1. Company Overview

Netflix, Inc. (NASDAQ: NFLX) is a global streaming entertainment service offering a wide variety of TV series, documentaries, and feature films across a range of genres and languages. Founded in 1997 and headquartered in Los Gatos, California, Netflix has grown from a DVD rental service to a dominant player in the streaming industry, serving over 230 million subscribers worldwide. The company's mission is to entertain the world by providing on-demand, commercial-free streaming experiences.

2.Business Segments

In 2023, Netflix's total revenue was $33.7 billion. The company's revenue is primarily derived from two business segments: streaming and DVD rentals. The streaming segment, which includes both domestic and international streaming, accounted for 99% of the total revenue, while the DVD rental segment contributed the remaining 1%

1. Streaming Services:

○ Domestic Streaming: This segment includes revenue generated from subscription services in the United States.

○ International Streaming: This segment covers subscription services outside the United States, which has been the primary growth driver.

2. DVD Rentals:

○ Although significantly reduced in scale, Netflix still operates a DVD rental business in the United States.

2.1 Revenue and cost drivers

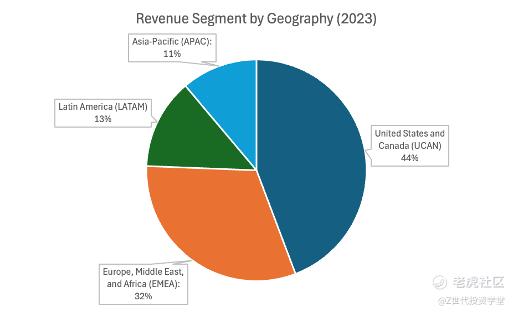

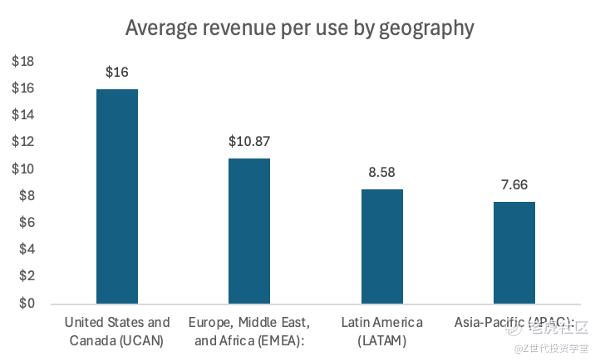

Our revenues are primarily derived from monthly membership fees for services related to streaming content to our members(99.754% of total revenue) with the largest revenue segment from the United States and Canada.

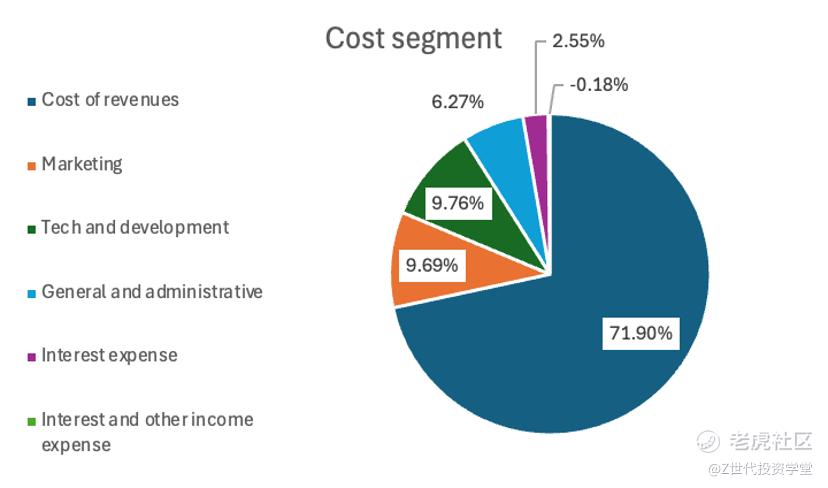

The main cost driver is from cost of revenue (71.90%) with 19.715 billion USD. Netflix’s EBITA in 2023 was 13.07 EBITDA with 8.23 billion USD.

