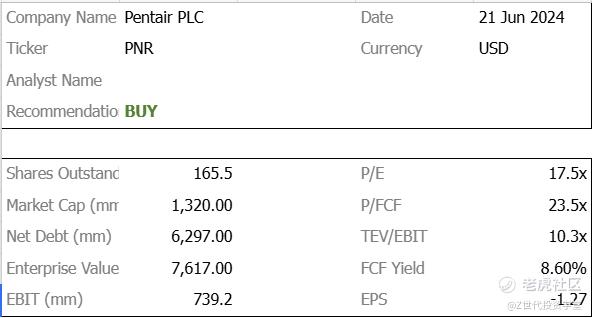

Linkedin: Xin Fei Tan

Company Overview: Move, Improve & Enjoy Water

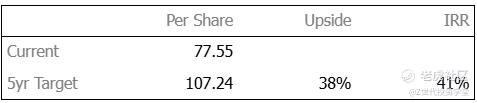

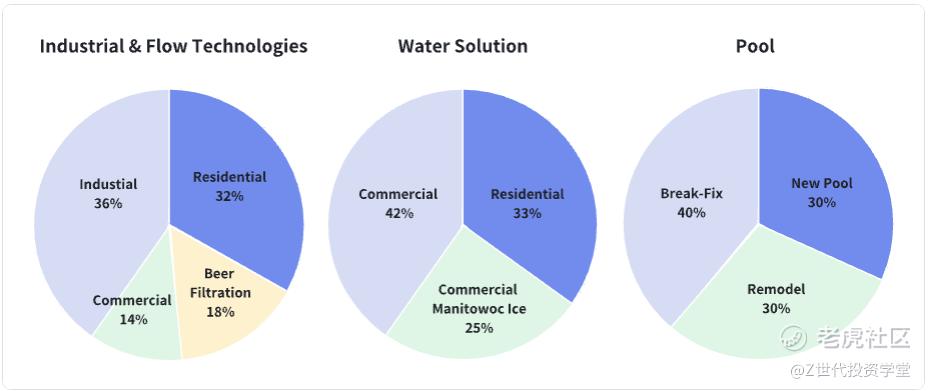

Pentair is a leading company specializing in water management technologies and solutions. Their core focus areas include water filtration, flow control, and related water management systems for various sectors including residential, commercial, and industrial markets.The company operates through three main business segments:

-

Pool

-

Water Solutions

-

Industrial & Flow Technologies

Pentair's Business Segments

Pentair's Segment Breakdown

Pentair's Revenue Breakdown

With a global presence spanning 24 countries, Pentair maintains 135 locations and employs approximately 11,000 people. Their diverse product portfolio is designed to address critical water-related challenges, including:

-

Providing access to clean, safe water

-

Reducing water consumption

-

Facilitating water recovery and reuse

Key Offerings

Pentair's range of products and services includes:

-

Residential Solutions

Whole-house water filtration systems, water softeners, and point-of-use filters for homes

-

Commercial Filtration

Advanced filtration systems for businesses, particularly in the foodservice industry, under the Everpure brand

-

Industrial Applications

Specialized water management solutions for various industries

By offering these comprehensive water management solutions, Pentair aims to improve water quality, enhance efficiency, and promote sustainable water use across different sectors and applications.

