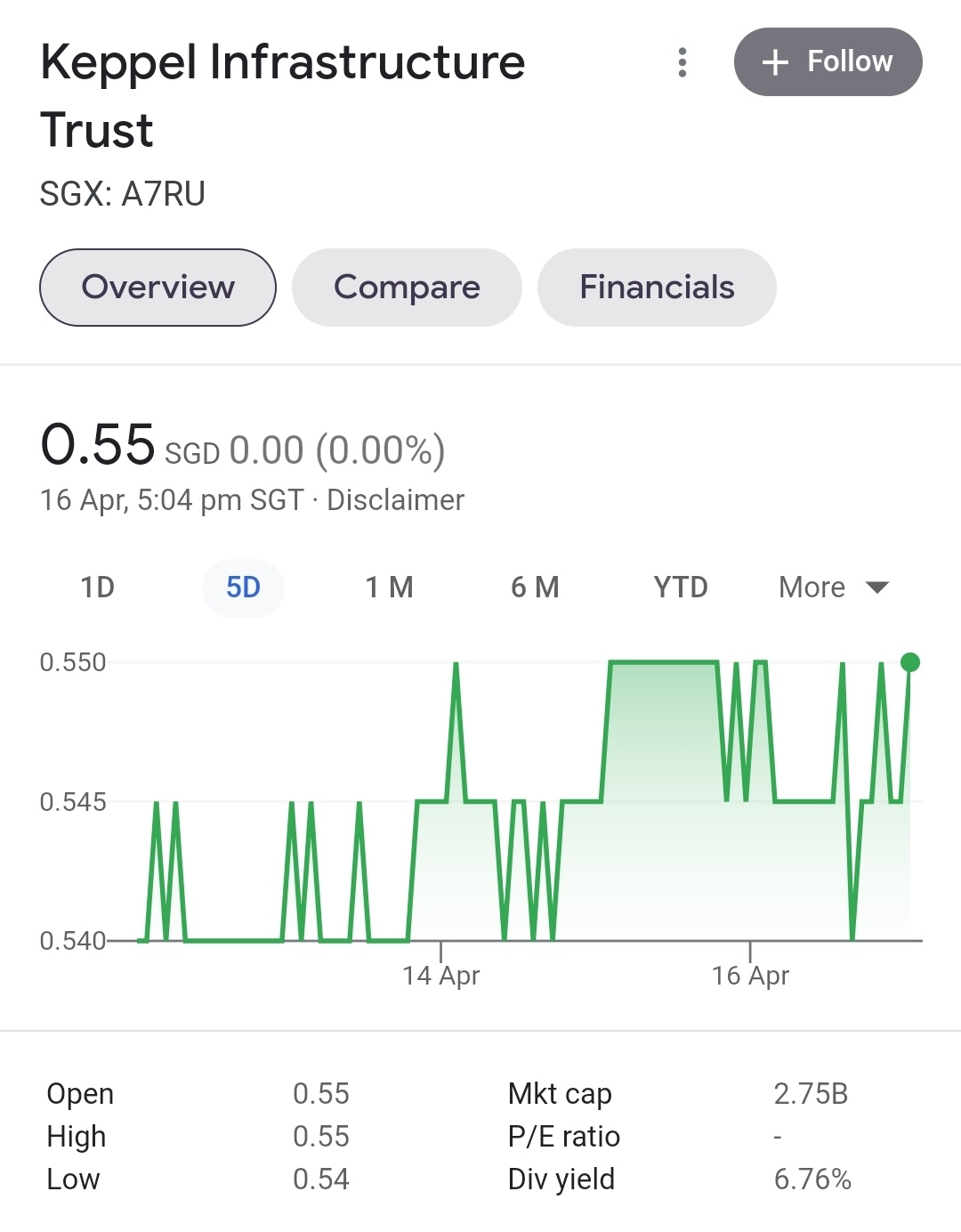

$KEPPEL INFRA TRUST WEF 2015(A7RU.SI)$

Why Invest in KIT?

