Founded in 1950 and headquartered in Eagle, Idaho, Lamb Weston (NYSE: LW) is a global leader in frozen potato and vegetable products, serving the foodservice and retail sectors worldwide. The company operates through four key segments: Foodservice, Retail, Global, and Other, with Global contributing significantly to its revenue. Lamb Weston employs approximately 10,300 people and emphasizes sustainability across its operations, aiming to reduce environmental impact and engage in community initiatives.

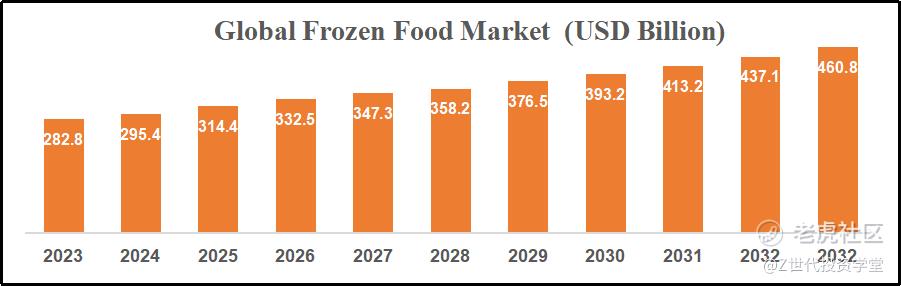

The global frozen food industry, valued at USD 282.8 billion in 2023 and expected to grow at a CAGR of 5.1% to USD 460.8 billion by 2033, is driven by changing consumer lifestyles and technological advancements in freezing technologies.

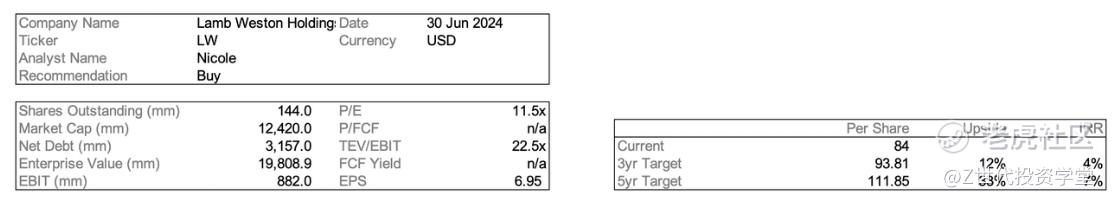

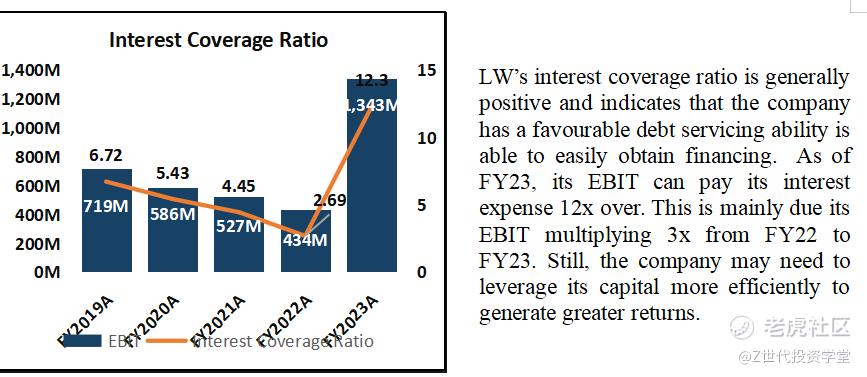

Lamb Weston's investment thesis highlights its position as a leading supplier of frozen potato products globally. The company's recent expansions in Europe and China, coupled with investments in operational efficiency through technologies like ERP systems, support its growth trajectory. Strong financial metrics, including robust earnings before interest and taxes (EBIT) and a favourable P/E ratio, underscore its potential for future growth and shareholder value.

Using a discounted cash flow (DCF) model, Lamb Weston shows a potential upside, reflecting investor confidence in its strategic expansions and operational efficiencies. However, risks such as climate change impacts on potato supply chains and supply chain disruptions are acknowledged, with proactive measures in place to mitigate these challenges.

Lamb Weston's ESG assessment focuses on reducing environmental footprint through sustainable agricultural practices, enhancing community engagement, and maintaining ethical governance standards. Opportunities exist to further enhance biodiversity conservation and scale sustainable practices globally.

Overall, Lamb Weston is positioned as a resilient leader in the global frozen food industry, leveraging its market leadership, strategic expansions, and commitment to sustainability. Despite challenges, the company's strategic initiatives and strong financial performance underscore its potential for long-term growth and value creation in the competitive landscape of frozen potato and vegetable products.

