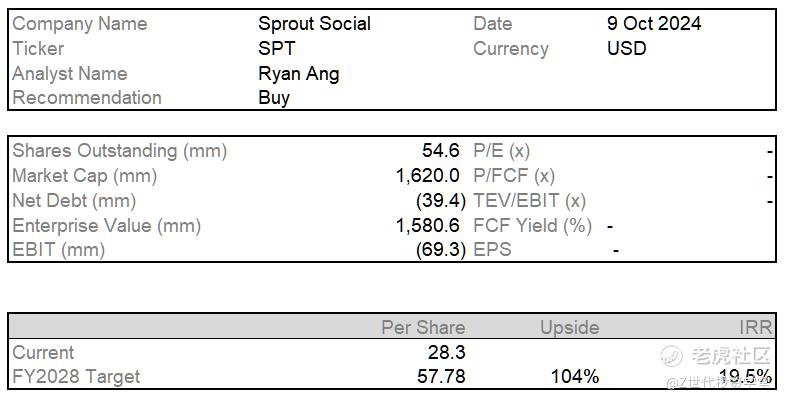

Investment Summary

Sprout Social is a social media management solution that enables enterprises to leverage social media for research, analytics, crisis management, customer support, and marketing. There is a transformation that is happening in Sprout Social, leading to a creation of a moat that I think is underappreciated by investors today. Sprout Social, originally a small and medium enterprises (SME) solution, has transitioned into an enterprise marketing solution. This transition was ignited by an exclusive Salesforce partnership which allows Sprout Social to be natively integrated and embedded inside Salesforce platforms and products. This is crucial because it provides a seamless experience for users, while allowing users to obtain fully connected data pipes between Sprout Social and its Salesforce account.

The pivot to selling to Enterprise is already bearing fruit. Growth has re-ignited amidst weak macroeconomic environment, with RPOs and RPOs bookings growing 30 - 40% over the past 2 years since the partnership announcement. A big part of organic growth will come from the growth in annual contract value (ACV). Sprout Social’s average ACV in the past averages $12,000 per customer, as compared to an enterprise customer who typically spends $400-500k on a solution such as Sprinklr.

What is particularly enticing about this partnership is the fact that Salesforce subsidizes Sprout Social’s R&D intensity by co-developing 100+ features annually since FY2022, while internal teams’ funnels clients to Sprout Social. It is an extremely capital efficient way for Sprout to develop its product. Furthermore, through the exclusive native integration and communication between data from Sprout Social and Salesforce, this creates a distinct value proposition for clients that competitors cannot match. The customer simply does not have a better reason to choose Sprinklr or any other solutions in this space, even with better features. This is already demonstrated by the higher win-rates from Sprout.

From a number’s perspective, in Q2 2024, both companies cited macroeconomic weakness, with Sprinklr’s RPO bookings growth falling by as much as 40% and its total pipeline shrinking. Meanwhile, Sprout Social maintained its RPO bookings growth, though at a much slower 7% rate. More importantly, it achieved record pipeline value. This signals a shift in relative competitive dynamics between Sprout Social and Sprinklr, especially now that both companies are competing for the same customers.

The increasing importance of social media management for businesses, combined with Sprout Social’s value proposition, sets an interesting tailwind for Sprout. Furthermore, a combination of idiosyncratic factors in Q1 crashed the stock by 50% which I believe it to be an opportunity to buy in an expanding moat, high-growth business at a high margin of safety.

Scenario Analysis

I will run through 4 key scenarios that will likely to play out in the future. This will provide us with the logic to think about the investment case moving forward.

The first scenario (Case 1) models an extremely pessimistic outlook, capturing the potential risk in the business model transition from SMEs to large customers and enterprise customers.

In case 2, I will try and understand what needs to happen to maintain current valuation, assuming the same level of customer churn in case 1.

In case 3, I will model a situation based on management guidance, what that upside will potentially look like and what needs to happen in order to hit management guidance.

In case 4, I will model what I think is the likely scenario and what the investment case will look like.