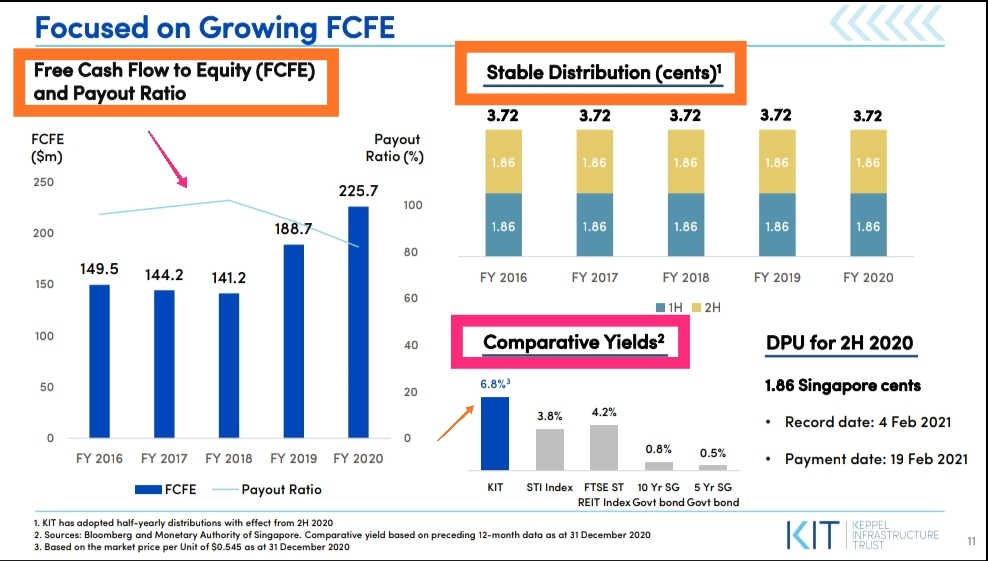

•Yield = 6.8% @ $0.545

• Stable Distribution, Payout twice a year

• FCFE > DPU

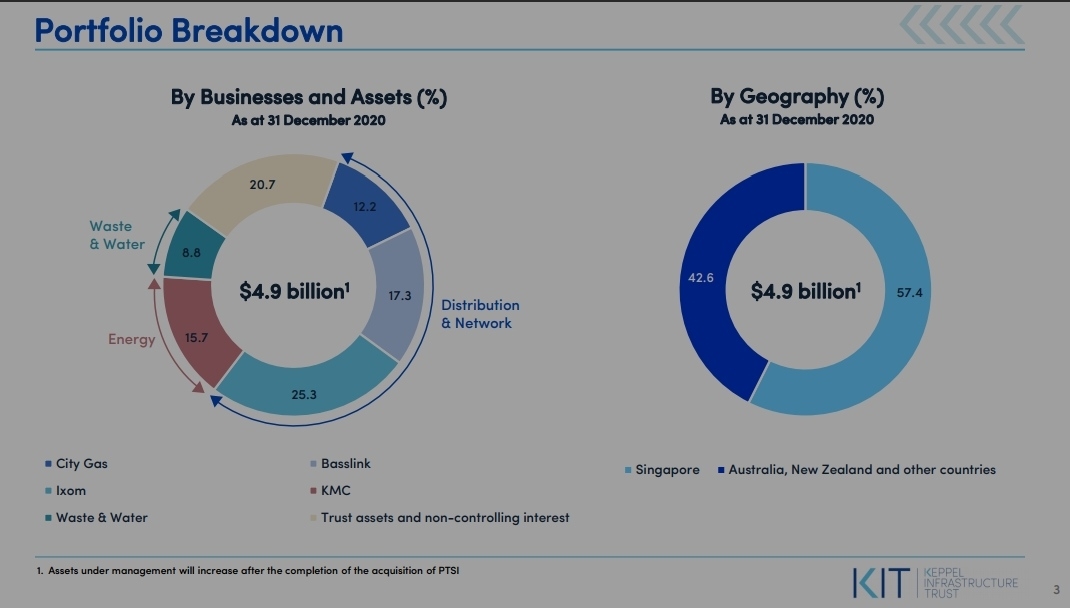

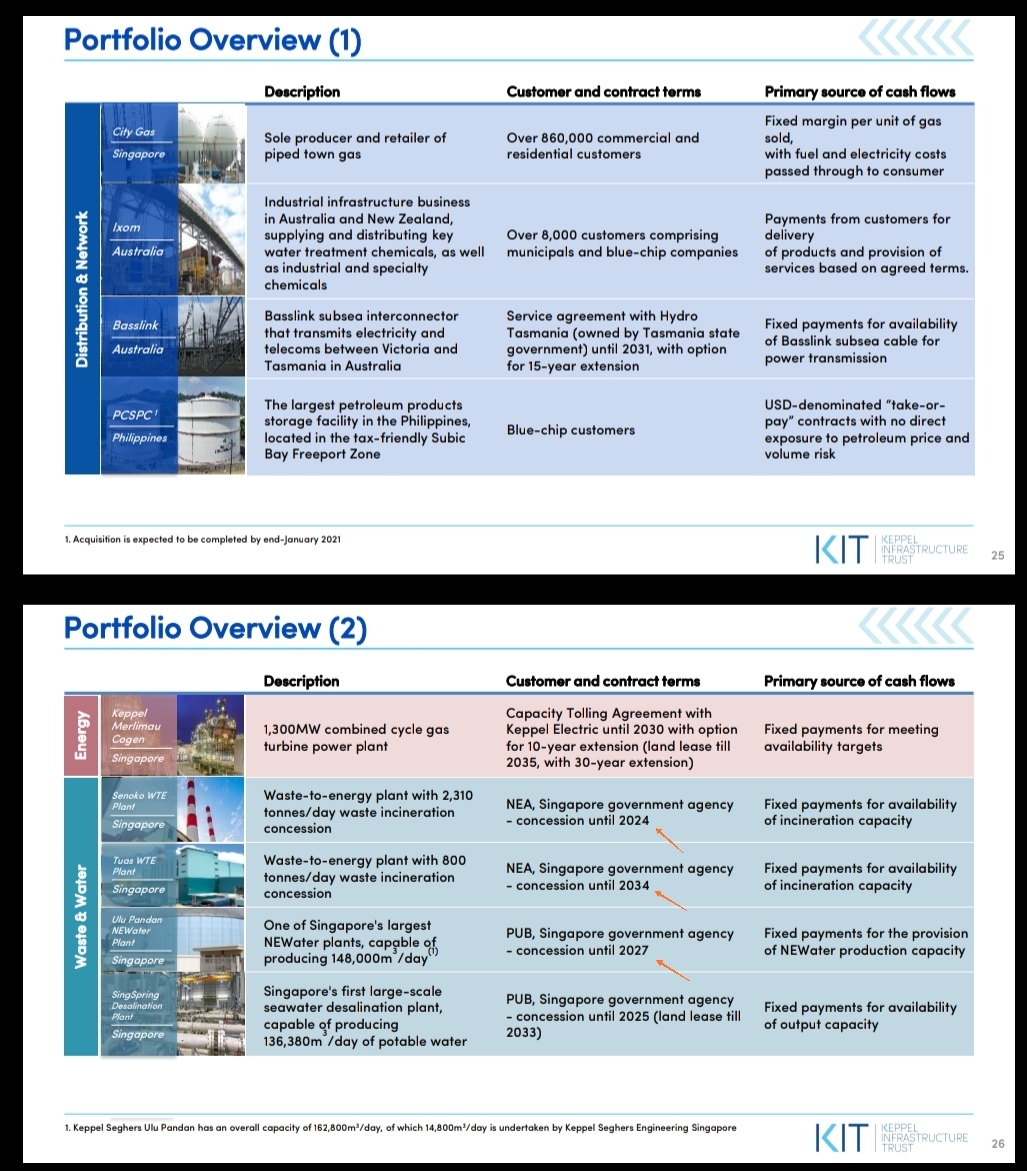

What Do They Do?

• Infrastructure like Power, Gas & Water, mostly government concessions for fixed terms & profit margins.

• Recent acquisitions provide diversification into non-concession based business.

