ESG Consideration

Water scarcity is a critical long-term theme in sustainability and ESG investing. As severe weather and rising demand increase pressure on water resources, efficient systems and water reuse become essential. The global water treatment market, valued at $303 billion in 2022, is expected to grow at a 7% CAGR, driven by the need for sustainable solutions. Water is crucial for public health and economic development, and its importance is recognized through strict regulation and a stable market.

When stock picking Pentair, its focus on water treatment and sustainability is a key strength. Pentair’s products align with growing demand for efficient water management, positioning it well within the expanding market. This makes Pentair a strong candidate for investors prioritizing long-term ESG considerations.

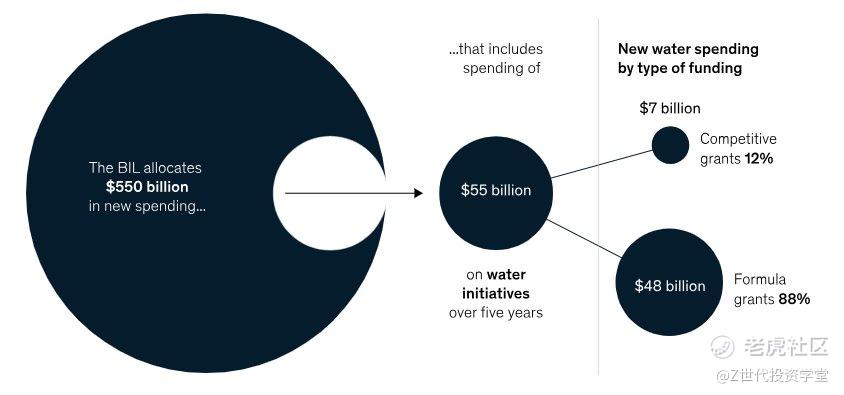

Bipartisan Infrastructure Law: Riding the waves of secular trends

Bipartisan infrastructure law includes over $1 trillion in public investment, with $55 billion allocated for water infrastructuremodernization.

Funding for water projects is provided through two EPA programs:

-

Drinking Water State Revolving Fund (DW-SRF) for lead serviceline replacement and drinking water projects,

-

Clean Water State Revolving Fund (CW-SRF) for water pollution and emerging contaminants programs

Implication: increased demand for water treatment solutions

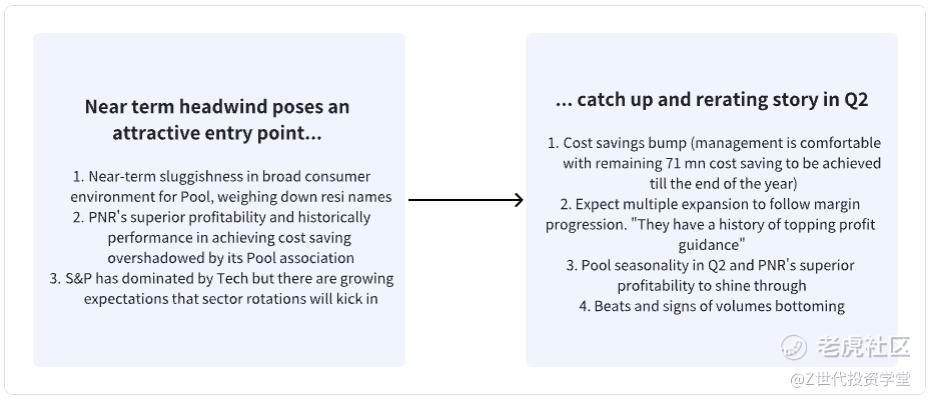

Risk

Being in an interest rate sensitive sector, is PNR ready?

Higher for longer, where do we stand? Pentair has high exposure to North America, approximately 71% of its revenue stems from the US. Higher for longer scenario is most likely to weigh on the consumers. This would affect dealer financing (where they are getting their working capital loans from). With higher interest rates, we don't see movement from people selling their house and buying another house, which is what Pentair tends to like. However, "If the narrative of higher for longer scenario stays in the headlines, we believe we could see consumers start to adapt to this and volume could start to recover next FY.

Mitigation

Given that pool segment accounts for ~33 of total revenue, short term growth is uncertain. However, backlog revenue as well as the stability of the maintenance and repair business provide protection to PNR.

2024 Q1 Earnings Call:

"Transformation and cost-cutting initiatives are in place to address any gaps caused by ongoing challenges"

"While new pools, remodel and aftermarket growth are expected to be down to low to high single digit ranges, improvement due to destocking is likely to offset and drive positive yoy growth."

"Interest rates are going to be testy, lower interest rates could signal a brighter future, as reflected in the full year forecast."

Conclusion

Quality companies do face temporary setbacks, paving the way for a comeback.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论