Competitive Advantage

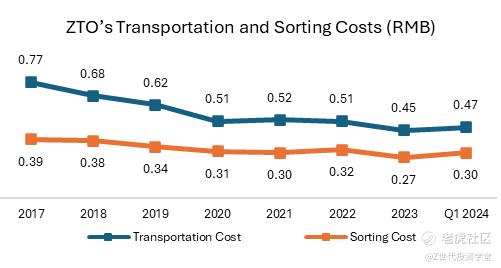

Figure 9: Average transportation and sorting cost of ZTO

First-mover advantage in capacity and automation investment lowers unit-cost

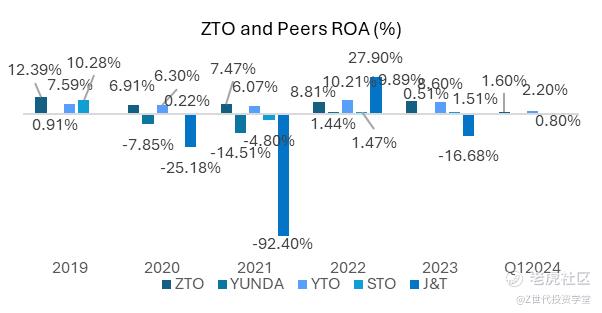

Leveraging Artificial Intelligence (AI), ZTO has managed to improve their load rate and optimize route planning for delivery vehicles, lowering transportation costs.

Automated sorting equipment along with better economies of scale is projected to lead to additional cost-cutting of between 15-20%, which will materialize over the next 2-3 years. Sorting costs dipped 18.8% in 4Q 2023 compared to a year ago.

Being the first-mover to use such transformative technology drives down unit cost that allows ZTO to adopt more competitive pricing.

Thesis

Thesis 1: Superior asset management and margins poises ZTO as a competitive lead

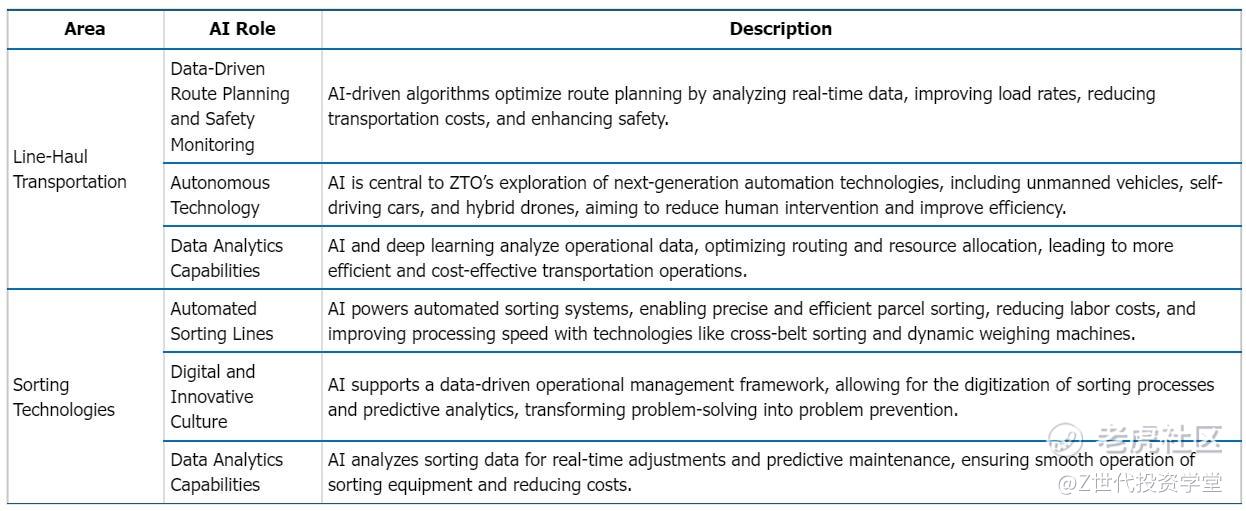

Figure 10: Net Income Margin comparison between ZTO and peers

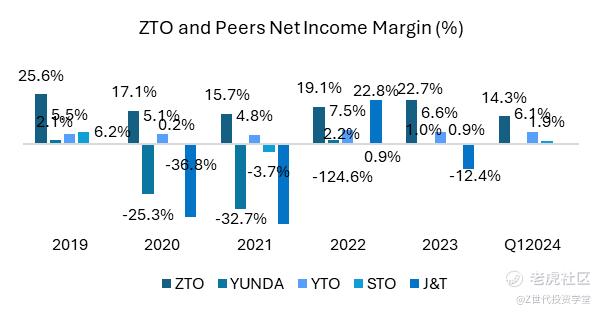

Figure 11: Return on Asset (%) comparision between ZTO and peers

Mix of distribution network partners and self-owned fleet lends to superior model with strong returns and margins

