$KEPPEL INFRA TRUST WEF 2015(A7RU.SI)$

IMO, KIT ought to be doing a Rights Issue soon as the mkt condition seems just abt right.

To recap, they completed the acquisition of PCSPC recently,

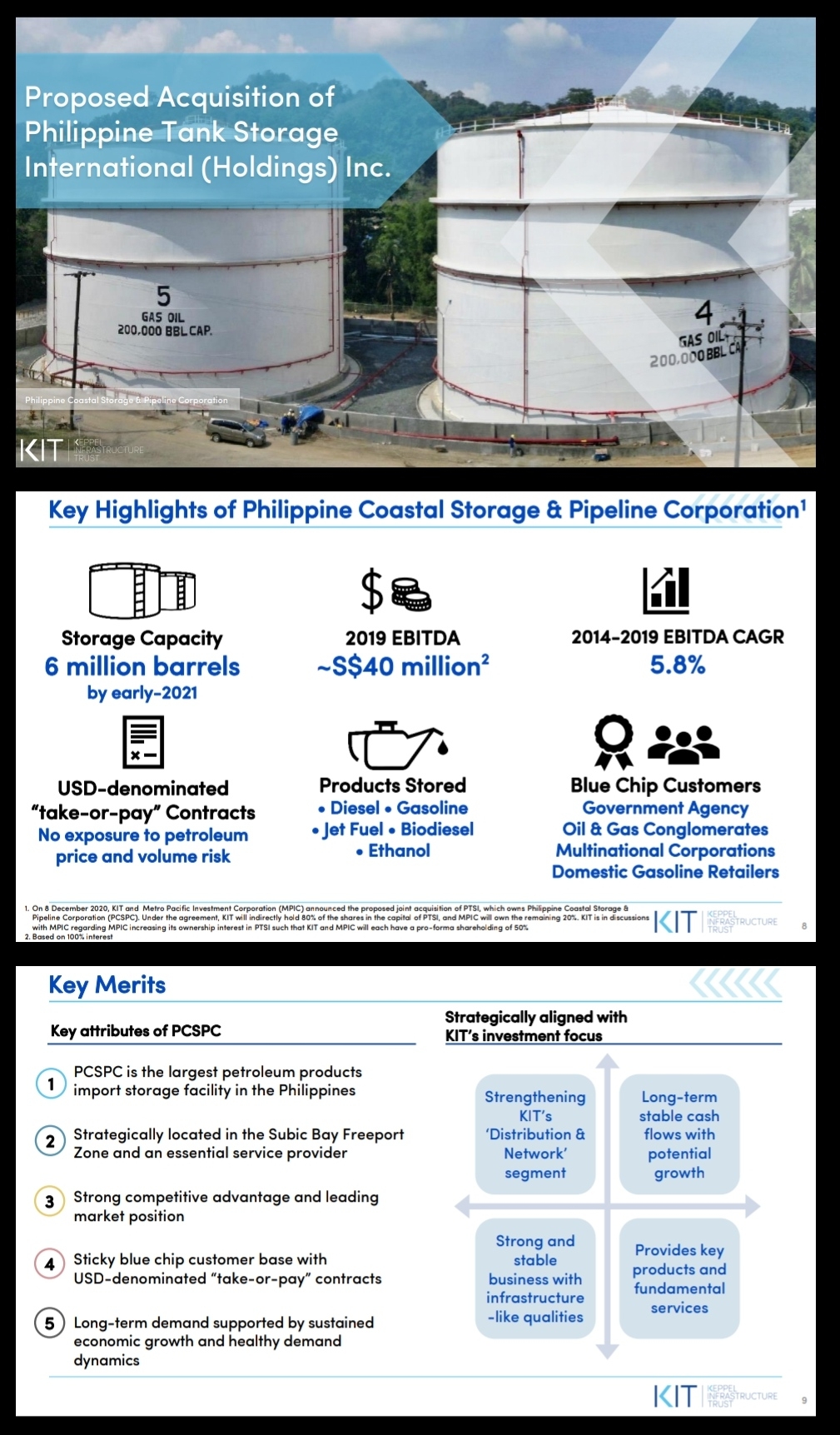

What is PCSPC?

