-

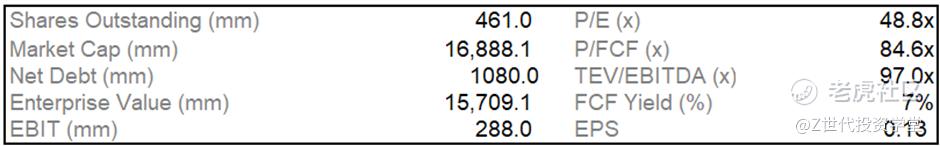

Company Overview

Toast, Inc. operates a cloud-based, all-in-one digital technology platform for the entire restaurant industry in the United States (US), Ireland, and India. The company was formerly known as Opti Systems, Inc. and changed its name to Toast, Inc. in May 2012. Toast, Inc. was incorporated in 2011 and is headquartered in Boston, Massachusetts.

It is a software suitable for all type of restaurants including Full Service, Quick Service, Fast Casual, Fine Dining, Bar, Café, Bakery, Food Truck, Hotel Restaurant and Pizzeria.

Majority of Toast’s clientele belong to the US SMBs or the mid-market restaurant segment. They also continue to pursue customer growth within enterprise segments of the restaurant market in recent years.

They serve as the restaurant’s operating system, connecting front of house and back of house operations across various service models such as dine-in, takeout, delivery, catering retails. The company offers both software and hardware products for restaurant operations and point of sale (POS).

Some recent notable customers include Sonny’s BBQ, Uni Pizzeria & Grills and PPX Hospitality Group (who owns brands including Legal Sea Foods, representing commitment more than 200 locations in the US).

a. Business Segment

Toast’s business model comes from a blend of subscription fees, transaction-based fees, hardware sales and value-added services. The mix of recurring revenue and transactional revenue create multiple streams of revenue for Toast to capture more value from each restaurant it serves.

There are 4 revenue streams:

Firstly, subscription services. This includes Toast POS, Toast Now, Multi-location management, Kitchen display system, Toast mobile order & pay, Toast catering & events, Toast invoicing, Toast tables, Restaurant retail, Toast online ordering & takeout, First-party deliver, Third-party delivery, payroll and team management,

Secondly, financial tech solutions. This consists of revenue from payment processing, toast capital and purchase plans.

Thirdly, hardware. This consists of revenue from sale of hardware such as Toast Flex, Toast Go 2, Toast Tap, Kiosk, Delphi by Toast.

Lastly, professional services. This consists of revenue deriving from services such as marketing & loyalty, team management, supply chain & accounting, data analytics, training, data migration, support & maintenance, installation and setup fees.

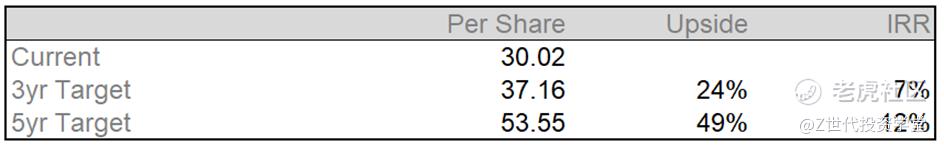

Customers can opt for individual service at ala-carte price or tiered-based subscription package plan for a single monthly price, depending on their operational needs.

b. Sectoral Performance

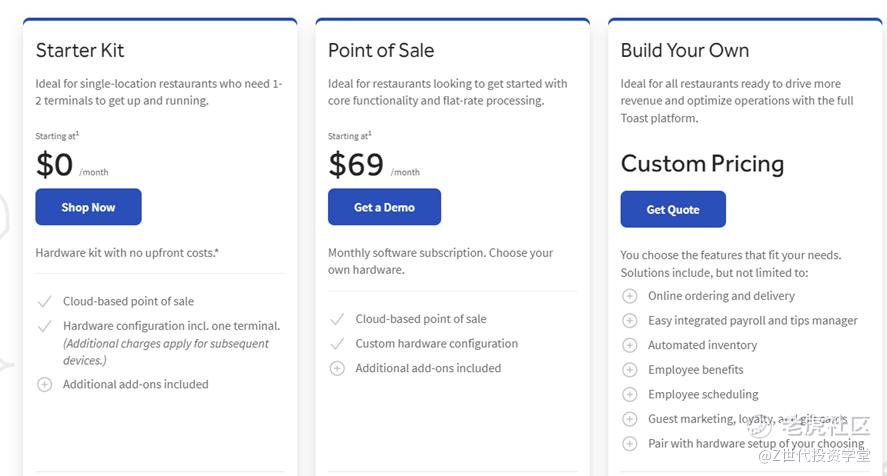

Revenue breakdown by segment

Overall revenue has grown by 27% YoY, from US$978M in 2Q’23 to US$1.2B in Q2’24.

