Analyzing the Powers possesed by Progyny

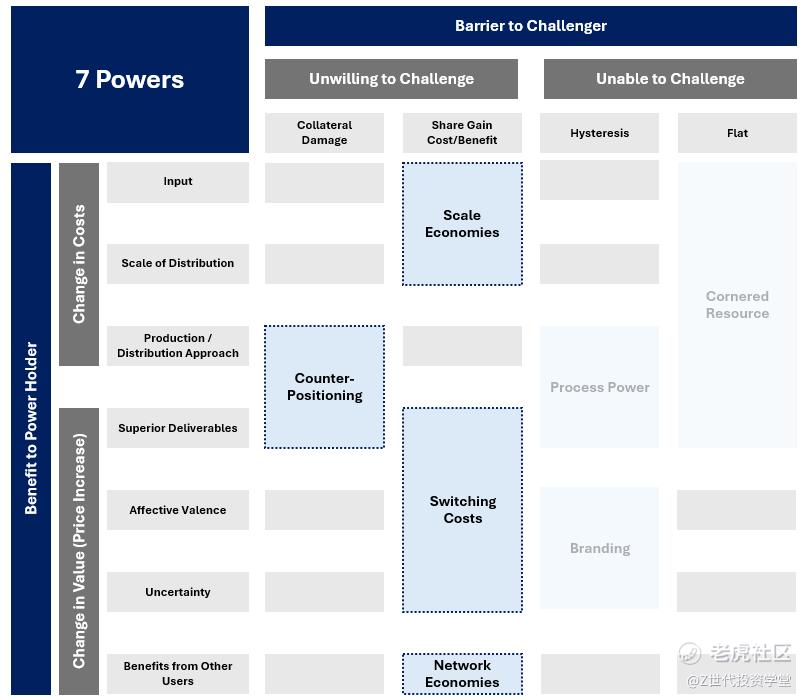

Power refers to a set of conditions creating the potential for persistent differential returns for a company, and must fulfill the conditions of generating a benefit to the Power holder and a barrier to a challenger. It is only with the existence of powers that allows a company to create value from growth as incremental returns exceed its cost of capital over a prolonged period of time. I believe Progyny currently possesses 4 out of 7 powers: Counter-positioning; Switching costs; Scale economies; and Network economies

-

Counter-Positioning

Progyny is the only benefits management company today that does not utilize a dollar maximum benefit model, and instead relies on its Smart Cycle model for its Clients and Members. This is a key differentiator and one that creates superior deliverables to Clients through higher efficacy rates for its employees' fertility treatments and cost advantages for the employers. For fertility benefits providers that utililize a dollar maximum benefit approach, the average lifetime dollar maximum is ~US$25,000. While the average cost of Progyny's Smart Cycle charged to its Clients is undisclosed, it is reasonable to assume that its Clients would pay more for each employee they have under Progyny's benefits solutions plan (which usually offers 2 to 3 lifetime Smart Cycles per employee / household) compared to a provider that utilizes a lifetime dollar maximum. Despite the higher costs, Progyny has rapidly amassed its Client base, proving its Smart Cycle model's superior value to employers.

Existing competitors cannot compete effectively with Progyny's Smart Cycle model without a turnaround of its dollar maximum reimbursement approach, which has likely been developed for an extended period of time and changing it risks disruption to its current business model, as well as potential impacts to all its key relevant stakeholders, especially patients that are undergoing an iVF cycle or have already utilized a % of their max dollar benefit. We can collectively term these as "Collateral Damage" to existing competitors.

For conventional health benefits insurers, a change is even more unlikely given that they operate other types of insurance coverage other than fertility benefits, where a dollar maximum benefit approach makes more sense for their entire organization as a whole.

