, Perth, Seoul, Singapore, Sydney and Tokyo.

The Trust is a stapled group comprising Ascott Real Estate Investment Trust and Ascott Business Trust. It is managed by Ascott Residence Trust Management Limited and Ascott Business Trust Management Pte. Ltd. Both of which are wholly-owned subsidiaries of Singapore-listed CapitaLand Investment Limited, a leading global real estate investment manager with a strong Asia foothold

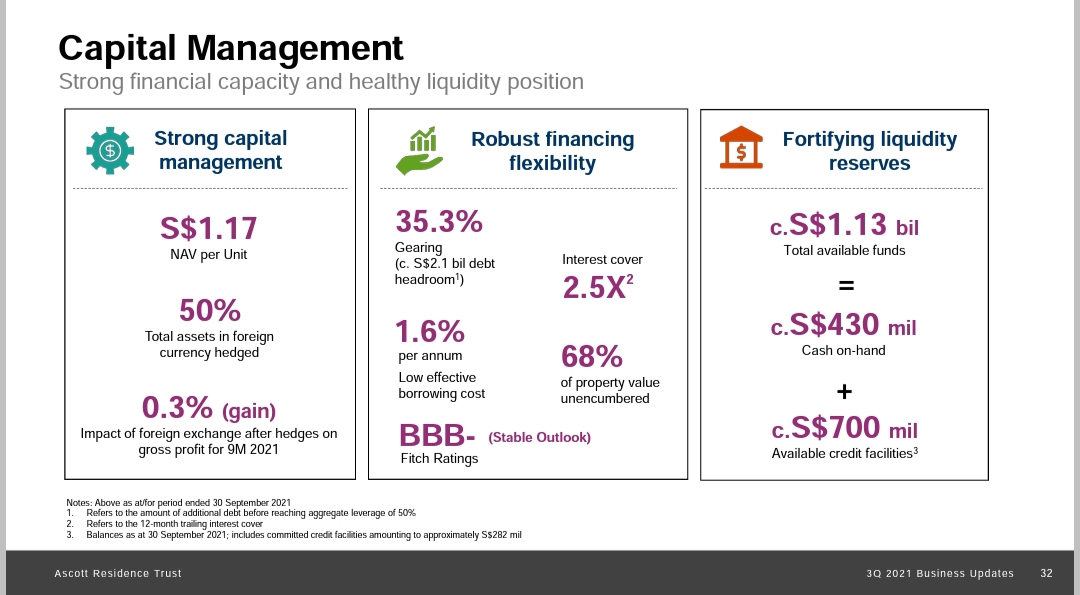

As mentioned we are at the very early stage of recovery for hospitality sector. So if we chose to take advantage and wanted to invest in it, personally, I would chose the top player. Its during these big crisis where we will see the strong will weather through the storm and emerge stronger. Ascott fits the criteria.

At present I am still not vested yet. But seriously considering@Tiger Stars@小虎活动

Thanks for reading and have a good weekend.

精彩评论