Stock review – VISA 2nd Dec 2021

$Visa(V)$ has dropped much for the last few months. Some have advised that this is good value now. Before we think of buying, let us look at some of the fundamentals. There were some concerns raised in a recent dispute with $Amazon.com(AMZN)$. VISA has advised that they are working this out with Amazon to address the issues.

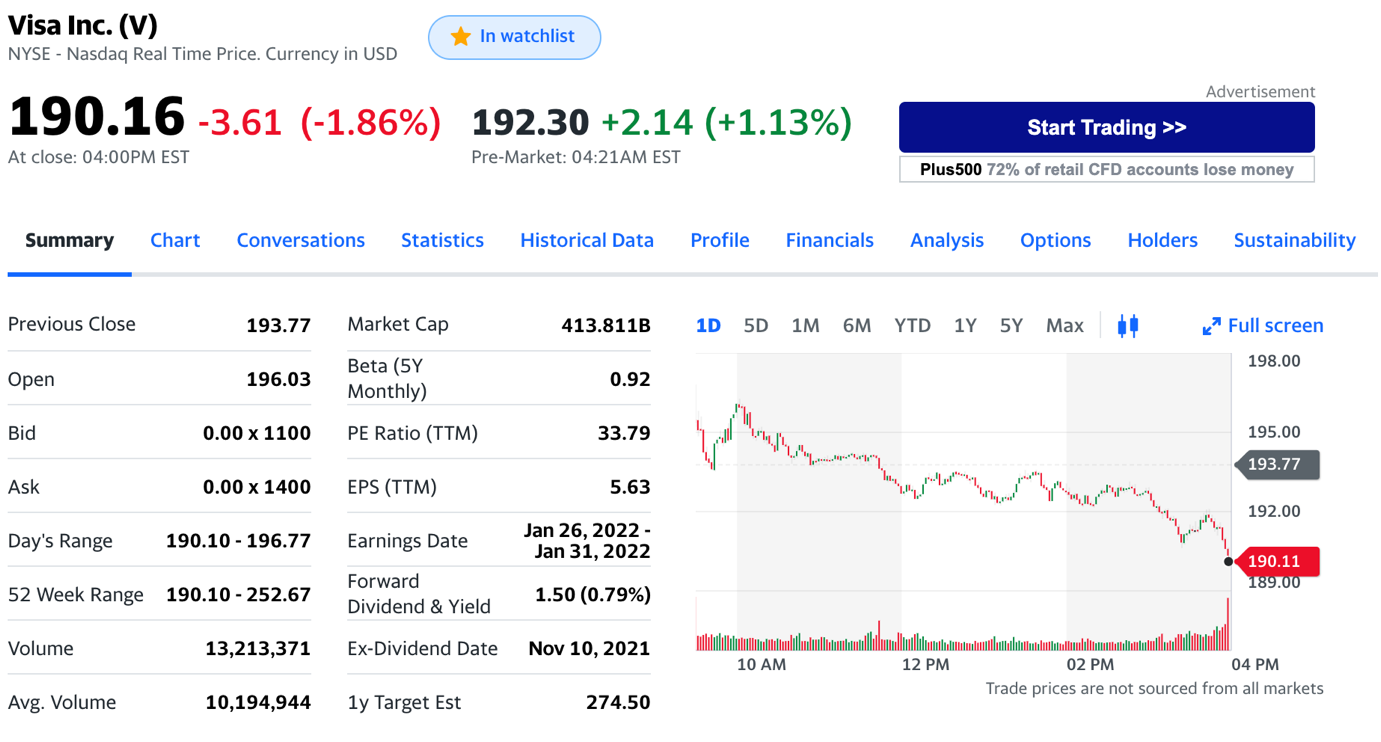

Screenshot above is taken on 2nd Dec 2021 4.21am EST

P/E (TTM) - 33.79 & EPS (TTM) – 5.63. Comparing with a close competitor Mastercard $MasterCard(MA)$ whose P/E (TTM) is 39.38 and EPS (TTM) is 8.13, VISA seems to be “cheaper” (P/E). VISA has clocked revenue of $24.1B compare to Mastercard’s $17.7B as per TTM.