01 Company Overview

Founded in 1950 and headquartered in Eagle, Idaho, Lamb Weston (NYSE: LW) is a global leader in frozen potato and vegetable products. The company supplies restaurants and retailers worldwide with innovative offerings from 27 strategically located production facilities. With approximately 10,300 employees, Lamb Weston emphasizes sustainability in its operations, aiming to reduce environmental impact. It holds a prominent market position as the leading supplier in North America's frozen food category and ranks second globally in frozen potatoes. The company is committed to community engagement, with employees contributing over 942 volunteer hours annually, and invests approximately $946,000 yearly in philanthropic initiatives.

1.1 Business Segments

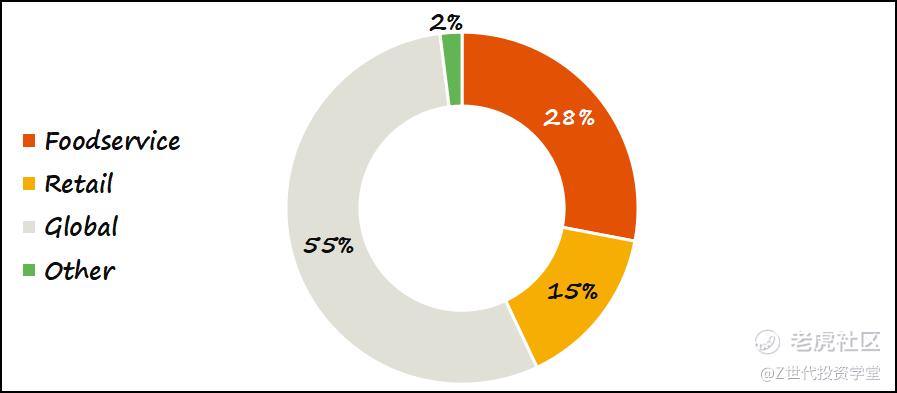

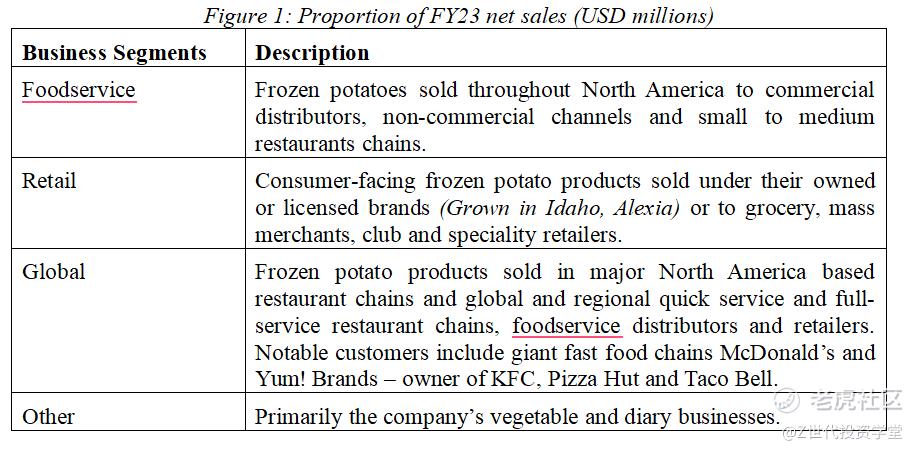

LW’s business model is comprised of 4 segments: Foodservice, Retail, Global and Other, with Global responsible for the main bulk of the business. In FY23 alone, Global accounted for 55% of the net sales.