ZTO’s network partnership model allows the company to reduce the capital expenditure and maintain a smaller fleet size of roughly 10,000 vehicles, which the company has maintained without the need to expand. Moreover, ZTO has continued to grow the number of distribution points allowing it to maintain their market share by servicing hard to access Tier 2 and 3 cities.

•Model has continued to demonstrate superior margins across all three contribution margins, stemming from the ability to cut down on labour cost, optimize route mix and charge at prices which provide reasonable incentives that has allowed them to retain distribution partners

•Short-term declines in net income are industry wide from the recent pricing battles, higher freight costs and weaker economic sentiments, nevertheless ZTO has continued to remain superior

•Resultingly, management has demonstrated a strong grasp on the asset base required to support the current level of operations without overgrowing, which has supported the company in maintaining sizable return on assets relative to peers

While there has been a sell-off from the express carrier companies in China, ZTO remains fundamentally a strong player to capture the recovery.

Thesis 2: Superior pricing power supported by network-partnership model and integration of technology

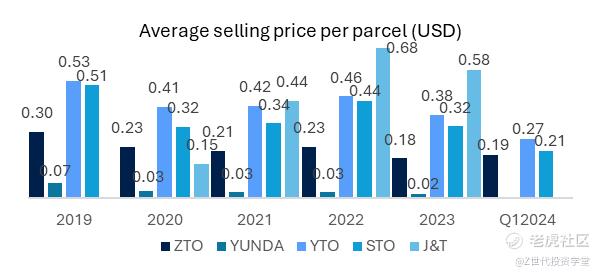

Figure 12: Average selling price per parcel between ZTO and peers

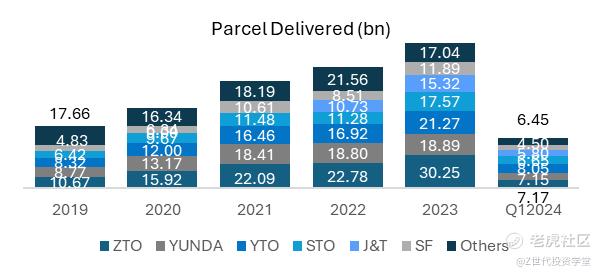

Figure 13: Parcel volume delivery in billions between ZTO and peers

Despite pricing competition, ZTO’s model has allowed it to retain superior pricing power

Consensus was that express parcel players would see eroding margins due to price wars added with increasing freight rates and weaker parcel delivery from macro-conditions, where players would lack ability to control top-line.

•ZTO remains robust in delivering a recovery to the average selling price of the parcels relative to peers as of Q1 2024 despite temporary weakness in 2023.

•Relative to peers ZTO has continued to hold average selling prices relatively steadily indicating that the implementation of artificial intelligence and other tools to increase loading rates and road optimization provides edge that allows it reduce the ASP decline.

•ZTO reported an increase relative to previous quarter for the same period for parcels delivered supporting the ability to deliver in-spite of charging higher prices.

While there was a short-term pull-back in the overall market share based on parcels delivered, ZTO has specifically done this to capture the higher margins transportation including reverse logistics, higher weight and time-sensitive items which are valued in Tier 2 and Tier 3 cities they service.

