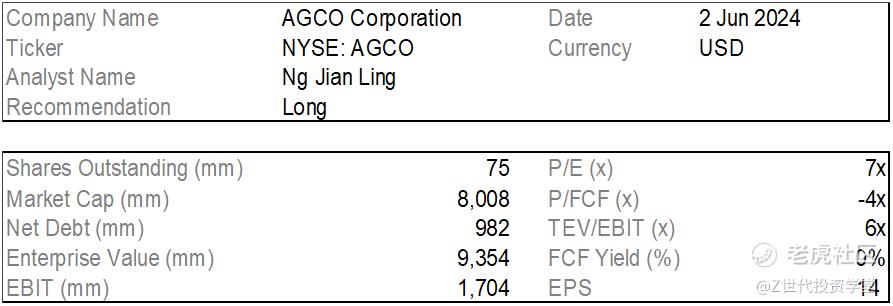

AGCO Corporation

NYSE: AGCO

“If she ain’t red, keep her in the shed.”- Farmer proverb

Investment summary

Rather than talk about precision agriculture and South America revenues, we are differentiated in that we believe that dealers will be the main thesis driving the stock in the near-medium term of 2 years. AGCO’s better command of dealerships will allow it to gain share in the industry downturn over CNH, its closest competitor.

We acknowledge that while precision agriculture is a thesis, it is still far from being a key driver of stock price, with it only contributing to 5% or less of current revenues. However, we believe that our medium-term thesis on dealerships will feed into the long-term thesis of precision agriculture due to dealers being required to sell new tractors with precision agriculture and also retrofit existing ones. They will also play a role in the longer-term thesis of shrinking middle class of tractors, parts and services and the growing South American market.

The AGCO brand is characterized by red tractors

AGCO owns the following sub brands

Industry secular trends

-

Consolidation of dealerships. In the past, there were more dealers and farmers placed a heavy emphasis on their relationship with their dealers. There are now fewer dealerships to serve farms, farmers, and per square mile/acre of farmland.

-

Newer tractors are becoming more complicated due to additional software meant to help farmers. In the past, farmers could fix issues easily. With software. many of these error codes are not fixable by farmers and locks the tractor preventing it from being used. They then need to be brought in to the dealer.

This is a problem because farmers need to be close to their dealers in order to purchase new tractors, add on equipment, and for parts and services.

Farmers do not wish or may not have the ability to haul their 20-ton tractors hundreds of miles whenever they make a new purchase or have to service and diagnose a problem. The problem is amplified during specific periods such as planting or harvesting seasons, where farmers have limited time, about 1-2 weeks, where every hour counts.

These 2 trends have resulted in:

-

Some farmers buying older equipment

-

The importance of dealerships rising even further

Key drivers of AGCO stock price and valuation

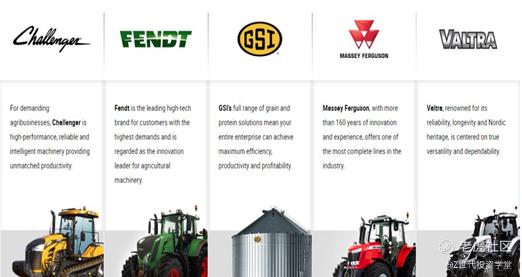

EU and US segment make up 78% of revenue

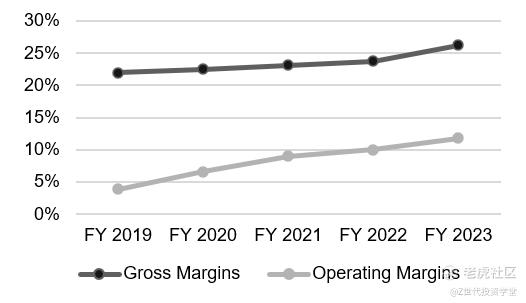

AGCO’s margins have rose throughout the years

Europe and Middle East segment:

-

Europe is responsible for 52% of net sales. AGCO is the market leader in Europe with strong presence in Germany and France. The EU market exhibits similar characteristics to the US apart from some differences in the types of crops planted

-

Segment revenues increased by 17% YoY due to positive pricing impacts, favorable product mix related to mid-range and high-horsepower tractors and higher replacement parts sales

US segment:

-

The US is responsible for 26% of net sales. Additionally this segment is a focus because the US agricultural market is a mature, fiercely competitive and also makes up majority of revenue of DE and CNH

-

Segment revenues increased by 18.2% YoY, due to positive pricing impacts and favorable product mix related to high-horsepower tractors, application equipment and combines

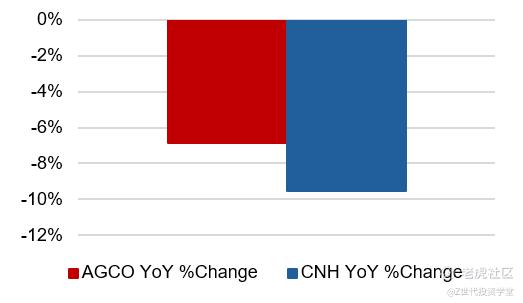

The market is paying attention to YoY topline revenue of these 2 segments given the industry downturn.