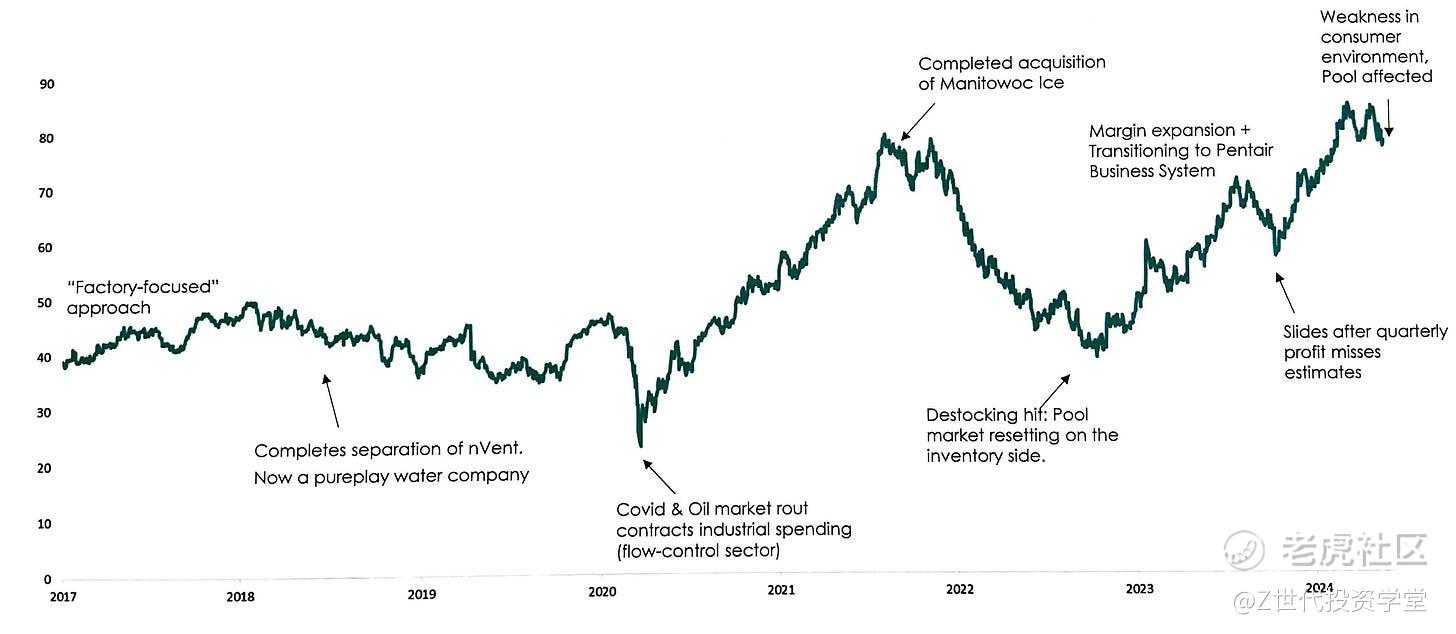

Share Price Movement: PNR's Transformational Journey

Pentair is cyclical in nature, due to 1/3 of its exposure in Pool. When sales environment is sluggish, portfolio is carried by margin expansion + cost savings (or other segments of its portfolio: Water/Flow when Pool is sluggish)

Investment Thesis

Thesis 1: An Undervalued Leader in Water Solutions, Mispriced as a Pool Company

Pentair (PNR) presents a compelling catch-up play, as the market continues to misprice the company, viewing it primarily as a pool equipment provider rather than a diversified water solutions and flow company. While approximately 33% of Pentair's revenue is tied to the pool segment, 67% of its business comes from the more stable and higher-growth flow and water solutions markets. This misclassification has led to Pentair being decoupled from its water solutions peers, despite the fact that its flow business is growing in line with key industry players like Xylem and Veralto

-

Superior Profitability Undermined

The company consistently posts stronger EBITDA margins than both its pool and water peers, yet it trades at a significant discount. For example, PNR trades at approximately 16.6x P/E 2025e, compared to water peers at 25.2x and industrial peers at 20.1x.

This disparity overlooks Pentair’s high-quality business mix and profitability profile, which is significantly better than its current valuation suggests. Furthermore, the market has remained skeptical of Pentair’s 2025 margin targets, even though management’s focus on pricing excellence and sourcing optimization has already shown tangible benefits.

-

Market Overlooks Strengths Beyond the "Pool Business Effect"

Despite the ongoing weakness in the pool consumer environment, which has weighed on Pentair’s share price, the company’s exposure to new pool builds is minimal, accounting for only 6% of total revenue (entire Pool segment accounts for 33% while New Pool accounts for 6% of the entire portfolio).

This "pool business effect" continues to unfairly hold back Pentair's stock, overshadowing the company’s stronger and more resilient flow and water solutions businesses. As Pentair rebalances its portfolio and demonstrates its ability to execute margin expansion, it deserves to be valued at higher multiples, aligning it more closely with its water solutions peers rather than its mischaracterized identity as a pool company.

Thesis 2: Pentair's Margin Transformation Set to Unlock Significant Value

Pentair is undergoing a significant transformation that is set to drive substantial margin expansion and value creation over the coming years.

-

Margin Expansion Target

Pentair has set a clear target to improve its Return on Sales (ROS) from 18.6% in 2022 to 24% by 2026, reflecting a meaningful step-change in profitability.

-

Margin Growth Bump Expected in Q2 due to Seasonality from Pool

Management expects EBITDA margins to improve by 150-200 basis points this year. However, margin expansion growth won't be linear, expecting a further margin improvement 168bps in Q2. Through the Q1 earnings call, management is confident in achieving the rest of FY targets and expecting a good bump in Q2 due to seasonality from Pool.

-

Substantial Cost Savings Transformation initiatives are expected to generate approximately $260 million in cost savings through 2026. The company’s strategy is built on four key pillars: Pricing Excellence, Sourcing Optimization, Operational Excellence, and Organizational Effectiveness.