Case 1 - SME Segment Churns at 10% with no growth in Enterprise and Large Customer Account.

You can think of Case 1 as the downside potential. Over here, we assume a certain conservative level of ARRs by backward induction for the different customer types, and assume that there will be no growth in enterprise and large customers, and a 10% churn in SMEs. This will capture the business transition risk as Sprout moves away from SMEs and into large and enterprise customers.

In this case, customer count declined by 50% by FY2028 for SMEs, while sales only declined by 16%. The implied EV at current multiple presents a 22% downside risk. What we should focus on is that any stock price reaction to poor performance of SMEs should be seen as an opportunity - SMEs represent a very small percentage of businesses and the overall investment cases. Our focus should therefore be on how the enterprise and large customer business is doing.

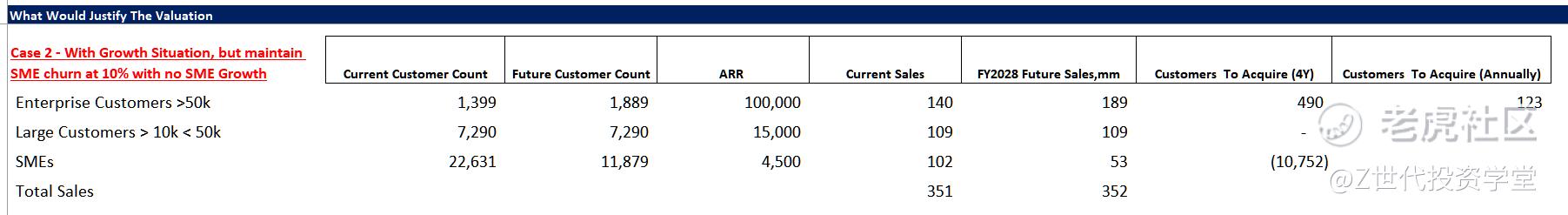

Case 2 - SME Churns but with growth in Enterprise and Large Customers

In case 2, what we are trying to understand is how many customers does Sprout Social needs to acquire in its enterprise customer in order to offset the decline in its SME business. From my calculation, Sprout Social will only need to acquire 490 enterprise customers by FY2028, translating to 123 customers annually in order to offset the decline in SMEs. Judging from the fact that Sprout social obtains about 150 enterprise customers on average in H1, this does not seem to be a difficult goal to achieve.

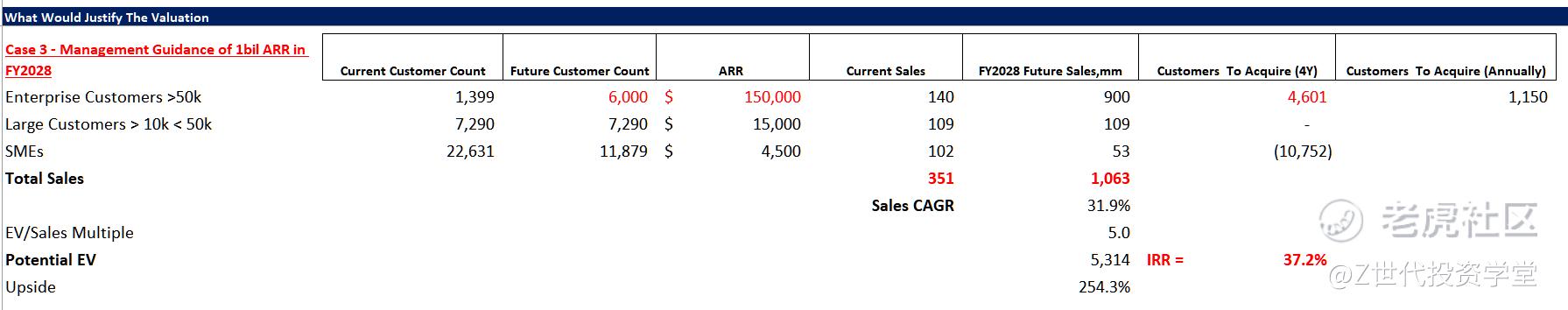

Case 3 - Management Guidance Scenario

In case 3, we are modelling out what will happen if management guidance is achieved assuming the same level of SME churn. Over here, we see that the impact of SME churn is negligible, while the main value driver is the growth in Enterprise Customers. In order to hit ARR of $1 billion per annum, Sprout Social will need to acquire about 4,600 enterprise customers in 4 years, or about 1,150 customers per annum. This is also on a higher ARR amount of $150,000 per year, up from $100,000. This is still significantly below Sprinkr's 400k-500k annual customer spendings (Sprinklr target enterprise customers.)

