2. Durable Powers to sustain an enduring period of differential returns, Smart Cycle model will continue to differentiate Progyny from competitors

Currently, Progyny is the only fertility benefits management company in the United States that does not utilize a max dollar benefit model for its fertility benefits solution, meaning Members or patients under Progyny's platform do not have to worry about hitting their benefits limit before achieving a successful pregnancy. Existing competitors will find it difficult to switch from a max-dollar benefit model to a model similar to Progyny's due to potential disruptions to their business. Even if they do change their models towards something similar to Progyny's Smart Cycles, which will probably involve recontracting their existing clients with new contractual terms, their existing clients can simply save themselves the hassle and switch to an entirely new provider instead (like Progyny). New entrants will also face increasingly higher barriers to compete in the industry given high switching costs for employers and thus the importance of being a first mover in the industry. A near 100% client retention rate for Progyny since 2017 is a clear testament to this. New entrants will be left with a much smaller TAM by the time they can actually begin scaling their business. In anticipation of this and the diminished opportunity for value creation, new entrants would have to think twice before entering the market, which will make them unwilling to challenge incumbents in the market.

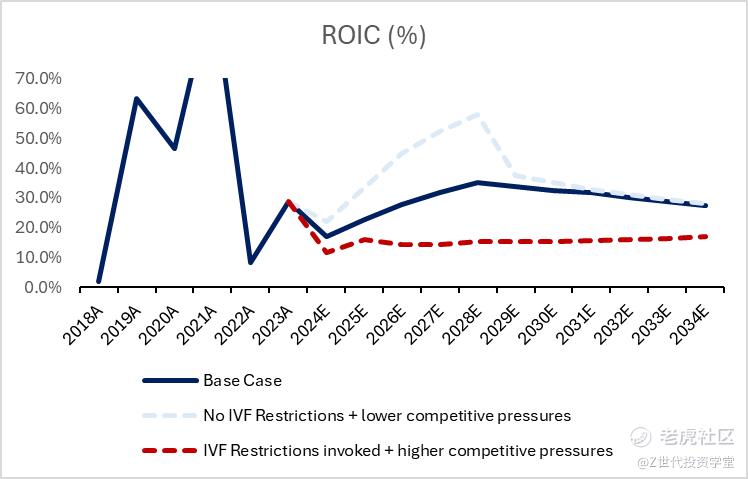

With that said, I do not foresee Progyny losing its competitive position in the fertility market anytime soon, which means opportunity for differential returns (ROIC - Cost of capital) will be enduring for a sustained period of time.

This is contributed by a competitive advantage from its unique Smart Cycle model, underpenetrated TAM, barriers for competitors to challenge, and increasing demand for ART and IVF treatments. As the market implied CAP for Progyny is 12 years, I've forecasted ROIC 12 years out (5 years explicitly based on granular operating drivers + 7 years based on simplified key value driver assumptions), which hits a peak at 35% before declining to 24%. With a 6-year historical average ROIC of 41%, I find the peak and taper-off of future ROIC projections reasonable given the tailwinds mentioned above and accounting for gradual decrease in TAM opportunity for Progyny as it continues to onboard more United States self-insured employers. This translates to a ~20% 12-year average differential return on invested capital by Progyny through 2035.

3. Addition of new services with potentially more favorable margins + going global to diversify risks inherent in the United States' IVF market

In Progyny's 1Q24 Earnings Call, management indicated the company's rollout of additional maternity services, including menopause, postpartum, etc, and indicated that while revenue contribution per utilization will be lower than that of fertility benefits and pharmacy, margins will be more favorable due to high efficiencies from relying on the Company's existing infrastructure. Note that this is a different line of service compared to what Progyny has previously provided (only fertility benefits services), and also the fact that most of Progyny's competitors are already offering these maternity services on their benefits platform.

While Progyny previously lacked its competitors in this aspect, it seems reasonable enough to assume that prospective employers looking to switch providers would be more inclined to switch to Progyny's platform given its unique Smart Cycle model and new maternity services, which combined together could provide greater value to both employers and their employees as compared to competitors' max dollar benefit model + maternity services. The introduction of maternity services also allows Progyny to diversify some of the risks of solely offering fertility services, which is filled with uncertainties in the United States due to potential regulations and laws that could incrementally restrict IVF services.

