Thesis

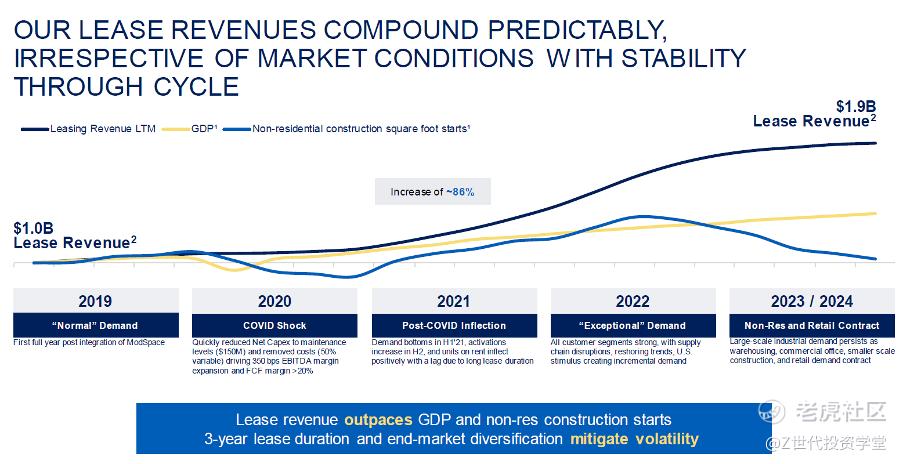

WSC is underappreciated by the market. Several factors are driving the company’s growth, making the stock currently undervalued. This includes the growing potential of WSC’s Value-Added Products (VAPS) line and strong free cash flow (FCF) generation.

(1) Single Point of Contact: Value-Added Products (VAPS)

WSC has mastered the single point of contact approach, streamlining the process for customers. Rather than requiring clients to source furniture and appliances separately, WSC offers everything under one invoice, making the space immediately ready for use. As the first company to introduce this concept, WSC has consistently stayed ahead of customer needs. It would be difficult for smaller companies to match WSC's pricing and quality, especially with a fraction of its workforce.

