ESG Assessments

Since there is no disclosure on Energy Management, we will be reviewing Toast’s GHG emission performance instead.

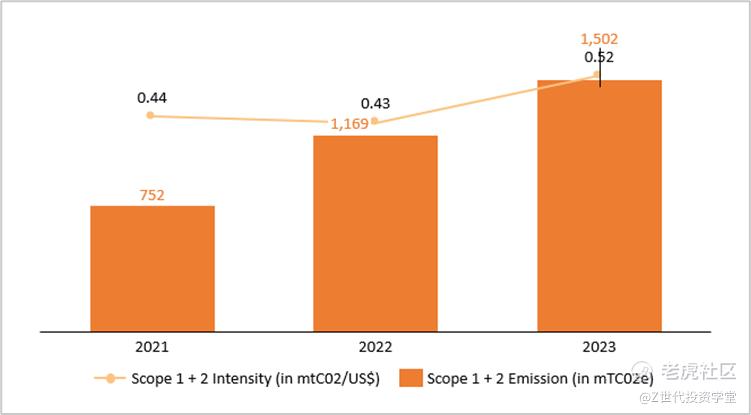

a. Greenhouse Gas Emission

Scope 1+2 emission increased from 1,169 mTC02e in 2022 to 0.52 mTC02e in 2023. At the same time, scope 1 + 2 intensity has slightly grew as well. However, intensity remained relatively low.

Scope 3 emission increased significantly and is concerning. However, it is mainly due to upstream emissions of goods and services purchased. Toast has launched several initiatives to tackle this matter. Firstly, hardware recycling where Toast works with a 3rd party recycler to recycle retired hardware and provides customers with carbon-neutral shipping labels to send their devices to recycler at no costs. Secondly, Toast is starting to track the GHG emission across its supply chain as well. Currently still in the midst of working to identify which vendors in supply chain.

b. Data Privacy

Toast adheres to standards such as Payment Card Industry (PCI), Service Organization Control (SOC 2), and Sarbanes-Oxley (SOX), as well as internal security policies rooted in the National Institute of Standards and Technology (NIST) guidelines. To align with the NIST control framework, Toast employs a variety of strategies, technologies, and controls. Under this framework, we also structure and assign responsibilities according to the American Institute of Certified Public Accountants (AICPA) three-lines-of-defense model, which defines roles for risk ownership, assessment, and monitoring by internal teams and external auditors. Our software development teams utilize a secure software development framework (SSDF) to mitigate the risk of software vulnerabilities.

However, information disclosed are all qualitative and there is no quantitative data disclosed in Toast’s ESG report. It seems that Toast is adhering to regulations and are aware of the importance of data privacy, but we have inadequate information to measure the actual performance and quality of Toast’s data privacy system.

-

Valuation

Based on the EV/EBITDA multiples method, EV/EBITDA is currently trading at an average of 24.23x resulting in an 3-year implied share price of US$37.16 (+24% upside) and 5-year implied share price of US$53.55 (+78% upside).

-

Risks & Mitigation

a. Macroeconomic Conditions Impacting Toast's Revenue: Toast has reported a consistent 3% decline in same-store sales (GPV per location), primarily due to broader economic factors. A slowdown in restaurant spending, driven by economic instability and shifts in consumer behaviour, could further reduce transaction volumes across Toast's platform and slow GPV growth, directly impacting revenue. Although restaurants have shown resilience, a significant drop in consumer spending would pose additional risks to Toast’s revenue growth and future projections. While the company is preparing for these potential challenges, it remains vulnerable to changes in the economic landscape.

b. Challenges in Market Share Expansion and TAM Strategy Execution: Toast is focused on scaling restaurant locations and growing its market share, but increasing competition and market saturation in key regions may limit its growth potential. The company relies on 'flywheel markets' for expansion, and any disruption in these areas could slow future gains. Additionally, Toast’s strategy to expand into enterprise chains, international markets, and food and beverage retail introduces operational complexities and demands significant investment, which could strain resources and divert attention from its core SMB and mid-market segments.

c. Customer Churn: Toast has experienced a slight increase in churn, with annualized churn now slightly exceeding 10%, mainly due to business closures. Although we have seen stickiness in ARR, customers have no obligations to continue the subscription plan after it expires. Typically, subscription contract lasts for 12 to 36 months. Hence, there is a risk that rising churn could jeopardize the company’s growth targets, particularly if it starts to significantly affect ARR.

-

Conclusion

To recommend a BUY on Toast, Inc (NYSE:TOST) with a 3-year target of US$37.16 and 5-year target of US$53.55.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论