This is a difficult goal, as it requires Sprout to triple its annual enterprise customer gain. However, we should be watchful on Q3/Q4's customer acquisition number as sales cycle typically gets concluded in the back-half of the year. Upcoming 2024Q3 and 2024Q4 numbers would be meaningful as it provide us a clear picture of whether this management guidance scenario is likely. Nonetheless, at such a guidance level, it means SPT will be growing sales at 30%+. At a conservative multiple (EV/Sales) of 5x, it gives us a potential EV of 5bil, reflecting 37.2% IRR.

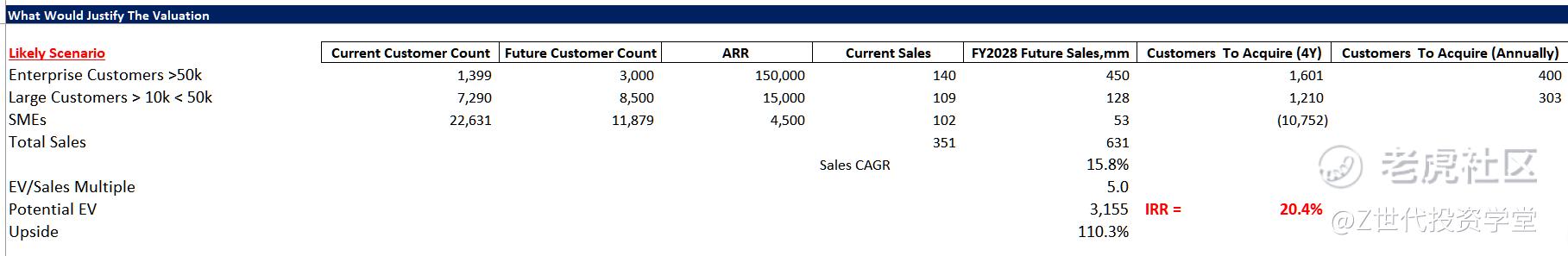

Case 4 - Likely Scenario

In this scenario, I assume that SPT would gain about 400 enterprise customers annually (150 H1/ 250 H2), with ARR of $150,000 for enterprise customers. I also assumed a similar ratio for large customer wins, although the impact to IRR is not very significant. This translates to a topline growth of 16%. At an appropriate EV/Sales of 5x, this gives us an upside of 110% or IRR of 20.4%. I think this case is reasonably achievable, with only slight increments in customer acquisition rates. The rapid scaling of dedicated sales teams and increasing productivity per sales rep points are signs that will support this case.

I believe that as Q3/Q4 numbers come in, the narrative will start to develop for Sprout Social, with the key metric being focused on enterprise customer gains. The risk/reward of this investment case is attractive, and the fundamentals of the business case are strong.

Business

Sprout Social is a social media management solution that helps businesses manage and extract more value from their social media channels. While this might seem trivial or non-essential to retail consumers like us, who use social media for personal accounts, it’s a completely different story for a company managing 20 different brands or 10 geographic units across potentially 18 mainstream platforms (yes, there are 18 mainstream social media platforms!) and countless industry-specific blogs and platforms. This can quickly become complex. Currently, Sprout Social is integrated with only seven key platforms, with room for further growth. Sprout Social offers five key business solutions, as outlined in its 10-K: Engagement, Publishing, Analytics, Social Listening, and Influencer Marketing. All core functions are typically included in the subscription, but there are advanced features that are added on a per seat basis.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论