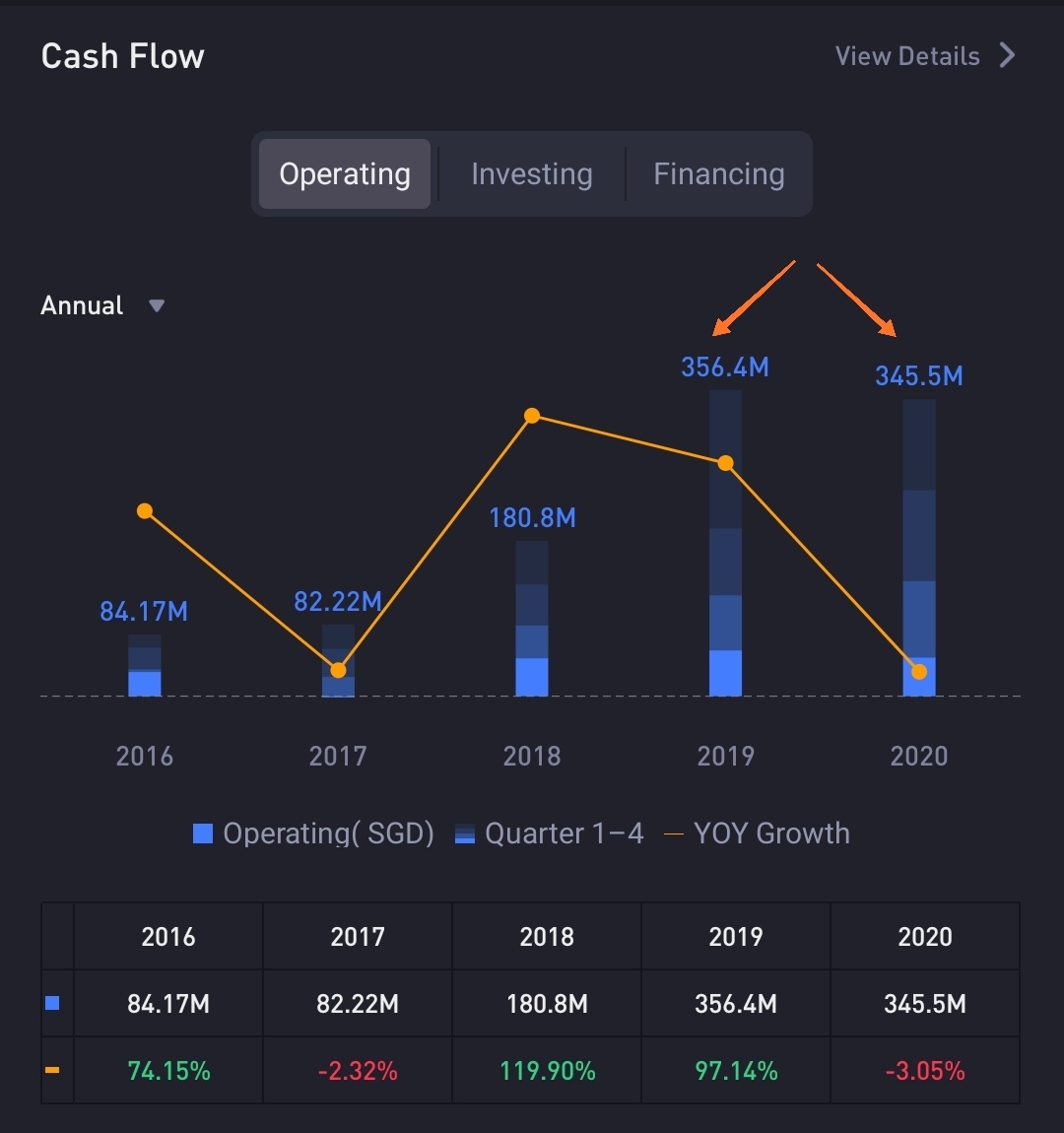

Very Scary, Huge Losses in FY20!!

• They're asset heavy, Depreciation Expenses are very hefty & Net Losses in their Income statements are not unexpected.

• As KIT is a Business Trust & are allowed to pay out 100% of available cash flow, we should look at FCF (Free Cash Flow) instead,