-

Value-Based Pricing and 80/20 Rule

Pentair focuses on "optimizing growth rather than simply cutting product lines," employing value-based pricing and an 80/20 strategy to prioritize top products and customers. This approach is designed to enhance pricing power, streamline the portfolio, and drive organic growth across its core businesses.

Pentair is executing a clear transformation playbook that positions the company well for sustained margin expansion and long-term value creation.

Thesis 3: Riding the Wave on Pool Seasonality

-

Seasonality Advantage

Pentair's pool segment traditionally experiences strong performance in the second quarter due to seasonal demand. Expectations for a 10% increase in pool segment revenue for Q2 2024 indicate a potential recovery from the current sluggish sales environment. While recent reports have highlighted a 4.1% decline in share prices following meetings with executives that pointed to ongoing challenges, it’s crucial to recognize that new pool builds account for only 30% of total sales, with aftermarket and maintenance comprising the remaining 70%. This sticky nature of aftermarket sales enhances resilience and provides a buffer against broader market headwinds.

-

Pool's Margin Superiority

The pool segment is characterized by its high profitability, boasting margins of approximately 30%, the highest among Pentair's various business units. Management's 2026 target of achieving a 24% Return on Sales (ROS) for the company appears conservative, especially considering the strong performance of the pool segment. As Pentair positions itself for recovery, anticipated cost savings from productivity initiatives and operational efficiencies are expected to further bolster margins, enhancing overall profitability.

-

Destocking Cycle Showing Positive Signs of Bottoming Out

The pool industry is showing signs of inventory normalization, suggesting an end to the destocking cycle. Historical data shows that pool volumes declined by 33% during the Global Financial Crisis, which informs current guidance that assumes a similar peak-to-trough reset. This leaves limited downside risk moving forward. Management has indicated that the previously projected headwind of approximately $150 million for 2023 is expected to turn into a tailwind in 2024

