In the universe of Unit Trust, there are thousands of funds investors can choose from to include in their portfolio. So how exactly do you choose the “right” fund to meet your investment needs? In today’s piece, we will teach you how to analyse funds and think like an analyst!

Top down or bottom up approach?

Before choosing which funds could potentially generate good returns for us as investors, we need to formulate an investment thesis which we believe in. This can be done through a top down (assessing macro factors such as GDP, employment, interest rates etc to identify specific sectors or companies that could benefit) or bottom up (focus on analysing specific companies or sector based on its fundamentals rather than looking at the greater economy) approach. To provide a better understanding, we will take an example of our recent view on Chinese equities.

Lately, we have reiterated our stance that China A shares is a compelling inclusion into one’s portfolio for a few reasons; 1) Industries and companies listed on the onshore market is poised to benefit from the reforms, 2) China A shares is the easiest way to gain exposure to the 2nd largest economy in the world and 3) the low correlation of China A shares plays a role as a portfolio diversifier, despite the recent slew of negative news surrounding the country’s equities – our thesis was based on a combination of the top-down and bottom-up approach.

Equity funds, fixed income funds or balanced funds?

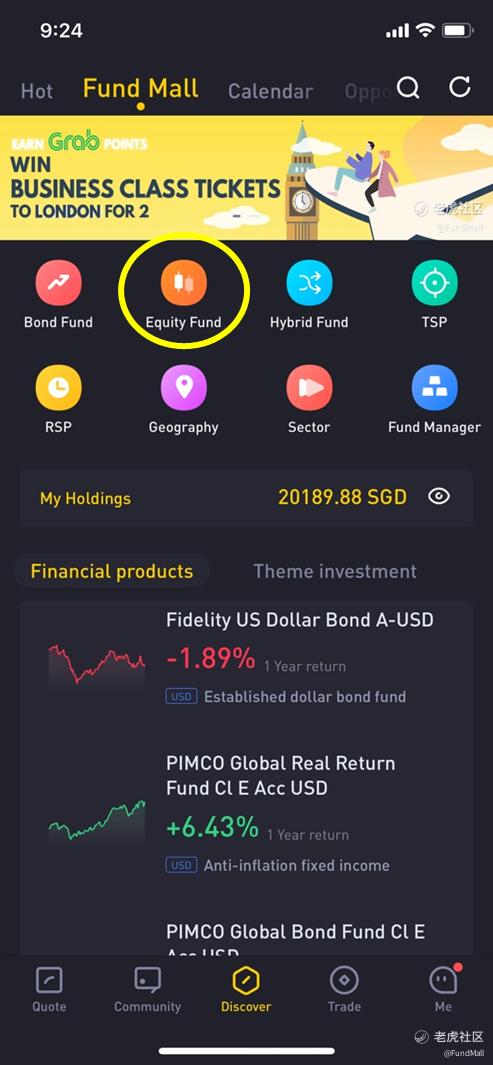

The thought process that goes through an analyst’s mind after building his investment case is to identify the type of funds to invest in. In the scenario painted above, the appropriate fund type will be an equity fund since we are looking to invest in the Chinese onshore equity market. However, to scroll through the array of funds on our platform can be a rather tedious process but fret not!

This hassle can be eliminated by using the tools provided on the Tiger Brokers platform. In this instance whereby you are looking for an equity fund investing in the China onshore market, one can simply select equity funds on the Fund Mall tab

