6.Risks and Mitigation

• Intensifying Competition in the Streaming Market

The streaming industry has become increasingly saturated, with formidable competitors such as Disney+, Amazon Prime Video, HBO Max, and Apple TV+ rapidly expanding their content libraries and global reach. These players not only provide alternative streaming options but also have access to vast resources, enabling them to produce high-budget original content and secure exclusive licensing deals. The rise of free, ad-supported streaming services (FAST) is also adding pressure on subscription-based models like Netflix.

Netflix maintains its competitive edge through continued investments in original programming and personalization technology. It spent over $17 billion in 2023 on content production, ensuring a steady pipeline of exclusive films and series to retain existing subscribers and attract new ones. Furthermore, Netflix’s recommendation algorithm provides a highly personalized user experience, promoting content engagement and reducing churn. This strategic focus on localized content in international markets also helps differentiate Netflix from global competitors, catering to specific regional tastes and preferences.

• Password Sharing and Subscriber Churn

Password sharing remains a significant issue for Netflix, with reports estimating that over 100 million households globally share their login credentials with non-paying users. This practice undermines Netflix’s potential subscriber growth and revenue, especially in markets where growth is slowing. In addition, Netflix’s shift to cracking down on password sharing risks alienating users, leading to an increase in churn rates.

Netflix has already started implementing strategies to combat password sharing, such as rolling out features that encourage users to add non-household members for an additional fee. This policy was recently piloted in Latin American countries and is being expanded to other regions. Netflix’s flexible subscription model, which includes the option to pay a lower fee for limited access or ad-supported content, may also help transition password-sharing users into paying subscribers.

• Subscriber Growth Plateau in Key Markets

With high penetration in North American and European markets, Netflix is facing slowing subscriber growth in these regions. The company added fewer new subscribers in these mature markets in recent quarters, signaling a potential saturation point. As growth slows in its largest and most profitable markets, the company may struggle to maintain its revenue growth trajectory.

Netflix has aggressively shifted its focus to international markets with high growth potential, such as India, Southeast Asia, Latin America, and parts of Africa. By increasing investment in region-specific content and making its pricing models more accessible (e.g., mobile-only subscriptions in India), Netflix aims to capture a larger share of these emerging markets. Additionally, the company is rolling out ad-supported subscription tiers to make its service more affordable and accessible to price-sensitive consumers, potentially driving subscriber growth in saturated markets.

7. ESG

Environmental (E):

Netflix’s environmental footprint is mainly associated with its data centers, content production, and cloud storage. While it has set goals to achieve net-zero greenhouse gas emissions by 2022, Netflix still faces criticism for the energy demands of streaming services. Its efforts to reduce its carbon footprint include partnerships with eco-friendly data providers and sustainable content production methods.

Social (S):

Netflix has made notable strides in promoting diversity and inclusion, both in its content and within the company. The company’s global reach allows it to create content in over 30 languages, providing cultural representation to millions of viewers. Internally, Netflix’s diversity initiatives have led to a more inclusive workplace, though challenges remain in closing gender and racial pay gaps. Its commitment to storytelling across various cultures has helped it resonate with a diverse audience.

Governance (G):

Netflix’s governance practices reflect a robust corporate structure with an independent board. However, executive compensation and stockholder rights have been areas of concern for activist investors. Netflix has been working to increase transparency in executive pay structures and ensure its board has the right balance of independent directors. The company’s clear corporate ethics guidelines and dedication to shareholder returns are key governance strengths.

8. Conclusion

Netflix’s strong content pipeline, expanding ad-supported tier, and new ventures into gaming and live events position the company for sustained growth over the next several years. However, there are risks associated with rising content costs and market saturation, and Netflix’s global scale and innovative strategies do not really make it a compelling investment. With a projected 5-year price target of $670, Netflix remains a stock worth that should be sold.

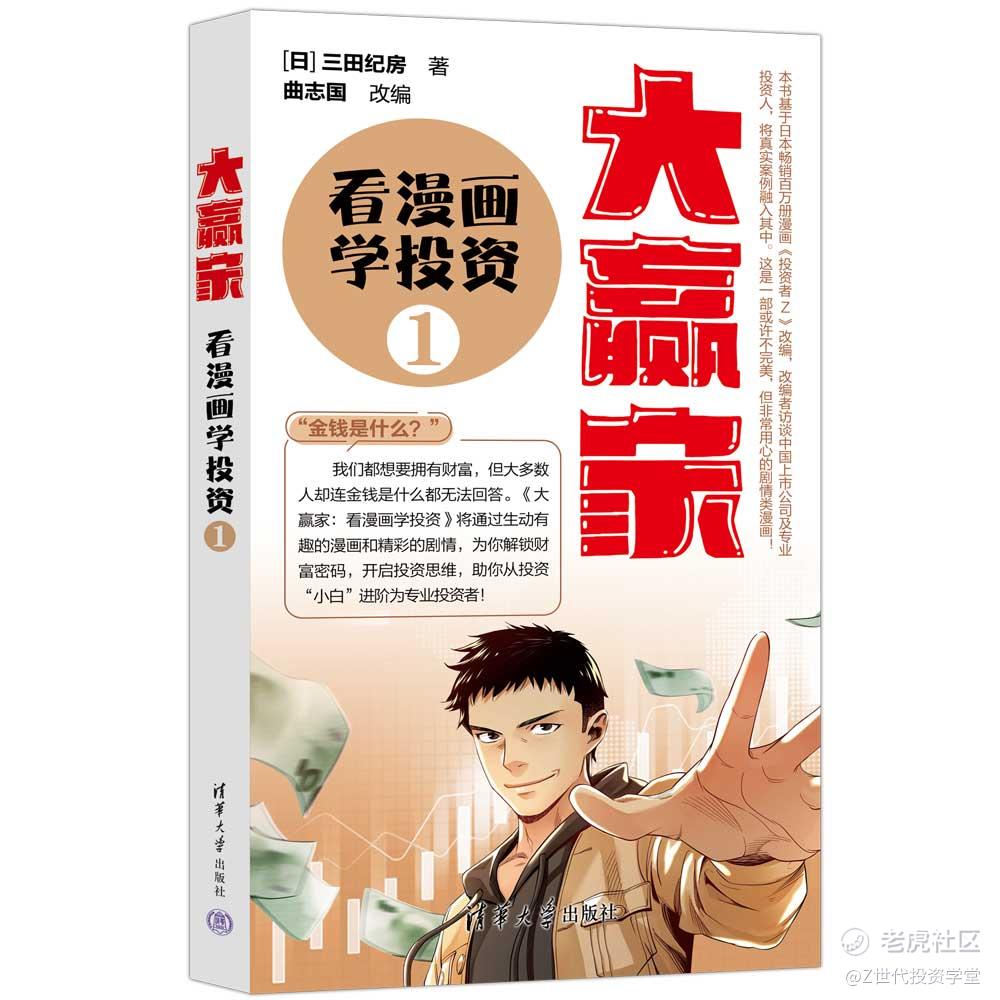

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。 如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论