Valuation

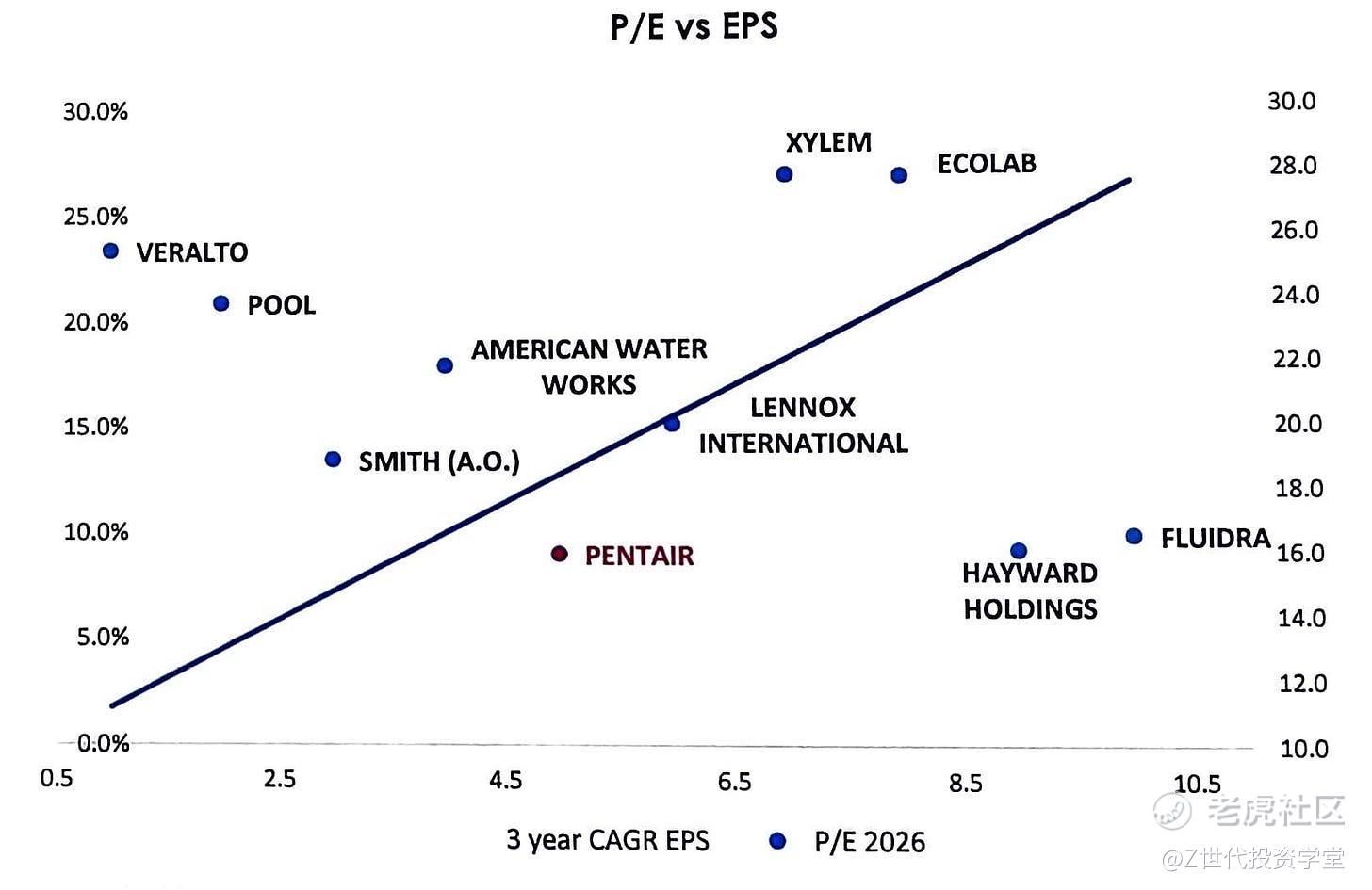

On a return vs pricing basis, PNR is undervalued compared to its major peers

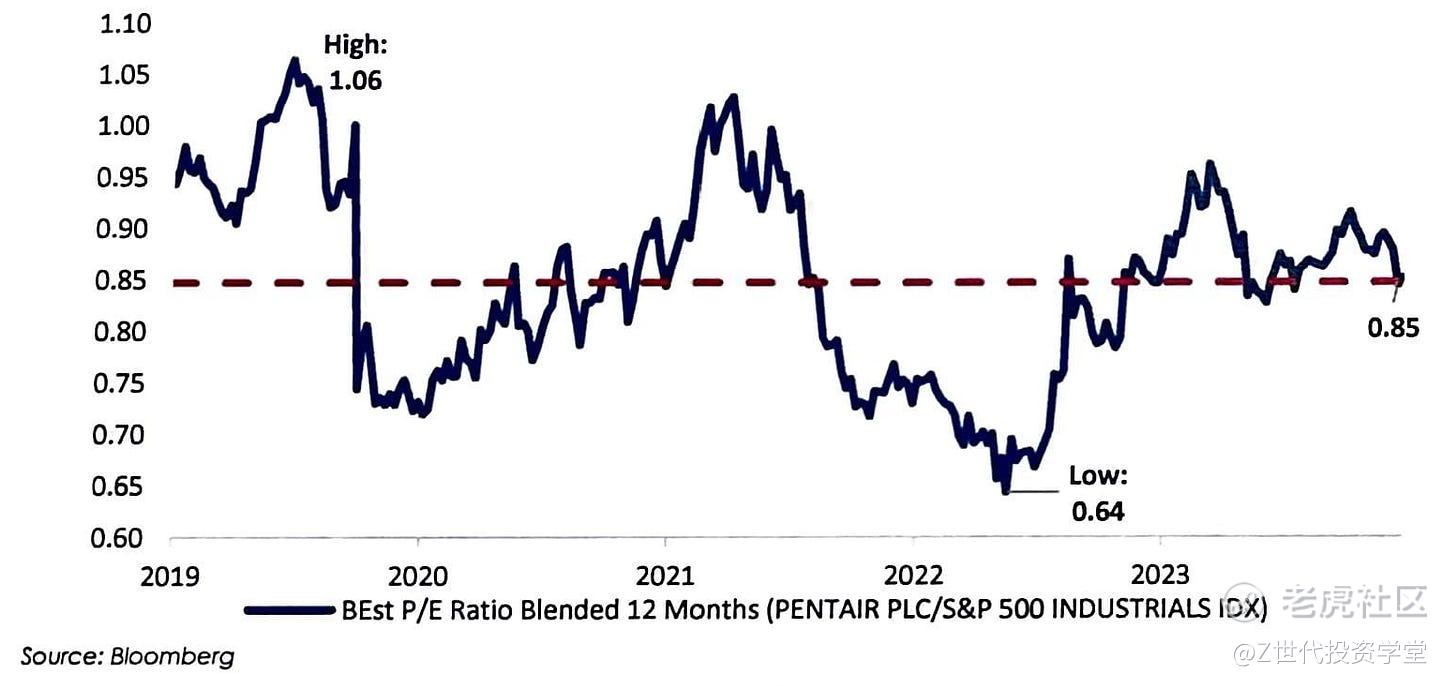

The market is not yet pricing growth and margin recovery, considering relative valuation is subdued against S&P 500 and resi competitors.

More recently, the stock has been gaining traction and now trades at ~0.85x S&P 500 Industrials, yet below the pre-pandemic range of ~1.06x- 0.91x. Despite its longer-term narrative on water, Pentair is valued at a 15% discount against S&P500 Industrials.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论