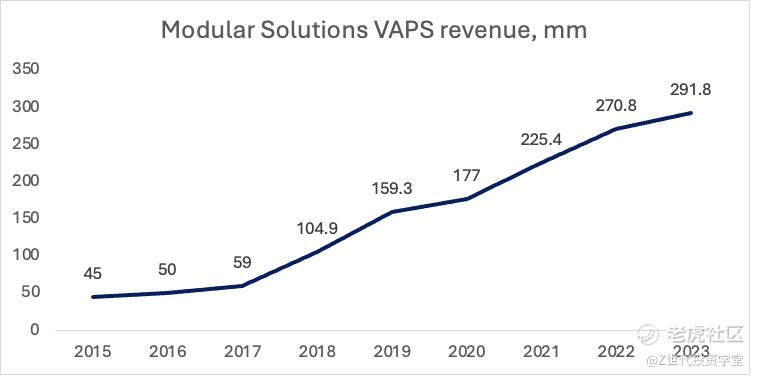

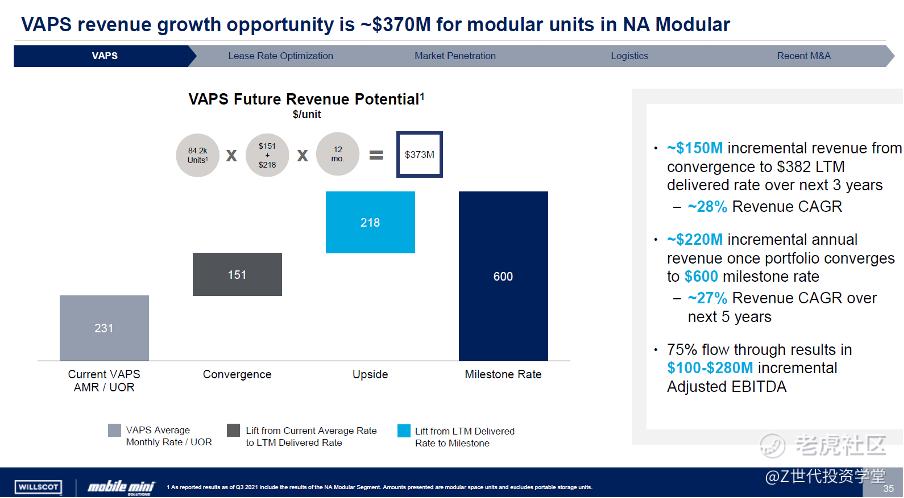

VAPS has been a core focus for WSC over the past five years, representing a $500 million revenue growth opportunity and growing at a double-digit penetration rate. Being a first mover in this area gives WSC a dominant position, enabling it to deliver before competitors can respond. WSC’s product availability allows it to charge higher prices than competitors, often 30-40% higher. Customers prioritize service availability, and WSC has more assets on the ground than its peers.

Additionally, the strong growth of VAPS is expected to continue, with WSC acquiring smaller players that lack access to similar offerings. This expands WSC's customer base,

providing new opportunities for cross-selling its services.

(2) Strong FCF generation with optionality

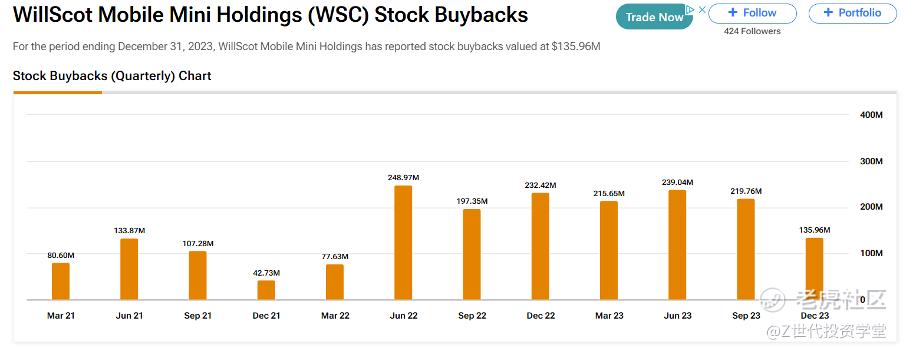

WSC’s strong free cash flow (FCF) generation is driven by its attractive unit economics, particularly in reusing and refurbishing modular spaces. This provides the company with flexibility for mergers and acquisitions (M&A), debt reduction, and share buybacks, while also reducing cyclical risk during potential downturns.

Following the failed M&A transaction with McGrath, WSC's Board of Directors announced the expansion of its existing share repurchase program to $1 billion. During the six months ended June 30, 2024, the company repurchased 2,035,513 shares of common stock for $78.7 million, excluding excise tax. As of June 30, 2024, $419.5 million remained available for future repurchases under the authorization.

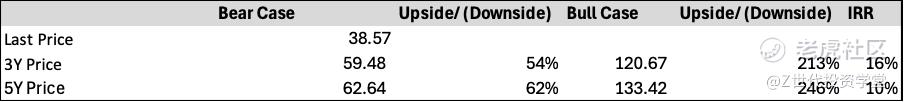

Valuation

WSC stock is trading at USD$38.57, 40.66x P/E. Based on trading multiples, a bear case of 7x EV/EBITDA would give us an upside of 54%. For the bull case of 13x EV/EBITDA it would achieve an upside of 213%. Based on a 12% weighted average cost of capital. Estimating EBITDA growing at ~7-10% CAGR.

Risk: What’s next for WSC and McGrant?

Earlier this month (Sept 2024), WSC and McGrath has mutually agreed to terminate the previously announced merger due to the regulatory requirements for the transaction. FTC felt that the merger will detract from the execution of other value creating initiatives inherent in WSC business. McGrant remains the closest competitor to WSC and present hurdles for WSC to dominate in the education sector in modular workplace solution.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。 如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论