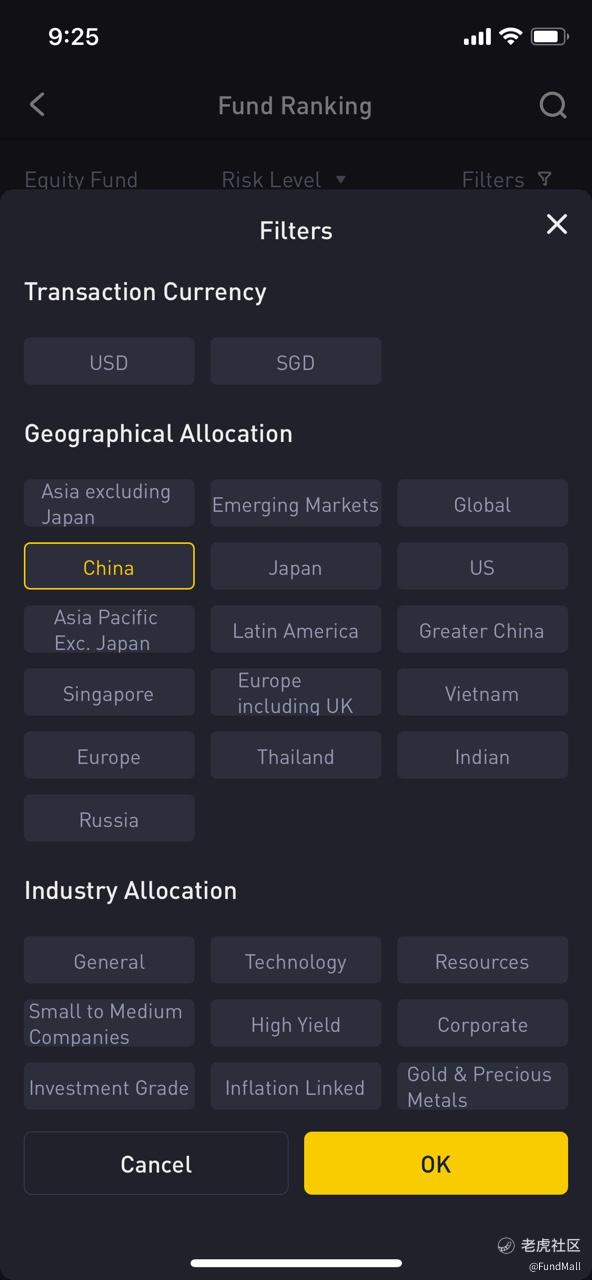

and sieve out China A shares funds by using the filter tool to narrow down the funds by geographical allocation.

The fund factsheet is your best friend!

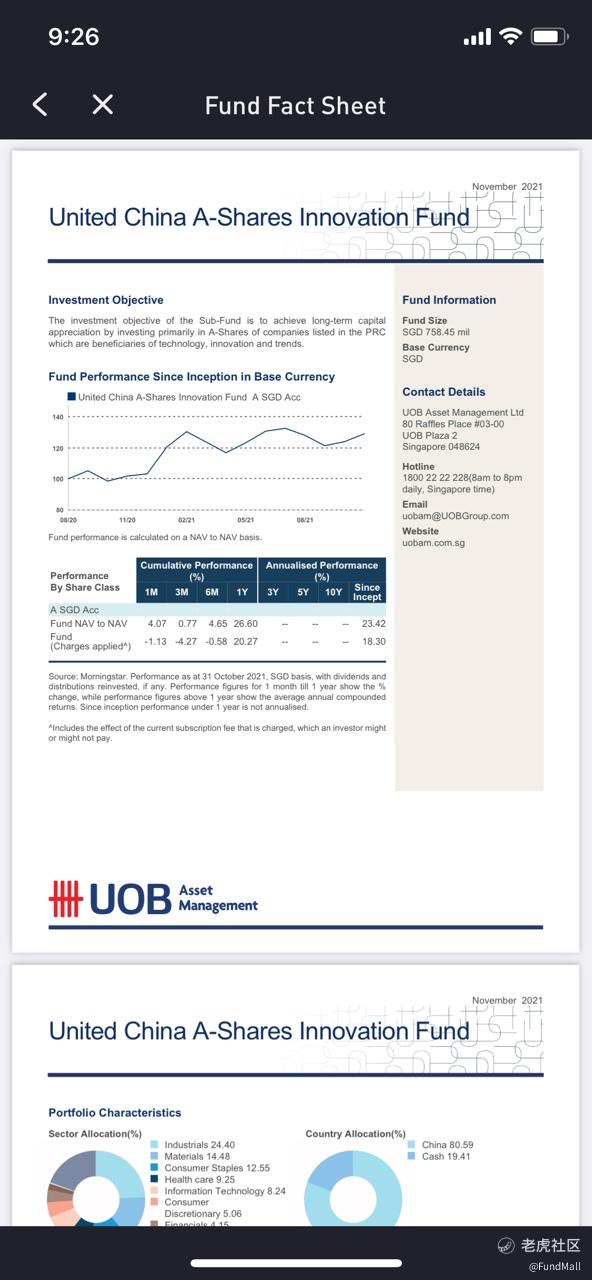

Now that you are probably looking at a list of funds investing into China, it is time to find the ‘right’ fund. To do so, click on the fund and go to the ‘about’ tab at the top of your screen and look for the fund factsheet. This piece of information is crucial when it comes to investing in Unit Trust.

Upon opening the factsheet, you will be met with the fund’s investment objective– how it invests into China (via the onshore or offshore market) and the investment strategy, allowing you to assess if the fund is suitable for your thesis. Going a step deeper, the factsheet provides investors with an understanding on the fund’s asset allocation, fund manager’s experience in managing the fund, fees involved, size of the fund and the overall performance against its benchmark (should there be one).

Reading the factsheet.

In essence, the information from the factsheet proves to be useful but what do all these terms mean?