Highest growth seen from revenue from Subscription Services with 37% YoY growth to US$166M, mainly driven by continues growth in restaurant locations on Toast platform, along with higher product adoption and hence, higher share of wallet across customer base. This shows that more restaurants who are utilising a broader range of Toast’s solutions are joining the platform.

Revenue from financial technology solutions saw a 27% growth YoY to US$1.0B, mainly driven by increase in restaurant location who are using Toast’s payment processing and other financial services such as toast capital and purchase plans. This indicate that Toast’s financial technology sector benefited from higher transaction volume as no. of restaurant onboarded increases.

Revenue from hardware and professional services increases by 8% YoY to US$53M, reflecting demand from POS hardware and professional as customer base grows.

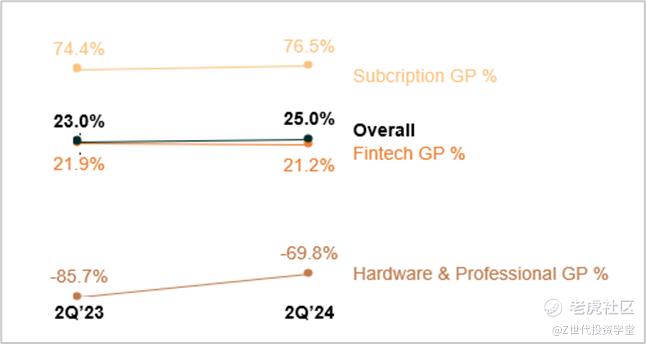

Gross profit breakdown by segment

Overall gross profit margin improved slightly from 23% in 2Q’23 to 25% 2Q’24. Financial Tech gross profit margin remained relatively stable at ~21%. Subscription services gross profit margin improved slightly due to 3% reduction in subscription services COGS as % of revenue. We see the highest improvement in hardware and professional services gross profit margin but still in the negative. This is likely due to offset by pricing and cost of packaging relating to bundled sales.

c. Growth Strategy

Increase location growth with both new and existing customers

Despite the rapid growth and scale, their current customer based are estimated to only account for ~10% of total restaurants in the United States (US). Hence, Toast believes that there is substantial opportunity to grow their location footprint in the US. Toast wants to invest in its go-to-market strategy and prioritize customer success through combination of tailored onboarding services, customer support, simple & intuitive product design and investing in R&D of new product to serve evolving needs or restaurants. They aim to onboard new customers and existing customers as they expand into new locations.

Increase adoption of Toast’s products

Toast believes that they are well-positioned to sell additional products to existing customers through sales & marketing efforts and product-led growth. They have used strategies such as bundling, upselling and cross-selling its products. Toast aims to broaden the subscription services and financial technology product offerings.

Further develop its partner ecosystem

Toast’s integrated platform connects customers to over 200 partners to provide customers with the tool that they need to run their businesses. Partnerships have expanded Toast’s product offerings to employee management, inventory, accounting, loyalty, mobile pay, gift cards, online ordering and digital signage.

International expansion

Toast believes that there is significant opportunity to expand usage to markets and clients outside of the US. It is still in the early stages of expansion and is a long-term initiative.

-

Industry Outlook

Restaurant industry is one of the largest industries. In the US, there are ~875K restaurants which are highly diverse and complex. Outside of the US, Toast expects a restaurant TAM of 280K international restaurants.

Market pain point among F&B restaurant lies within low margins, high employee turnover, highly perishable products, and complex regulations. On top of these challenges, restaurant industry experiences foundational changes driven by changing consumer preferences and there is a rising demand for restaurants to utilize technology and data to innovate.

The need for efficient scaling

Modern POS system has become essential in today’s F&B scene. The move to cloud-based POS systems has made business management more flexible, efficient and cheaper.

Global cloud-based POS market is estimated to be at US$4.7B in 2023 and expected to grow at a CAGR of 18.2% from 2024 to 2030 (Grandviewresearch, 2024). To scale effectively, businesses need to achieve operational efficiency, which drives investment in cloud POS systems.

Changing mode of payment among consumers

We have seen an increased popularity of cashless transaction such as credit cards, debit cards, mobile wallets and other digital payment solutions. Firstly, Contactless payments has been a game changer for F&B industry. This has been particularly noticeable in customer facing businesses like coffee shops, eateries and breweries where speed and convenience is highly valued. Secondly, trend would be in mobile payment and apps. According to tech.co 66% of the restaurants in the US and Canada accepted mobile payments in 2023. Thirdly, QR code payments has become a vital part of payment infrastructure.

No. of cashless transaction globally totalled to US$1.3B in 2023 and expected to reach US$2.3B in 2027. In the US alone, cashless transaction totalled to US$232B in 2023 and expected to reach US$298B in 2027 (Statista, 2024).