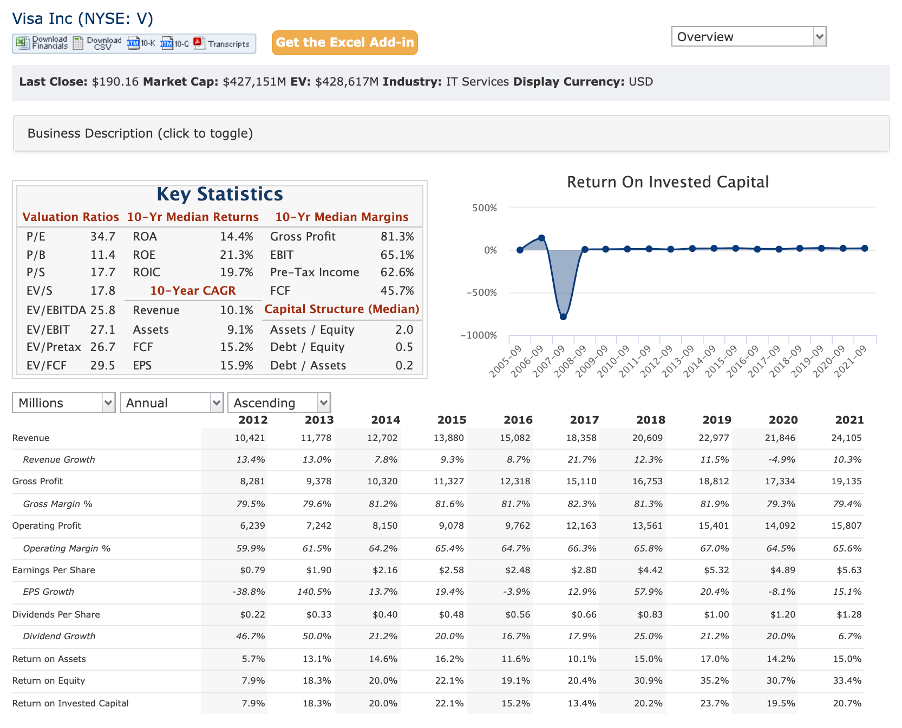

From the overview above, we see the following:

Good 10 years CAGR growth for revenue (10.1%), assets (9.1%), FCF (15.2%) and EPS (15.9%). 2020 saw decline in both revenue growth and EPS but it was the Covid19 year. We see a healthy margin of 81.3% for gross profit. Things are already looking better in 2021.