3. Competitive Landscape

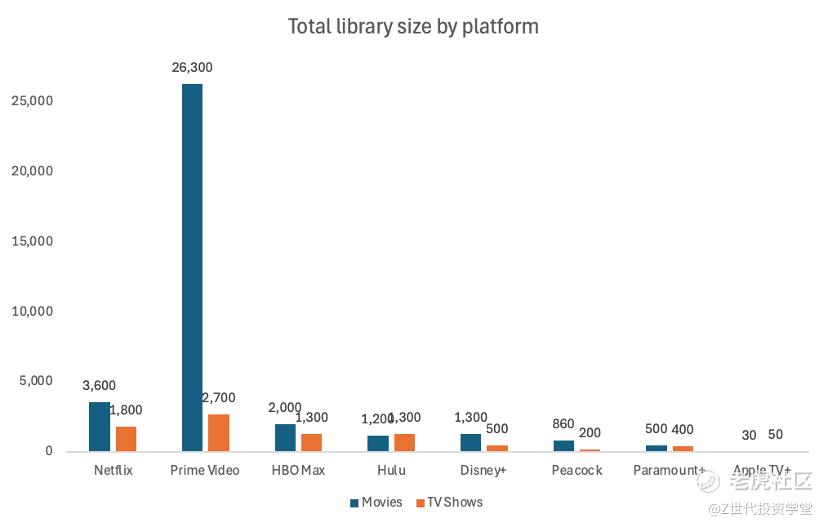

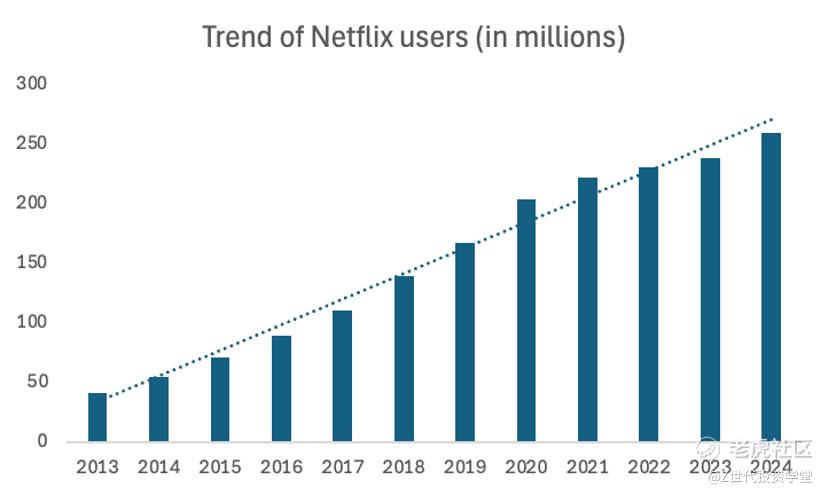

In terms of total library size, Netflix is far behind Amazon Prime Video, but ahead of all other streaming platforms in the US. However, there has been an upward promising trend of Netflix users.