Thesis 3: Overcorrection within the market leading to depressed multiples

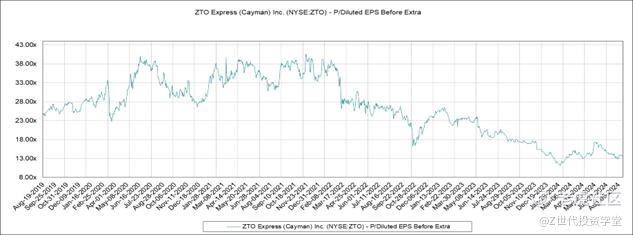

Figure 14: ZTO's historical Price-to-Earnings ratio 2021-2024

Figure 15: ZTO's historical Earnings Per Share 2021-2024

ZTO’s is currently trading below its past 5 year historical P/E ratio

ZTO is currently trading significantly below its historical P/E ratios. Over the past five years, its P/E ratio peaked at 40.59 in November 2021 and dropped to a low of 11.12 in February 2024. The median P/E ratio during this period was 26.60. As of August 16, 2024, the P/E ratio stands at 13.76. This sharp decline suggests that the stock is trading at a depressed multiple, well below its historical norms, indicating a possible market overcorrection.

ZTO’s earnings per share (EPS) has been generally been on the rise since 2019

ZTO’s annual earnings per share (EPS) has been steadily rising since 2019, with a notable 23.14% increase in 2023 from the previous year. However, EPS for the quarter ending March 31, 2024, declined from 0.377 to 0.247. This drop may be due to a strategic shift in management focus from parcel volume to the development of personal parcels and reverse logistics services.

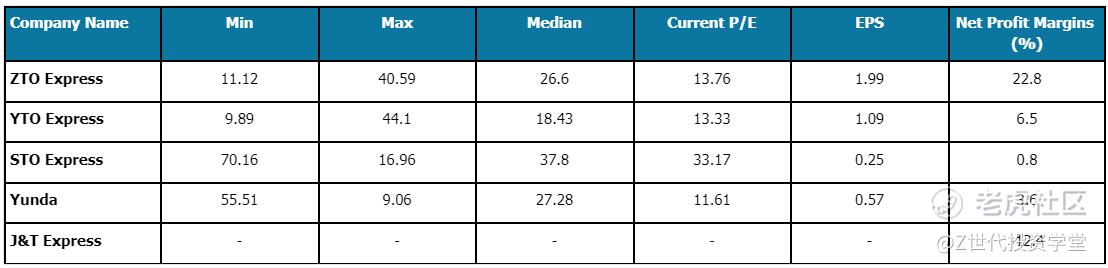

Figure 15: Price-to-earning ratio between ZTO and peers

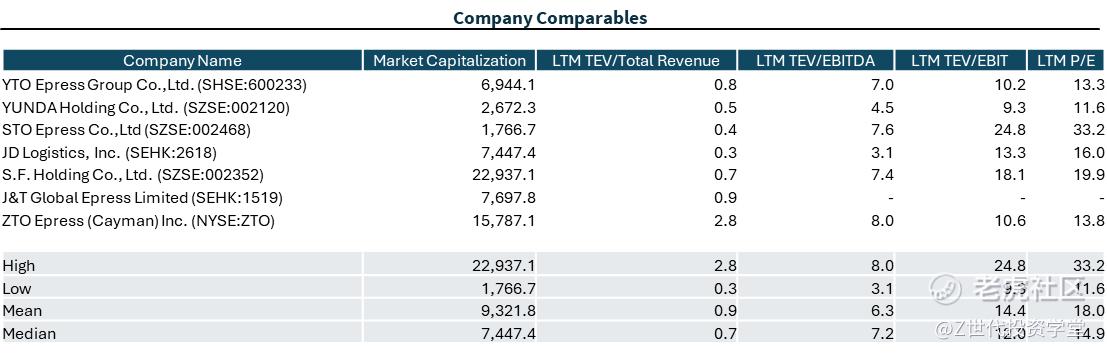

Fundamental Mismatch: Despite not having the lowest P/E ratio, ZTO has the strongest fundamentals amongst its competitors

Despite not having the lowest P/E ratio among its peers, ZTO Express stands out for its strong fundamentals, particularly its high net profit margin of 22.8%. This indicates that ZTO is highly efficient in converting revenue into profit. The lower P/E ratio, despite its superior profitability, could be attributed to its higher EPS. This discrepancy suggests that the market may not have fully recognized ZTO’s earning potential, possibly due to an overreaction. As a result, there may be a valuation disparity that presents a potential opportunity for investors if the market corrects this mismatch.