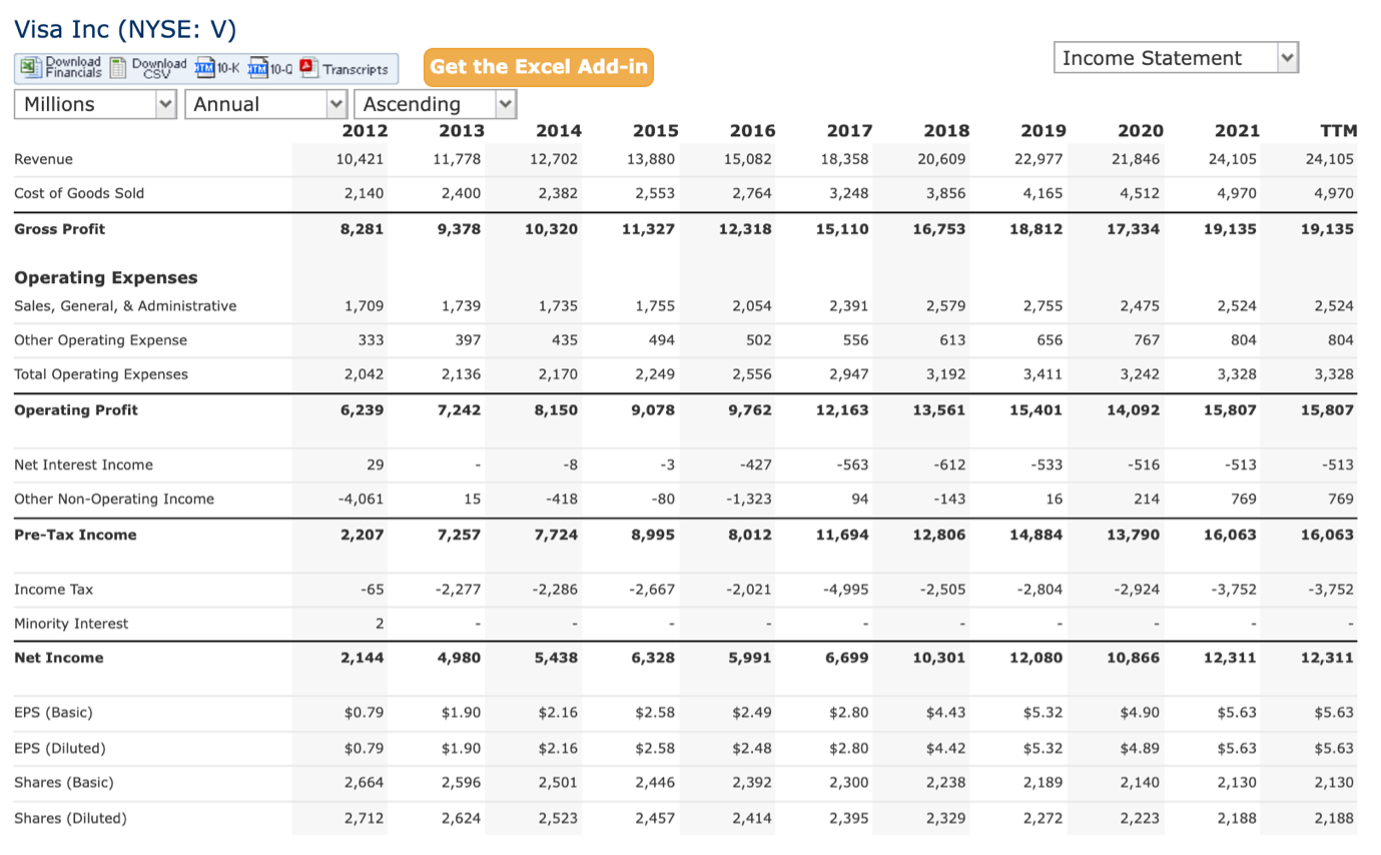

From the income statement above, we see a good trend of growing revenue and profits (net income) except for 2020 – Covid19.

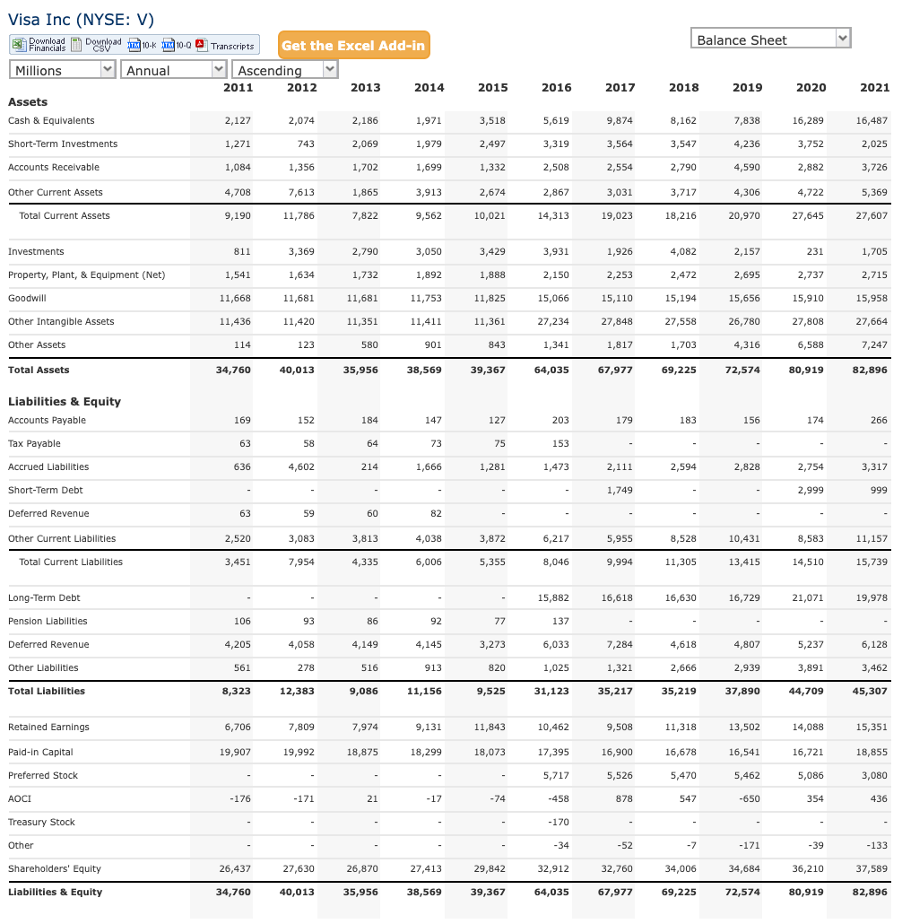

From the balance sheet above, cash & equivalents stands at a healthy 16,487 million that is more than the total current liabilities. It is good to see a reduction of long-term debt from 2020 to 2021. Retained earnings have been increasing on an uptrend.