Key Competitive Dynamics

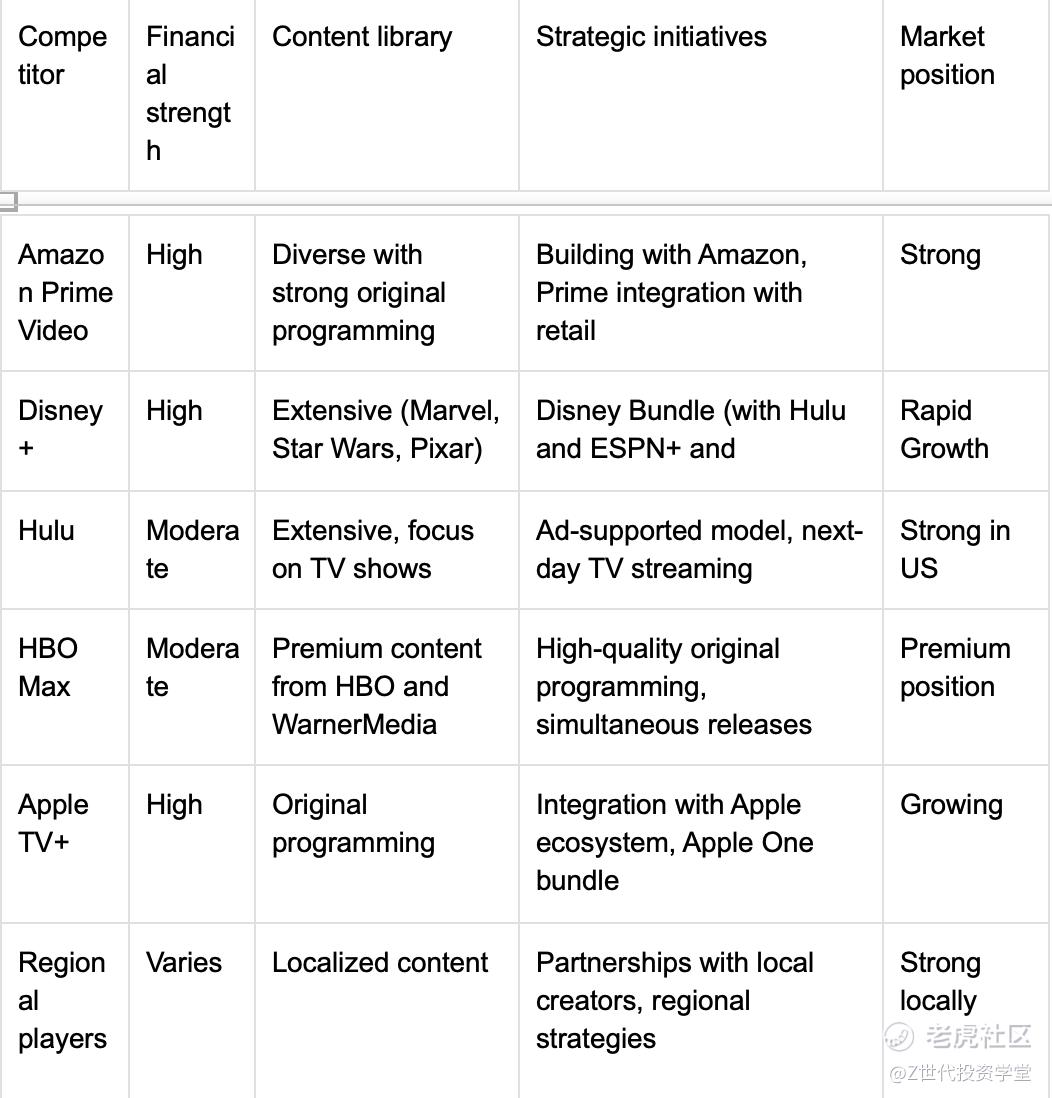

I. Content Quality and Exclusivity: Netflix continues to invest heavily in original content to differentiate itself. Competitors like Disney+ leverage existing franchises, while HBO Max focuses on premium content. This content arms race impacts subscriber acquisition and retention across platforms (Business Strategy Hub) (Business of Apps).

II. Pricing and Bundling: Price sensitivity and value perception are critical. Competitors like Amazon Prime Video and Disney+ offer bundled services that enhance value perception and reduce churn. Netflix's recent introduction of an ad-supported tier aims to attract price-sensitive customers (Business of Apps).

III. Technological Advancements: Netflix's investment in data-driven content recommendations and user experience enhancements remains a key differentiator. Competitors also focus on improving their platforms, with Amazon leveraging AWS for performance and Apple integrating hardware and services for seamless user experience (Business of Apps).

IV. Regional Strategies: Netflix's global expansion and localization efforts are matched by regional players tailoring content to local markets. This regionalization is crucial for growth, especially in areas where global players have less penetration (Business Strategy Hub) (Business of Apps).

4. Investment Thesis

Thesis 1: Growth of the Video streaming market

The video streaming market is experiencing phenomenal growth, fueled by the convergence of several key trends. Firstly, the ubiquitous presence of smartphones, with global penetration reaching nearly 70% in 2023, provides a readily available platform for video consumption. Secondly, a significant shift in viewing habits is underway, with users increasingly turning to mobile apps for entertainment. This is evidenced by statistics like Americans dedicating a substantial portion of their smartphone usage (around 90%) to apps, with a growing focus on video content. Furthermore, data suggests a potential tipping point has been reached, with smartphone video consumption surpassing traditional television viewing in some regions (e.g., the US in 2019). This trend is further amplified by a rising user base for streaming services, with penetration projected to climb from 17% in 2023 to 20.7% by 2027. The increasing popularity of streaming services can also be seen in the high number of US households with subscriptions (83% in 2023), a significant jump from just a few years ago (52% in 2015). In conclusion, the video streaming market is poised for continued expansion as the confluence of widespread smartphone adoption, a shift towards mobile video consumption, and a growing user base for streaming services creates a perfect storm for explosive growth.

Thesis 2 :How Personalization and Regional Relevance Drive Netflix's Success

Netflix's success hinges on its economic moat, a meticulously crafted user experience built on personalization. Unlike traditional one-size-fits-all approaches, Netflix leverages vast user data to curate a tailored content library for each subscriber. This goes beyond just offering a variety of content. It's a strategic approach that fosters deeper user engagement, loyalty, and ultimately, significant cost savings.