-

Switching Costs

Switching costs are generally high for Clients that have contracted with a benefits management company, given that fertility treatments are time-sensitive procedures and switching from one provider to another disrupts their employees' treatment cycle, from a change in specialist clinics, pricing methodology, fertility expert consultants, etc, which will not be well-received by employees of a company. This can be attributed to Progyny's near 100% Client retention since its inception (7 years record). Switching makes sense only if another benefits management company can deliver superior value to both employers and employees where a disruption will be worthwhile. An instance of this is the trend of employers switching from conventional health benefits insurers to fertility benefits management companies, where Progyny has reported that >66% of its client base has switched over from these conventional health benefits insurers. This means that retention rate of Progyny's Clients will likely remain at the same level as new entrants and existing competitors will face difficulties trying to convince them to switch to their platform.

-

Network Economies

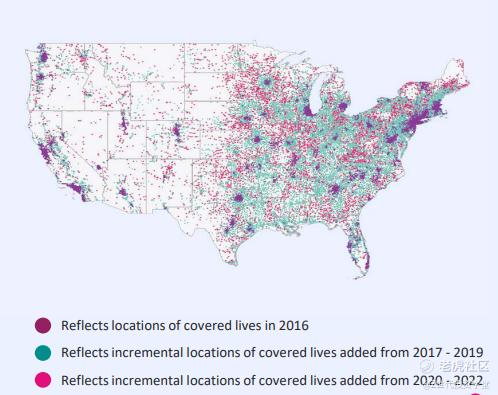

There exists a "Flywheel Effect" for fertility benefits management companies as elaborated on earlier, where the network contains the Clients, Members and Specialist Clinic partners. Progyny's differentiated Smart Cycle approach has contributed to a ramp up in Clients contracted, which has accelerated its member base (61x increase in 2024 compared to 2016), generating incremental value for Specialist Clinic partners with a higher patient consultation-to-treatment conversion rate, which increases specialist clinic partners onboarded, contributing to Progyny's increasingly broader network access and scale, which in turn further incentivizes existing Clients to stay on and uncontracted employers to switch to Progyny's platform.

New industry entrants / fertility benefits management companies entering the market will face increasing difficulties in taking market share as the Flywheel sets into motion, including incurring larger costs and having to provide better pricing terms to onboard clients, which could very well end up destroying value as their returns on incremental invested capital fall below their cost of capital. In anticipation of this, potential new entrants will be unwilling to participate / challenge for market share in this industry altogether.

Progyny's covered lives in the United States

-

Scale Economies

Being a first-mover in this industry is crucial, given high switching costs from one fertility benefits management provider to another. The low hanging fruit for fertility benefits management providers lies in contracting with employers that currently have some form of fertility benefits coverage with a conventional health benefit insurer. Once these low hanging fruits diminish, it becomes reasonable to assume that a provider's ability to onboard new clients will slow drastically due to switching costs, or at least require substantial incremental expenses and investments to convince them to switch to their platform.

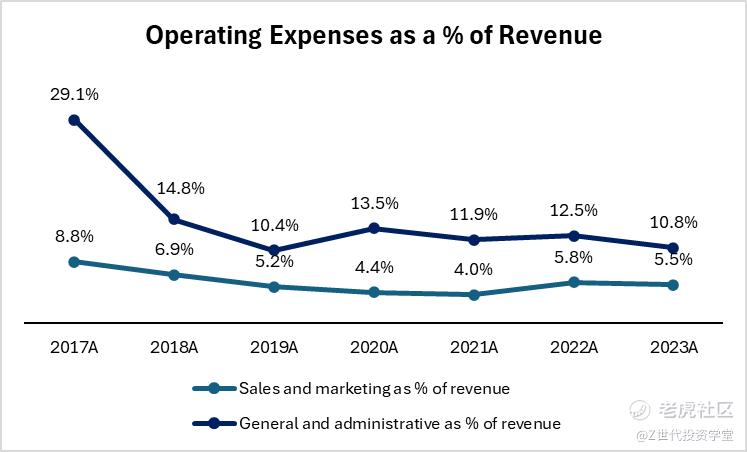

Progyny has managed to rapidly scale its business with around 0.8% of incremental market share per year in terms of Clients onboarded since 2017, which has effectively reinforced its network economies and switching costs for its existing client base. Scale economies are apparent from a reduction in operating expenses as a % of revenue for Progyny across the years, where such expenses are spread over an increasing number of covered lives and Client base.