Environmental, Social and Governance Consideration

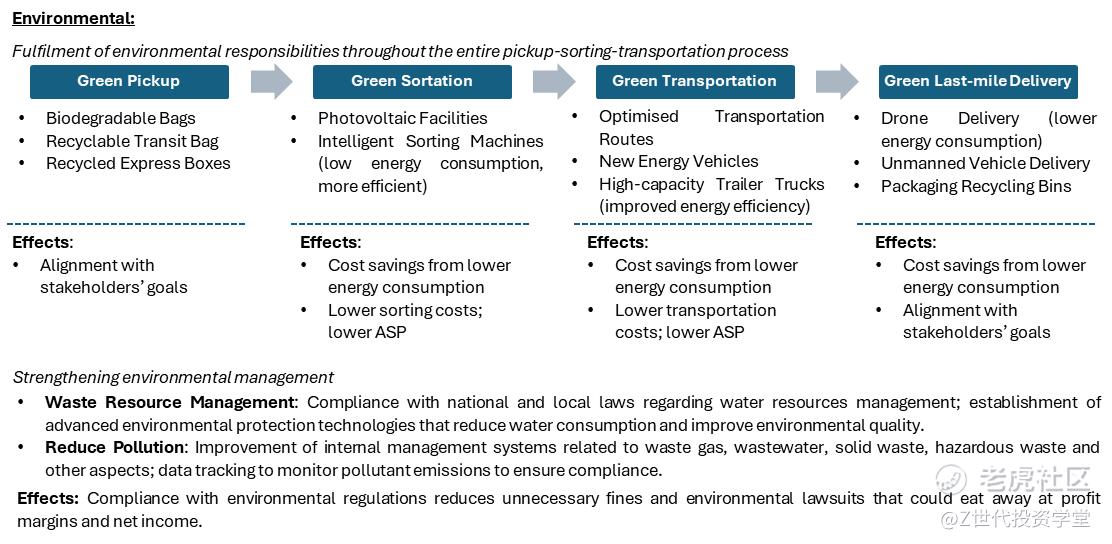

Figure 16: Key summary of ZTO's environmental considerations

Notably, ZTO has taken to releasing quarterly reports outlining key progress across all three pillars of ESG. While the company remains asset-light by nature of their model, other areas of key material risk is the disposal of packaging use and difficulty to curtail the third-party network providers it works with to redcue emission footprint.