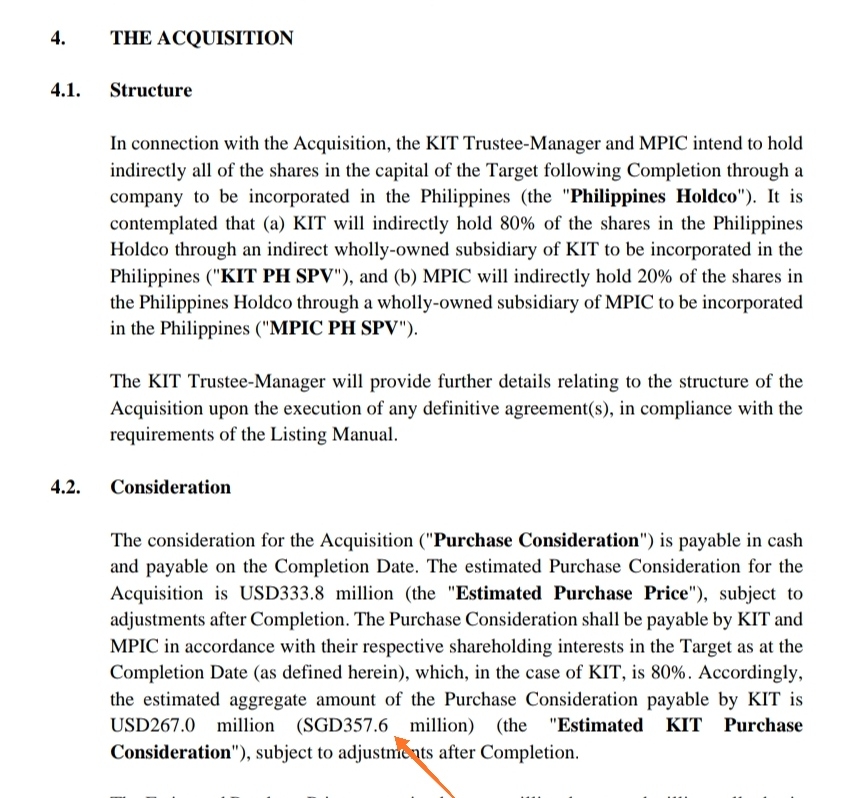

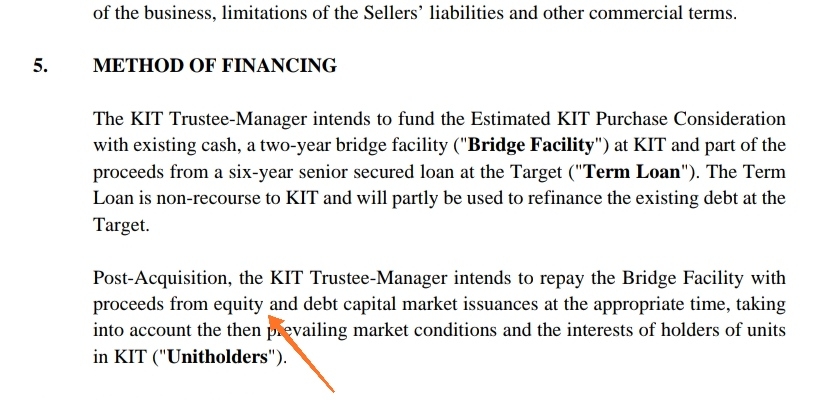

What's the cost?

Why do we care?

OMG! How much money do I need to reserve for this?

As reference, KIT did a bigger Rights Issue in 2019 to raise $500m,

This time round, they require S$357.6m. Assuming they plan to maintain the same Gearing Ratio, that means ~$243m in new shares, with the rest in borrowings.

In the worst case (ie max to raise fm new shares to existing shareholders),

Total Shares = 4,990,437,786

Divide $243m by that means 4.87ct/share

ie 1-for-10 @ $0.50 can easily do the trick!

However, during the last Equity Fund Raising, they also had a Private Placement portion with the Rights at 118-for-1000 @ $0.441.

Assuming they also do a part via Private Placement, then the amt required fm unit holders will be lower.

Conclusion

I'd still reserve ~10% of current KIT mkt value to prepare for any upcoming Rights Issues. More will be required to apply for excess Rights (last round was very generous, I got all I applied for - regretted not applying more as that 44.1ct cost is now worth 54.5ct!).

The alternative is of course to sell off the Rights (if renounce able) or even KIT itself if you're in a "Money-No-Enough" situation.

Disclaimer : Above is just useless ramblings from a bored untrained & inexperienced individual on a rainy Saturday

精彩评论