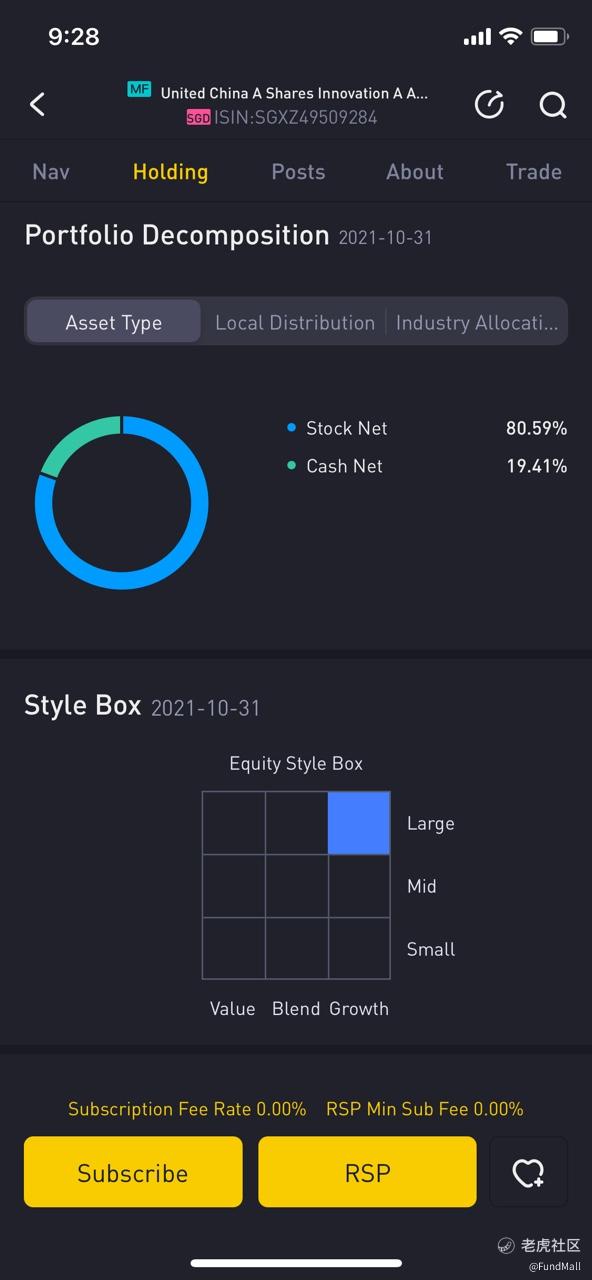

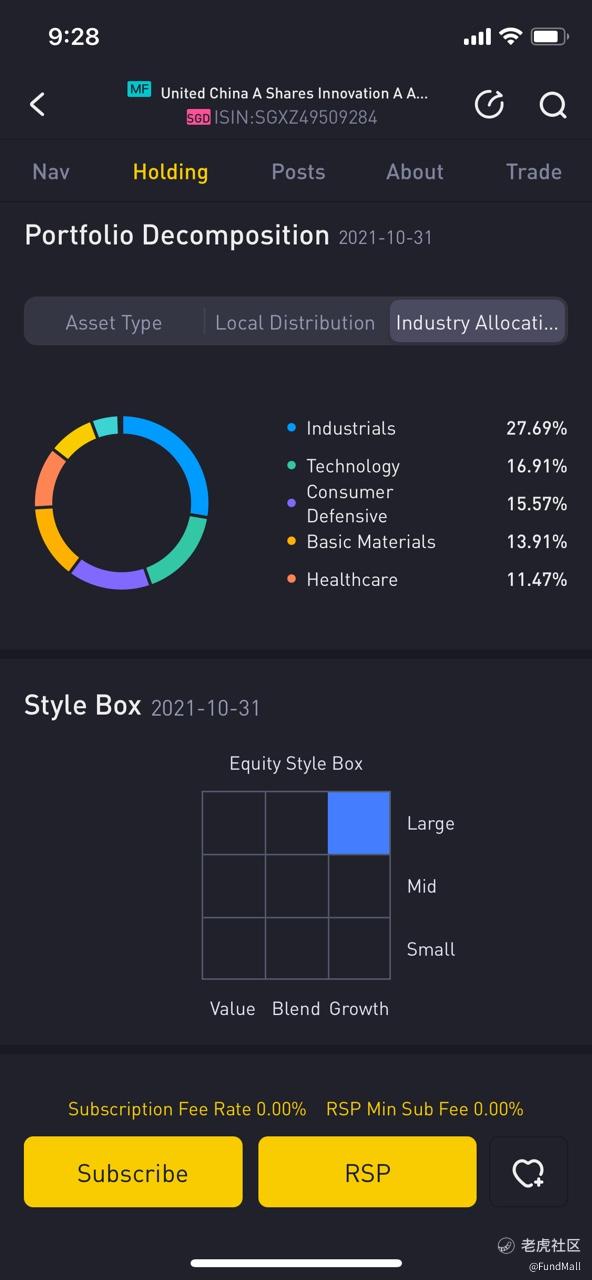

Fund asset allocation: The asset allocation tells an investor how much the fund invest in a particular sector or company, which in this case, in China. This allows investors to gauge how diversified the fund is and if it meets his or her investment principles and where the fund manager believe the fund should be invested in.

