Management and Capital Allocation and Culture

Stacked. That’s the word to describe Sprout Social’s management team. Despite the small market cap, it is filled with seasoned executives from enterprise companies who were previously holding key executive roles in Salesforce, Google, Atlassian and ZenDesk. The alignment of skill sets toward the next chapter of enterprise focus is particularly noteworthy, especially with the recent addition of new Chief Product Officer Erika Trautman, who previously served as Product Director for Google Drive and Editors (Docs, Sheets, Slides, Forms) and more recently at Atlassian (Trello, Jira, Confluence). Additionally, Mike Wolf, who most recently served as the Chief Revenue Officer for Salesforce, has joined as the new Chief Revenue Officer. These seasoned executives left companies that are 200 times the size of Sprout Social—perhaps a sign of confidence in the company despite its share price being down 80% since its peak.

In many ways, I believe the culture at Sprout Social will continue to be product-first. Co-founders Justyn Howard and Aaron Rankin created a laser focus on product quality, and even though both co-founders are now taking a back seat, they are still supporting the team in areas where they can provide the most value (Product Development). This embedded culture is evidenced by recent achievements and awards, with G2 ranking Sprout Social #1 in all software categories in the recent summer 2024 software report. Glassdoor reviews show Sprout Social ratings at 4/5, with 79% of employees willing to recommend it to a friend. In contrast, Sprinklr scores 3.3/5, with only 50% willing to recommend it. While such statistics should be taken with a grain of salt, as they can often be skewed, some patterns are emerging.

Lastly, capital allocation. The company is investing heavily in R&D, doing so efficiently through the co-development of over 100 new features with Salesforce. Essentially, Salesforce is subsidizing a portion of R&D for Sprout Social. Moreover, the company is not shy about using acquisitions to enhance its capabilities, as evidenced by its past acquisitions of Tagger, Repustate, and Simply Measured. All acquisitions were small percentages of market capitalization, with the largest being Tagger at $140 million. These acquisitions are now playing a significant role in Sprout Social's offerings, particularly in sentiment analysis, social listening capabilities, and influencer marketing.

Some Pushbacks

Firstly, much of the promotion surrounding the partnership is done by Sprout Social, with minimal announcements from Salesforce. This may be by design, but when companies look to add Sprout Social, they still have to sift through hundreds of add-ons on Salesforce AppExchange, making Sprout Social one of many options. It is also uncertain whether Salesforce's sales reps are indeed pushing customers to Sprout Social actively. This raises questions about the strength of the partnership and whether Salesforce is truly incentivized to direct customers towards Sprout Social. Nonetheless, I argue that the native integration between the two platforms, along with the co-development of over 100 annual features, offers a significant value differentiation for companies seeking social media management tools.

Secondly, the new CEO,Ryan Baretto, though aligned with Sprout’s needs, remains unproven as a CEO. A big chunk of success is contingent on the management team’s ability to capture the larger untapped Service Cloud customers. Despite this, I would argue that Ryan Baretto, though new as a CEO, is a veteran of Sprout Social, serving over the past 8 years as President and SVP of Sales. There is no new "ramp" or learning curve that a new external CEO might have.

Thirdly, although the partnership with Salesforce is valuable, the failure of Salesforce’s own product underscores the high R&D demands in this space, making scale essential for Sprout Social’s long-term success. While this is true, one also need to consider the larger context at hand - Social Studio represents a very small % of Marketing Cloud, which represents a further smaller % of overall Salesforce Revenues. It did not make economic sense for Salesforce to invest heavily into it. This is not the case for Sprout Social. But this is also the risk for Sprout Social, it's identity as a singular product and tool. As the rate of disruption is high in tech sectors, we need to pay attention to Sprout Social plans and product roadmaps, and whether it is able to capture adjacent sectors to diversify its revenue base.

Lastly, disruption risks from AI, while unlikely to fully replace social media management, pose a potential threat as innovative tools may emerge. For now, AI serves as a tailwind, aiding in auto-generated replies and data analytics, which allows for further up-selling and cross-selling of tools. There are equally strong arguments from both sides, but to me, A.I. is an optionality that is not yet priced into the growth potential.