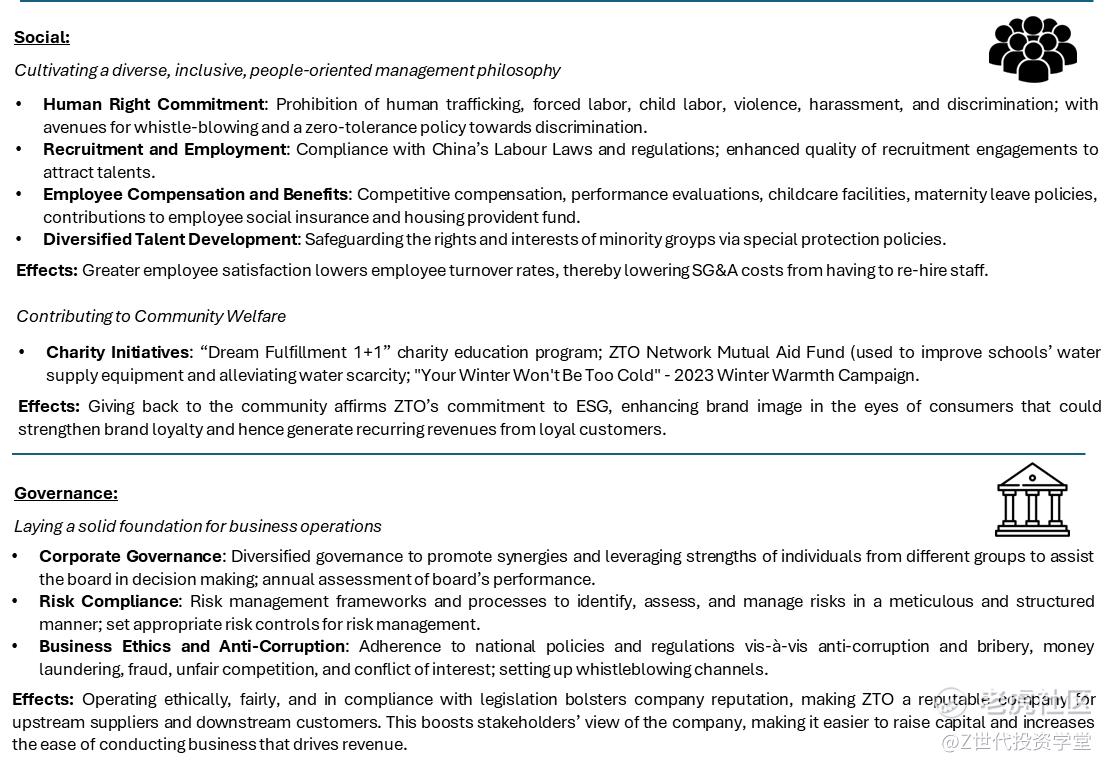

Figure 17: Key summary of ZTO's social and governance consideration

ZTO has laid out their labour rights policies and does not appear to have any controversial activities to-date and seemingly standard corporate governance policies.

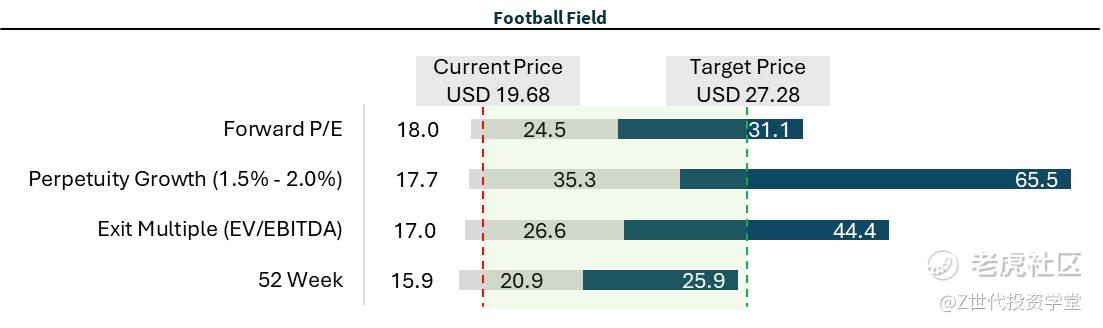

Valuation

Using a discounted cash flow (DCF) method to discount the next five years unlevered free cash flow, as the company cash flow is stable, to attain the free cash flow for the firm and the present value of terminal value. Using these two values, the EV/EBITDA Exit Multiple valuation method was utilised to achieve a target price of USD27.28.

Key Risks and Catalysts

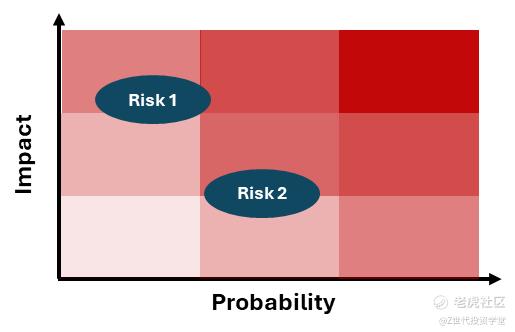

Key Risk 1: First-mover advantage in leveraging A.I. to lower transportation and sorting costs might be eroded when competitors get their hands on similar technology, competitors would be able to further lower ASP and engage in more aggressive price wars.

Mitigation 1: Continue to invest in R&D to improve on their proprietary 'Zhongtian system’ to further decrease bottom-line costs.

Key Risk 2: The multitude of smaller players might be able to erode tiny portions of ZTO’s market share that when added up become significant, which could chip away at topline revenue.

Mitigation 2: Identify and acquire or form partnerships with the growing small to mid-sized market players to consolidate market share.

Catalyst 1: Improving macro-economic indicators in China will improve investor sentiment in the Chinese equities market that could drive share price up significantly to more fairly-priced levels.

Catalyst 2: EPS for 2Q 2024 picks up from $0.247 in 1Q 2024, showing increasing profitability sends a bullish price signal to the market.

Summary

ZTO remains a compelling proposition for exposure to China's express delivery market, looking to capitalise on the long-term sustained growth of the e-commerce market. The report recommends a LONG position but caveats that the broader sentiment regarding the Chinese stock market should be considered.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论