Fund size: Theoretically, when the fund size is huge, it means that investors are generally confident in the fund manager’s methodology to generate good returns for them in the long run and vice versa. The larger fund size also means that there is lesser risk of one big institutional client suddenly pulling out his investment and affecting the portfolio.

Fund performance: Broadly speaking, the top of mind concern amongst market participant would be the performance of the fund. By reading the factsheet, investors will get an idea on how the fund has performed on a 1 year, 3 years, 5 years, and 10 years basis. Nonetheless, should a fund have underperformed in a particular year due to a black swan event or a market drawdown, investors should not immediately avoid it as the fund could have outperformed its benchmark and managed downside risk better than its peers. Alternatively, investors can also look to the morning star rating – ratings are based on the fund’s historical performance to the fund’s peer group on a scale of 1 to 5, with 1 being the worst. Always make sure you compare funds that have similar/same investment objective, asset type so that they are an apple to apple comparison.

Costs go on forever.

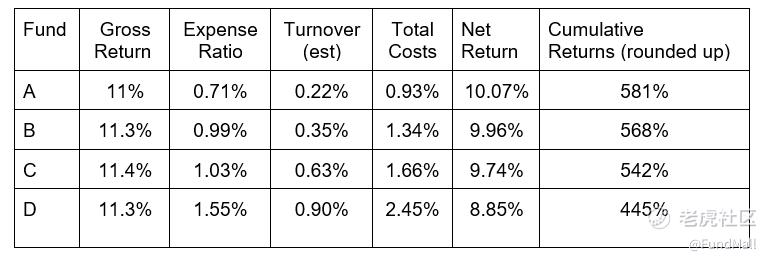

Often enough when we speak about investing in a Unit Trust, cost is always the main reason investors’ shun away from the investment vehicle. Yes, cost matters. Ideally speaking, investors should look for funds with a low expense ratio in order to ensure that their profits are maximised and here’s why.

From the illustration above, we can clearly see that as the expense ratio of a fund increases, your net returns decreases. Indeed, it may not seem like there’s a huge difference in net returns between fund A and fund D. However, when we compound the returns over a 20 years period, the cumulative difference reaches staggering proportions.

That said, it may sometimes be impossible to avoid funds with higher expenses ratio especially if investors are looking to invest in niche markets like Latin America (“LATAM”).

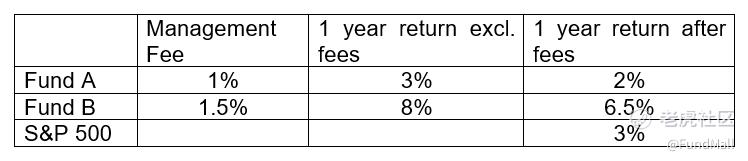

Aside from expense ratio, another type of fees that comes with the purchase of unit trust is the annual management fee. This fee helps to cover the cost of operating the fund as well as the fund manager’s expertise in managing the fund.

Now that we know what are some of the fees involved when buying a unit trust, we argue that these fees are justified. In the scenario below, fund B comes with a higher management fee yet is able to generate returns higher than that of the S&P500 by 3.5% (assuming no fees are charged). Hence, while fees may be important, we should also consider the fund’s performance, strategy, fund manager’s experience and the exposure that an investor can get through investing in fund.

The bottom-line when it comes to the topic of fees is that low fees does not necessarily translate to higher returns for investors. As the saying goes, if you pay peanuts, you get monkey. A strong fund performance track record by a fund manager definitely does not come cheap. The key consideration investors should have in mind is to decide whether the additional fees are worth paying when compared to similar funds.

Overall, we think that these are some guidelines investors can take into consideration when selecting which funds to include into their investment portfolio.

Still not sure where to begin? Check out our post on If I have $1000, which funds should I buy?

Disclaimer: The information herein was obtained and derived from sources that we believe are reliable, but while reasonable care has been taken to ensure that stated facts are accurate and opinions are fair and reasonable, Tiger Brokers does not represent that it is accurate or complete and it should not be relied upon as such. The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance.

精彩评论