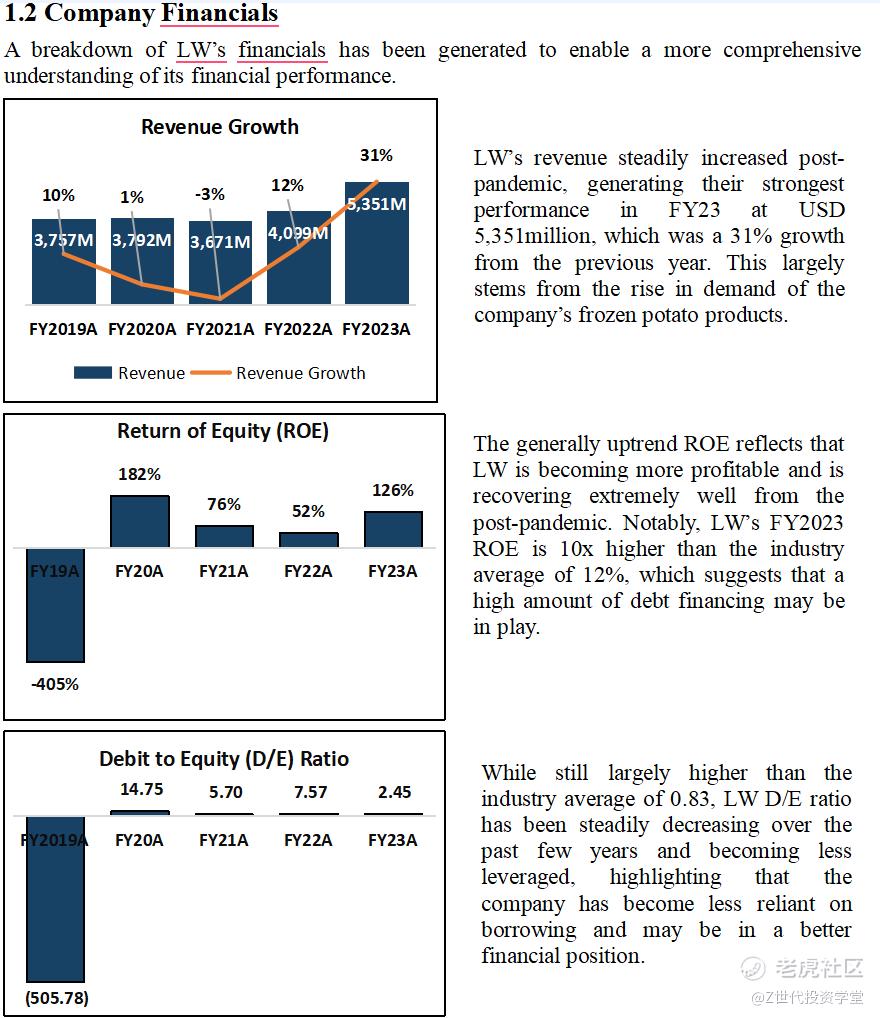

Overall, LW's financial performance appears to be very positive. It is experiencing strong revenue growth and improving profitability, and managing its debt effectively. However, there might be room for further improvement in capital efficiency to maximize returns for shareholders.

02 Industry Overview

2.1 Market Size

In 2023, the global frozen food industry was valued at USD282.8 billion and is expected to grow at CAGR of 5.1%, and potentially reaching USD460.8 Billion in 2033.

Figure 1: Global Frozen Food Market (USD Billion)

2.2 Growth Drivers

This rise of the global frozen food market has been driven by changing lifestyle habits and advancements in technology.

2.2.1 Changing lifestyle habits

Due to an increasingly urbanised lifestyle, with over 50% of the world’s population living in urban areas, consumers are more likely to opt for quicker and more convenient solutions. The rise in demand of ready-to-eat meals, with the industry expected to grow at a CAGR of 12.35% largely contributes to the growth in the frozen food industry. Furthermore, statistics show 27% of the global population shops online. With the prevalence of online shopping, consumers can now easily order a wide range of frozen foods and have them delivered at their front doors. The culmination of the various modern lifestyle factors have fuelled the growth of the frozen food industry.

2.2.2 Technological advancements

The advancements in freezing technologies are not just improving the quality of frozen foods; they're also driving the growth of the frozen food industry. Techniques like quick freezing and cryogenic freezing preserve the taste, texture, and nutrients of foods, making them more appealing to consumers. This increased appeal translates to higher demand for frozen foods, boosting industry growth. Additionally, these freezing methods help extend the shelf life of products, reducing food waste and enhancing sustainability. With better machinery to apply these techniques at a larger scale, companies can meet growing demand more efficiently, further fuelling industry expansion, which can drive the overall growth and sustainability of the frozen food industry.