Additionally, increasing scale has allowed Progyny to negotiate cost savings with its Specialist Clinic partners for its Clients while still ensuring a win-win situation for both parties, which new entrants will find impossible to execute without incurring substantial costs. The barriers to a potential entrant or challenger are especially high with Progyny's first-mover advantage via its differentiated approach and rapid scaling, which may help to deter potential entrants.

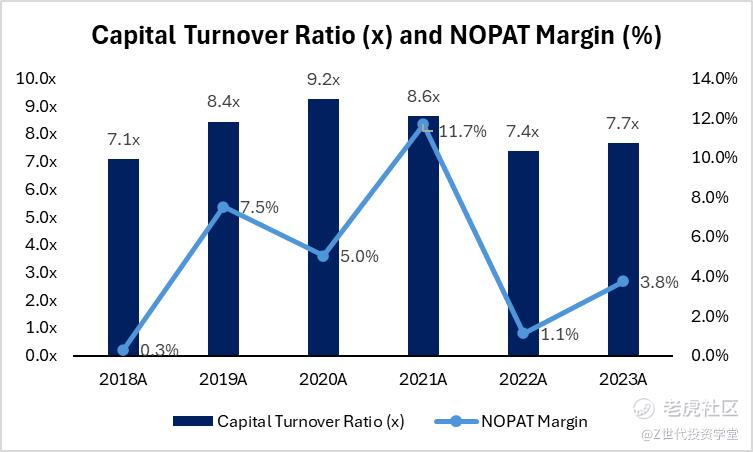

Evidently, the existence of these powers and an underpenetrated market for Progyny have translated into a 6-year average ROIC of 41%, well in excess of any reasonable estimate of the Company's cost of capital in that period. NOPAT used in the calculation of ROIC is calculated using EBITA * (1 - Operating Cash Tax Rate)

*Note: (1) 2022's decline in ROIC was attributed to an increase of over 300% in stock-based compensation paid out to employees which depressed NOPAT. Stock-based compensation is included as an operating expense which reflects the economic reality of a company paying its employee salaries in stock options, which is still part of operating expenses