-

Key Operational Metrics

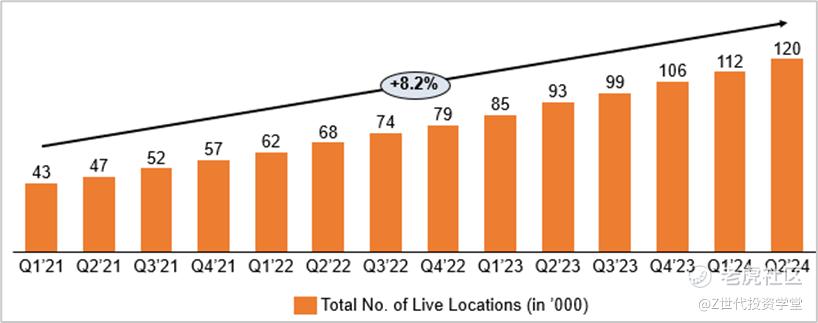

a. No. of Total Live Locations

Total locations increased by 29% YoY to ~120,000 locations as of Q2’24. Toast added ~8K net new locations in Q2’24. In 2023, Toast launched their brand in Canada, Ireland and the UK as an initial effort to unlock significant opportunity outside the US. Toast has onboarded 2K international location as of Q2’24.

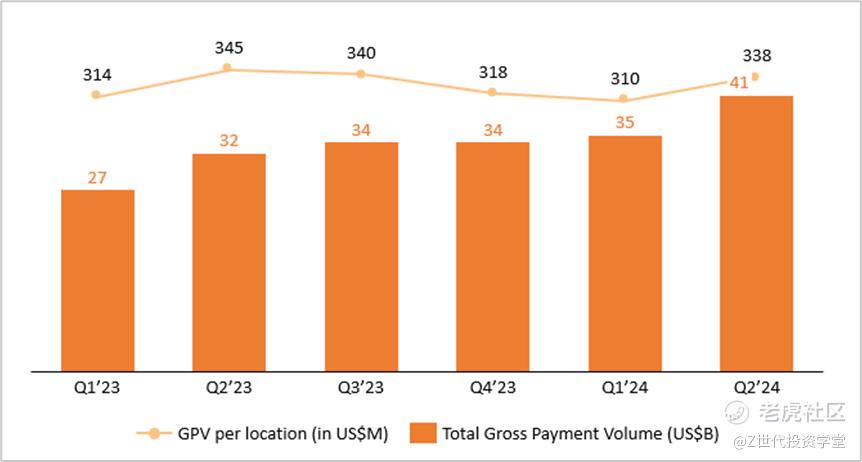

b. Gross Payment Volume (GPV)

GPV increased by 25% YoY to US$40.5B in Q2’24, indicating strong business growth. This means that Toast is expanding its customer base and there has been an increased in usage of its platform by its existing users.

While Toast’s gross margins are expanding, GPV per location declined by ~2% YoY to US$338K on Q2’24, mainly driven by a decrease in transaction volume while average ticket size remains relatively stable. This reflects some pressure on same-store sales growth, likely reflecting persistent macroeconomic headwinds, where inflationary pressure reduces consumer spending and increases operational costs have contributed to slower transaction volumes at existing locations.

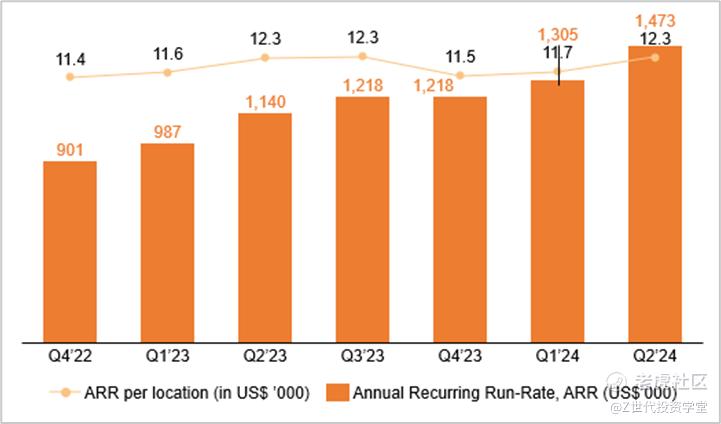

c. Annualized Recurring Run Rate (ARR)

ARR grew by 29% YoY to US$1.5B as of Q2’24. Toast currently generates !40% of its recurring revenue from software and payment processing. Toast is aiming to tilt the mis towards software revenue as it adds and cross-sells new products to its client base. In Q2’24, Subscription ARR grew by 35% YoY to US$730M (accounting for ~50% of total ARR) and Payments ARR grew by 24% YoY to US$743M.

Several factors may affect ARR such as customer’s satisfaction on platform, pricing, competitive offerings, economic conditions and overall guests’ spendings.

ARR per location experienced a slight dip in Q4’23 to ~US1,150K. However, it has recovered to the same level as of Q2’24.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论