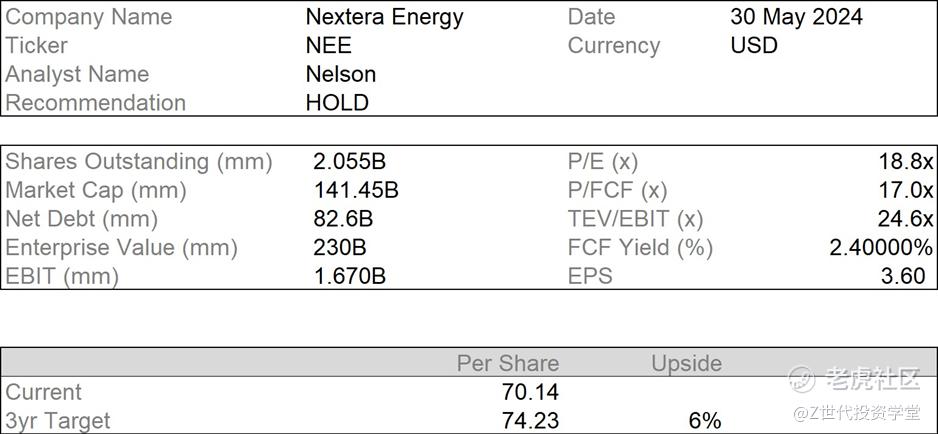

Company Overview

NextEra Energy, Inc. (NYSE: NEE) is one of the largest electric utility companies in the United States and a global leader in renewable energy. Some key facts about the company:

-

Founded: 1925

-

Headquarters: Juno Beach Florida, USA

-

CEO: John W. Ketchum

-

GICS Industry: Energy and Utilities

Business & Revenue Segments

NextEra Energy operates primarily through two key subsidiaries:

Florida Power & Light Company (FPL) [70%~ of assets]: This is NEE’s rate-regulated electric utility arm, providing electricity to approximately 5.6 million customer accounts in Florida. FPL has a generating capacity of about 33,276 megawatts and extensive transmission and distribution infrastructure, including 90,000 circuit miles of lines and 883 substations. [largest rate-regulated utility in U.S]

-

Operates a diverse fleet of power generation facilities including natural gas and solar

-

Revenue primarily derived from electricity sales

NextEra Energy Resources (NEER) [20%~ of assets]: This segment of their business is the world’s largest generator of renewable energy from wind and solar sources. NEER develops, constructs, and manages electric generation facilities across North America, with a total generating capacity exceeding 21,900 megawatts from renewable sources. [1# market share, 25-year track record]

Competitor Analysis

Clearly, NEE through NEER has established itself as a leader in the utility and renewable energy sector, but it faces stiff competition from several major players in the industry, namely the likes of Duke Energy, Iberdrola, Enel Green Power, Brookfield Renewable, and Orsted.

Duke Energy, for instance, competes directly with NEE in the southeastern United States, boasting a strong utility base and ambitious renewable energy plans. However, NEE maintains an edge in terms of renewable capacity and international presence. Iberdrola and Enel Green Power, both European giants, pose significant challenges on the global stage. Iberdrola's technological prowess and Enel's diverse portfolio across five continents rival NEE's international ventures. Brookfield Renewable's strength lies in its ability to acquire and optimize existing assets, allowing for rapid expansion, as demonstrated by their recent acquisition of Urban Grid.

Despite the fierce competition, I think NEE stands out in several key areas. Specifically, the company's scale and diversity are unmatched, producing more wind and solar energy than any other company worldwide. I believe this scale provides significant advantages in terms of cost efficiency and technological expertise. Furthermore,

NEE’s integrated utility model, which includes ownership of Florida Power & Light, the largest electric utility in the U.S., provides a stable cash flow to fund renewable energy projects – a key factor in a capital-intensive industry. This integrated approach sets NEE apart from pure-play run-in-the-mill renewable companies.

On a separate note, financial strength is another area where I believe NEE excels. The company's strong balance sheet and consistent profitability give it an advantage in capital-intensive renewable energy projects. With an equity-to-asset ratio of 0.27 and a net margin of 26%, their financial metrics are competitive within the industry. This financial robustness allows the company to invest heavily in innovation, particularly in integrating energy storage solutions with renewable sources and also to address the complex intermittency challenge of wind and solar power.

Also, with NEE’s operations in 49 U.S. states, the company has demonstrated skill in managing diverse regulatory landscapes, which I think is a critical factor for success in the energy sector. This expertise becomes increasingly valuable as the renewable energy market continues to grow rapidly, with technological innovation driving change and global expansion becoming a key battleground for industry dominance.

Investment Theses

NEE’s Lasting Competitive Advantage – Idiosyncratic Rationale

Cost Efficiency: NEE's lasting competitive advantage is driven by its exceptional cost efficiency and industry leadership in renewable energy. Serving over 5.6 million customers, the company offers electricity rates 37% below the national average, leveraging economies of scale and operational efficiency to lower costs and maintain one of the industry's best reliability rates. This large customer base allows NEE to spread infrastructure and operational expenses, reducing per-customer costs and ensuring lower rates. Additionally, its heavy investments in renewable energy—being the world’s largest generator of wind and solar power—further enhance its cost advantage by minimizing reliance on fossil fuels – which can be extremely volatile in the market today. NEE also holds a dominant 20% market share in renewables and energy storage, allowing the company to excel in project development, financing, and long-term operations.