Additionally, Progyny very recently announced the acquisition of Apryl, a UK-based fertility benefits company with services in over 100 countries. This effectively allows Progyny to tap into markets globally and further diversify risks associated with the United States' fertility market. Without disclosure to the transaction and historical operational and financial performance of Apryl, it is currently difficult to assess whether the acquisition was a good capital allocation strategy by Progyny's management. For now, I assume that fair value was paid on the acquisition of Apryl and it neither contributes nor destroys value for Progyny. The focus will be on the underlying trajectory of reduced risks + potential margin expansion from new maternity services introduced by Progyny, which I believe could lead to revised market expectations on future shareholder value creation (less pessimistic).

Valuation

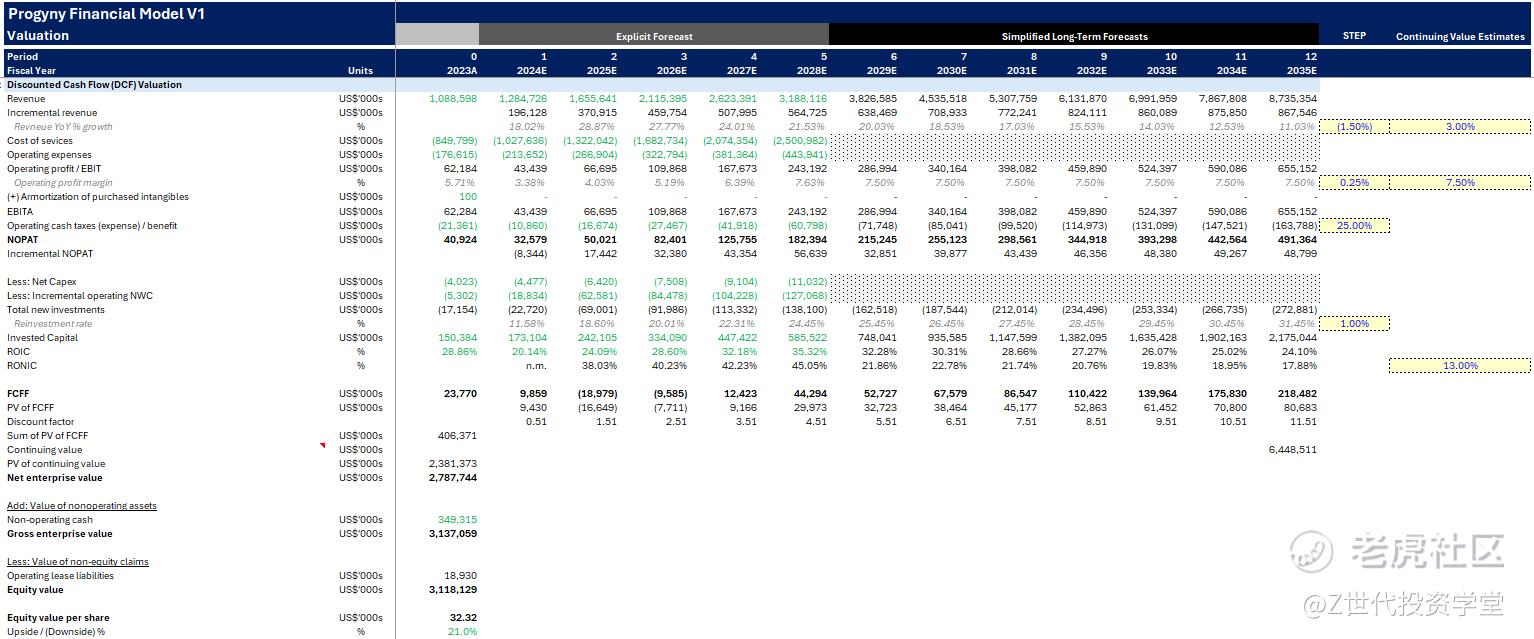

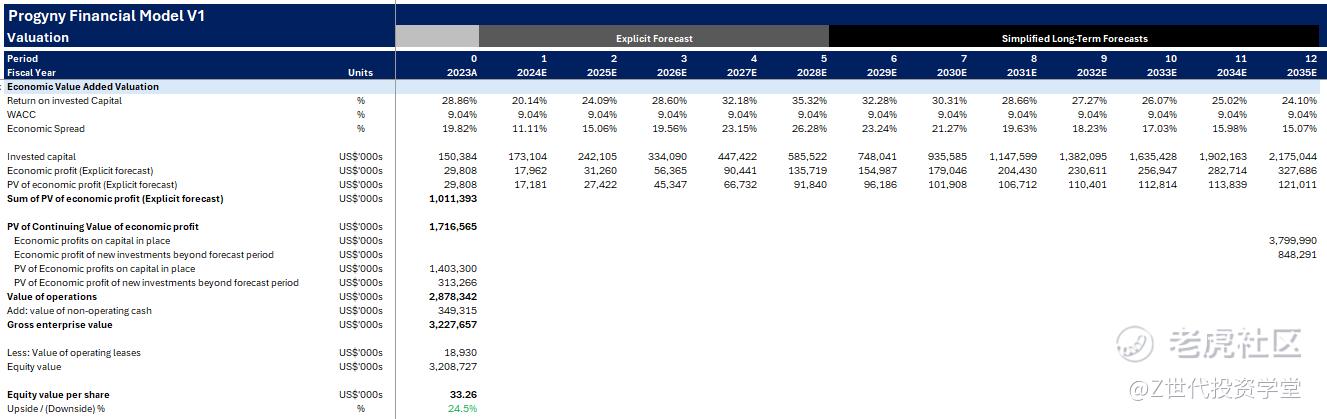

To value Progyny, DCF and EVA valuations are done with a 5-year granular forecast of operating drivers and a further 7-year simplified forecast on key value drivers.

Base Case Discounted Cash Flow ("DCF") Valuation:

Base Case Economic Value-Added ("EVA") Valuation:

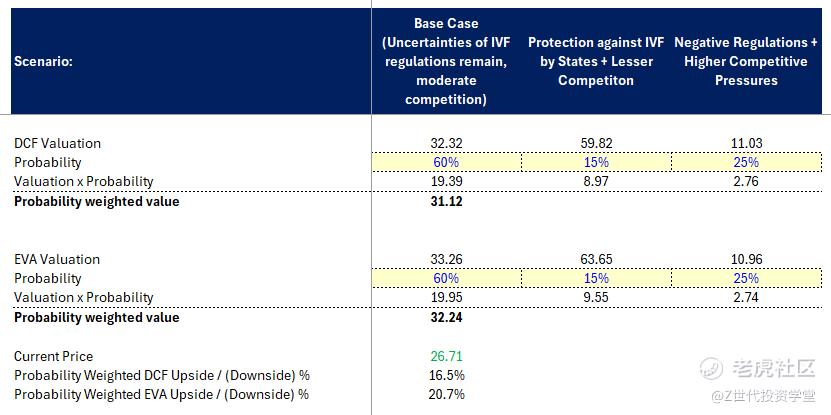

Probability Weighted Valuations:

Using three scenarios with varying assumptions for certain material operating drivers (Incremental market penetration by employers, Fertility benefits service revenue per ART Cycle % growth, and ART cycles utilized per Progyny Member % growth) and assigning a probability to each scenario, I derived a probability weighted fair value of US$31.12 and US$32.24 for the DCF and EVA probability-weighted values respectively. This translates to a 16.5 - 20.7% divergence from Progyny's market price.

Accordingly, based on DCF valuation:

3 year probability weighted target price will be US$40.34 (~51% Upside / ~15% IRR)

5 year probability weighted target price will be US$47.97 (~80% Upside / ~12% IRR)

Conclusion

To ensure a sufficient margin of safety, I would target a 30% 1 year upside potential w.r.t probability weighted value derived from the DCF valuation, which implies waiting for the price to drop to ~24.00 before taking a position in Progyny. (Which translates to an entry P/E of 37.7x and entry EV/EBITDA of 29.0x).

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论