Margins:

-

AGCO has a margin story after pulling off back-to-back increases in its operating margins for the past 5 years

-

It’s FY2023 operating margin of 12% is lower compared to DE of 25% and same as CNH at 12%

-

Management has set a target of 11% operating margins for FY2024

AGCO Long thesis:

-

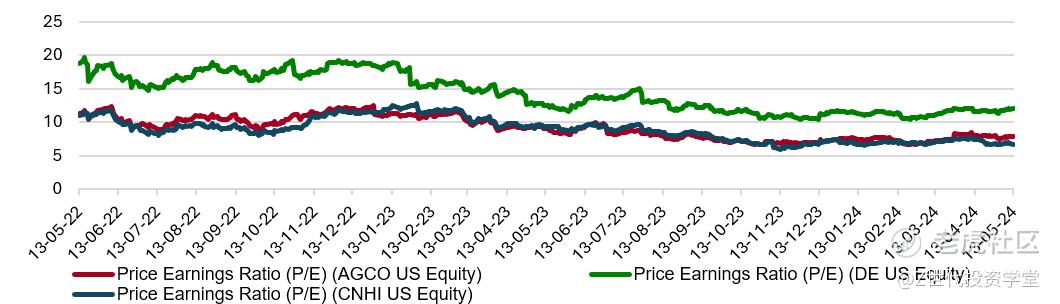

AGCO is trading at a relative valuation of 7x PE. It is at a discount to industry leader DE, and at similar levels to CNH. We believe that AGCO deserves a higher valuation relative to CNH because:

AGCO is trading at a similar PE level to CNH

-

The US Ag equipment market is a mature, competitive and largely consolidated market, with 3 companies, DE, CNH and AGCO holding ~75% of total market share, with smaller companies such as Kubota and Mahindra fighting for scraps. Therefore, any market share gain is at the expense of other players.

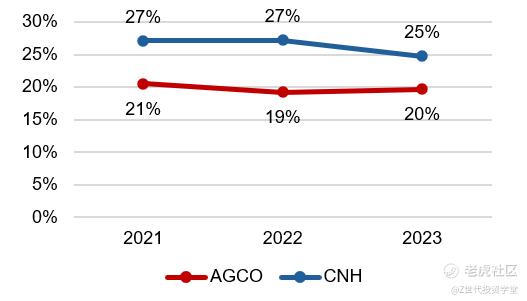

AGCO’s market share is steady while CNH is falling

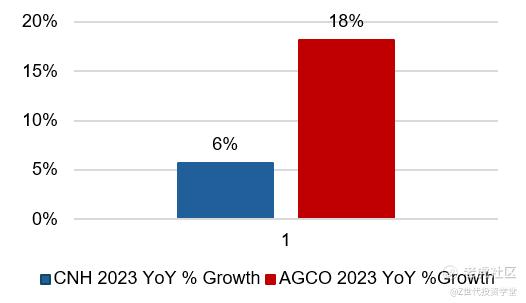

AGCO is growing much quicker in North America

-

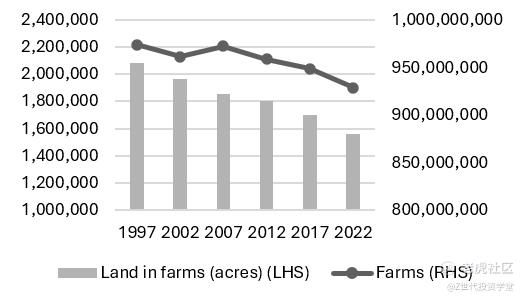

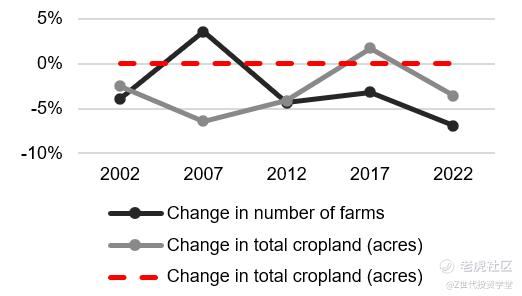

Furthermore long-term underlying trends suggest that the US customer base has not been growing. In the medium term we foresee customer base to stagnate or worse, shrink due to:

-

The commodity and industry downcycle

-

Thriving secondary market

In the long term, we foresee the customer base to stagnate due to:

-

Decreasing number of farms

-

Shrinking farmland acres

Customer base decreasing long term

There is a trend of farms consolidating

-

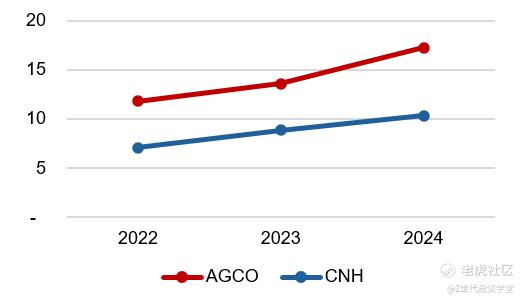

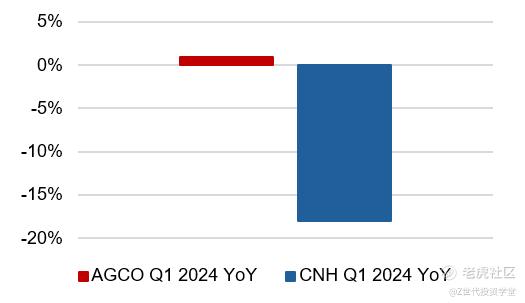

AGCO has increased its market share in the past in FY2023 as seen from topline revenue increase in especially in FY2023, where AGCO’s revenue increased by 14% as compared to 1% growth by CNH.

This was underappreciated by the market given the lack of increased valuation during the period.

-

AGCO will continue to outgrow CNH in North America. This is because we believe that AGCO will be a key beneficiary of the secular trend of dealerships increasing in importance.

-

AGCO management has plans to focus more on serving farmers by improving all aspects of their sales and distribution network including their dealer network.

This initiative adds mobile support to meet the needs of farmers. More importantly, it adds light retail outlets, service centers and parts-only locations which increases coverage and will increase sales given the importance of physical closeness to the dealership.

This is expected to roll out in starting Q1 2024 and we believe will be incremental to revenue starting Q3 2024.

-

We have also seen dealers for all 3 major manufacturers close in 2023. This is anticipated given the expected downturn cycle.

AGCO has much higher revenue per dealer

CNH has higher dealer closures at end of 2023

The resiliency of AGCO’s dealers is a positive sign indicating the management’s and dealers’ faith in demand. Furthermore, it has been reported that CNH’s dealers have been informed of a major restructuring of its dealer network, with news reporting that they will be further cutting/downsizing the number of its dealers.

-

AGCO is the market leader in Europe. With it having a share of 37% among the 3. The Europe farming industry is in a similar position to the US, being a mature industry and exhibiting the same trends. In addition to the dealer network thesis in the US, there is another key difference to the US in the near term, which is unfavorable high dealer inventory levels across the industry.

AGCO has a better track record of effective dealers and better management of inventory levels at dealerships as compared to CNH. CNH reported high levels of dealer inventory as compared to AGCO, which only reported slightly higher than average inventory levels indicating weaker demand for CNH in Europe.

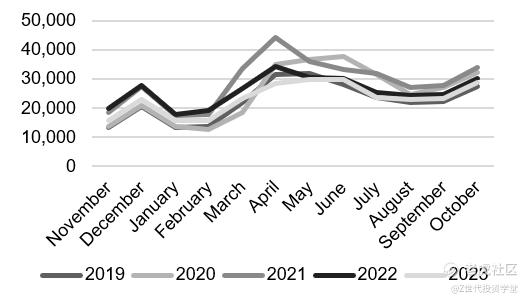

Sales usually peak in Q2

AGCO performing significantly better in Europe

We believe that CNH will take at least 2-3 months to clear this issue. This implies that the majority of CNH’s sales for Europe have already been frontloaded to Q1 of 2024 and in addition to that CNH’s Q1 sales were actually down -18% YoY while management is guiding AGCO’s sales to be flat.

This is important because Q2 and then Q4 is when sales peak for agricultural machinery, implying that CNH’s full year sales will be even worse, and consequently favorable for AGCO.

-

We see margins staying resilient amid the industry downturn and exceeding management targets. This is because:

-

We foresee the Parts and services business to grow as part of AGCO’s Farmercore strategy, elevated interest rates, and it will serve the hot secondary market given general disdain from low-mid level farmers for advanced tractors

Replacement parts are a high margin business.

-

Preemptive lowering of production volumes and together with decreasing component costs will further bring down production costs.

-

Even by following management guidance in our base case we can achieve an EBIT margin of 11% which meets the goal of 11%. We see management’s target as achievable, as we see AGCO benefiting from positive net pricing and mix in selling more high horsepower tractors.

ESG

Precision agriculture protects the environment because:

-

Ensuring places with weed are sprayed with weed killer. This reduces the overall volume of chemicals used, which decreases the risk of runoff into water bodies and minimizes soil contamination.

-

Soil moisture sensors and remote sensing can optimize irrigation schedules, ensuring crops receive the right amount of water at the right time. This reduces water wastage and conserves water resources.

Both result in cost savings for the farmer, incentivizing farmers to buy the latest technology in a period of high fertilizer and input costs.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论