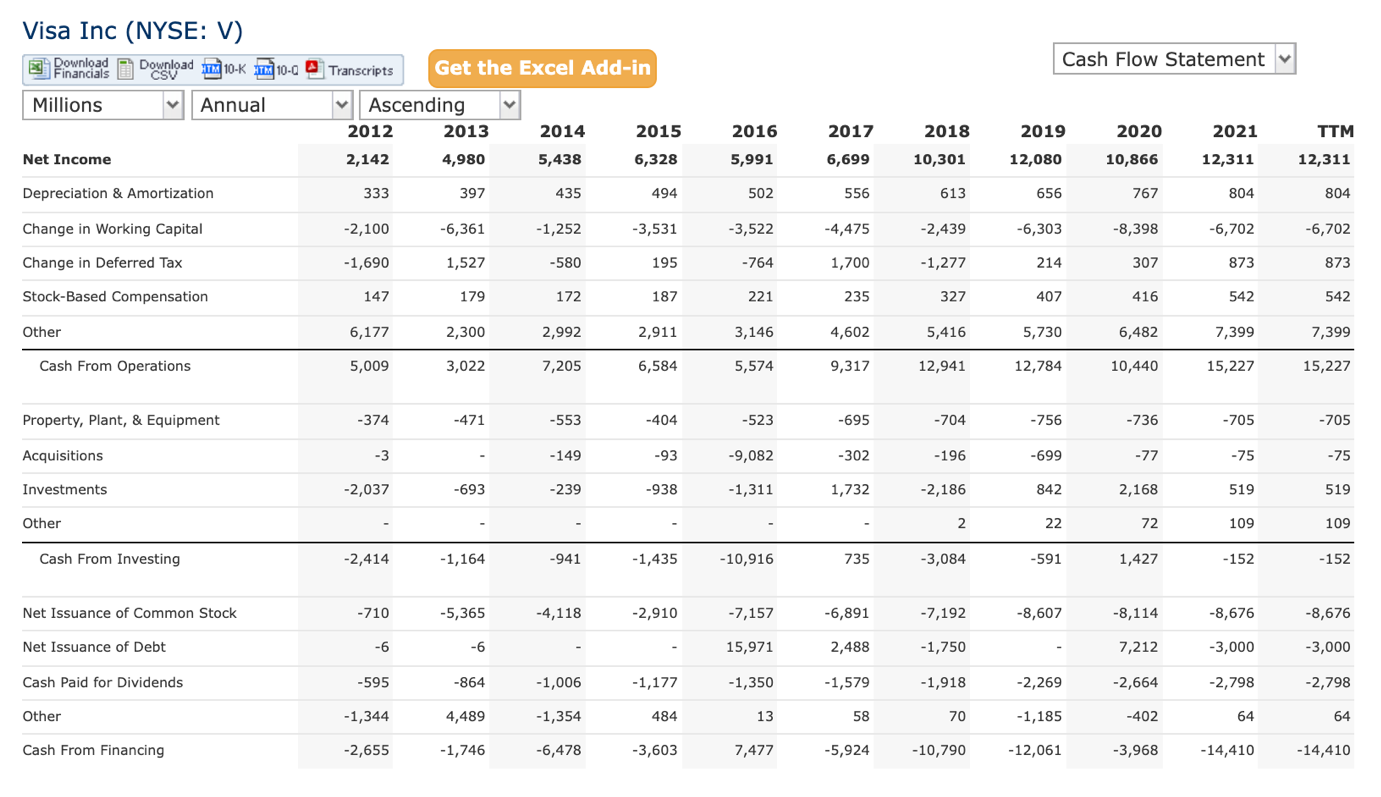

Good to see repayment of debt ($3 billion) from 2020 to 2021.

In essence, VISA has good fundamentals. Now, let us see how we can position ourselves to take position.

How to take position for VISA?

From the 1 Day chart above, I would prefer to take up a position after MACD has bottomed up (when the purple line in MACD indicator cuts the red line from bottom). It is a lagging indicator but has lesser false signals compared to the Stochastic as per above. Please do your own due diligence before investing. All the best.

精彩评论