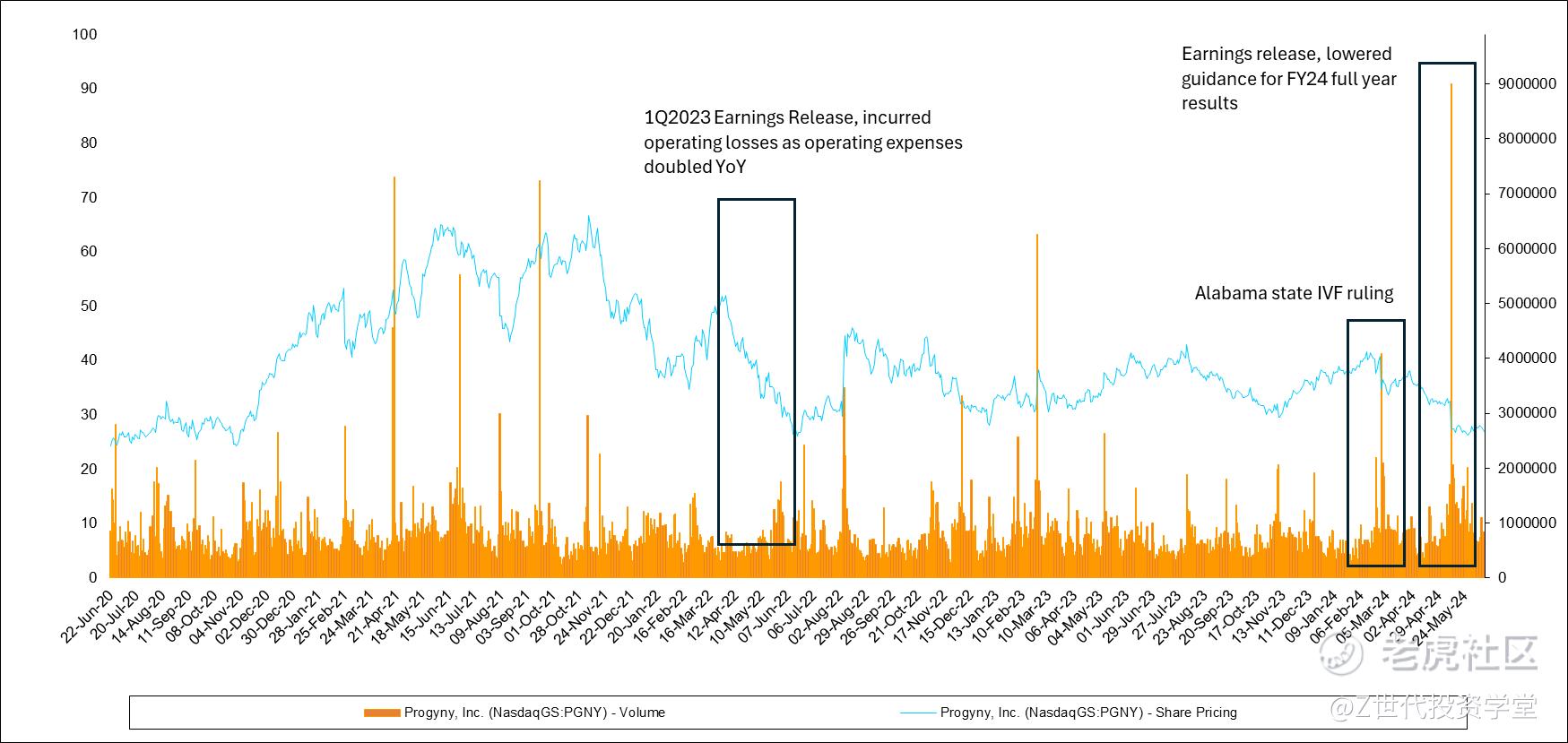

The recent slump in share price performance

From end 2021, Progyny's share price performance has been deteriorating up till today. In April 2022 after the Company's 1Q2022 earnings release showed a doubling of operating expenses (mainly from a spike in stock-based compensation), which produced an operating loss compared to ~S$11m of operating profit in 1Q2022, its share price tumbled. Naturally, given the rapid increase in contracted Clients and covered lives, the Company had to hire and spend more on employee compensation, which drove operating and net profit margins down, though these have recovered slightly in 2023.

Since then, its share price has remained largely stagnant up until February 2024, when an Alabama State IVF Court Ruling sent the share price down by 19% (from 40.30 on 21 Feb 2024 to 32.50 on 9 May 2024), which was made worse when Progyny released its 1Q24 earnings and announced a lowering of FY2024 full year results guidance, sending the stock down another 17% (from 32.50 on 9 May 2024 to 26.98 on 14 Jun 2024). The revised guidance indicated a 3.8% and 3.1% decline in full year FY24 revenue and adjusted EBITDA respectively, from what Management had set out earlier in the Company's 4Q23 earnings call.

No mans' land for the United States' IVF market

On 16 February 2024, The Alabama Supreme Court issued a ruling that declared embryos created through IVF should be considered children, as a result of a lawsuit by families against someone who had accidentally destroyed their frozen embryos in negligence. As a result, three IVF clinics in Alabama promptly suspended all services due to fear of criminal prosecution, which led to patients undergoing IVF treatment in Alabama being stuck without access to their stored eggs and embryos in those clinics. This led to the nationwide uproar.

As mentioned earlier, woman undergoing IVF treatment may opt to extract multiple eggs and have them combined with sperm to create multiple embryos as backup. However, if the first embryo inserted into the woman results in a successful pregnancy, the leftover embryos in the IVF clinic can be handled in three main ways: 1) Kept forever, where patient incurs storage costs for life; 2) Destroyed; 3) Donated for medical research. Of course, with the new ruling in Alabama, options 2 and 3 are no longer possible if one does not wish to be prosecuted for wrongful death, given that embryos are now human and technically possess equal human rights.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

精彩评论