Preferential access and pricing on key components: Exclusive agreements such as with General Electric (GE) for advanced wind turbines, significantly enhance its operational efficiency and competitive edge in the renewable energy market.

This partnership is centred around the deployment of GE's 1.7-100 wind turbines, which are recognized as the most efficient in their class. These turbines feature a 6% increase in power output compared to previous models, thanks to their advanced design and technology that allows for better energy capture and production. The turbines are equipped with innovative capabilities harnessing the Industrial Internet, enabling them to analyse vast amounts of data in real-time to optimize performance and manage the variability inherent in wind energy generation – a prevailing industry challenge.

Beyond the wind turbines, recent deals include:

-

Supply of up to 4 gigawatts (GW) of onshore wind turbines to NEE annually

-

Access to GE's latest 3 MW onshore wind platform

Notably, this agreement is one of the largest in the industry's history and secures NEE’s access to up to 4 GW of cutting-edge wind turbines annually, including exclusive rights to GE's latest 3 MW platform in the U.S. market. I believe that this deal not only ensures a stable supply chain for the company’s ambitious expansion plans but also reinforces its position as a leader in renewable energy innovation and deployment.

Long Term Electricity and Energy Demand from AI Advancements – Industry Rationale

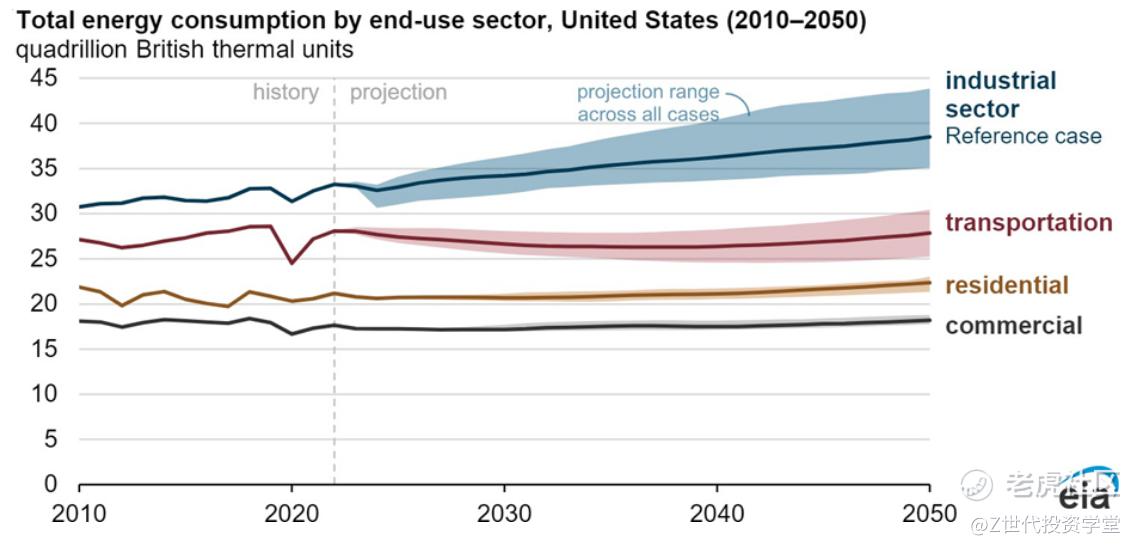

The demand for energy is rising rapidly, with U.S. power consumption projected to grow by 4.7% in the next five years and by 38% over the next two decades—a rate four times higher than that of the previous two decades.

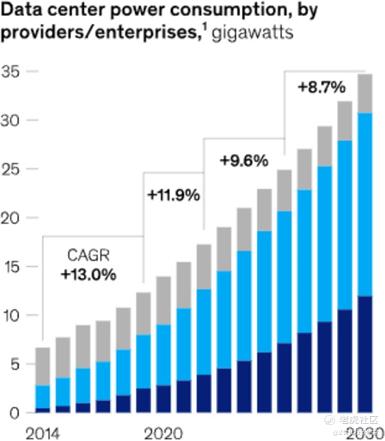

Demand is supported by drivers such as higher data centre growth rates and the lack of near-term capacity in which case would most definitely keep pricing elevated. According to McKinsey data, energy demand from data centers is set to grow at a high single-digit rate through 2030, potentially reaching 35 gigawatts by that year.

Data centers, which have consistently driven renewable energy demand, are poised to see even greater growth due to the acceleration of AI technologies. The shortage of available grid connections, expected to remain constrained, has led to customers paying a premium for assets with existing connections. I believe this is a significant tailwind for NEE, which has a strong data center backlog and the capacity to scale up to meet increasing demand.

For example, NEE is set to double its battery storage capacity from 2 gigawatts (GW) to 4 GW over the next ten years, with a $1.5 billion investment in battery storage planned over the next four years. Total battery capacity is projected to grow by 25% annually through 2033. This expansion ensures that solar energy can be efficiently stored and used during non-sunny periods, addressing a key limitation of solar power.

Moreover, it can be seen that NEE is already addressing the growing demand for renewable energy from tech companies, exemplified by its agreement to supply Google with 860 MW of renewable energy to power its expanding AI operations.

On a different note, AI also enhances NEE’s operational efficiency. The company has already launched over 100 AI projects, including proprietary AI applications, to optimize site selection, development, and operations. With more than 50 GW in its operating portfolio and 34 GW of standalone interconnection queue spots, I think that NEE is well-positioned to meet future demand.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论