The foundation of this moat lies in Netflix's early recognition of the need for regional relevance during their global launch in 2016 across 160 countries. Sophisticated algorithms identify user location and viewing habits, ensuring content recommendations are culturally relevant. This regionalization, coupled with personalized content libraries based on user viewing data, has led to a remarkable statistic: 80% of Netflix shows streamed in the past two years were directly influenced by Netflix's recommendation engine, developed by Gomez-Uribe and Netflix's chief of product Neil Hunt. They assert that “the combined effect of personalization and recommendations save us more than $1B per year,” highlighting the financial strength of this economic moat.

Thesis 3: Diversification and Localisation

Netflix’s ability to produce and distribute content globally gives it a key advantage. Its content localization strategy—producing regionally relevant shows like Squid Game (South Korea) and Money Heist (Spain)—has created global hits. Netflix’s aggressive investment in international content (spending $17 billion on content in 2022 alone) continues to drive its global user engagement, differentiating it from competitors like Disney+ and HBO Max, which are more focused on English-language content. Netflix has also signaled diversification beyond streaming by entering the gaming and live event spaces. Its acquisition of game studios like Night School Studio reflects its push into interactive entertainment. Moreover, Netflix’s live event content, such as comedy specials and exclusive releases, aims to capture new segments of the audience. By moving beyond traditional streaming, Netflix is setting the stage for multi-platform revenue opportunities and improving user retention.

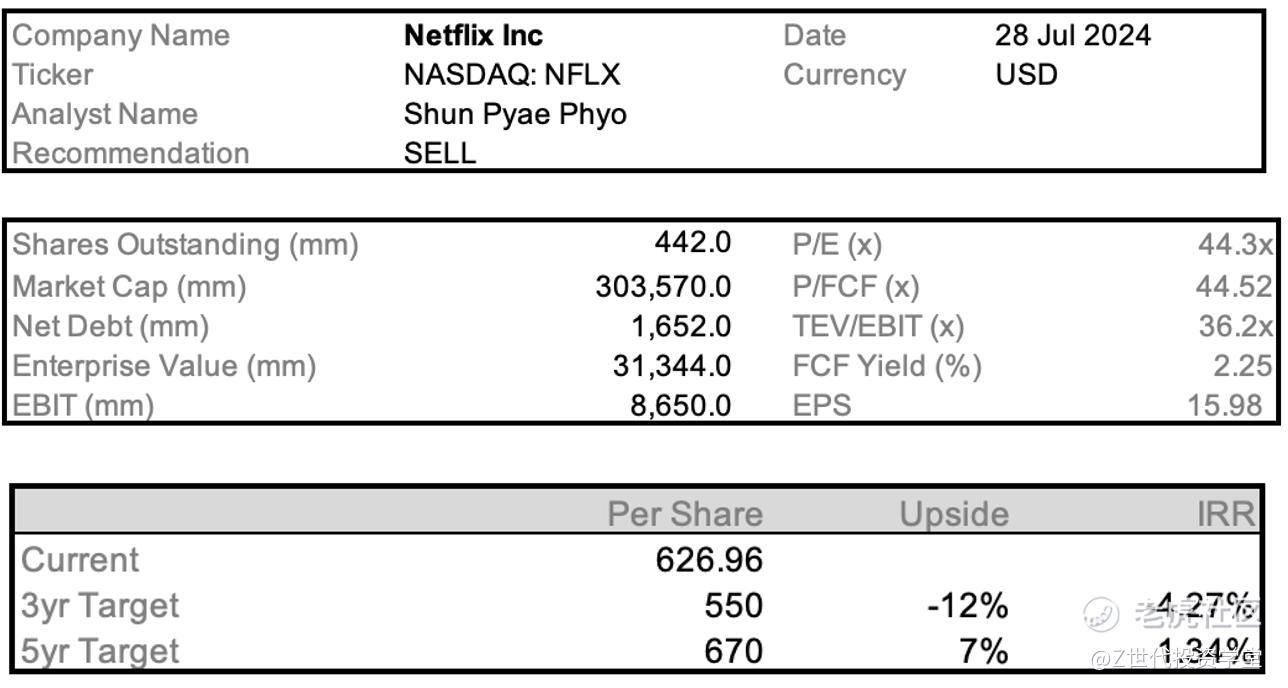

5. Valuation

Using a relative valuation approach, Netflix’s current P/E ratio is 35x, while peers like Disney and Warner Bros. Discovery trade at lower multiples, suggesting Netflix’s premium valuation is driven by its robust growth prospects. Based on an EV/EBITDA multiple of 18x (higher due to its content expenditure), Netflix's fair value over the next three years is estimated at $550 per share and $670 in five years. This projection assumes steady growth in the ad-supported tier, increased profitability from content amortization, and continued international expansion.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论