• FCF = OCF - CAPEX

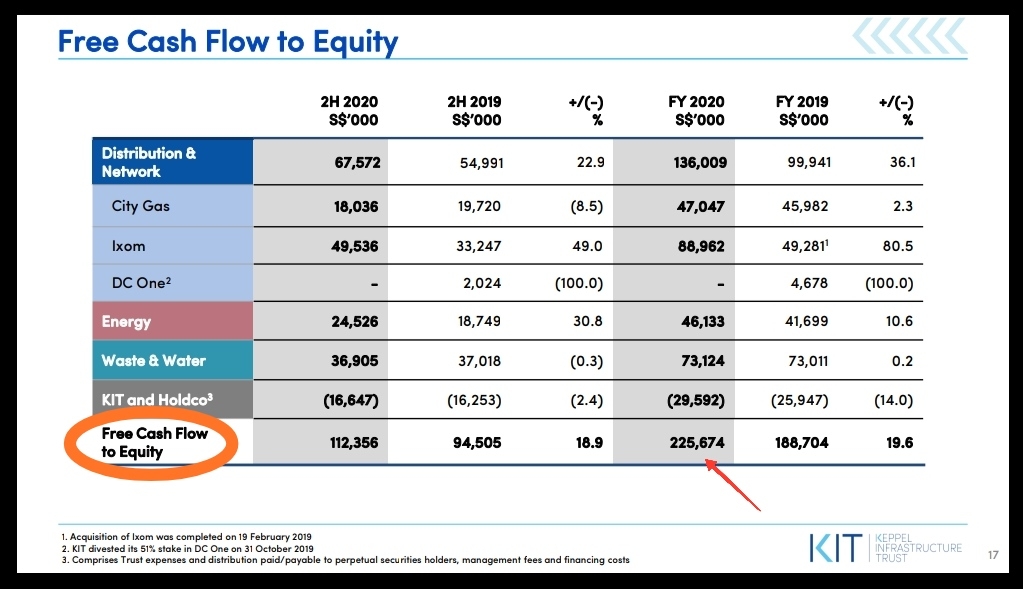

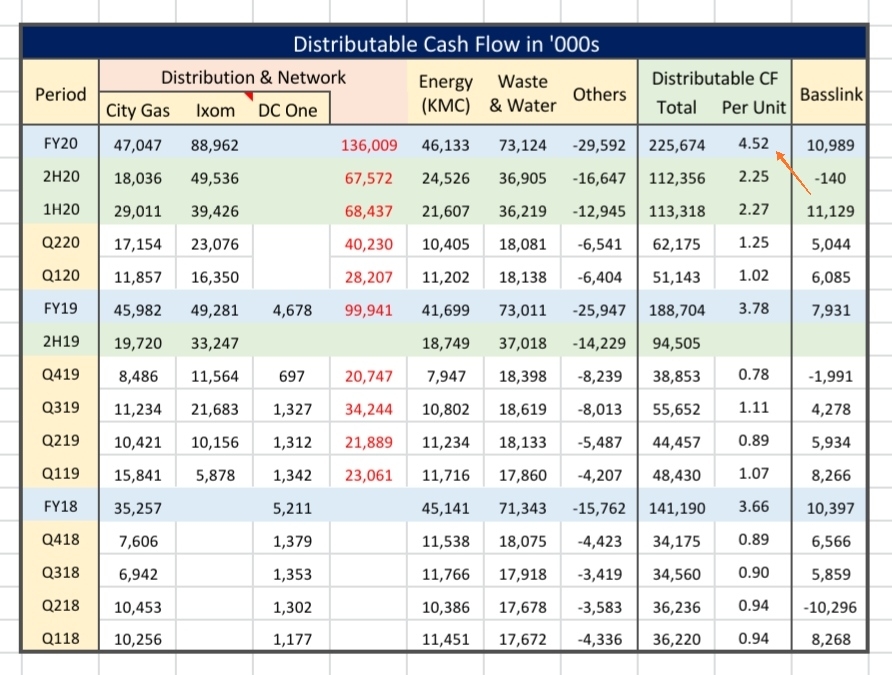

More importantly, we're more interested in DCF (Distributable Cash Flow), which KIT now calls FCFE,

Huge Numbers BUT How Much is that to Me?