2.3 Competitor Analysis

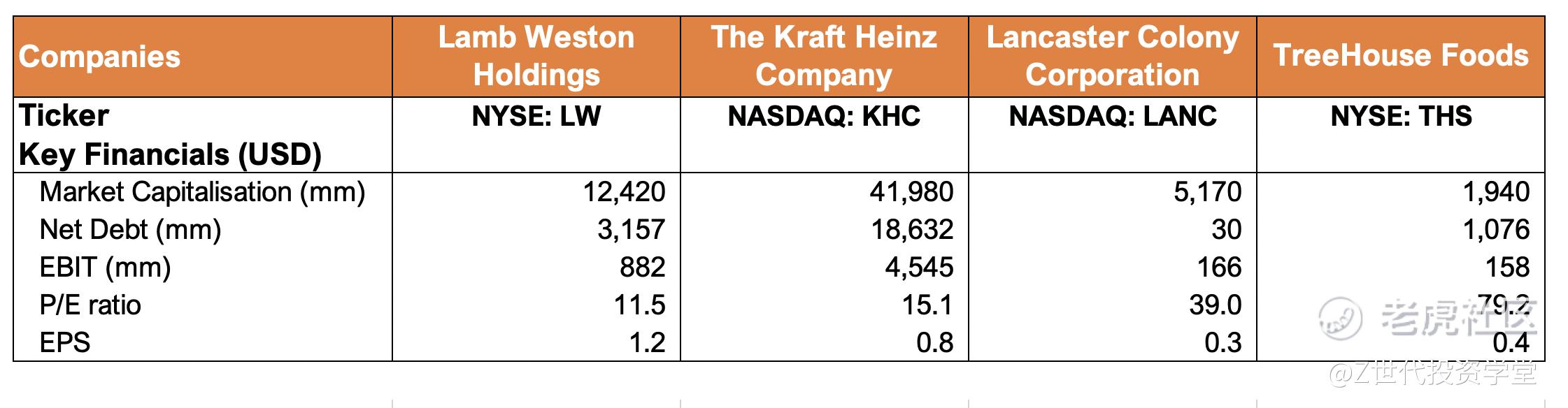

The following competitor analysis enables a more comprehensive understanding of LW’s competitiveness and relative overall financial positioning.

Figure 2: Peer Comparison

Market Capitalisation: Despite not being the largest, Stride’s market capitalisation of USD 12,420 million suggests that the company holds a solid position in the market, reflecting investor confidence in its business model and growth prospects.

Net Debt: In comparison to many of its competitors, Stride has a relatively higher net debt of USD 3,157 million, indicating weaker liquidity. However, the company has been seen to be able to service its debt, and is also rapidly progressing to be less reliant on borrowing (Section 1.2), which helps to reduce concerns around its financial position.

EBIT: LW's robust EBIT of $882 million underscores its operational efficiency and profitability within the frozen food sector. The company's ability to generate strong earnings before interest and taxes demonstrates its competitiveness and ability to navigate market challenges while delivering value to shareholders.

P/E ratio: In particular, the company is appealing due to its relatively low P/E ratio of 11.5, suggesting that the company's stock is undervalued compared to its earnings potential. This presents an opportunity for investors to acquire shares at an attractive valuation, potentially realizing capital appreciation as the company continues to execute its growth strategy and capitalize on emerging market trends.

EPS: Furthermore, LW’s EPS of $1.20 highlights its ability to generate substantial earnings per share, translating into relatively more tangible returns for shareholders. This stronger earnings performance, coupled with the company's solid fundamentals and strategic positioning in the frozen food industry, bodes well for its growth trajectory and long-term value creation.

Overall, LW has proven itself to be a company that is poised for strong future growth.

03 Investment Thesis

3.1 Leading Supplier of Frozen Potato Products

Lamb Weston is positioned as a leading global supplier of frozen potato products, distinguished by over 60 years of industry expertise and a robust reputation for delivering high-quality offerings. With a dominant presence in more than 100 countries, the company holds significant brand recognition and consumer preference. As the top supplier in the US and second globally in the frozen potato category, Lamb Weston sells approximately 60 million portions of fries daily, showcasing its extensive market reach and operational scale. Beyond its market leadership, Lamb Weston's commitment to innovative product development and sustainable agriculture practices reinforces its competitive edge, promising potential growth and profitability in the expanding global food market.

3.2 Global Expansion and Synergistic Growth

Following the acquisition of full ownership of Lamb Weston/Meijer in Europe, as well as the opening of the company’s new processing facility in China’s ‘potato capital’, Ulanqab, Lamb Weston has significantly expanded its global manufacturing footprint. The strategic move not only enhances their production capabilities in Europe and Asia, but also strengthens their overall global market presence. By fully consolidating these facilities into its operations, the company can improve not only widen their global market share, it can better achieve economies of scales and synergies across it global supply chain. This provides potential for enhance profitability through geographic diversification and increased global market penetration.

3.3 Increased Operational Efficiency

Lamb Weston is committed to technological advancements, such as the implementation of a new ERP system, aimed at improving operational efficiency and reducing costs over the long term. Although the transition has encountered initial challenges, such as lower customer order fulfilment rates leading to a $135 million impact on shipments and net sales in the fiscal third quarter, I believe in the long run, these investments are expected to streamline processes, enhance inventory management, and improve overall customer service. As Lamb Weston continues to optimize its supply chain and operations, sustainable long-term growth and profitability ahead is foreseeable.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论