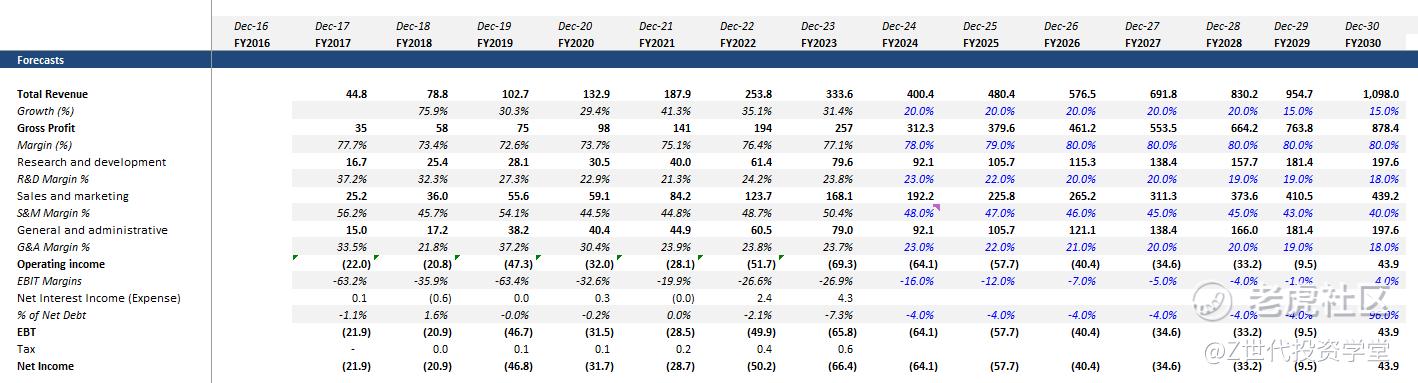

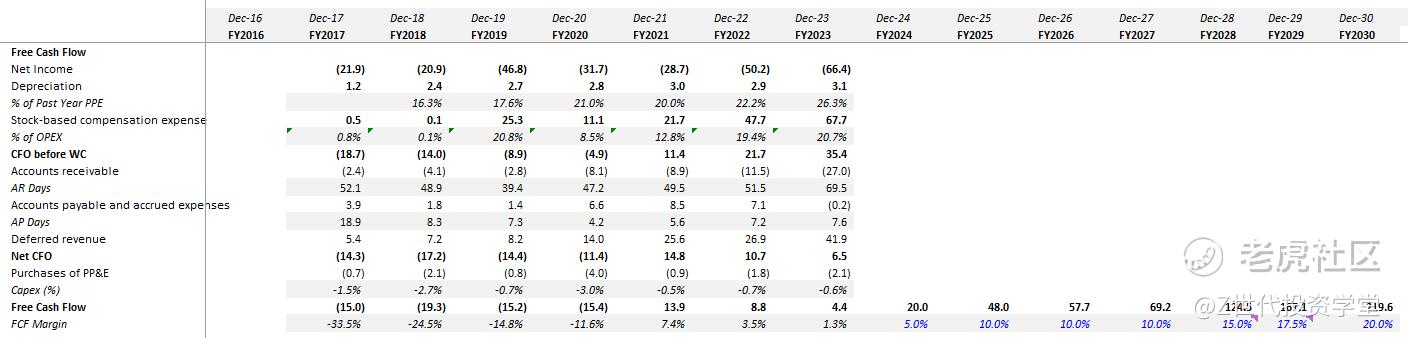

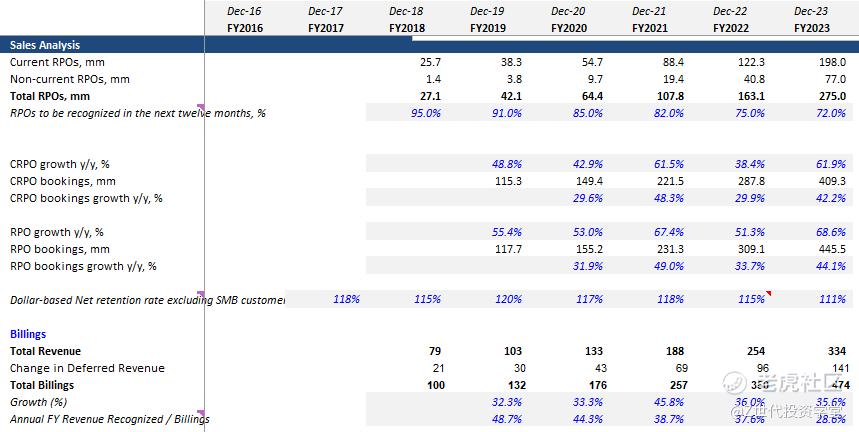

Financials

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论