• For FY20, FCFE = 4.52ct / Unit > DPU 3.72ct

• Basslink FCFE Not Used for DPU Payout

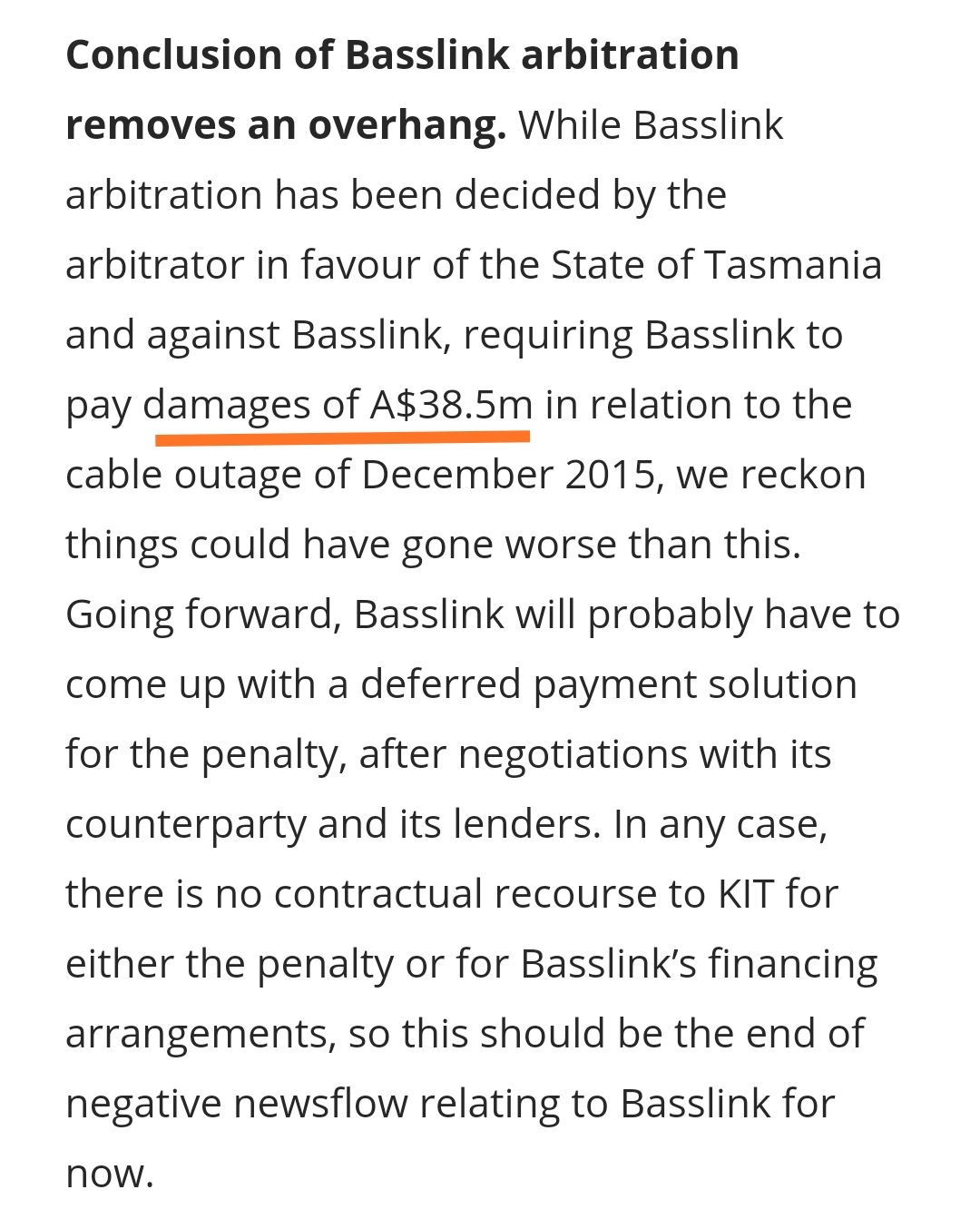

Big Fine @ Basslink, Very Scary!!

• Yes, A$38.5m or S$0.008/Unit

• IMO, unlikely to affect DPU as FY20 FCFE is more than enough + Basslink FCFE

• Potential Upside if they Decide to Sell Basslink (Just Before the Tasmanian Issue, KIT was in Discussions with Potential Buyers)

Anything to Keep Me Awake at Night?

• The Concession-based businesses, with the first expiry in 2024.

• Although there's a good chance it'll get renewed, nothing is set in stone.

• Recent diversification into non-concession based assets ought to provide some cushion (in case of non-renewal of concessions).

Is KIT Good for Trading?

• Sorry! You'll Either Die from Hunger or Die from Boredom.

• On Both the Buy & Sell Qs, they're usually Millions in Q. Daily Fluctuations Usually within ONE Bid.

Any Last Words

• The Usual, DYODD!

• Yes, it's Raining AGAIN!! [黑眼圈]

精彩评论